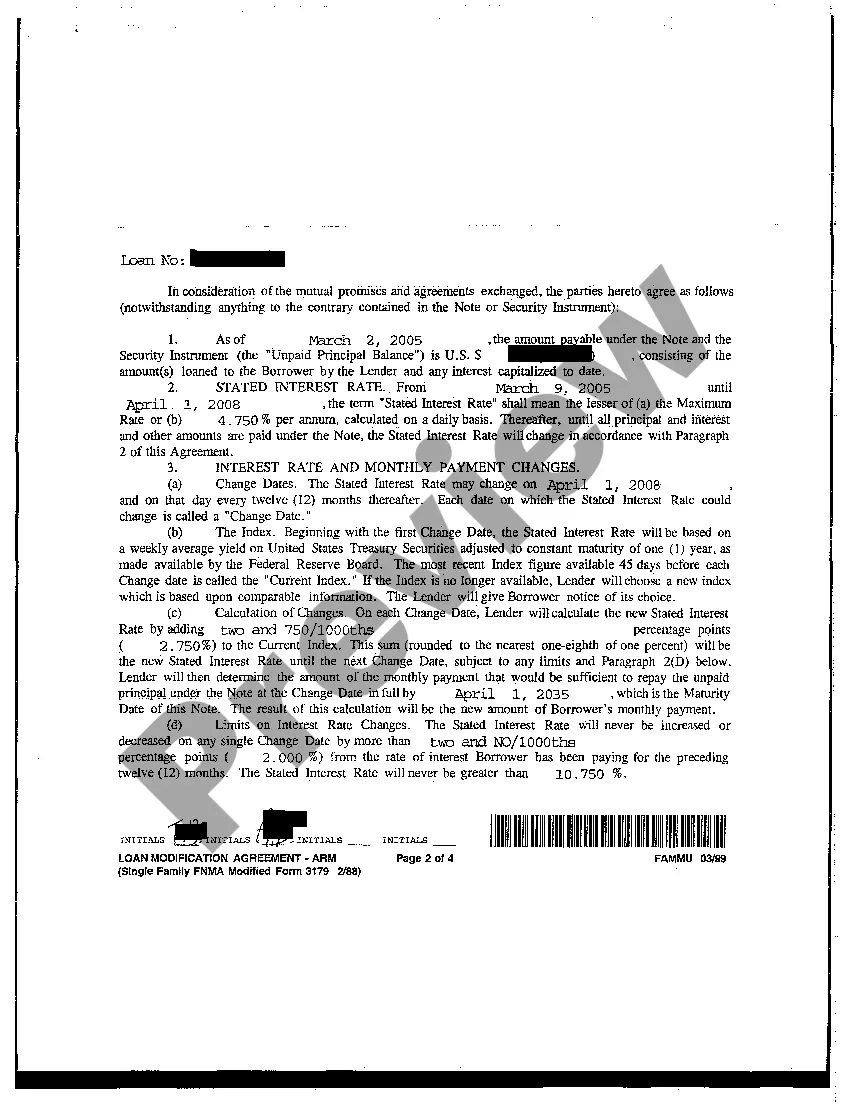

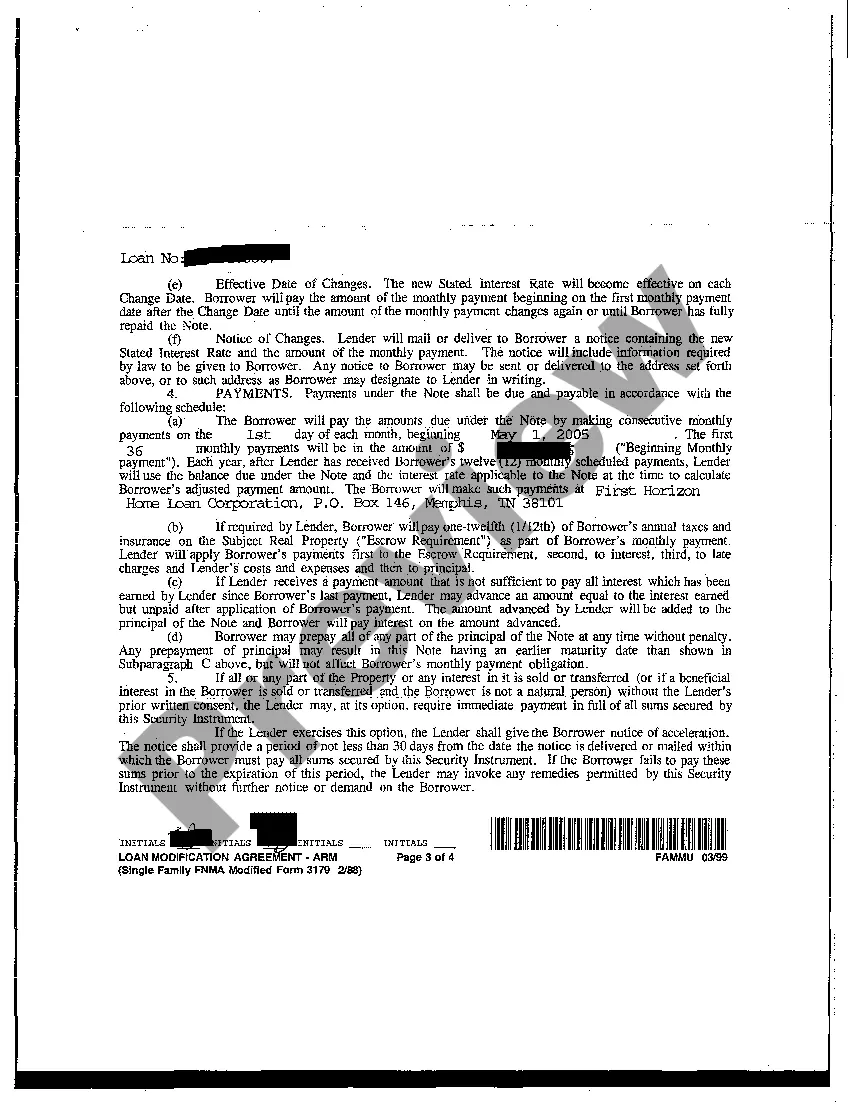

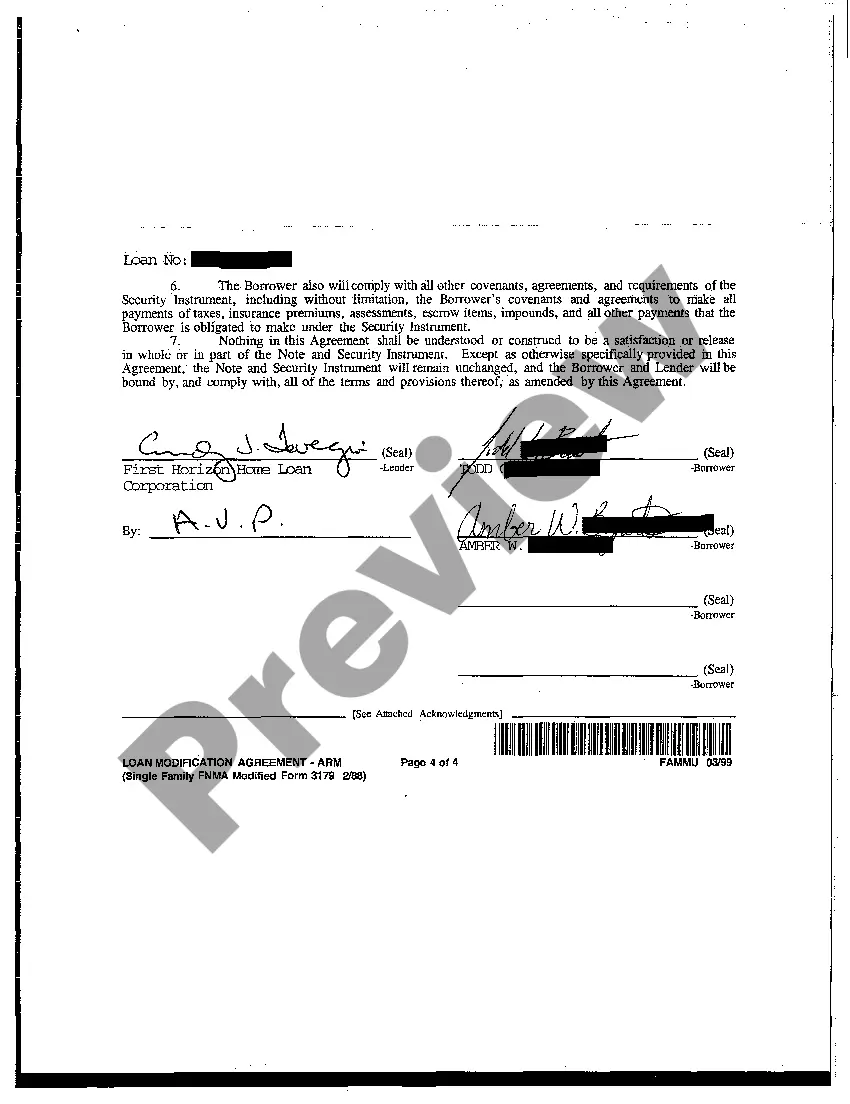

Gresham Oregon Loan Modification Agreement providing for Adjustable Rate: A Gresham Oregon Loan Modification Agreement providing for Adjustable Rate is a contractual agreement between a borrower and a lender that allows for adjustments to be made to the interest rate on a mortgage loan in Gresham, Oregon. This type of loan modification is specifically designed to cater to borrowers who have an adjustable-rate mortgage (ARM) and are struggling to meet their monthly payment obligations due to fluctuating interest rates. The primary purpose of a Gresham Oregon Loan Modification Agreement providing for Adjustable Rate is to provide borrowers with the opportunity to reduce their monthly mortgage payments and make them more affordable. By modifying the loan terms, borrowers can potentially avoid foreclosure and stay in their homes. The adjustable rate feature of this loan modification allows for periodic adjustments to be made to the interest rate, typically based on a predetermined index such as the U.S. Treasury Bill rate or the London Interbank Offered Rate (LIBOR). This means that the interest rate on the loan can increase or decrease over time, depending on the prevailing market conditions. Different types of Gresham Oregon Loan Modification Agreements providing for Adjustable Rate may include: 1. Rate Cap Modification: This type of agreement often includes a rate cap, which sets a maximum limit on how much the interest rate can increase over the life of the loan. The rate cap provides borrowers with some level of protection against significant interest rate hikes. 2. Interest-Only Modification: In this arrangement, borrowers may have the option to pay only the interest portion of their monthly mortgage payment for a specified period. This can provide temporary relief for borrowers facing financial difficulties by reducing their monthly payment amount. 3. Term Extension Modification: This modification allows borrowers to extend the term (length) of their loan, typically beyond the original loan term. By extending the loan term, borrowers can spread out their payments over a longer period, thus reducing their monthly payment amount. 4. Principal Forbearance Modification: With this type of modification, a portion of the principal loan amount may be temporarily suspended or forgiven, reducing the borrower's monthly payment obligation. The suspended or forgiven principal is typically added back to the loan balance or payable at the end of the loan term. It is important to note that the specific terms and eligibility criteria for Gresham Oregon Loan Modification Agreements providing for Adjustable Rate may vary based on the lender and the borrower's financial situation. Borrowers interested in pursuing such modifications should consult with their lenders or seek legal advice to fully understand the available options and their potential implications. Keywords: Gresham Oregon, loan modification agreement, adjustable rate, adjustable-rate mortgage, ARM, interest rate adjustments, monthly mortgage payments, affordable, foreclosure, rate cap, interest-only, term extension, principal forbearance.

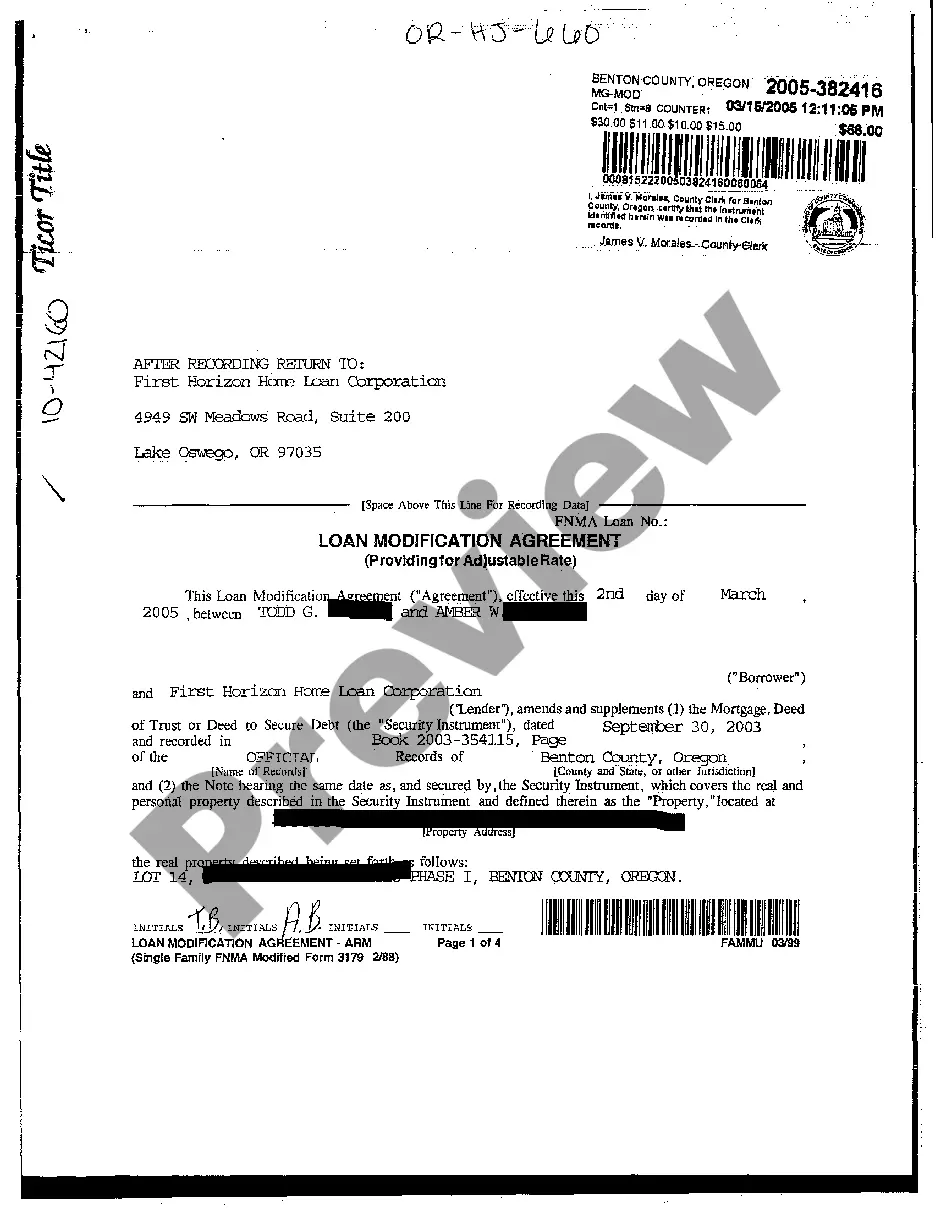

Gresham Oregon Loan Modification Agreement providing for Adjustable Rate

Description

How to fill out Gresham Oregon Loan Modification Agreement Providing For Adjustable Rate?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, as a rule, are extremely expensive. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Gresham Oregon Loan Modification Agreement providing for Adjustable Rate or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Gresham Oregon Loan Modification Agreement providing for Adjustable Rate complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Gresham Oregon Loan Modification Agreement providing for Adjustable Rate would work for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!