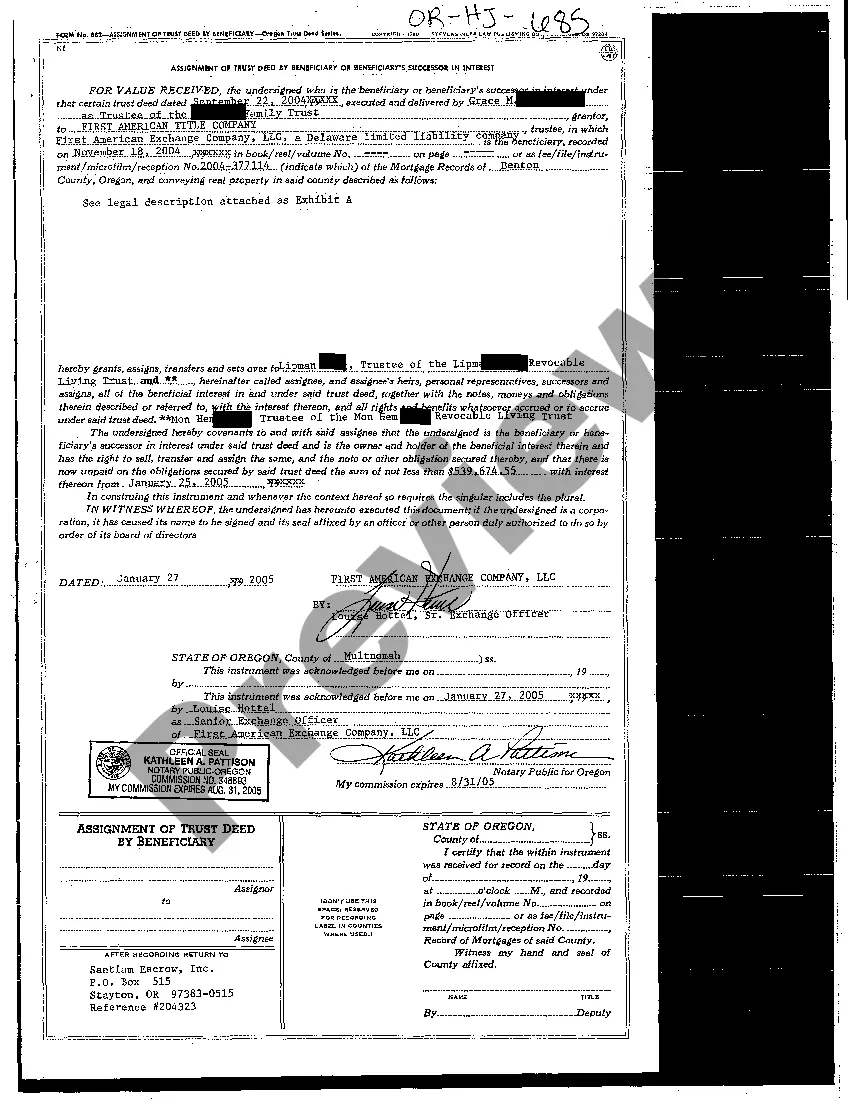

The Gresham Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest refers to a legal document that allows the transfer of a Trust Deed from the beneficiary of a property to either another party or the successor of the beneficiary's interest. This assignment can be utilized for various purposes such as transferring ownership, settling a debt, or streamlining estate planning. A beneficiary or their successor in interest may find it necessary to assign their rights and interests in the Trust Deed to another individual or entity for reasons such as financial gain or convenience. There are different types of Gresham Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest, each serving a specific purpose: 1. Assignment for Monetary Consideration: This type of assignment occurs when the beneficiary or their successor transfers the Trust Deed to another party in exchange for a monetary consideration. This can be done to raise funds for personal reasons, invest in other properties, or pay off existing debts. 2. Assignment for Debt Settlement: In this scenario, the beneficiary or their successor assigns the Trust Deed to another party as a means to settle a debt or obligation. The assignee would assume the responsibility of paying off the debt owed by the beneficiary or their successor, relieving them of their financial burden. 3. Assignment for Estate Planning: A beneficiary or their successor may choose to assign the Trust Deed to a family member, trust, or organization as part of their estate planning strategy. By transferring the Trust Deed, they ensure a smooth transition of ownership and asset management upon their passing, for the benefit of their heirs or designated individuals. 4. Assignment for Business Purposes: Some beneficiaries or their successors may assign the Trust Deed to a business entity or partner for operational or investment purposes. This allows the business entity to utilize the property for commercial activities or generate income through leasing or selling. The Gresham Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest is a legally binding document that requires thorough understanding and adherence to applicable laws and regulations. Professional legal advice is recommended to ensure compliance with all statutory requirements and to protect the interests of all parties involved in the assignment process.

Gresham Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest

Description

How to fill out Gresham Oregon Assignment Of Trust Deed By Beneficiary Or Beneficiary's Successor In Interest?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone without any law education to draft such paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our service provides a huge library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Gresham Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Gresham Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest in minutes using our reliable service. If you are already an existing customer, you can go on and log in to your account to download the appropriate form.

However, in case you are unfamiliar with our library, make sure to follow these steps prior to downloading the Gresham Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest:

- Ensure the form you have found is good for your location since the regulations of one state or county do not work for another state or county.

- Review the form and read a brief outline (if provided) of scenarios the paper can be used for.

- In case the form you selected doesn’t suit your needs, you can start again and look for the needed document.

- Click Buy now and choose the subscription plan you prefer the best.

- Log in to your account credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Gresham Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest once the payment is through.

You’re all set! Now you can go on and print out the form or complete it online. Should you have any problems getting your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.