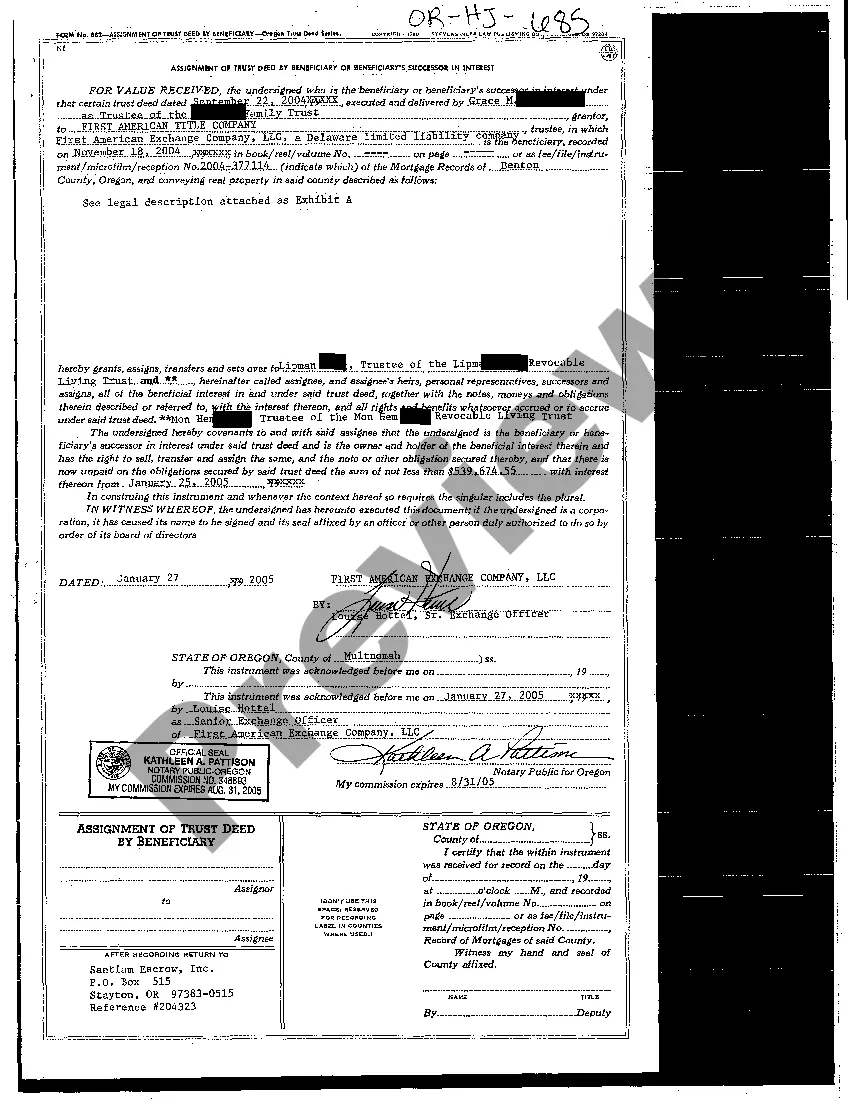

The Hillsboro, Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest is a legal document that transfers the rights and interests of a beneficiary or their successor in interest in a trust deed to another party. This assignment is commonly utilized in real estate transactions where a beneficiary or their successor wishes to transfer their rights and interests to a new party. The assignment of trust deed is a crucial step in the process of transferring ownership and responsibilities of a trust deed. It ensures that the new party, known as the assignee, assumes all the rights, benefits, and obligations associated with the trust deed. This assignment can be beneficial in various situations, including when the beneficiary wishes to sell their interest in the trust deed or when the beneficiary assigns their rights to a family member or a business partner. There are different types of Hillsboro, Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest, depending on the specific circumstances: 1. Assignment of Trust Deed by Beneficiary: This type involves the beneficiary of a trust deed transferring their rights and interests to another party. It could be either an individual or an entity, such as a corporation or a trust. 2. Assignment of Trust Deed by Successor in Interest: In certain cases, the original beneficiary of a trust deed may pass away or transfer their interests to a successor in interest. This type of assignment allows the successor to assume all the rights and obligations associated with the trust deed. 3. Partial Assignment of Trust Deed: There might be situations where a beneficiary or their successor in interest wishes to assign only a portion of their rights and interests in the trust deed to another party. This type of assignment allows for the transfer of specific rights and interests, while retaining partial control over the trust deed. 4. Assignment of Trust Deed with Assumption of Debt: In some cases, the assignee may assume the debt associated with the trust deed. This type of assignment allows the new party to not only acquire the rights and interests but also take responsibility for the outstanding debt. It is important to note that the exact terms and conditions of the assignment of trust deed can vary based on the specific agreement between the parties involved. It is recommended to consult an attorney or legal professional to ensure compliance with local laws and regulations, and to draft a comprehensive and enforceable assignment document.

Hillsboro Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest

Description

How to fill out Hillsboro Oregon Assignment Of Trust Deed By Beneficiary Or Beneficiary's Successor In Interest?

If you are looking for a valid form, it’s difficult to choose a better place than the US Legal Forms website – one of the most comprehensive libraries on the internet. With this library, you can get a large number of form samples for company and individual purposes by categories and states, or keywords. Using our advanced search feature, finding the latest Hillsboro Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest is as elementary as 1-2-3. Furthermore, the relevance of each and every record is proved by a group of skilled attorneys that regularly review the templates on our platform and update them based on the most recent state and county regulations.

If you already know about our platform and have a registered account, all you need to receive the Hillsboro Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have discovered the sample you need. Check its explanation and make use of the Preview feature to explore its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to find the appropriate document.

- Affirm your choice. Click the Buy now option. Next, select the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the form. Pick the format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Hillsboro Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest.

Each form you add to your profile does not have an expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you want to get an additional copy for enhancing or creating a hard copy, you may come back and export it once more at any moment.

Make use of the US Legal Forms extensive collection to get access to the Hillsboro Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest you were seeking and a large number of other professional and state-specific samples on one platform!