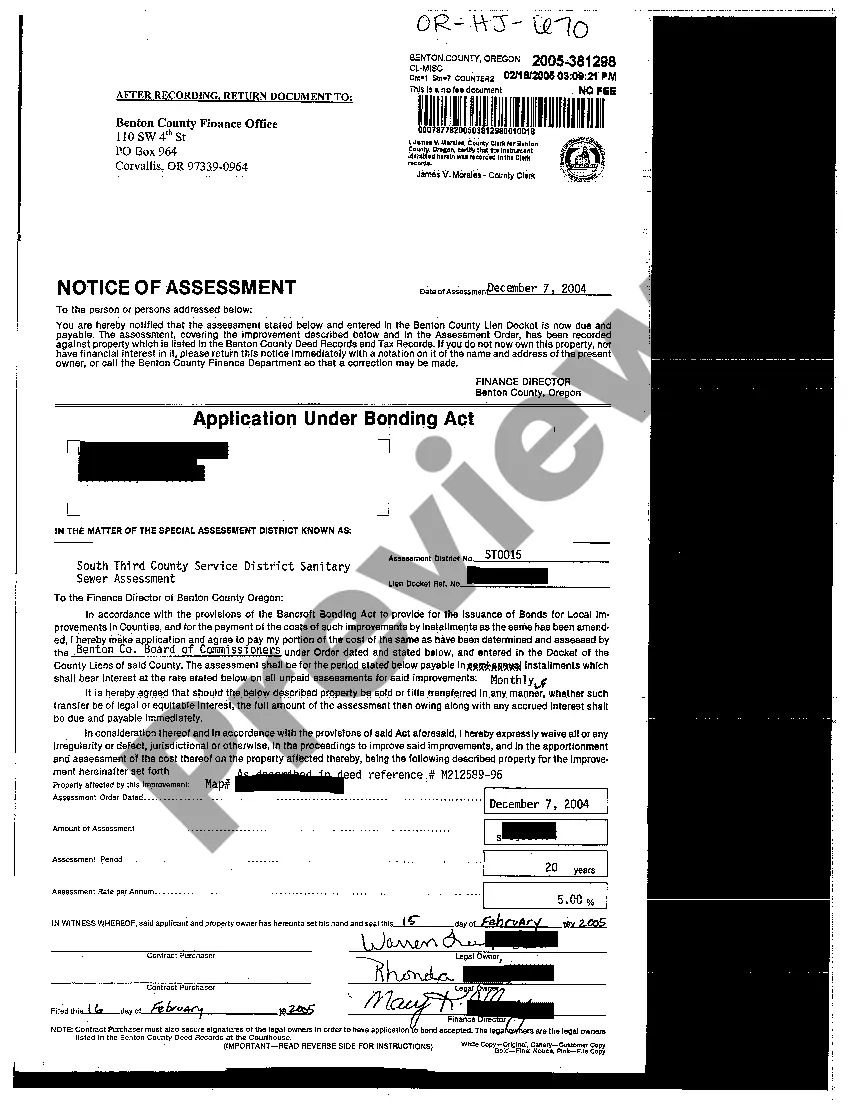

Eugene Oregon Notice of Assessment for County Improvements is a document issued by the county government to inform property owners about the assessment value of their properties. This notice is a significant part of the property tax assessment process and provides detailed information about the property's assessed value, any changes made to the assessment, and the resulting tax liabilities. When it comes to County Improvements, there are several types of Eugene Oregon Notice of Assessment that property owners may encounter: 1. Land Improvements Assessment: This notice specifically focuses on any enhancements or modifications made to the land associated with the property. It includes improvements such as landscaping, drainage systems, irrigation, or any other modifications performed on the land to enhance its value. 2. Building Improvements Assessment: This particular notice deals with any changes, additions, or repairs done to the structures or buildings on the property. It encompasses modifications like renovations, expansions, or the addition of new amenities that increase the overall value of the property. 3. Infrastructure Improvements Assessment: The infrastructure notice of assessment pertains to improvements made to public infrastructure near the property, such as roads, sidewalks, water supply, sewage systems, or any other communal enhancements that positively impact the property's value. 4. Environmental or Sustainability Improvements Assessment: This notice focuses on any eco-friendly or sustainable improvements made to the property. It includes upgrades like renewable energy installations (solar panels, wind turbines), energy-efficient systems, water conservation measures, or any environmental initiatives that aim to reduce the property's carbon footprint. The Eugene Oregon Notice of Assessment for County Improvements is essential to property owners as it determines the property taxes that they will be required to pay based on the assessed value. By providing accurate and detailed information about the assessment and any modifications made, property owners can review and understand their tax obligations and take appropriate measures if they wish to appeal the assessment. It is crucial for property owners to thoroughly examine the notice and seek clarification from the county authorities if they have any queries or concerns regarding the assessment calculation or the improvements made on the property.

Eugene Oregon Notice of Assessment for County Improvements

Description

How to fill out Eugene Oregon Notice Of Assessment For County Improvements?

If you are searching for a valid form template, it’s extremely hard to choose a better service than the US Legal Forms website – one of the most comprehensive libraries on the internet. Here you can find thousands of document samples for organization and personal purposes by types and regions, or key phrases. With our advanced search option, discovering the latest Eugene Oregon Notice of Assessment for County Improvements is as elementary as 1-2-3. In addition, the relevance of every file is confirmed by a group of professional attorneys that regularly check the templates on our website and revise them based on the latest state and county regulations.

If you already know about our system and have a registered account, all you need to get the Eugene Oregon Notice of Assessment for County Improvements is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the form you want. Check its description and use the Preview function to check its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to find the proper record.

- Confirm your decision. Select the Buy now button. Following that, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Choose the format and download it to your system.

- Make changes. Fill out, edit, print, and sign the received Eugene Oregon Notice of Assessment for County Improvements.

Every form you add to your profile has no expiry date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you need to receive an extra copy for editing or creating a hard copy, you may return and save it once again at any moment.

Make use of the US Legal Forms extensive library to gain access to the Eugene Oregon Notice of Assessment for County Improvements you were seeking and thousands of other professional and state-specific samples on a single platform!