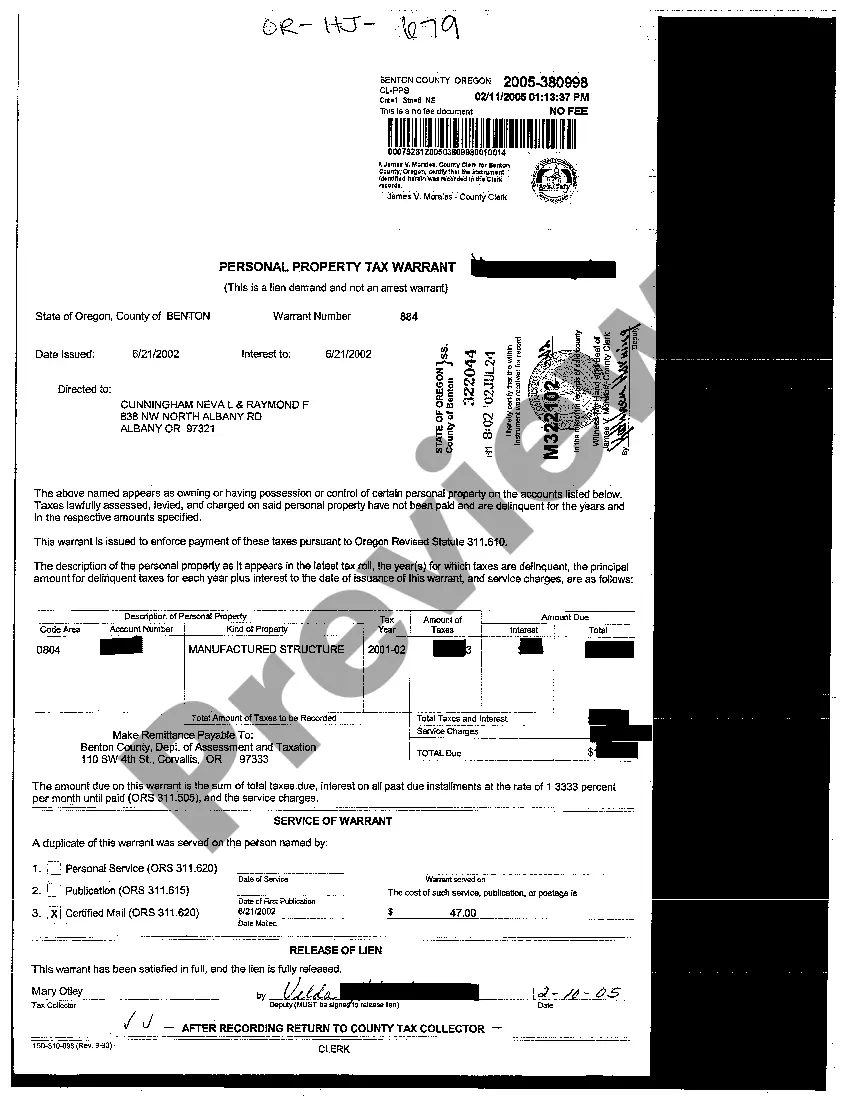

A Bend Oregon Personal Property Tax Warrant is a legal document issued by the Department of Revenue in the city of Bend, Oregon, to recover unpaid personal property taxes. This warrant allows the local government to place liens on or seize personal property owned by individuals or businesses who have failed to pay their property taxes. The Bend Oregon Personal Property Tax Warrant is typically issued after a taxpayer has received multiple notices and reminders regarding their outstanding tax obligations. Failure to promptly resolve these tax debts can lead to the issuance of a warrant, which serves as a serious warning and legal action against the taxpayer. There are different types of Bend Oregon Personal Property Tax Warrants that may be issued based on specific circumstances: 1. Standard Personal Property Tax Warrant: This is the most common type of warrant issued when individuals or businesses fail to pay personal property taxes within the given deadline. It allows the government to take necessary measures to recover the owed tax amount. 2. Late Payment Penalty Warrant: If a taxpayer fails to pay the personal property tax within the set timeframe and accumulates additional penalties due to late payment, the Department of Revenue may issue a warrant specifically for the purpose of collecting these penalties. 3. Seizure Warrant: In extreme cases where a taxpayer continually neglects their personal property tax obligations and disregards all attempts at communication, the local authorities may obtain a warrant to seize the taxpayer's personal property directly. This warrant allows law enforcement agencies to physically take possession of the assets and sell them to fulfill the outstanding tax debt. 4. Warrant of Distraint: A warrant of distraint is issued when the government intends to seize and auction off the personal property to recover the unpaid taxes. This warrant gives the authorities the right to enter the taxpayer's premises and seize assets, which will then be sold to satisfy the tax liability. It is important for individuals and businesses in Bend, Oregon, to promptly address any personal property tax obligations to avoid the issuance of these warrants. Responding to tax notices and making timely payments are crucial to maintaining compliance and avoiding any legal consequences associated with a Bend Oregon Personal Property Tax Warrant.

Bend Oregon Personal Property Tax Warrant

Category:

State:

Oregon

City:

Bend

Control #:

OR-HJ-679

Format:

PDF

Instant download

This form is available by subscription

Description

Personal Property Tax Warrant

A Bend Oregon Personal Property Tax Warrant is a legal document issued by the Department of Revenue in the city of Bend, Oregon, to recover unpaid personal property taxes. This warrant allows the local government to place liens on or seize personal property owned by individuals or businesses who have failed to pay their property taxes. The Bend Oregon Personal Property Tax Warrant is typically issued after a taxpayer has received multiple notices and reminders regarding their outstanding tax obligations. Failure to promptly resolve these tax debts can lead to the issuance of a warrant, which serves as a serious warning and legal action against the taxpayer. There are different types of Bend Oregon Personal Property Tax Warrants that may be issued based on specific circumstances: 1. Standard Personal Property Tax Warrant: This is the most common type of warrant issued when individuals or businesses fail to pay personal property taxes within the given deadline. It allows the government to take necessary measures to recover the owed tax amount. 2. Late Payment Penalty Warrant: If a taxpayer fails to pay the personal property tax within the set timeframe and accumulates additional penalties due to late payment, the Department of Revenue may issue a warrant specifically for the purpose of collecting these penalties. 3. Seizure Warrant: In extreme cases where a taxpayer continually neglects their personal property tax obligations and disregards all attempts at communication, the local authorities may obtain a warrant to seize the taxpayer's personal property directly. This warrant allows law enforcement agencies to physically take possession of the assets and sell them to fulfill the outstanding tax debt. 4. Warrant of Distraint: A warrant of distraint is issued when the government intends to seize and auction off the personal property to recover the unpaid taxes. This warrant gives the authorities the right to enter the taxpayer's premises and seize assets, which will then be sold to satisfy the tax liability. It is important for individuals and businesses in Bend, Oregon, to promptly address any personal property tax obligations to avoid the issuance of these warrants. Responding to tax notices and making timely payments are crucial to maintaining compliance and avoiding any legal consequences associated with a Bend Oregon Personal Property Tax Warrant.

How to fill out Bend Oregon Personal Property Tax Warrant?

If you’ve already used our service before, log in to your account and save the Bend Oregon Personal Property Tax Warrant on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Bend Oregon Personal Property Tax Warrant. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!