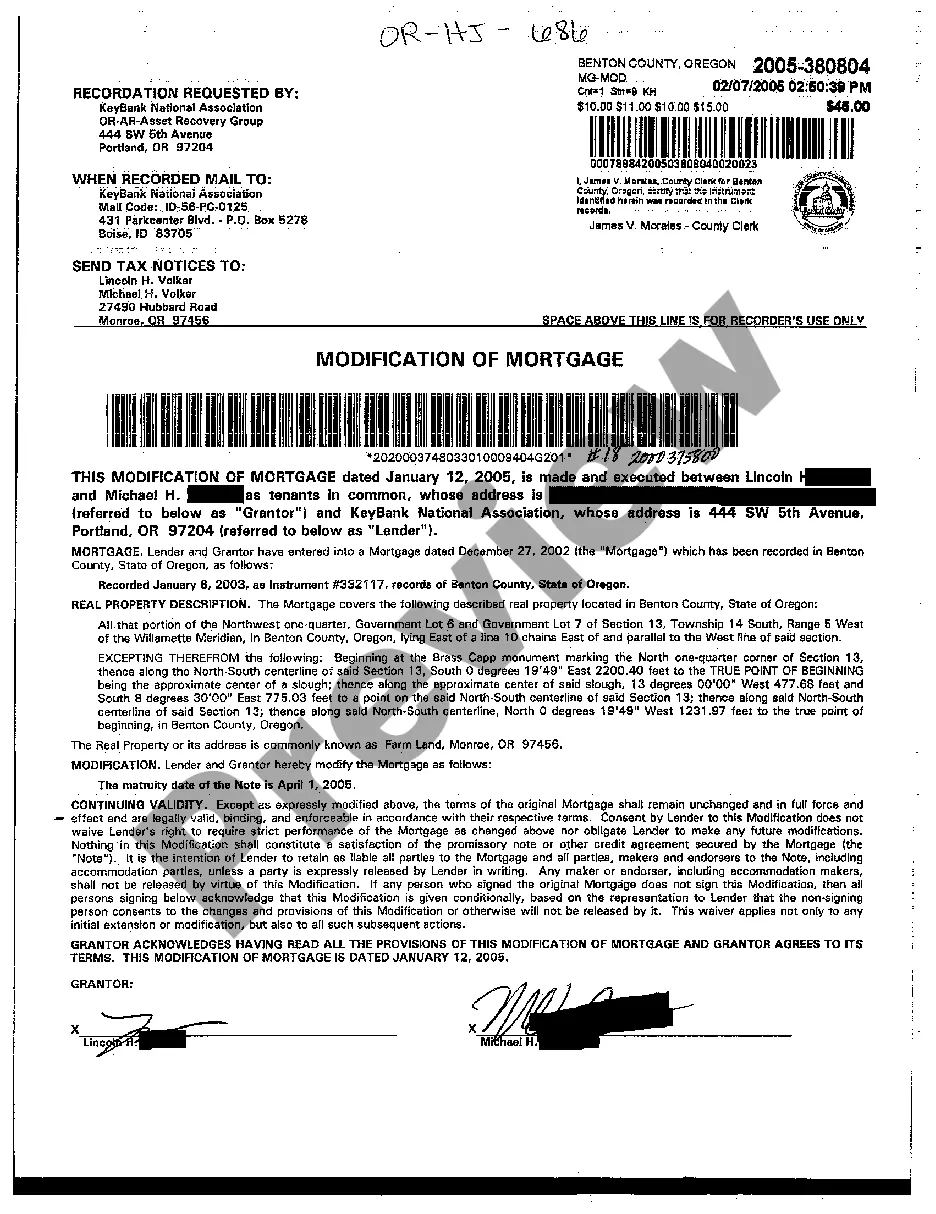

Eugene Oregon Modification of Mortgage is a process that allows homeowners in Eugene, Oregon, to modify the terms of their existing mortgage loans. This modification aims to help financially struggling homeowners by adjusting the interest rate, extending the loan term, or reducing the outstanding loan balance. One type of Eugene Oregon Modification of Mortgage is the interest rate reduction. Under this modification, the lender and borrower agree to lower the interest rate on the mortgage loan. This can significantly reduce the borrower's monthly mortgage payments, making it more affordable and helping them avoid foreclosure. Another type of modification is loan term extension. In this case, the lender and borrower agree to extend the mortgage loan term, which increases the repayment period. By spreading the payments over a longer period, homeowners can experience a considerable decrease in their monthly payments, making them more manageable and easing their financial burden. Additionally, some borrowers may qualify for principal reduction modification. This type of modification involves reducing the outstanding loan balance by forgiving a portion of the principal owed. This can help homeowners who owe more on their mortgage than their property's current value and are facing significant financial hardships. The Eugene Oregon Modification of Mortgage process is typically initiated by the homeowner, who contacts their lender to express their financial difficulties and request a modification. The lender will then evaluate the homeowner's financial situation, reviewing income, expenses, credit history, and the value of the property. If the lender determines that the borrower qualifies for a modification, they will propose new loan terms. It's important to note that not all homeowners are eligible for a Eugene Oregon Modification of Mortgage. Applicants must demonstrate a genuine financial hardship and provide supporting documentation such as income statements, tax returns, bank statements, and hardship letters. Each case is assessed individually, and the lender will consider factors such as the homeowner's ability to make modified payments and the potential benefit of modification compared to foreclosure. In conclusion, Eugene Oregon Modification of Mortgage offers struggling homeowners in Eugene, Oregon, an opportunity to modify the terms of their mortgage loans. By lowering interest rates, extending the loan term, or reducing the outstanding loan balance, homeowners can achieve more manageable monthly payments and avoid foreclosure. However, eligibility requirements and the types of modifications available may vary depending on the lender and the homeowner's specific financial situation.

Eugene Oregon Modification of Mortgage

Description

How to fill out Eugene Oregon Modification Of Mortgage?

If you are looking for a relevant form template, it’s difficult to choose a better service than the US Legal Forms site – one of the most extensive libraries on the web. Here you can get a large number of templates for company and individual purposes by types and regions, or key phrases. With our high-quality search option, discovering the most up-to-date Eugene Oregon Modification of Mortgage is as easy as 1-2-3. Moreover, the relevance of each file is confirmed by a team of skilled lawyers that on a regular basis review the templates on our platform and update them based on the newest state and county demands.

If you already know about our platform and have a registered account, all you should do to receive the Eugene Oregon Modification of Mortgage is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the form you want. Read its information and make use of the Preview function to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to get the appropriate record.

- Affirm your choice. Select the Buy now option. After that, pick your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Choose the format and save it on your device.

- Make changes. Fill out, revise, print, and sign the obtained Eugene Oregon Modification of Mortgage.

Each and every form you add to your profile does not have an expiration date and is yours forever. You can easily access them using the My Forms menu, so if you need to receive an additional duplicate for editing or printing, feel free to come back and download it once again at any moment.

Take advantage of the US Legal Forms professional library to get access to the Eugene Oregon Modification of Mortgage you were looking for and a large number of other professional and state-specific templates on one website!