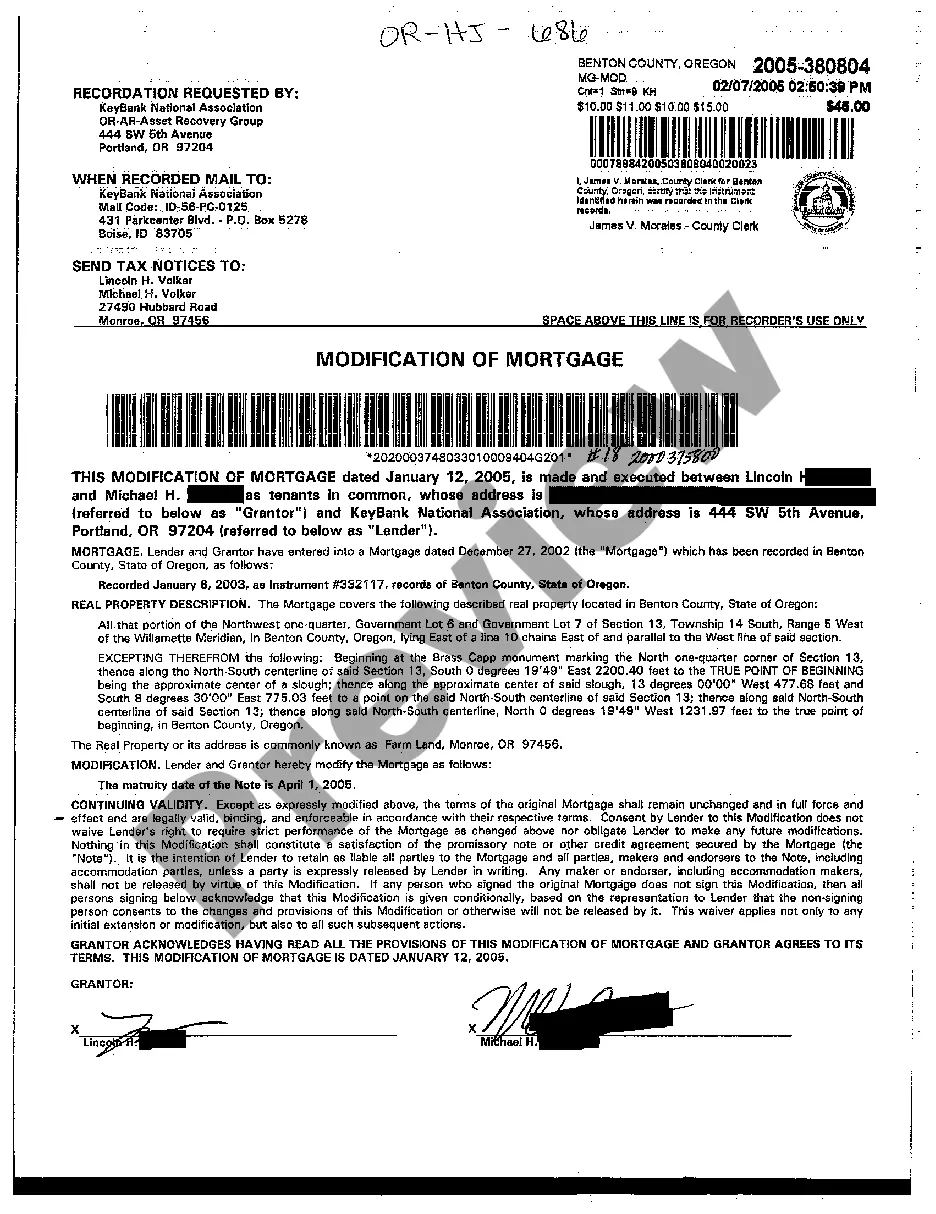

Hillsboro Oregon Modification of Mortgage is a legal process that allows homeowners in Hillsboro, Oregon, to modify the terms and conditions of their existing mortgage agreements. This modification aims to make the mortgage payments more affordable for homeowners who are facing financial hardship or struggling to keep up with their monthly mortgage obligations. The process of Hillsboro Oregon Modification of Mortgage typically involves negotiating with the mortgage lender to reach a new agreement that better aligns with the homeowner's current financial circumstances. This may include lowering the interest rate, extending the loan term, reducing the principal balance, or changing other terms of the mortgage. The goal is to create a repayment plan that the homeowner can manage while avoiding foreclosure. There are different types of Hillsboro Oregon Modification of Mortgage options available to homeowners based on their specific needs and eligibility criteria. These include: 1. Interest Rate Reduction: This type of modification involves lowering the interest rate on the mortgage, which can result in a significant reduction in monthly mortgage payments. Homeowners who have adjustable-rate mortgages or high-interest rates may benefit from this modification. 2. Loan Term Extension: This modification involves extending the loan term by adding additional years to the mortgage repayment period. Extending the loan term can lower the monthly payments, making them more affordable for homeowners who are struggling financially. 3. Principal Reduction: In some cases, lenders may consider reducing the principal balance of the mortgage. This modification option is typically granted to homeowners who owe more on their mortgage than the current market value of their home or for those facing severe financial hardship. 4. Forbearance Agreement: A forbearance agreement is a temporary modification that allows homeowners to temporarily reduce or suspend their mortgage payments for a specified period. This option is generally offered to homeowners facing a short-term financial hardship, such as job loss or medical emergency. To initiate a Hillsboro Oregon Modification of Mortgage, homeowners are required to submit a hardship letter explaining the reasons for their financial difficulties, along with supporting documentation such as income statements, bank statements, and tax returns. It is advisable to consult with a foreclosure prevention counselor or an experienced attorney who can guide homeowners through the process and help them navigate the complex negotiations with the lender. Overall, Hillsboro Oregon Modification of Mortgage provides a lifeline to struggling homeowners, enabling them to avoid foreclosure and safeguard their homes while finding a more affordable path to long-term homeownership. If you find yourself in financial distress and need assistance, reach out to local housing counseling agencies or legal professionals knowledgeable in this field.

Hillsboro Oregon Modification of Mortgage

Description

How to fill out Hillsboro Oregon Modification Of Mortgage?

Do you need a trustworthy and inexpensive legal forms supplier to get the Hillsboro Oregon Modification of Mortgage? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of separate state and county.

To download the document, you need to log in account, locate the needed form, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Hillsboro Oregon Modification of Mortgage conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the document is intended for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Hillsboro Oregon Modification of Mortgage in any available format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online once and for all.