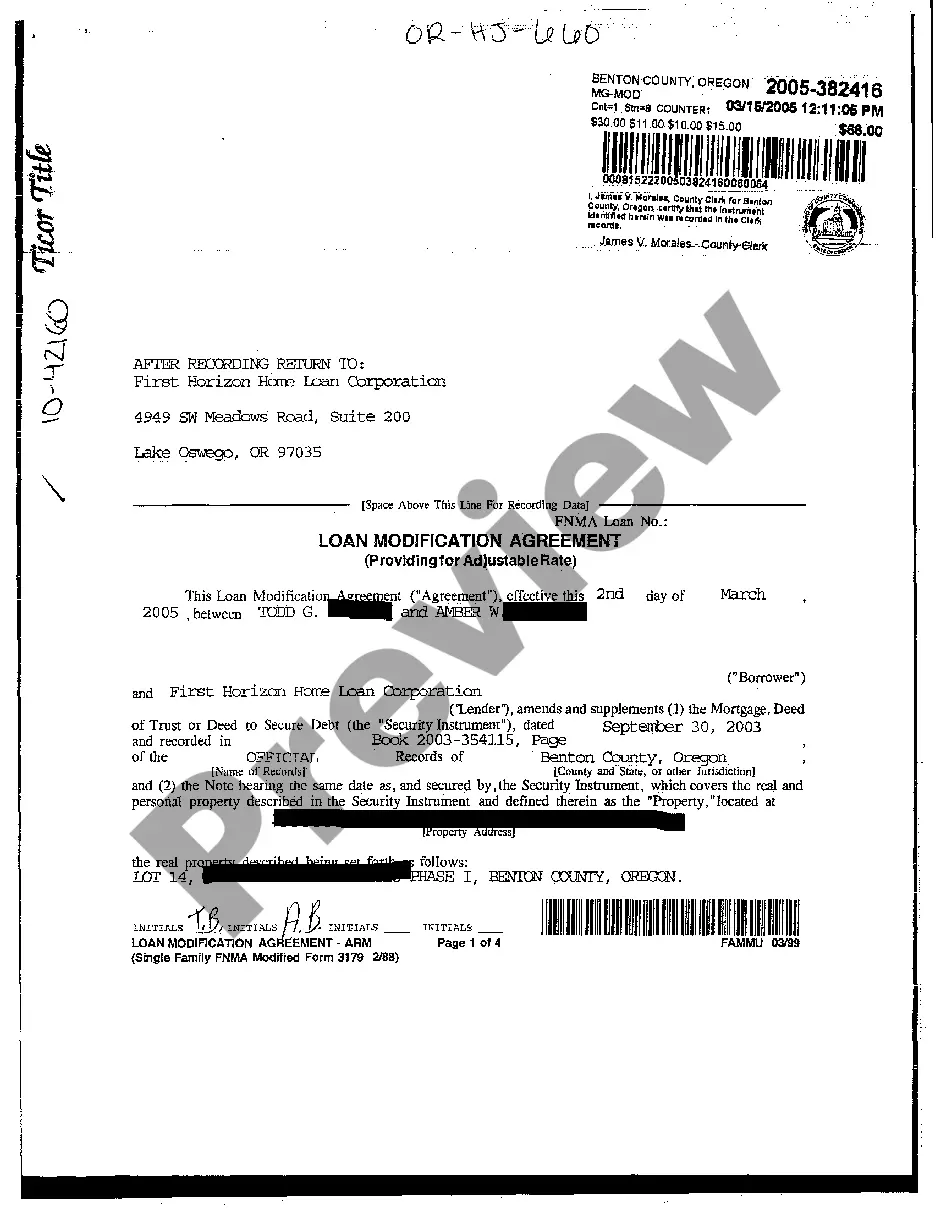

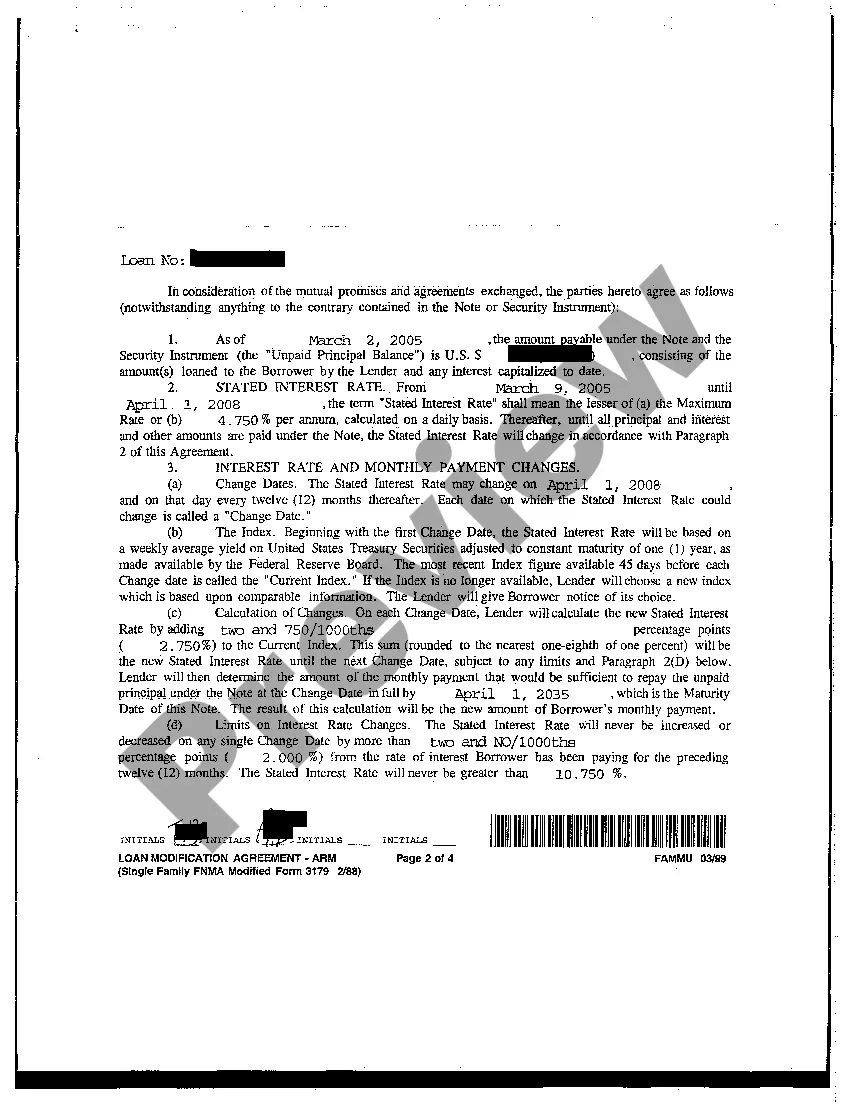

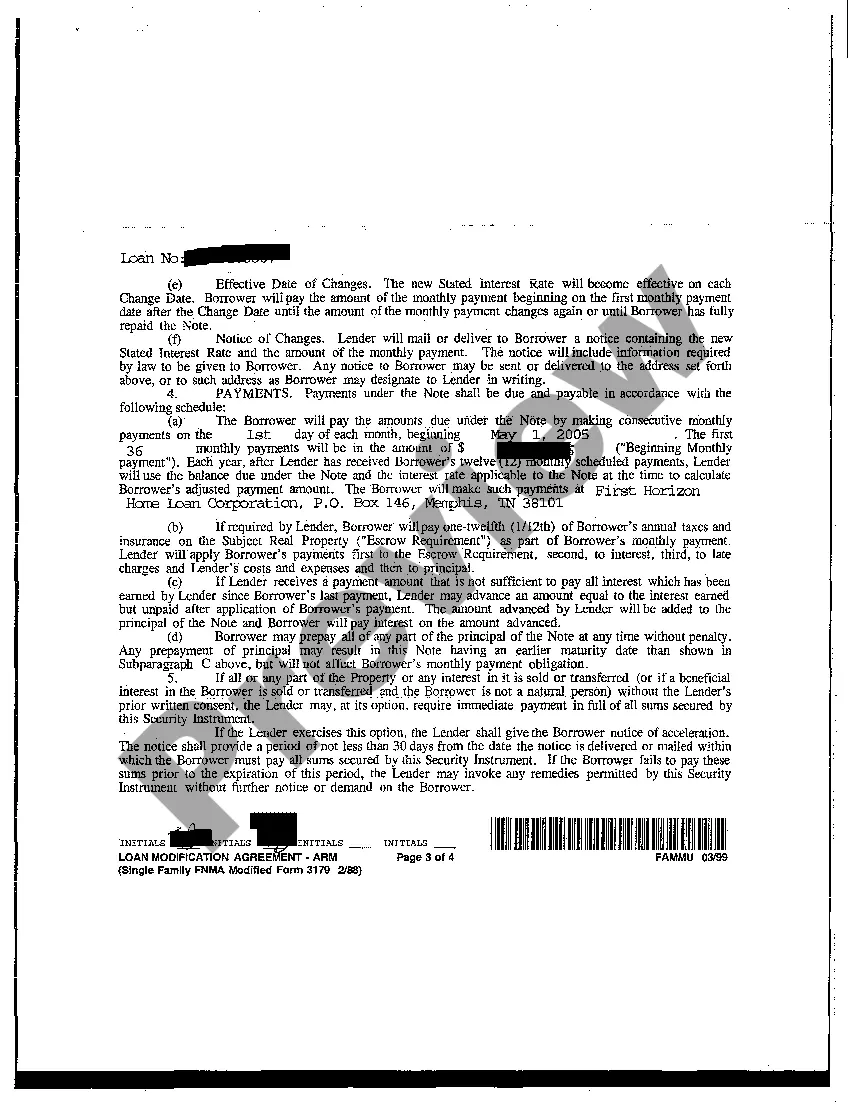

A Hillsboro Oregon Loan Modification Agreement providing for Adjustable Rate is a comprehensive financial arrangement that allows borrowers in Hillsboro, Oregon to modify the terms of their existing loan, specifically those with adjustable interest rates. This agreement helps borrowers facing financial challenges to negotiate new terms and make their mortgage payments more manageable. With an adjustable rate loan modification agreement, borrowers can typically alter the interest rate and other key aspects of their loan to ensure more favorable terms. This can mitigate the risk of payment increases for borrowers and provide greater stability in uncertain financial situations. Different types of Hillsboro Oregon Loan Modification Agreements providing for Adjustable Rate may include: 1. Interest Rate Modification: This type of loan modification agreement focuses solely on adjusting the interest rate associated with the loan. Borrowers may negotiate a lower interest rate, which can result in significantly reduced monthly mortgage payments. This adjustment can be particularly helpful if the current interest rate is high or if it becomes financially burdensome over time. 2. Term Extension: A term extension modification agreement allows borrowers to extend the length of their loan term. This results in a reduction of the monthly mortgage payments, making it more affordable for the borrower. By spreading the loan payments over a longer time period, borrowers can better manage their monthly cash flow and retain their property. 3. Hybrid Modification: A hybrid modification agreement combines elements of interest rate modification and term extension. This type of loan modification is designed to provide borrowers with a balanced payment arrangement. The interest rate may be adjusted, and the term of the loan can be extended to ensure a more affordable monthly payment. 4. Principal Reduction: In certain cases, borrowers may be able to negotiate a principal reduction with their lender. This agreement involves decreasing the total loan amount owed, which can significantly reduce monthly payments and overall debt burden. However, obtaining a principal reduction can be more challenging, as lenders typically require a strong justification for this type of modification. In conclusion, a Hillsboro Oregon Loan Modification Agreement providing for Adjustable Rate allows borrowers to modify the terms of their loan with adjustable interest rates. This financial arrangement offers several possibilities, including adjusting the interest rate, extending the term, combining modifications, or even obtaining a principal reduction. For homeowners in Hillsboro, Oregon experiencing financial difficulties, these loan modification options offer a way to regain financial stability and avoid potential foreclosure.

Hillsboro Oregon Loan Modification Agreement providing for Adjustable Rate

Description

How to fill out Hillsboro Oregon Loan Modification Agreement Providing For Adjustable Rate?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Hillsboro Oregon Loan Modification Agreement providing for Adjustable Rate becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Hillsboro Oregon Loan Modification Agreement providing for Adjustable Rate takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

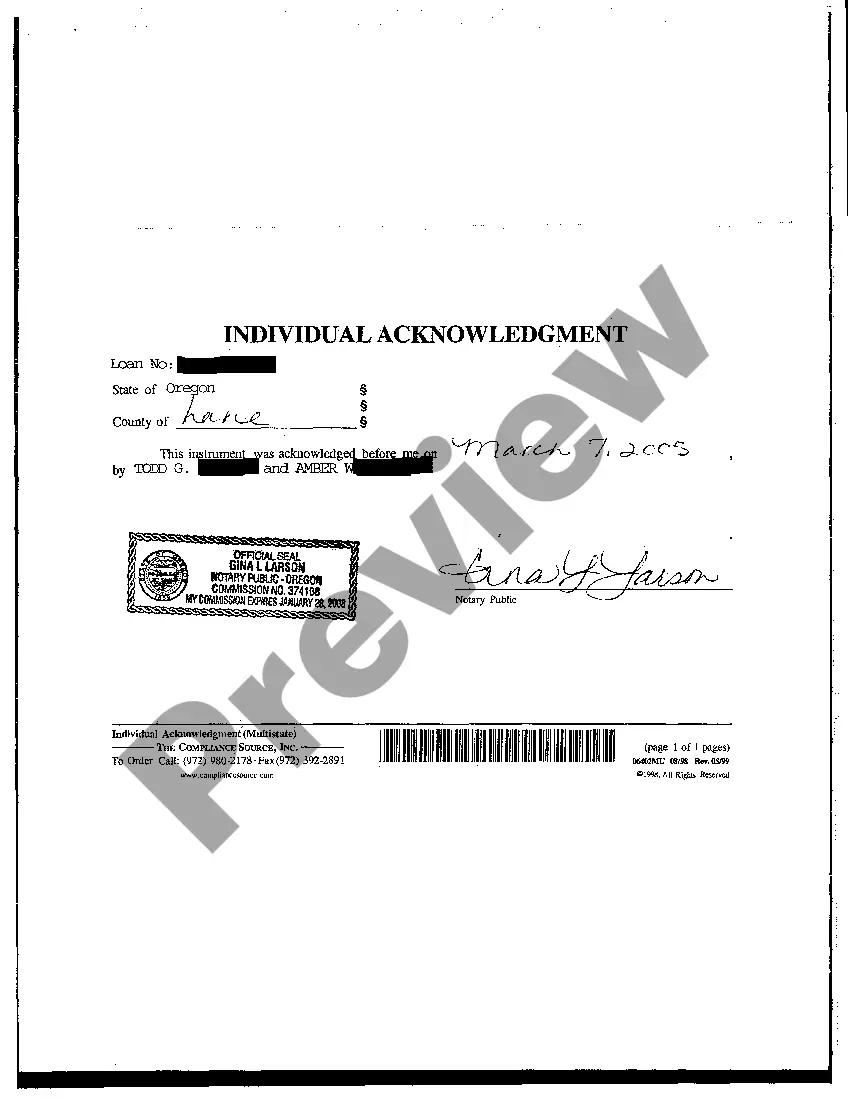

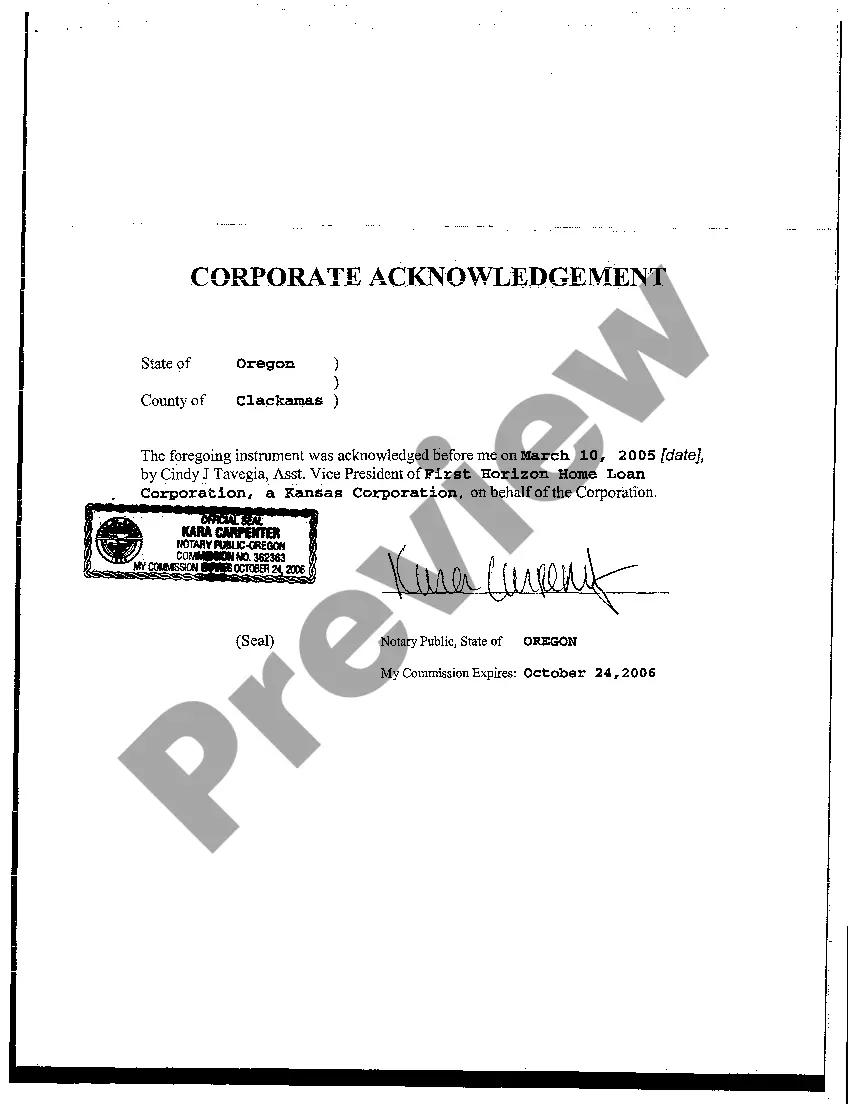

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Hillsboro Oregon Loan Modification Agreement providing for Adjustable Rate. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

A loan modification can change the principal of the loan, the interest rate, and other terms to make the loan more affordable. However, a lender must agree to the loan modification, which means borrowers must negotiate with them.

The disadvantages of a loan modification include the possibility that you will end up paying more over time to repay the loan. The total you owe may even be more than your house is worth in some cases. In addition, you may pay extra fees to modify a loan or incur tax liability.

If your servicer or lender agrees to a mortgage loan modification, it may result in lowering your monthly payment, extending or shortening your loan's term, or decreasing the interest rate you pay.

Obtaining a loan modification can also hurt your credit. It will show up on your credit report, and it may lower your credit score, which can affect your ability to get another loan in the future. Loan modifications are also complex, time-consuming, and carry the risk of scams.

Loan modification fees may be charged if a person tries to change the terms of his or her loan. These fees may be charged by the lender or by a third-party professional that negotiates the modification process.

The disadvantages of a loan modification include the possibility that you will end up paying more over time to repay the loan. The total you owe may even be more than your house is worth in some cases. In addition, you may pay extra fees to modify a loan or incur tax liability.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments.

Simply put, no, the mortgage company is not required under any state or federal law to modify your home loan. Due to all of the government talk about helping homeowners, many people assume that their mortgage company is bound to provide a loan modification. This is not the case.