Title: Portland Oregon Tax Collector Request for Waiver of Recording Fees: A Comprehensive Guide Introduction: In Portland, Oregon, the Tax Collector offers a Request for Waiver of Recording Fees service to assist residents with reducing their financial burdens. This detailed description will provide a comprehensive overview of the request process, eligibility criteria, and the importance of applicable keywords. 1. Portland Oregon Tax Collector Request for Waiver of Recording Fees Overview: The Portland Oregon Tax Collector Request for Waiver of Recording Fees is a service designed to alleviate the financial burden associated with recording fees for eligible residents. This process enables individuals to seek exemption or reduction of fees related to recording essential documents with county recording offices. 2. Eligibility Criteria: To qualify for a waiver of recording fees, applicants must meet specific eligibility criteria outlined by the Portland Oregon Tax Collector. These may include: — Proving low income or financial hardship — Demonstrating that the recording is vital for housing, employment, or other essential purposes — Meeting specific qualifications set by the Tax Collector's office It is crucial to review the specific requirements mentioned in the Portland Oregon Tax Collector guidelines to ensure compliance and a successful application. 3. Types of Portland Oregon Tax Collector Request for Waiver of Recording Fees: a. Residential Property Waiver: This waiver category focuses on individuals applying for fee waivers related to recording documents concerning their primary residence. Examples include deeds, mortgages, and property liens. b. Subsidized Housing Waiver: This waiver category is designed to benefit individuals residing in subsidized or low-income housing programs. It includes fee waivers related to recording documents such as rental agreements and lease addendums. c. Small Business Waiver: This waiver category aims to support small business owners navigating financial difficulties and reduces the burden associated with recording essential business-related documents, such as contracts and agreements. 4. Application Process: To request a waiver of recording fees, individuals must follow a prescribed application process. It typically involves the following steps: a. Obtain and complete the official Tax Collector's Request for Waiver of Recording Fees application form. b. Gather supporting documentation, such as income statements, proof of residency, or other applicable documents specified in the guidelines. c. Submit your completed application and supporting documents to the designated Tax Collector's office within the specified timeframe. 5. Importance of Relevant Keywords: When completing the Portland Oregon Tax Collector Request for Waiver of Recording Fees application, including relevant keywords is vital to ensure effective communication and streamlined processing. Keywords may include: — "Request for Waiver of Recording Fees" — "Portland Oregon Tax Collector— - "Recording documents" — "Low income" or "financial hardship— - "Residential property waiver" — "Subsidized housing waiver— - "Small business waiver" — "Eligibility criteria— - "Application process" Conclusion: Applying for a Request for Waiver of Recording Fees through the Portland Oregon Tax Collector can provide much-needed financial relief to eligible residents. It is essential to thoroughly review the eligibility criteria, complete the application accurately, and include relevant keywords to enhance communication and ensure a smooth process. By understanding the different types of waivers and following the prescribed steps, applicants can maximize their chances of a successful fee waiver request.

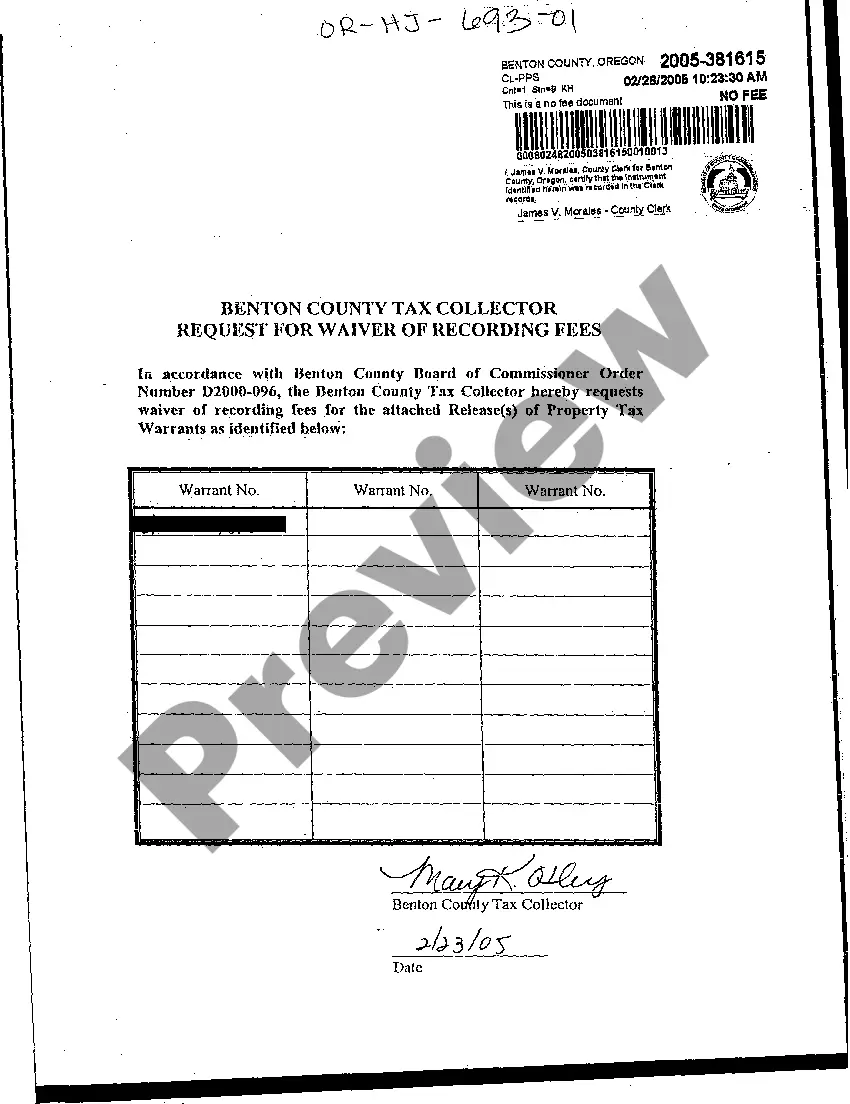

Portland Oregon Tax Collector Request for Waiver of Recording Fees

Description

How to fill out Portland Oregon Tax Collector Request For Waiver Of Recording Fees?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney solutions that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Portland Oregon Tax Collector Request for Waiver of Recording Fees or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Portland Oregon Tax Collector Request for Waiver of Recording Fees adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Portland Oregon Tax Collector Request for Waiver of Recording Fees would work for you, you can choose the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!