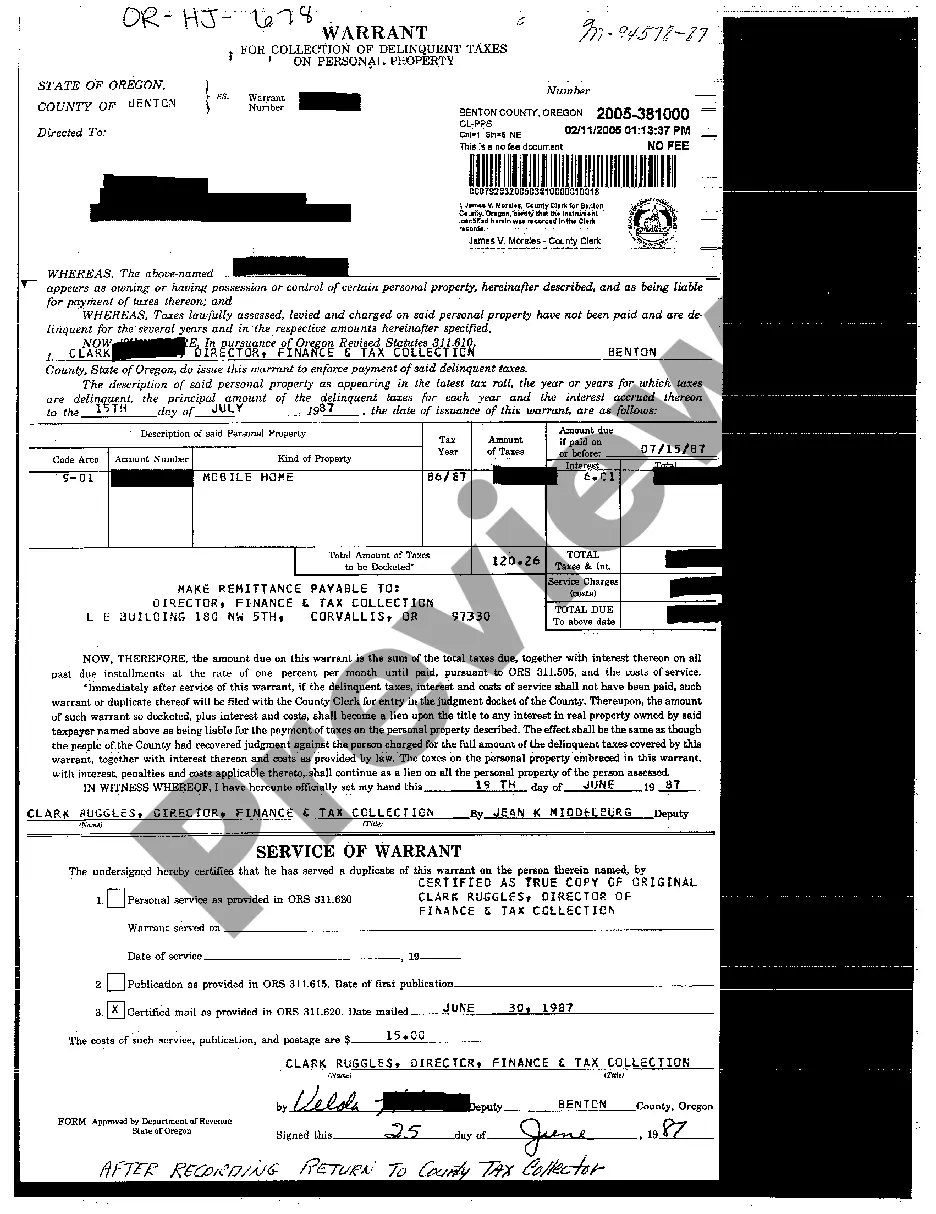

Keywords: Hillsboro Oregon, warrant, collection, delinquent taxes, personal property A Hillsboro Oregon Warrant for Collection of Delinquent Taxes on Personal Property is a legal document issued by the Hillsboro government to collect unpaid taxes on personal property. It is designed to compel individuals or businesses who have failed to pay their property taxes to fulfill their financial obligations. There are several types of Hillsboro Oregon Warrants for Collection of Delinquent Taxes on Personal Property, each tailored for specific circumstances. These may include: 1. Residential Property Warrant: This type of warrant is issued when a homeowner fails to pay property taxes on their residential property in Hillsboro. It is aimed at recovering the outstanding taxes owed on the property. 2. Commercial Property Warrant: When a business or commercial property owner neglects to pay their property taxes, a Commercial Property Warrant may be issued. It enables the government to legally collect the delinquent taxes owed on the commercial property. 3. Vacant Land Warrant: If taxes on a vacant or undeveloped land in Hillsboro are left unpaid, a Vacant Land Warrant for Collection of Delinquent Taxes on Personal Property may be issued. This warrant allows the government to pursue the overdue taxes associated with the vacant land. 4. Personal Property Warrant: Sometimes, individuals or businesses fail to pay taxes on specific personal property items, such as vehicles or equipment. A Personal Property Warrant may be issued in such cases to retrieve the unpaid taxes related to the personal property. It is important to note that Hillsboro Oregon Warrants for Collection of Delinquent Taxes on Personal Property are serious legal documents that should not be taken lightly. They provide the government with the authority to take appropriate actions to recover the outstanding taxes, which may include property seizure, asset sale, or other forms of legal intervention. If you have received a Hillsboro Oregon Warrant for Collection of Delinquent Taxes on Personal Property, it is crucial to address the situation promptly. Seeking professional advice from a tax attorney or contacting the Hillsboro government's tax department can help you understand your options and find a resolution for your delinquent taxes. Ignoring or neglecting the warrant may result in further penalties and legal consequences.

Hillsboro Oregon Warrant for Collection of Delinquent Taxes on Personal Property

Category:

State:

Oregon

City:

Hillsboro

Control #:

OR-HJ-678

Format:

PDF

Instant download

This form is available by subscription

Description

Warrant for Collection of Delinquent Taxes on Personal Property

Keywords: Hillsboro Oregon, warrant, collection, delinquent taxes, personal property A Hillsboro Oregon Warrant for Collection of Delinquent Taxes on Personal Property is a legal document issued by the Hillsboro government to collect unpaid taxes on personal property. It is designed to compel individuals or businesses who have failed to pay their property taxes to fulfill their financial obligations. There are several types of Hillsboro Oregon Warrants for Collection of Delinquent Taxes on Personal Property, each tailored for specific circumstances. These may include: 1. Residential Property Warrant: This type of warrant is issued when a homeowner fails to pay property taxes on their residential property in Hillsboro. It is aimed at recovering the outstanding taxes owed on the property. 2. Commercial Property Warrant: When a business or commercial property owner neglects to pay their property taxes, a Commercial Property Warrant may be issued. It enables the government to legally collect the delinquent taxes owed on the commercial property. 3. Vacant Land Warrant: If taxes on a vacant or undeveloped land in Hillsboro are left unpaid, a Vacant Land Warrant for Collection of Delinquent Taxes on Personal Property may be issued. This warrant allows the government to pursue the overdue taxes associated with the vacant land. 4. Personal Property Warrant: Sometimes, individuals or businesses fail to pay taxes on specific personal property items, such as vehicles or equipment. A Personal Property Warrant may be issued in such cases to retrieve the unpaid taxes related to the personal property. It is important to note that Hillsboro Oregon Warrants for Collection of Delinquent Taxes on Personal Property are serious legal documents that should not be taken lightly. They provide the government with the authority to take appropriate actions to recover the outstanding taxes, which may include property seizure, asset sale, or other forms of legal intervention. If you have received a Hillsboro Oregon Warrant for Collection of Delinquent Taxes on Personal Property, it is crucial to address the situation promptly. Seeking professional advice from a tax attorney or contacting the Hillsboro government's tax department can help you understand your options and find a resolution for your delinquent taxes. Ignoring or neglecting the warrant may result in further penalties and legal consequences.

How to fill out Hillsboro Oregon Warrant For Collection Of Delinquent Taxes On Personal Property?

If you’ve already used our service before, log in to your account and download the Hillsboro Oregon Warrant for Collection of Delinquent Taxes on Personal Property on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

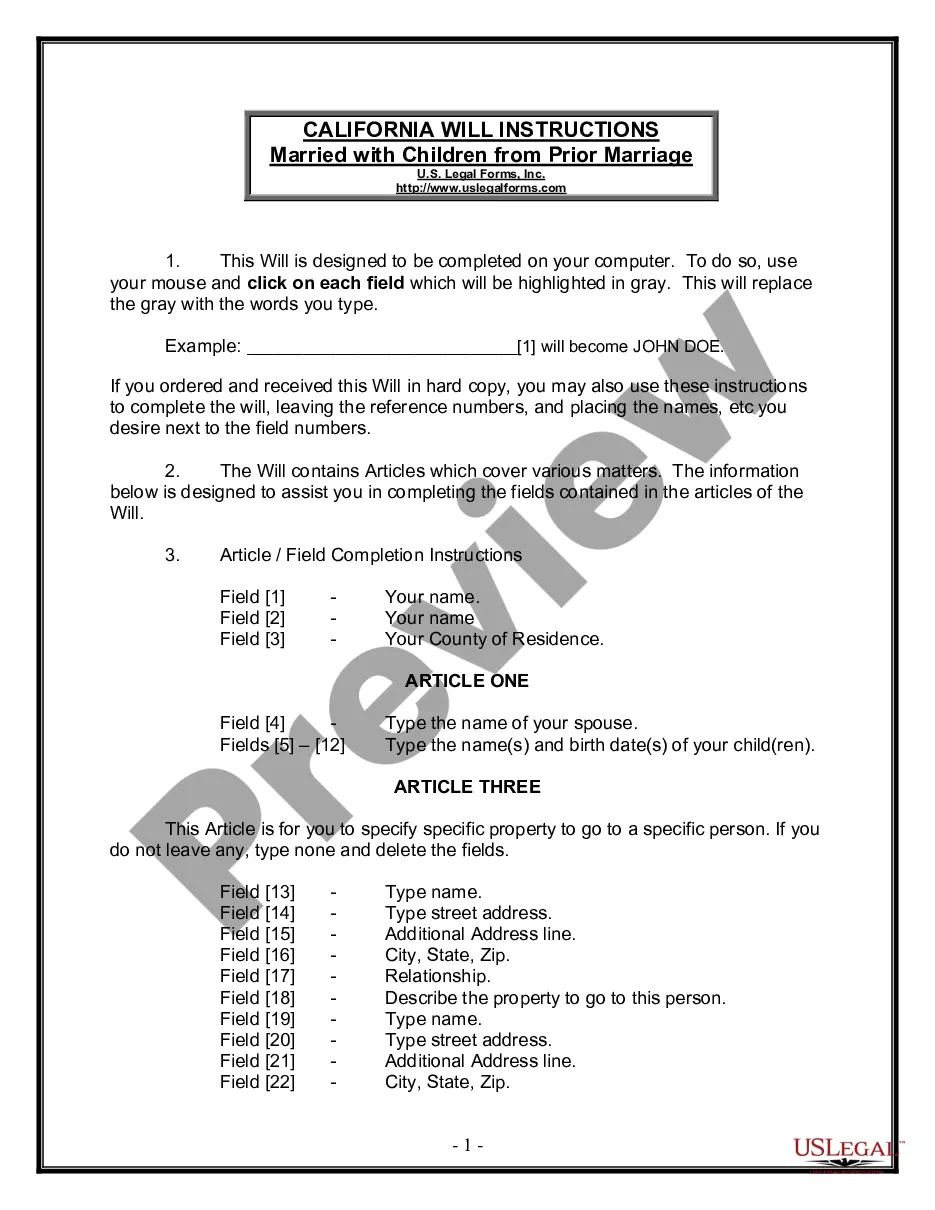

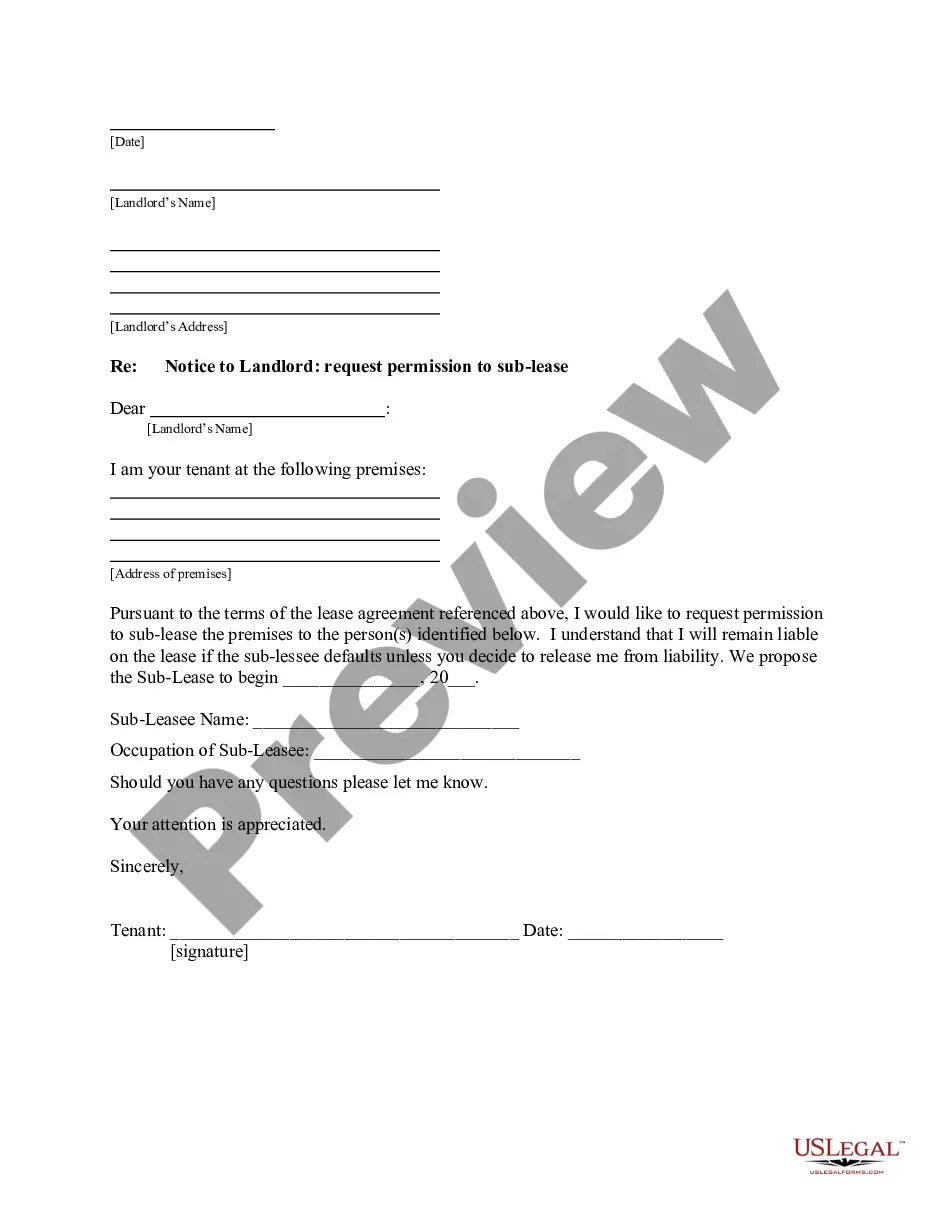

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Hillsboro Oregon Warrant for Collection of Delinquent Taxes on Personal Property. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!