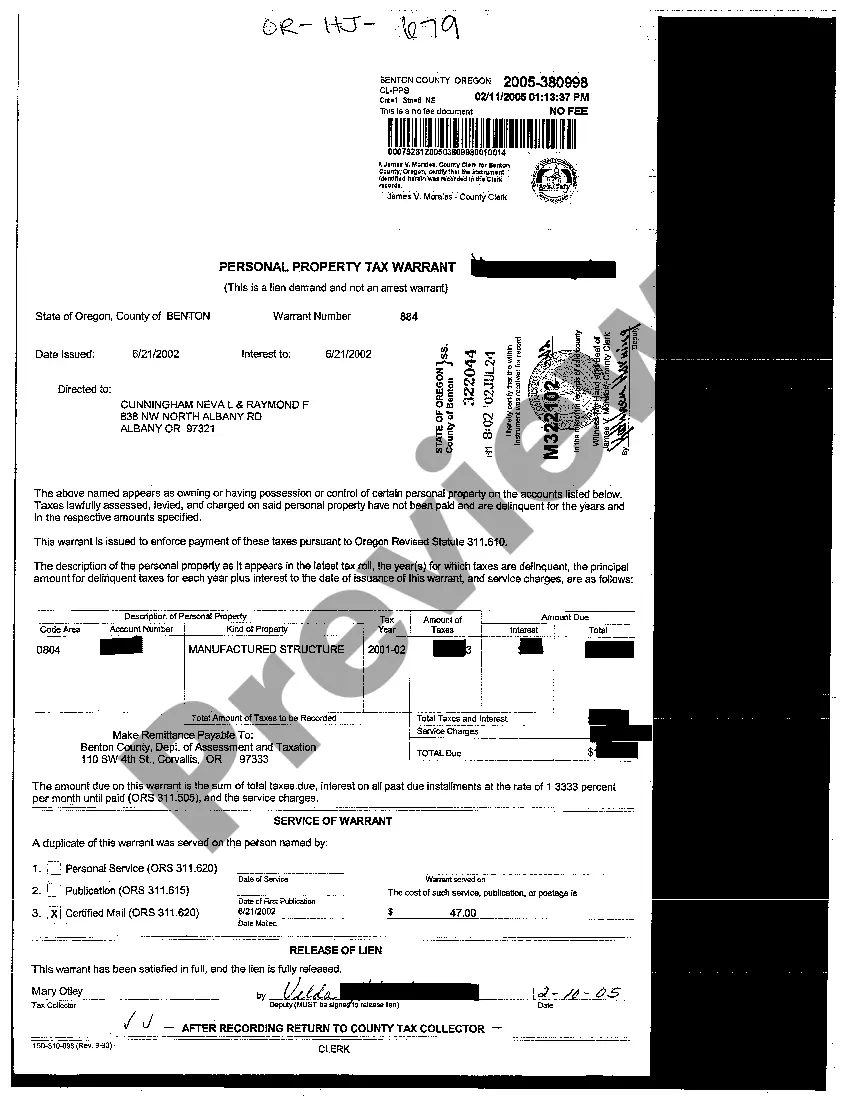

Eugene Oregon Personal Property Tax Warrant is a legal document issued by the City of Eugene to collect unpaid personal property taxes. Personal property refers to tangible assets owned by individuals or businesses, excluding real estate. This type of warrant targets individuals or businesses residing in Eugene who have failed to pay their personal property taxes. The Eugene Oregon Personal Property Tax Warrant serves as an alert to taxpayers, notifying them that they have overdue personal property tax payments. The warrant authorizes the City of Eugene to take necessary actions to collect the unpaid taxes, including pursuing legal remedies and seizing the delinquent taxpayer's assets or property. There are two main types of Eugene Oregon Personal Property Tax Warrants: 1. Initial Warrant: This type of warrant is issued when a taxpayer fails to pay their personal property taxes by the specified due date. It serves as an initial notice and provides the taxpayer with an opportunity to rectify the situation by paying the outstanding taxes, penalties, and any associated fees. 2. Final Warrant: If a taxpayer does not respond to the initial warrant or fails to make the necessary payment within the given timeframe, the City of Eugene may issue a final warrant. A final warrant indicates that all available options for voluntary compliance have been exhausted, and the City will proceed with more aggressive collection efforts, such as asset seizure, wage garnishment, or placing liens on property. It is important for Eugene residents and businesses to promptly address any personal property tax obligations to avoid the issuance of a warrant. Failure to do so can result in significant financial consequences and legal actions. Taxpayers should contact the City of Eugene's Tax Division to discuss payment options, arrangements, or seek clarification regarding the personal property tax warrant.

Eugene Oregon Personal Property Tax Warrant

Description

How to fill out Eugene Oregon Personal Property Tax Warrant?

Take advantage of the US Legal Forms and gain immediate entry to any document you desire.

Our advantageous website featuring thousands of papers enables you to locate and acquire nearly any document template you need.

You can download, fill out, and authenticate the Eugene Oregon Personal Property Tax Warrant in just a few moments rather than searching the internet for hours for a suitable template.

Utilizing our catalog is a fantastic tactic to enhance the security of your form submissions.

Moreover, you can access all previously saved documents in the My documents section.

If you don’t have an account yet, follow the instructions below.

- Our experienced attorneys routinely review all the documents to guarantee that the forms are suitable for a specific area and compliant with new laws and regulations.

- How can you obtain the Eugene Oregon Personal Property Tax Warrant.

- If you already possess a subscription, simply Log In to your account.

- The Download button will be visible on all the samples you examine.

Form popularity

FAQ

To obtain a Eugene Oregon Personal Property Tax Warrant, first, a local tax authority reviews the tax records. If outstanding taxes remain unpaid, they may file for a tax warrant with the court. This legal document allows the government to collect the owed taxes through various means, such as placing liens on properties or seizing assets. If you face this situation, consider using US Legal Forms to navigate the requirements for filing or responding to a tax warrant effectively.

In Oregon, real property taxes become delinquent on May 16 of each year. If property taxes remain unpaid by this date, the county may issue a Eugene Oregon Personal Property Tax Warrant against the property. Homeowners must stay vigilant and manage their tax payments effectively to avoid penalties or risk losing their property. Always check local regulations for specific dates and updates regarding tax payments.

To buy tax delinquent property in Oregon, you typically participate in a public auction managed by the county. This process involves examining properties with outstanding taxes, which may include homes or land linked to a Eugene Oregon Personal Property Tax Warrant. It's wise to conduct title searches and understand the terms of the sale, as these properties often come with certain obligations. Be prepared to act quickly and have funding ready since competition can be fierce.

In Oregon, you can claim unpaid property taxes up to five years back. This means if you have an outstanding balance, it is crucial to address it promptly to avoid fees and legal actions, such as a Eugene Oregon Personal Property Tax Warrant. The sooner you acknowledge and settle these taxes, the better your financial health will be. It's important to stay informed about your tax status to prevent further complications.

While typically, a tax warrant does not directly lead to jail time, it can escalate if taxes remain unpaid and legitimate efforts are not made to resolve the issue. Engaging with the tax authorities and fulfilling your tax obligations can prevent legal action. Each case is unique, so it's essential to consult a tax professional for personalized advice. Understanding the nuances of a Eugene Oregon personal property tax warrant may help in avoiding serious legal troubles.

Having a tax warrant can lead to severe consequences, including wage garnishment, property liens, and bank levies. Authorities can seize your property to settle the unpaid taxes, which can create significant financial hardship. Addressing a Eugene Oregon personal property tax warrant quickly is vital to avoid escalated actions. Seeking legal help can guide you through this process.

A personal tax warrant is a legal document allowing authorities to collect unpaid taxes from an individual. It serves as a claim against your personal property, indicating that you owe taxes. When a personal property tax warrant is issued, it can impact your financial standing and credit. Understanding its implications in Eugene, Oregon, is crucial for effective management.

To resolve a tax warrant, you first need to understand its nature and implications. You may consider contacting an attorney who specializes in tax law. In some cases, filing for a settlement or payment plan can help clear the warrant. Utilizing platforms like USLegalForms can assist you in managing paperwork efficiently.

Certain groups may be exempt from property taxes in Oregon, including some veterans, seniors, and individuals with disabilities. The criteria for these exemptions can vary, so it is essential to research who qualifies. Understanding these exemptions can help you navigate the complexities of a Eugene Oregon Personal Property Tax Warrant. Always consult local laws to ensure you're informed on available benefits.

In Oregon, property taxes can remain unpaid for several years before the property is subject to foreclosure. Usually, if taxes remain unpaid for three consecutive years, the county may begin the foreclosure process. Knowing the timeline associated with a Eugene Oregon Personal Property Tax Warrant is crucial, as it can impact your financial situation significantly. Staying proactive is key to avoiding such outcomes.