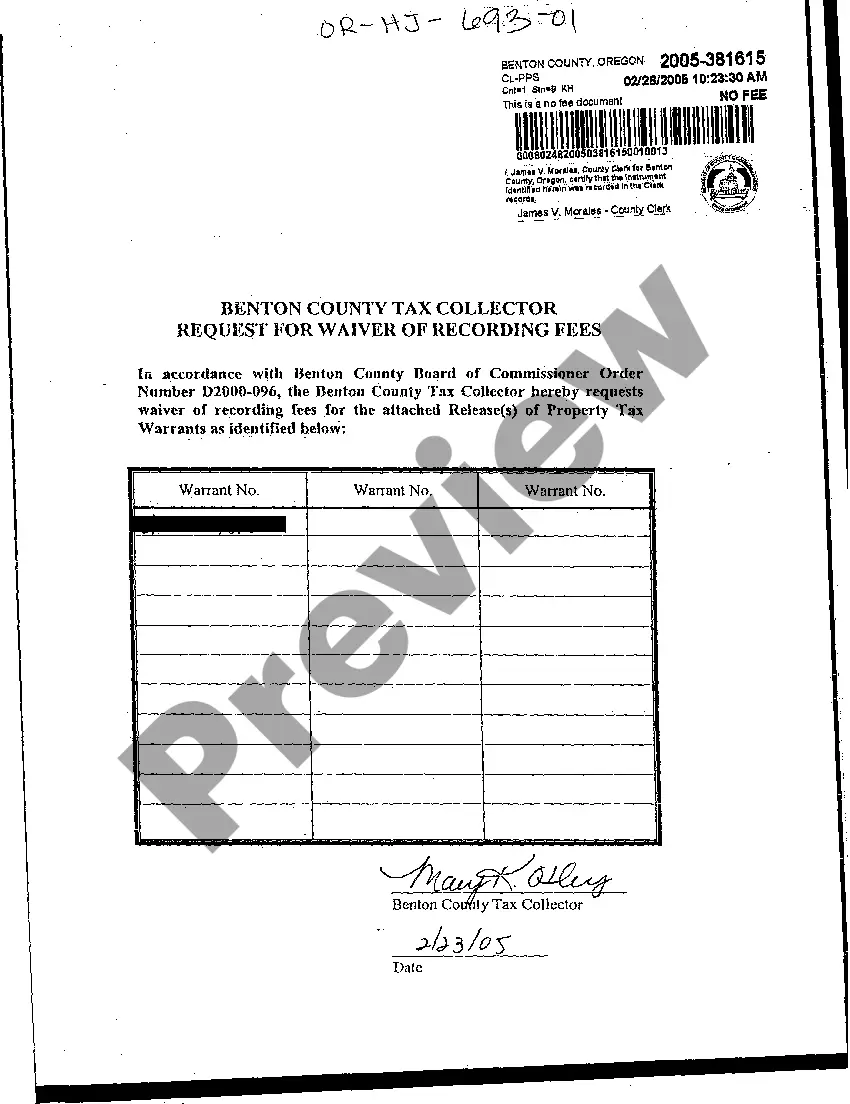

Gresham Oregon Tax Collector Request for Waiver of Recording Fees is a legal procedure used by individuals or entities seeking relief from the financial burden of recording fees related to tax collection in Gresham, Oregon. This request aims to waive or reduce the fees required for recording specific documents associated with tax obligations. Types of Gresham Oregon Tax Collector Request for Waiver of Recording Fees may include: 1. Property Tax Waiver Request: Property owners in Gresham, Oregon, may file this request to seek a waiver or reduction in recording fees when dealing with property tax-related documents such as assessment notices, tax statements, or payment records. 2. Business Tax Waiver Request: Business entities operating in Gresham may submit this request to request relief from recording fees concerning tax-related documents like business license applications, tax returns, or other financial statements required by the tax collector. 3. Vehicle Tax Waiver Request: Vehicle owners residing in Gresham might utilize this request to seek a waiver or reduction in recording fees for documents like vehicle registration, transfer of ownership, or release of liens related to unpaid taxes associated with their vehicles. 4. State Tax Waiver Request: Individuals or businesses who owe state taxes can submit a Gresham Oregon Tax Collector Request for Waiver of Recording Fees to mitigate the financial burden of recording relevant documents connected to the collection of state taxes. To initiate the Gresham Oregon Tax Collector Request for Waiver of Recording Fees process, individuals or entities must complete the appropriate form provided by the Gresham Tax Collector's office. Alongside the completed form, the applicant may need to provide supporting documentation relevant to their request, such as proof of financial hardship, evidence of compliance with tax obligations, or any other documents required by the specific waiver category. It's crucial to ensure that the Gresham Oregon Tax Collector Request for Waiver of Recording Fees is submitted within the designated timeframe, adhering to any specific guidelines enforced by the tax collector's office. Failure to meet these requirements may result in delays or denial of the waiver request. Upon receiving the request, the Gresham Tax Collector's office will review the submitted information and documentation provided by the applicant. The office may also consider factors such as the individual's financial circumstances, compliance history, and the overall impact of the waiver on tax collection efforts in Gresham, Oregon. The decision to grant or deny the request for waiver of recording fees lies within the discretion of the tax collector or the designated reviewing authority. If the Gresham Tax Collector's office approves the request, the applicant will receive notification of the granted waiver along with any conditions or stipulations imposed. The applicant can then proceed with the recording process without incurring the previously applicable fees. However, if the request is denied, the applicant may need to pay the required recording fees to ensure compliance with Gresham's tax collection regulations. In summary, the Gresham Oregon Tax Collector Request for Waiver of Recording Fees offers individuals and entities a potential means of alleviating the financial burden associated with recording fees for various tax-related documents. By following the specific requirements and guidelines set by the Gresham Tax Collector's office, applicants can seek relief and address their tax obligations more effectively.

Gresham Oregon Tax Collector Request for Waiver of Recording Fees

Description

How to fill out Gresham Oregon Tax Collector Request For Waiver Of Recording Fees?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Gresham Oregon Tax Collector Request for Waiver of Recording Fees becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Gresham Oregon Tax Collector Request for Waiver of Recording Fees takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Gresham Oregon Tax Collector Request for Waiver of Recording Fees. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!