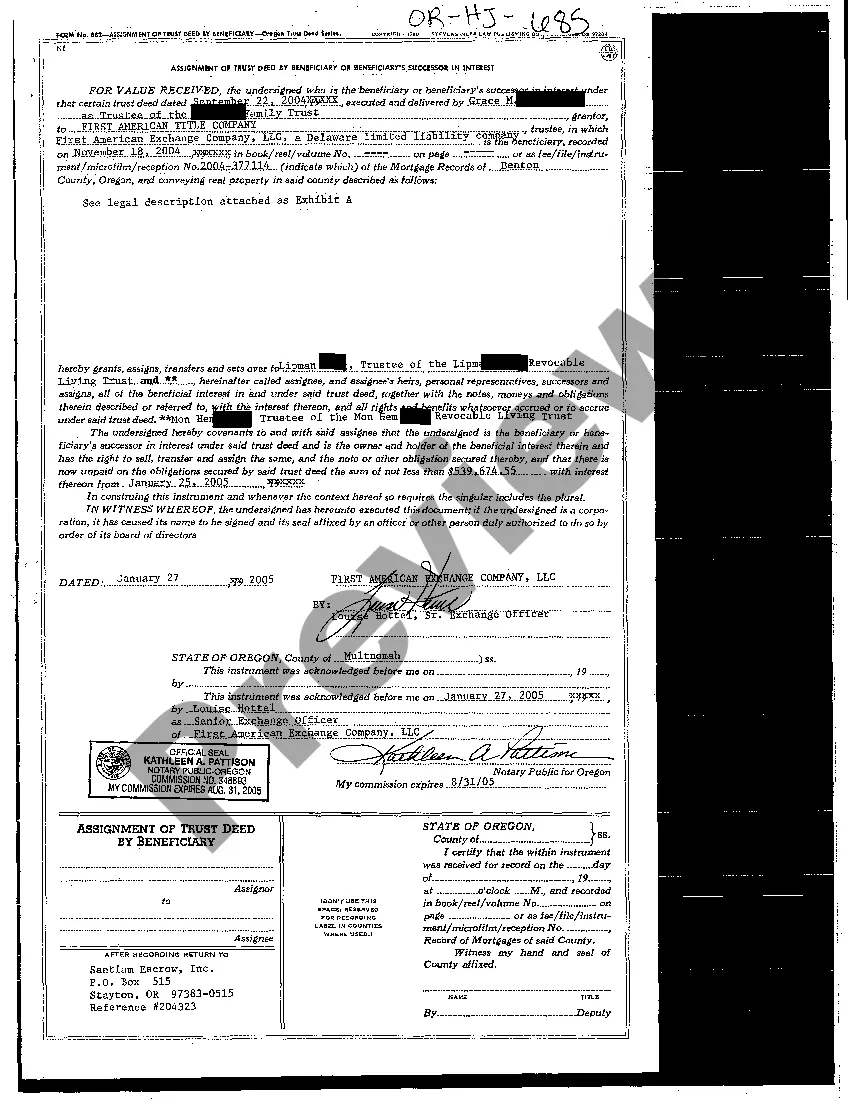

Portland Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest is a legal document that allows for the transfer of rights and interests in a trust deed to another party. This assignment typically occurs when the beneficiary of the trust deed wishes to transfer their rights and responsibilities to a new individual or entity. The Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest is an important process in the real estate industry, as it ensures that all parties involved in the trust deed are aware of the transfer of rights and obligations. In Portland, Oregon, there are different types of Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest, including: 1. Individual Assignee: This type of assignment occurs when an individual beneficiary of a trust deed wishes to transfer their rights and interests to another person. This could be due to various reasons, such as the beneficiary selling their property or wanting to assign their rights to a family member or friend. 2. Corporate Assignee: In some cases, the beneficiary of a trust deed may be a corporation or business entity. In such cases, the assignment of the trust deed can be made to another corporation or business entity, allowing for a seamless transfer of rights and interests. 3. Successor in Interest Assignee: This type of assignment occurs when the original beneficiary of a trust deed passes away, and their rights and interests are transferred to their successor in interest. This can be a family member, a designated heir, or anyone who has a legal claim to the beneficiary's property and assets. It is essential to follow the proper legal procedures when executing an Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest in Portland, Oregon. This includes drafting a comprehensive assignment document that clearly identifies the parties involved, the property covered by the trust deed, and the terms of the assignment. Additionally, the assignment document should be notarized and recorded with the appropriate county office to ensure its validity. Overall, the Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest plays a crucial role in the real estate industry in Portland, Oregon. It allows for the smooth transfer of rights and interests in a trust deed to ensure the proper functioning and ownership of properties within the state.

Portland Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest

Description

How to fill out Portland Oregon Assignment Of Trust Deed By Beneficiary Or Beneficiary's Successor In Interest?

Are you seeking a reliable and economical supplier of legal forms to acquire the Portland Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce through the court, we are here to assist. Our platform provides over 85,000 current legal document templates for both personal and business usage. All templates we offer are tailored and designed in accordance with the regulations of specific states and regions.

To obtain the document, you must Log In to your account, find the desired form, and click the Download button next to it. Please remember that you can access your previously purchased document templates anytime from the My documents tab.

Is this your first visit to our platform? No need to worry. You can effortlessly create an account, but first, ensure to do the following.

You can now register your account. Then select the subscription plan and proceed with payment. After payment is completed, download the Portland Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest in any available format. You can revisit the website whenever necessary to redownload the document at no additional cost.

Acquiring current legal forms has never been simpler. Try US Legal Forms today and say goodbye to spending countless hours searching for legal paperwork online once and for all.

- Verify if the Portland Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest adheres to the laws of your state and locality.

- Review the details of the form (if available) to understand who and what the document is meant for.

- Restart the search if the form does not fit your legal needs.

Form popularity

FAQ

The trustee must be one of the following: An attorney under the Oregon State Bar. A law firm under the Oregon State Bar. A title company.

A trust deed is similar to a mortgage but usually gives the security holder a ?right of sale.? This ?right of sale? allows the security holder to foreclose on the property without having to file a lawsuit in court. This process is called ?foreclosure by advertisement and sale? and is found in ORS 86.735.

Start Deed of Trust StateMortgage allowedDeed of trust allowedOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

A mortgage is a legal agreement designed for purchasing homes. In a mortgage, the bank or another creditor lends a borrower money at interest to take the title of the borrower's property....Lien Theory States 2022. StateMortgage TheoryOregonTitleSouth DakotaTitleTennesseeTitleTexasTitle46 more rows

Because of this, deeds of trusts can be preferable, especially for smaller, non-traditional lenders....Start Deed of Trust. StateMortgage allowedDeed of trust allowedOklahomaYOregonYPennsylvaniaYRhode IslandY47 more rows

?Beneficiary? means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

The Beneficiary of a Deed of Trust is the Lender, and the Deed serves to protect their investment. The Trustor is the borrower. While the legal title on the property is put into a Trust, as long as timely and consistent payments are made, the borrower has equitable title.

The Oregon Trust Deed Act was established in 1959 to make the foreclosure process easier and faster by not involving the courts. The Act allows the lender to file a trust deed, which assigns the deed to a third-party (trustee).