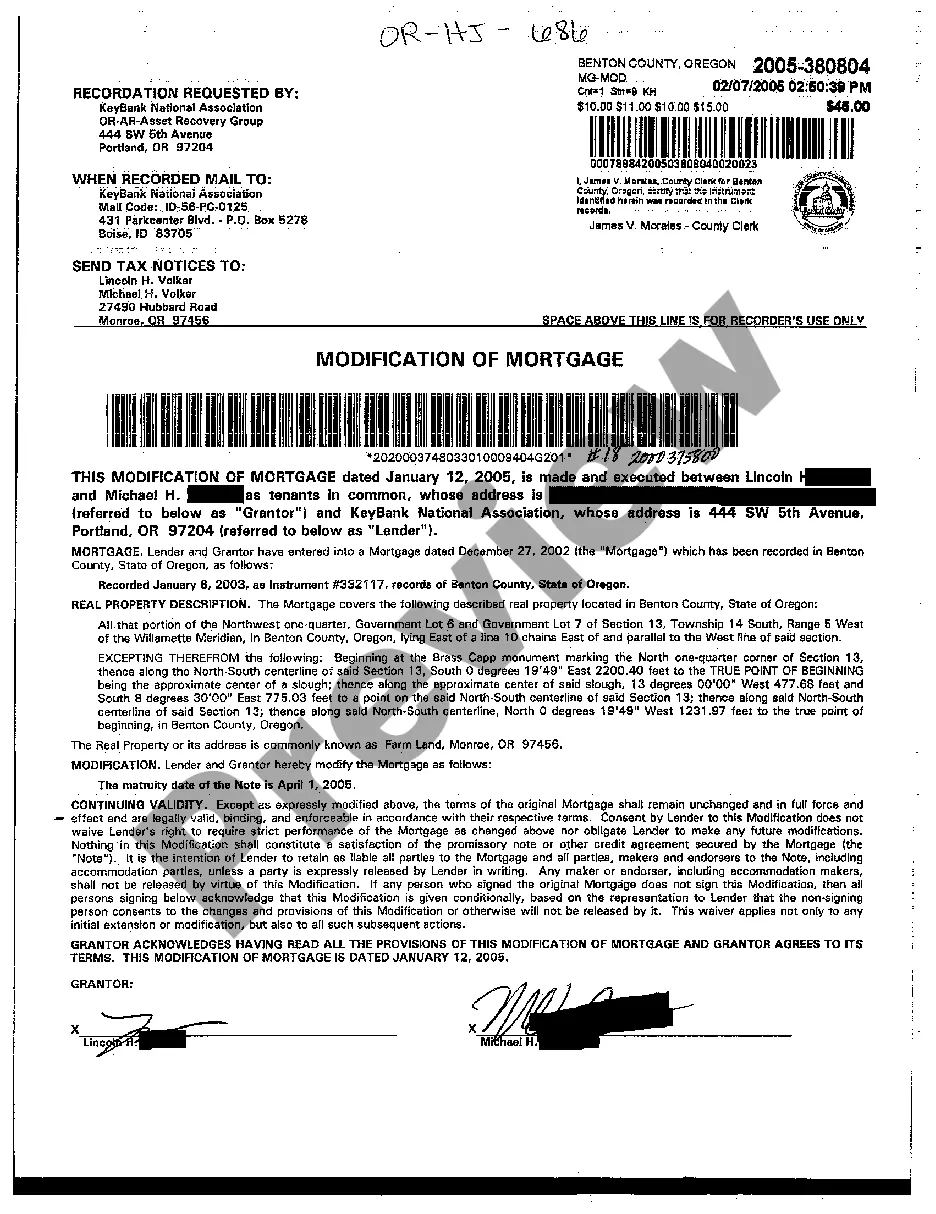

Bend Oregon Modification of Mortgage is a program designed to assist homeowners in Bend, Oregon, who are struggling to make their mortgage payments. This initiative aims to provide options for homeowners to modify the terms of their existing mortgage agreements in order to make them more affordable and sustainable. One type of Bend Oregon Modification of Mortgage is a loan modification, which involves altering the terms of the mortgage to reduce the monthly payments, adjust the interest rate, extend the loan term, or forgive a portion of the principal balance. This option is typically chosen by homeowners facing financial hardship or experiencing a temporary setback. Another type of modification available in Bend, Oregon is a principal reduction program. This option involves reducing the outstanding balance of the loan, which helps homeowners with significant negative equity or facing extreme financial distress. A principal reduction can make the mortgage more affordable and bring it in line with the current market value of the property. Bend Oregon Modification of Mortgage also offers payment forbearance plans. This option allows homeowners to temporarily suspend or reduce their mortgage payments for a specified period. During this time, the homeowner can focus on resolving their financial difficulties, such as finding a new job or recovering from a temporary setback, without facing the risk of foreclosure. Additionally, Bend Oregon Modification of Mortgage may include interest rate modifications. This option involves reducing the interest rate on the existing mortgage, which lowers the monthly payment amount and reduces the overall cost of the loan. Interest rate modifications are usually offered to homeowners facing financial hardship or those with higher interest rates. The process of applying for Bend Oregon Modification of Mortgage typically involves providing the necessary financial documentation, including income statements, tax returns, bank statements, and a hardship letter explaining the reasons for the request. Homeowners may need to work with their mortgage service or a housing counselor to navigate the application process and determine the most suitable modification option for their situation. Overall, Bend Oregon Modification of Mortgage aims to provide feasible alternatives for struggling homeowners to avoid foreclosure and maintain homeownership. It is crucial for homeowners facing financial difficulties to explore these options and consult with professionals to find the best solution for their unique circumstances.

Bend Oregon Modification of Mortgage

Description

How to fill out Bend Oregon Modification Of Mortgage?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Bend Oregon Modification of Mortgage? US Legal Forms is your go-to solution.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed based on the requirements of particular state and area.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Bend Oregon Modification of Mortgage conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Restart the search if the template isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Bend Oregon Modification of Mortgage in any available file format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal paperwork online once and for all.

Form popularity

FAQ

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments.

Why Was I Denied for a Loan Modification? An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment. ?Lack of hardship,? or ability to pay the current mortgage payments without issue. You have already received the maximum number of loan modifications the lender allows.

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score.

The loan modification process typically takes 6 to 9 months, depending on your lender.

Who is eligible for a loan modification? To qualify for a loan modification, a borrower usually must have missed at least three mortgage payments and be in default. ?Sometimes, a borrower who has experienced financial setbacks, which makes a default imminent, can qualify for a loan modification.

You can only appeal when you're denied for a loan modification program. You can ask for a review of a denied loan modification if: You sent in a complete mortgage assistance application at least 90 days before your foreclosure sale; and. Your servicer denied you for any trial or permanent loan modification it offers.

Some possible factors determining whether you'd qualify for a loan modification include: Your circumstances, why you fell behind on your mortgage and your ability to pay in the future. Your monthly income and how it compares to your housing costs. Your property value, the amount of your equity.