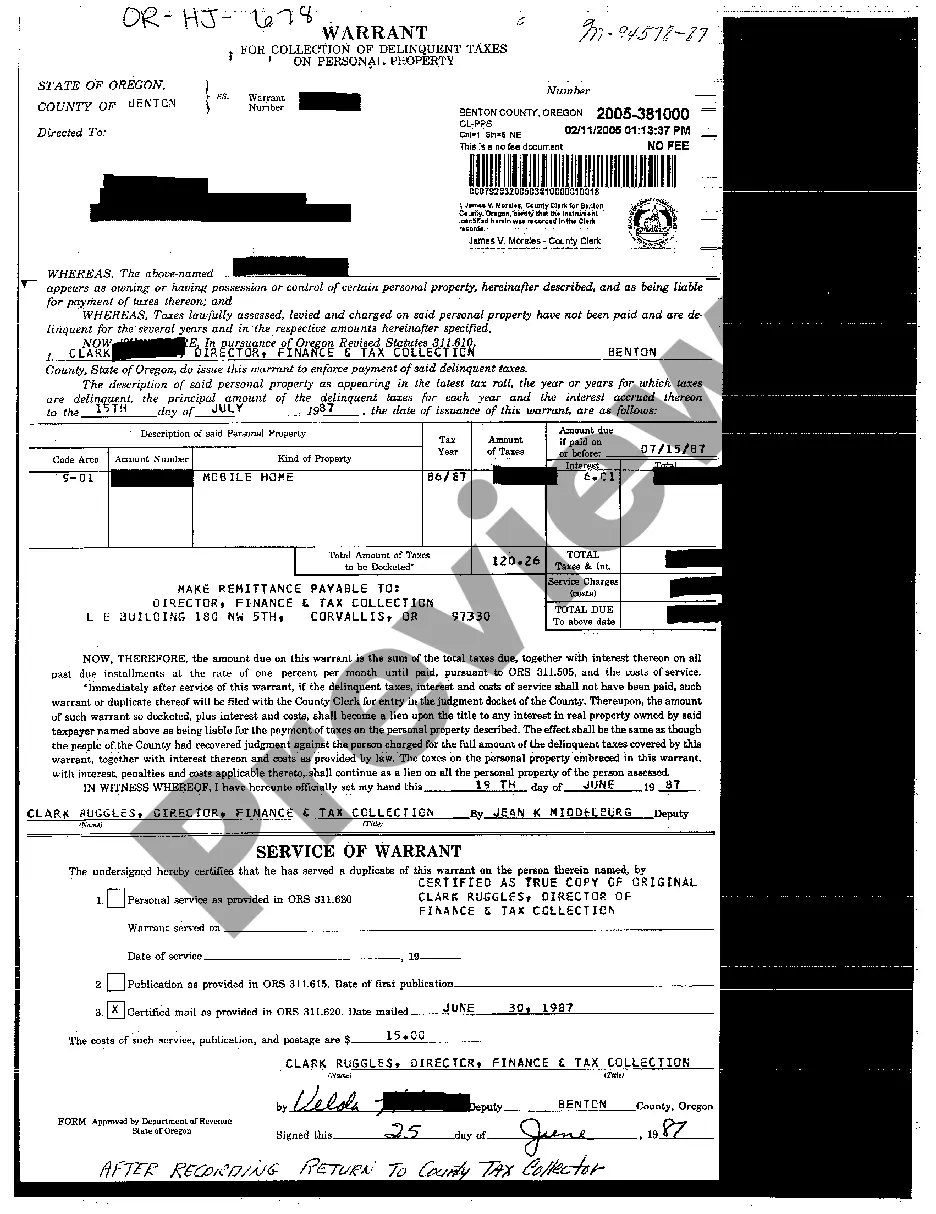

A Portland Oregon Warrant for Collection of Delinquent Taxes on Personal Property is a legal document issued by the city of Portland to collect unpaid taxes on personal property. It allows the city to seize and sell the property in order to satisfy the outstanding tax debt. Typically, a warrant is issued when an individual or business fails to pay their property taxes on time. Personal property refers to items such as vehicles, boats, equipment, and other tangible assets that are subject to taxation by the city. There are several types of Portland Oregon Warrants for Collection of Delinquent Taxes on Personal Property, including: 1. Standard Warrant: This is the most common type of warrant issued by the city for collection of delinquent taxes. It allows the city to initiate the legal process of collecting the unpaid taxes, including seizing and selling the personal property. 2. Final Warrant: A final warrant is issued after all other attempts to collect the delinquent taxes have failed. It signifies that the city has exhausted all other collection methods and is now authorized to take legal action to collect the debt. 3. Distraint Warrant: This type of warrant allows the city to seize the delinquent taxpayer's personal property and sell it to satisfy the outstanding tax debt. It may involve hiring a third-party auctioneer to conduct the sale. 4. Execution Warrant: An execution warrant is issued when a distraint warrant is not sufficient to collect the unpaid taxes. It authorizes the city to use other means, such as garnishing wages or placing liens on real property, to enforce the collection of the delinquent taxes. The issuance of a Portland Oregon Warrant for Collection of Delinquent Taxes on Personal Property is a serious matter. It is recommended that individuals and businesses promptly address any outstanding tax liabilities to avoid the potential consequences of a warrant, such as property seizure and public auction. Seeking professional tax advice or contacting the city's tax collection department may be helpful in resolving the issue.

Portland Oregon Warrant for Collection of Delinquent Taxes on Personal Property

Description

How to fill out Portland Oregon Warrant For Collection Of Delinquent Taxes On Personal Property?

Are you looking for a reliable and affordable legal forms supplier to get the Portland Oregon Warrant for Collection of Delinquent Taxes on Personal Property? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of particular state and area.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Portland Oregon Warrant for Collection of Delinquent Taxes on Personal Property conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is good for.

- Restart the search in case the template isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Portland Oregon Warrant for Collection of Delinquent Taxes on Personal Property in any available format. You can get back to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal paperwork online once and for all.