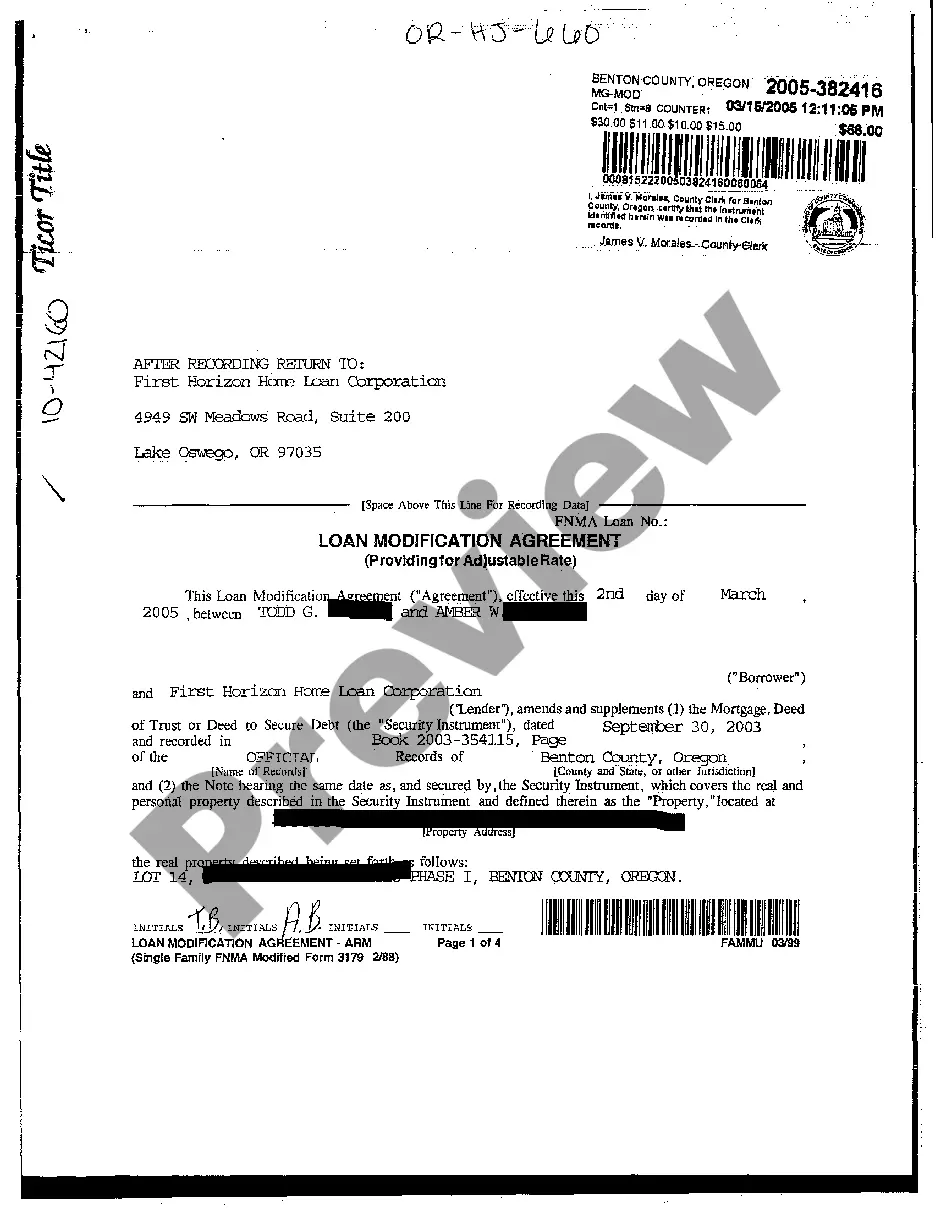

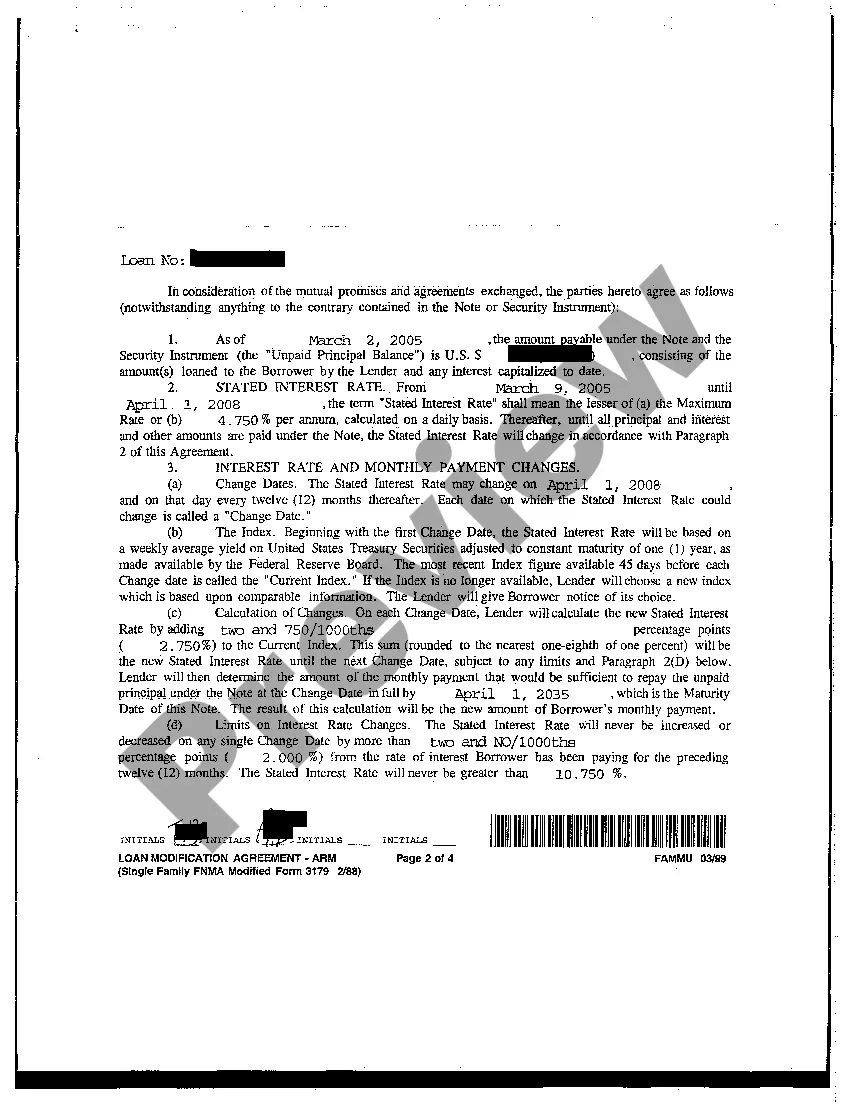

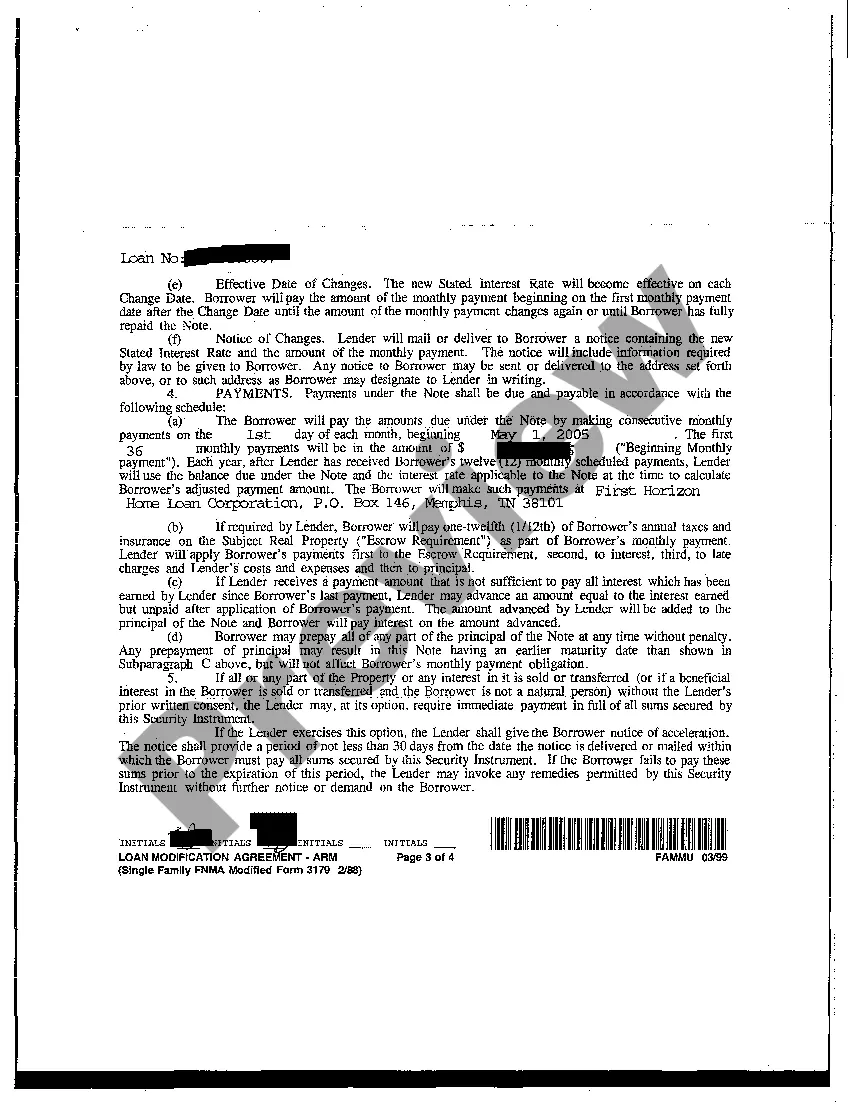

Portland Oregon Loan Modification Agreement providing for Adjustable Rate is a legal document designed to assist borrowers in modifying their existing home loan payments. This agreement is specifically tailored for residents of Portland, Oregon, who possess an adjustable-rate mortgage (ARM). Adjustable-rate mortgages are loans that have an interest rate that fluctuates periodically based on an index. The purpose of a Portland Oregon Loan Modification Agreement providing for Adjustable Rate is to alleviate financial burden by adjusting the terms and conditions of the existing ARM. It aims to prevent foreclosure and defaults by providing borrowers with more affordable monthly mortgage payments. This modification can be requested when the borrower's financial circumstances change significantly or when the current ARM terms are no longer manageable or affordable. The key feature of this loan modification agreement is the adjustment to the interest rate. Borrowers may be able to negotiate a new, lower adjustable interest rate that will remain in effect for a predetermined period. This adjustment is determined based on updated financial information, market conditions, and the lender's evaluation of the borrower's ability to make modified payments. The agreement protects both the borrower and the lender by setting specific terms, such as the duration of the new interest rate and any associated fees. The Portland Oregon Loan Modification Agreement providing for Adjustable Rate is designed with flexibility and considers the unique circumstances of each borrower. It prioritizes affordability, making homeownership sustainable even during periods of economic uncertainty or personal financial challenges. There may be different types of Portland Oregon Loan Modification Agreements providing for Adjustable Rate. These variations can include: 1. Rate Reduction Modification Agreement: This type of modification agreement involves reducing the interest rate on the ARM to a more manageable level. The reduced interest rate remains adjustable but at a lower level, providing immediate relief to the borrower. 2. Hybrid ARM Conversion Agreement: This modification may involve converting the adjustable-rate mortgage into a hybrid loan. A hybrid loan typically starts with a fixed interest rate for a specific period and later converts to an adjustable rate. This type of modification provides stability for a predetermined time, followed by adjustable payments to suit the borrower's financial capabilities. 3. Interest-only Loan Modification Agreement: In this type of modification agreement, the borrower is allowed to make interest-only payments for a specific period. This temporary reduction in payment allows borrowers to manage their financial situations, and thereafter, the payments revert to principal and interest. It is important for borrowers seeking a Portland Oregon Loan Modification Agreement providing for Adjustable Rate to consult with experienced professionals, such as loan modification specialists or attorneys specializing in real estate law. These experts can guide borrowers through the process, ensure compliance with legal requirements, and negotiate the best terms and conditions on their behalf.

Portland Oregon Loan Modification Agreement providing for Adjustable Rate

Description

How to fill out Portland Oregon Loan Modification Agreement Providing For Adjustable Rate?

Finding authentic templates that comply with your regional regulations can be difficult unless you utilize the US Legal Forms library.

It is an online repository containing over 85,000 legal documents for individual and professional requirements as well as various real-world scenarios.

All the forms are systematically categorized by usage area and jurisdiction, making it as straightforward and effortless as ABC to find the Portland Oregon Loan Modification Agreement for Adjustable Rate.

Ensure that your paperwork is organized and meets the legal standards. Utilize the US Legal Forms library to always have crucial document templates readily available for any requirements!

- Examine the Preview mode and form description.

- Ensure you’ve selected the accurate one that fits your needs and aligns completely with your local jurisdiction criteria.

- Look for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to find the right one. If it meets your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay. Using an updated appraisal report the modification underwriter will confirm the current market value of the property as security for the loan.

Loan modification fees may be charged if a person tries to change the terms of his or her loan. These fees may be charged by the lender or by a third-party professional that negotiates the modification process.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

The disadvantages of a loan modification include the possibility that you will end up paying more over time to repay the loan. The total you owe may even be more than your house is worth in some cases.

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

Loan modification fees may be charged if a person tries to change the terms of his or her loan. These fees may be charged by the lender or by a third-party professional that negotiates the modification process.

The success rate for streamlined modifications was 64.1 percent in the first 36 months after modification, compared with a 68.9 percent success rate for standard modifications, a 4.8 percentage-point difference.

Don't pay an upfront fee for a loan modification. Fees can only be collected when your lender has agreed to modify your loan and has presented you with the new terms and contract for your approval.

A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable. Borrowers seeking a modification have to provide proof of hardship to their mortgage lender or servicer.

A loan modification can change the principal of the loan, the interest rate, and other terms to make the loan more affordable. However, a lender must agree to the loan modification, which means borrowers must negotiate with them.