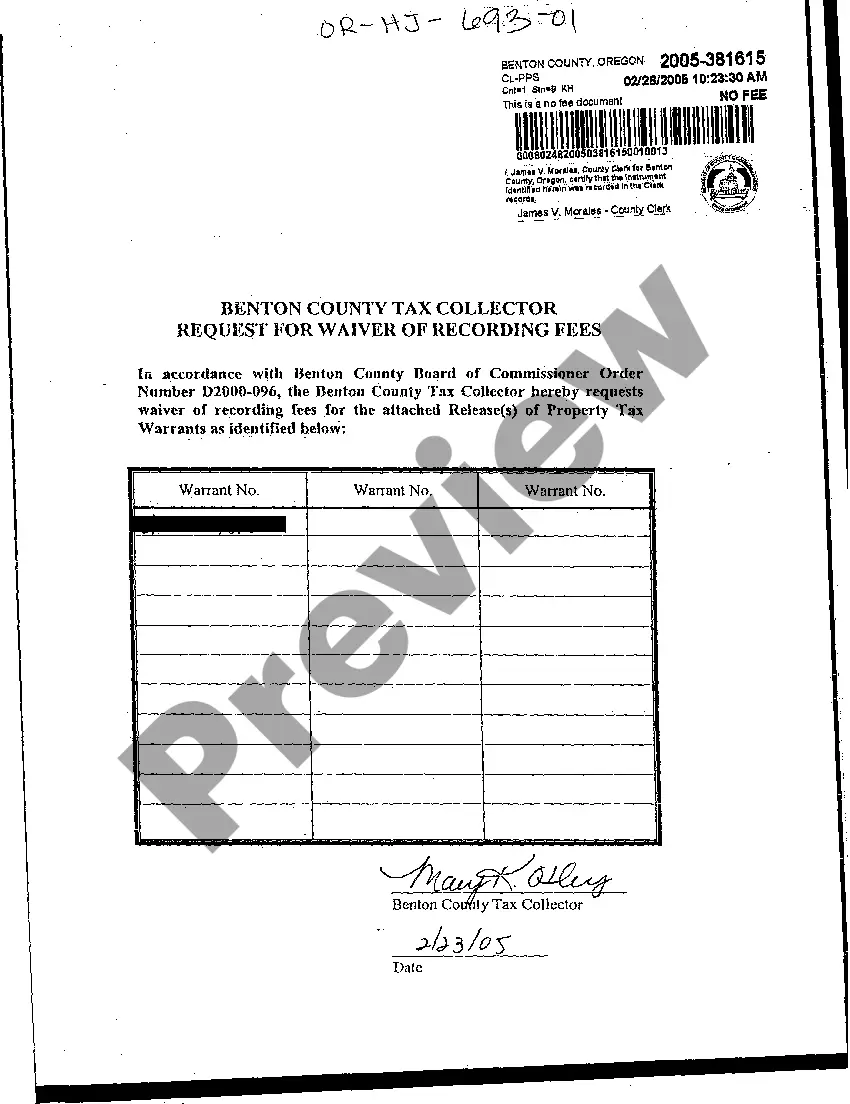

The Hillsboro Oregon Tax Collector Request for Waiver of Recording Fees is a formal application submitted to the tax collector's office in the city of Hillsboro, Oregon. This request aims to secure a waiver of recording fees for specific transactions or documents related to tax purposes. By obtaining this waiver, individuals or organizations can save on expenses associated with recording fees, thus promoting affordability and accessibility. There are several types of Hillsboro Oregon Tax Collector Requests for Waiver of Recording Fees, each catering to different circumstances. These include: 1. Real Estate Transactions: This type of request is commonly used when individuals or entities are involved in real estate transactions that require documents to be recorded, such as deeds, mortgages, or liens. By submitting this request, applicants seek to have the recording fees waived for these specific transactions, making real estate activities more financially feasible. 2. Property Tax Exemptions: Certain properties in Hillsboro, Oregon, may qualify for tax exemptions based on specific criteria, such as nonprofit organizations, veterans, or senior citizens. Individuals seeking a waiver of recording fees for documents related to property tax exemptions can utilize this request to save on fees associated with recording the necessary paperwork. 3. Tax Payment Plans: Taxpayers who face difficulties in paying their tax obligations in a lump sum may opt to request a waiver of recording fees for documents related to tax payment plans. By utilizing this request, individuals can reduce costs and focus more on managing their tax liabilities in an organized and affordable manner. 4. Tax Lien Discharge: In cases where tax liens have been placed on properties due to outstanding tax liabilities, individuals seeking to release or discharge these liens can submit a request for a waiver of recording fees. This enables them to save on expenses when recording the necessary documents to clear the property's title. Overall, the Hillsboro Oregon Tax Collector Request for Waiver of Recording Fees is a valuable tool for individuals and organizations navigating through tax-related transactions within Hillsboro. It serves to promote accessibility, affordability, and fairness by alleviating the financial burden of recording fees in specific circumstances. The various types of requests available cater to a range of situations, ensuring that taxpayers can find the appropriate avenue to seek fee waivers according to their specific needs.

Hillsboro Oregon Tax Collector Request for Waiver of Recording Fees

Description

How to fill out Hillsboro Oregon Tax Collector Request For Waiver Of Recording Fees?

Benefit from the US Legal Forms and obtain immediate access to any form sample you need. Our useful website with a huge number of documents makes it easy to find and get virtually any document sample you require. It is possible to export, fill, and sign the Hillsboro Oregon Tax Collector Request for Waiver of Recording Fees in just a few minutes instead of surfing the Net for hours searching for an appropriate template.

Using our library is a superb way to improve the safety of your form filing. Our experienced legal professionals on a regular basis check all the records to make certain that the forms are appropriate for a particular region and compliant with new acts and polices.

How can you get the Hillsboro Oregon Tax Collector Request for Waiver of Recording Fees? If you already have a profile, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions listed below:

- Open the page with the template you require. Make certain that it is the form you were hoping to find: examine its title and description, and utilize the Preview option if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the downloading process. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Pick the format to obtain the Hillsboro Oregon Tax Collector Request for Waiver of Recording Fees and change and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and reliable form libraries on the web. Our company is always happy to assist you in any legal case, even if it is just downloading the Hillsboro Oregon Tax Collector Request for Waiver of Recording Fees.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!

Form popularity

FAQ

You may be eligible for this program if: You are at least 62 years of age by April 15th of the year you file.

You cannot avoid paying taxes since collecting property tax money is one of the main sources of revenue for Oregon districts....The most common exemptions apply to: Charitable organizations. Religious institutions. Senior or disabled Oregon citizens. Disabled veterans or their surviving spouses.

As a disabled or senior homeowner, you can borrow from the State of Oregon to pay your property taxes to the county. How does the program work? If you qualify for the program, Oregon Department of Revenue will pay your county property taxes on November 15 of each year.

? Oregon is the only U.S. state, imposing a property tax and providing property tax relief to low-income senior homeowners exclusively through a property tax deferral program (excluding the disabled war veterans exemption).

Penalty for delinquency : Failure to pay the real property tax during the period of payment without penalty to the quarterly installment thereof shall subject the taxpayer to the payment of interest at the rate of (2%) per month on the unpaid amount or a fraction thereof.

Most exemptions granted to non-governmental entities are granted to religious, fraternal, literary, benevolent, or charitable organizations. The exempt property must be reasonably necessary and used in a way to achieve the organization's purpose.

You must send a copy of your federal Social Security award letter with your deferral application. For the Senior Citizens' Property Tax Deferral, you must be at least 62 years old by April 15 of the year you apply.

Oregon Property Tax Exemption ?If you are a disabled veteran, you may be entitled to exempt some of your homestead property's assessed value from your property taxes.

Oregon has over 100 exemption programs A property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or part of their property taxes.

Oregon Property Tax Exemption ?If you are a disabled veteran, you may be entitled to exempt some of your homestead property's assessed value from your property taxes.