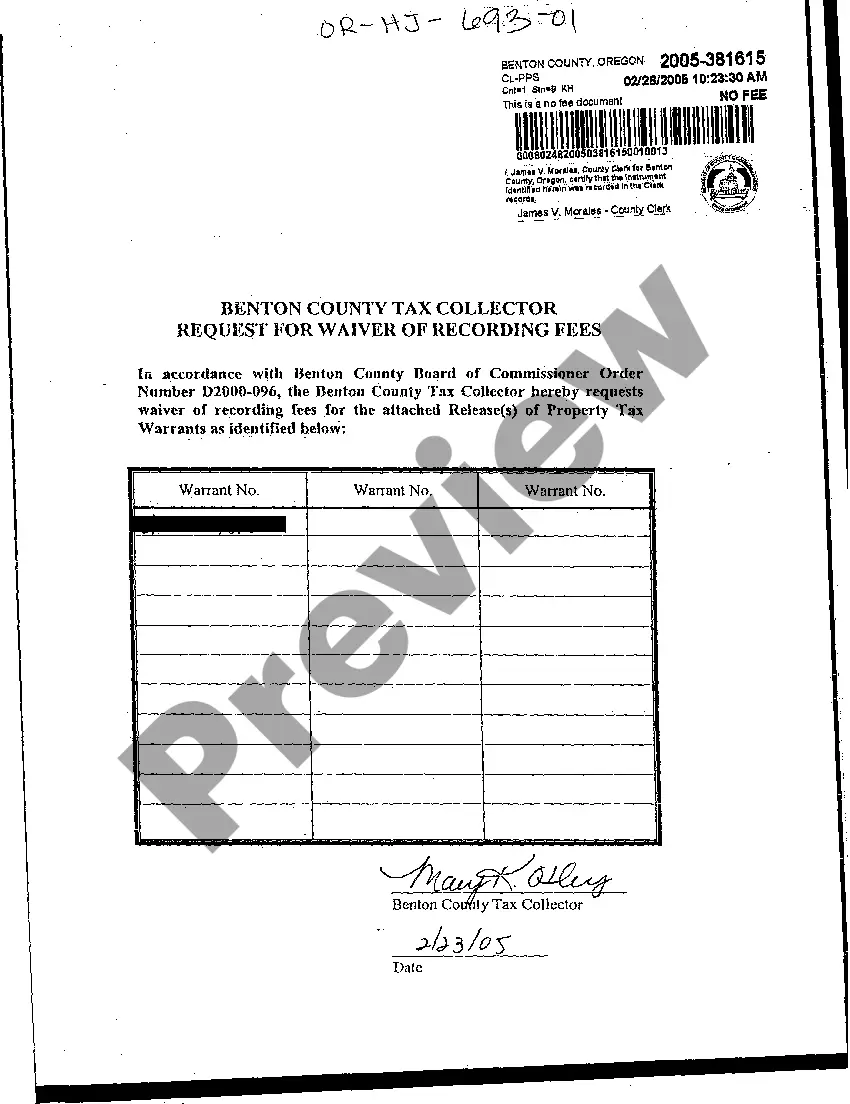

Title: Eugene Oregon Tax Collector Request for Waiver of Recording Fees: Explained Introduction: In Eugene, Oregon, the Tax Collector offers taxpayers the opportunity to request a waiver of recording fees under specific circumstances. This comprehensive guide aims to provide a detailed description of the Eugene Oregon Tax Collector Request for Waiver of Recording Fees, including its purpose, eligibility criteria, and different types of waivers available. 1. Purpose of the Request for Waiver of Recording Fees: The Tax Collector's office in Eugene, Oregon, understands that certain taxpayers face financial hardships or encounter difficulties paying recording fees associated with property transactions or other relevant documentation. To address such situations, the Tax Collector provides a Request for Waiver of Recording Fees, which allows qualified individuals or organizations to be exempt from these fees, ensuring that access to essential services remains accessible to all. 2. Eligibility Criteria: To request a waiver of recording fees, taxpayers in Eugene must meet certain criteria. Eligibility is typically determined based on financial need or validity of reasons provided in the waiver request. Common reasons for granting a waiver may include: a. Financial hardship: Taxpayers who can demonstrate significant financial hardship or low income are often eligible for fee waivers. Supporting documentation such as income statements, tax returns, or proof of government assistance may be required. b. Non-profit organizations: Certain non-profit organizations may qualify for waivers if the requested records relate to their charitable activities or if the requested fees pose a financial burden that could limit their ability to pursue their mission. 3. Different Types of Eugene Oregon Tax Collector Request for Waiver of Recording Fees: The Eugene Oregon Tax Collector may have various types of waivers available, depending on the specific circumstances and nature of the recording fees requested. While the exact titles may vary, some common types of waivers include: a. Property-related waivers: These waivers typically apply to recording fees associated with property transactions such as deeds, mortgages, or property transfers. Taxpayers seeking to waive recording fees for these purposes must provide supporting documentation relevant to the property involved. b. Business-related waivers: If taxpayers request waivers for recording fees related to business activities, such as licenses, permits, or documentation for incorporation, the Tax Collector may evaluate eligibility based on the business's financial need or social impact. c. Legal document waivers: In certain cases, taxpayers may request waivers for recording fees concerning legal documents like court judgments, liens, or releases. The validity and necessity of these requests will be carefully considered by the Tax Collector. Conclusion: The Eugene Oregon Tax Collector Request for Waiver of Recording Fees aims to assist individuals, organizations, and businesses facing financial hardships or other valid reasons by granting exemptions from recording fees associated with property transactions, business activities, or legal documents. By offering these waivers, the Tax Collector ensures that access to essential services remains inclusive and accessible for all residents of Eugene, fostering a more equitable community.

Eugene Oregon Tax Collector Request for Waiver of Recording Fees

Description

How to fill out Eugene Oregon Tax Collector Request For Waiver Of Recording Fees?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Eugene Oregon Tax Collector Request for Waiver of Recording Fees gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Eugene Oregon Tax Collector Request for Waiver of Recording Fees takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Eugene Oregon Tax Collector Request for Waiver of Recording Fees. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!