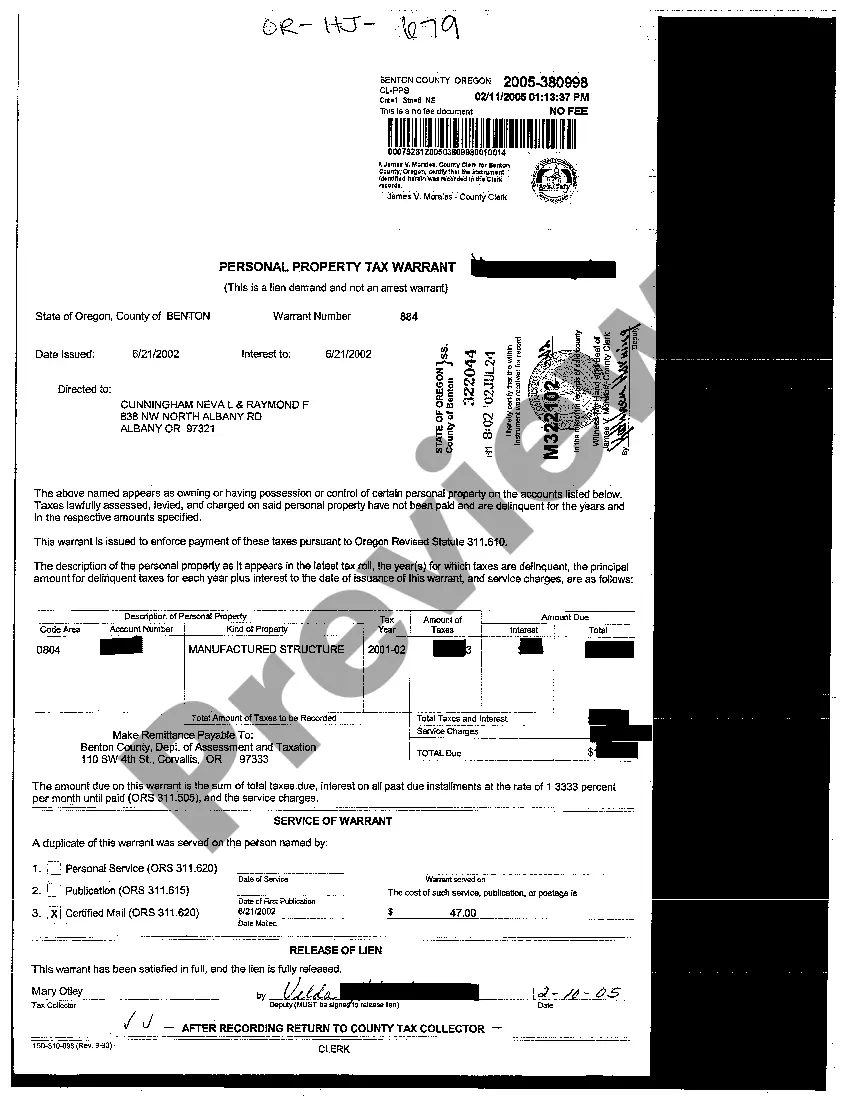

Gresham Oregon Personal Property Tax Warrant is a legal document issued by the local government to collect outstanding personal property taxes owed by individuals or businesses in the city of Gresham, Oregon. It serves as an enforcement mechanism to ensure that taxpayers fulfill their financial obligations to the government. A Gresham Oregon Personal Property Tax Warrant is typically issued when taxpayers fail to pay their personal property taxes or fail to respond to previous reminders or notices regarding the outstanding tax amount. These warrants are issued by the Gresham tax authority, such as the Gresham Department of Revenue or Gresham City Hall, and are served by tax collectors or authorized agents. The purpose of a Gresham Oregon Personal Property Tax Warrant is to legally enforce the collection of unpaid taxes. Once a warrant is issued, the local government has the authority to take various actions to recover the outstanding tax amount. This may include placing a lien on the individual or business' property, garnishing wages or bank accounts, seizing assets, or even taking legal action. There are several types of Gresham Oregon Personal Property Tax Warrants, depending on the severity of the non-compliance or the outstanding tax amount. These may include: 1. Standard Gresham Oregon Personal Property Tax Warrant: This is the most common type of warrant issued when taxpayers fail to pay their personal property taxes within the specified timeframe. 2. Delinquent Gresham Oregon Personal Property Tax Warrant: This warrant is issued when taxpayers consistently fail to meet their personal property tax obligations and have a history of non-payment. 3. Substantial Amount Gresham Oregon Personal Property Tax Warrant: This warrant is issued when a significant amount of personal property tax remains unpaid, and the local government seeks more aggressive measures to recover the outstanding amount. 4. Repeat Offender Gresham Oregon Personal Property Tax Warrant: This type of warrant is issued when individuals or businesses have repeatedly failed to pay their personal property taxes or have a history of non-compliance. 5. Non-Responsive Gresham Oregon Personal Property Tax Warrant: This warrant is issued when taxpayers fail to respond to previous notices or attempts to communicate regarding their outstanding personal property tax amount. It is crucial for taxpayers in Gresham, Oregon, to promptly address any personal property tax obligations and resolve any outstanding tax liabilities. Failure to do so may result in the issuance of a Gresham Oregon Personal Property Tax Warrant and subsequent legal consequences.

Gresham Oregon Personal Property Tax Warrant

Description

How to fill out Gresham Oregon Personal Property Tax Warrant?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law education to create this sort of papers from scratch, mostly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our platform provides a huge library with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Gresham Oregon Personal Property Tax Warrant or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Gresham Oregon Personal Property Tax Warrant quickly using our reliable platform. In case you are presently an existing customer, you can proceed to log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Gresham Oregon Personal Property Tax Warrant:

- Be sure the template you have found is specific to your area since the rules of one state or county do not work for another state or county.

- Preview the document and go through a short description (if available) of scenarios the document can be used for.

- If the form you picked doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your login information or create one from scratch.

- Choose the payment method and proceed to download the Gresham Oregon Personal Property Tax Warrant once the payment is through.

You’re all set! Now you can proceed to print the document or complete it online. In case you have any issues locating your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.