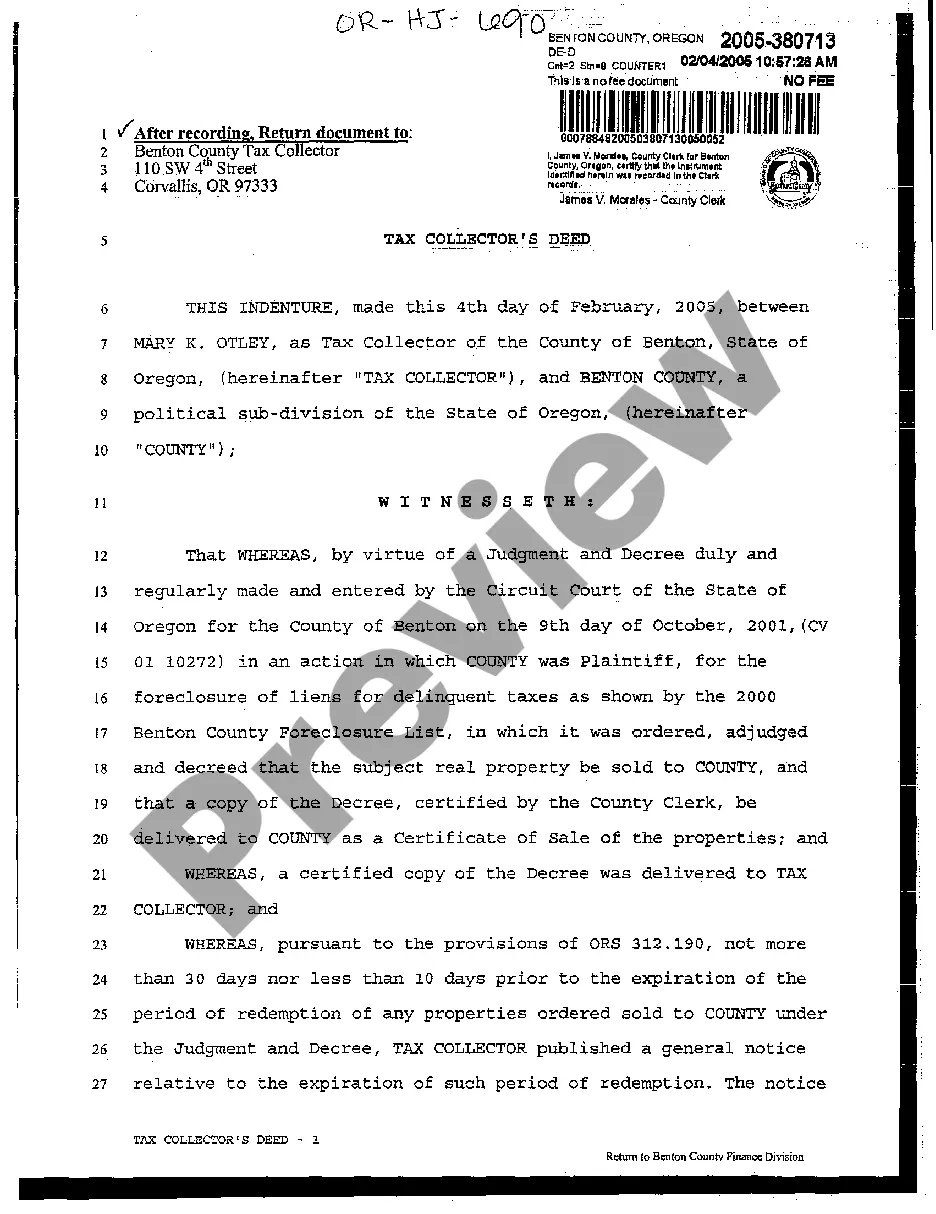

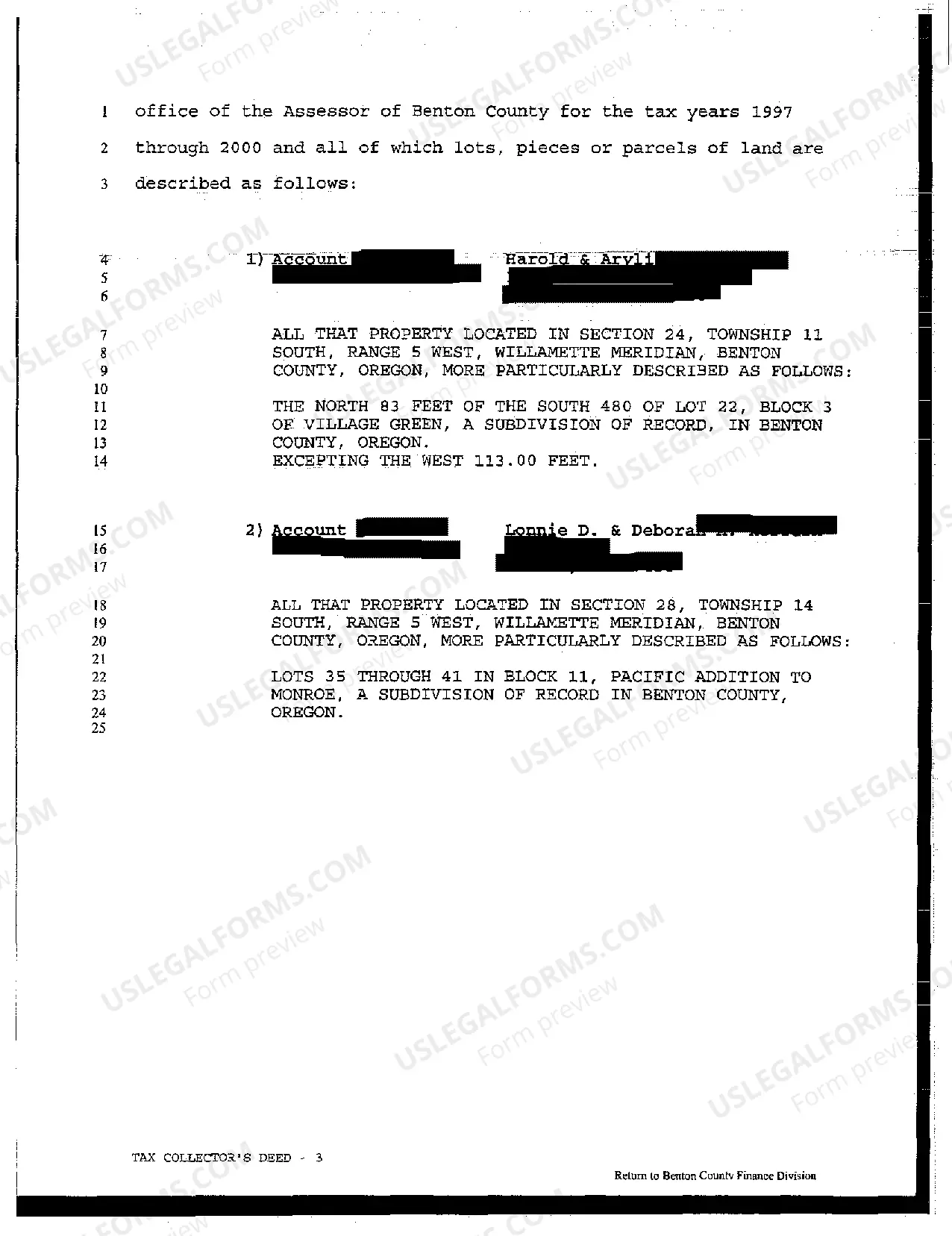

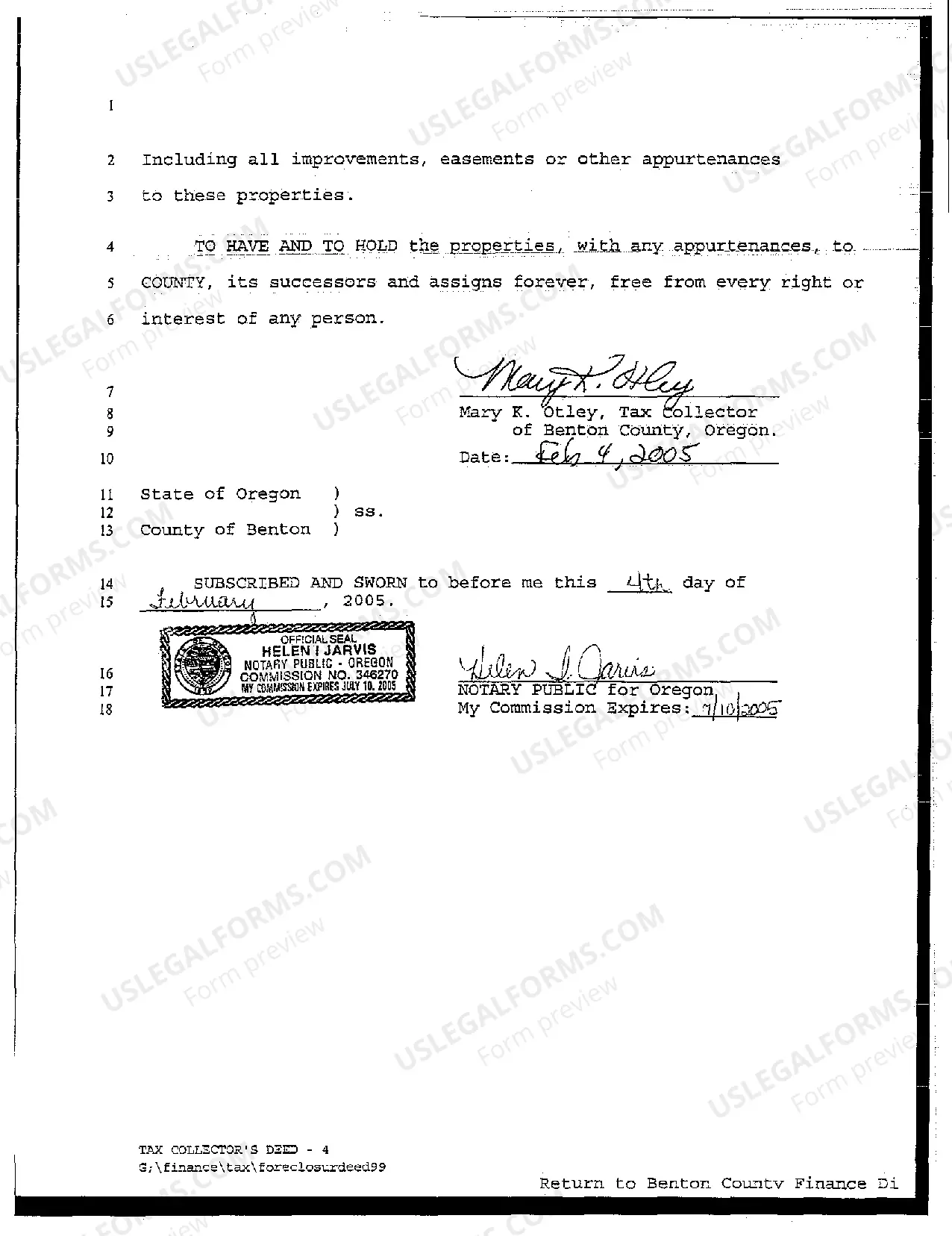

Bend Oregon Tax Collector's Deed is a legal document that grants ownership of a property to the winning bidder at a tax foreclosure auction in Bend, Oregon. This deed is issued by the tax collector's office after the property owner fails to pay their property taxes, and the property goes through the foreclosure process. The Tax Collector's Deed is a crucial document that transfers the rights and interests of the delinquent property owner to the new owner, who successfully bids on the property at the tax sale. The winning bidder must fulfill all legal obligations and pay the delinquent taxes, penalties, and auction fees in order to receive the Tax Collector's Deed. There are several types of Bend Oregon Tax Collector's Deed, each with its own distinct characteristics and conditions. These types include: 1. General Warranty Deed: This type of deed offers the highest level of protection for the new property owner. It guarantees that the seller (in this case, the tax collector's office) holds clear title to the property and will defend the new owner against any prior claims or encumbrances. 2. Special Warranty Deed: Unlike the General Warranty Deed, the Special Warranty Deed only guarantees that the seller (tax collector's office) will defend the new owner against claims or encumbrances arising during the time they owned the property, not prior claims. 3. Quitclaim Deed: This type of deed provides the least amount of protection to the new owner. It merely transfers whatever interest the seller (tax collector's office) has in the property, without making any guarantees regarding title or any potential encumbrances. It's essential for individuals interested in purchasing a property through a Bend Oregon Tax Collector's Deed to thoroughly research and understand the specific type of deed being offered. Hiring a professional real estate attorney is highly recommended navigating the complexities of these deeds and ensure a smooth transfer of ownership.

Bend Oregon Tax Collector's Deed

Description

How to fill out Bend Oregon Tax Collector's Deed?

If you are looking for a valid form, it’s difficult to find a more convenient platform than the US Legal Forms website – probably the most considerable online libraries. With this library, you can find thousands of templates for company and personal purposes by categories and regions, or key phrases. With our advanced search option, discovering the newest Bend Oregon Tax Collector's Deed is as elementary as 1-2-3. In addition, the relevance of every document is verified by a team of expert lawyers that regularly check the templates on our platform and update them according to the latest state and county laws.

If you already know about our system and have an account, all you should do to get the Bend Oregon Tax Collector's Deed is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have opened the sample you require. Look at its description and make use of the Preview function (if available) to see its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to discover the appropriate document.

- Confirm your decision. Select the Buy now option. Next, choose your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the file format and download it to your system.

- Make changes. Fill out, revise, print, and sign the obtained Bend Oregon Tax Collector's Deed.

Every template you add to your account does not have an expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to receive an additional version for editing or creating a hard copy, you may come back and download it once more whenever you want.

Make use of the US Legal Forms extensive library to get access to the Bend Oregon Tax Collector's Deed you were looking for and thousands of other professional and state-specific templates on a single platform!

Form popularity

FAQ

A state tax lien is the government's legal claim against your property when you don't pay your tax debt in full. Your property includes real estate, personal property and other financial assets. When a lien is issued by us, it gets recorded in the county records where you live.

In Oregon, property is valued each year as of January 1. The fiscal tax year runs from July 1 through June 30. Property taxes are mailed no later than October 25 and payment is due November 15.

Property tax statements are mailed before October 25 each year. Payments are due November 15. If the 15th falls on the weekend, payment is due the next business day.

Online information can be found through their two online databases, MultCoPropTax and MultCoRecords. You can also find basic property information, including ownership information, through Portland Maps . Title companies can also research the title to a piece of property. Generally, this will involve a fee.

In Oregon, real proper- ty is subject to foreclosure three years after the taxes become delinquent. When are taxes delinquent? Property taxes can be paid in full by November 15 or in three installments: November 15, February 15, and May 15. If the taxes aren't paid in full by May 16 they are delinquent.

Use multcoproptax.com to look up your property tax bill/statement.

Counties in Oregon acquire fee title to tax foreclosed properties and do not sell tax liens or tax lien certificates. The first step in disposing of surplus real property with an assessed value of $15,000 or greater is to offer it at a public sale (auction).

As a disabled or senior homeowner, you can borrow from the State of Oregon to pay your property taxes to the county. How does the program work? If you qualify for the program, Oregon Department of Revenue will pay your county property taxes on November 15 of each year.

Counties in Oregon acquire fee title to tax foreclosed properties and do not sell tax liens or tax lien certificates. The first step in disposing of surplus real property with an assessed value of $15,000 or greater is to offer it at a public sale (auction). Lane County generally holds one such sale annually.

8 Ways To Find The Owner Of A Property Check Your Local Assessor's Office.Check With The County Clerk.Go To Your Local Library.Ask A Real Estate Agent.Talk To A Title Company.Use The Internet.Talk To A Lawyer.Knock On Their Door Or Leave A Note.