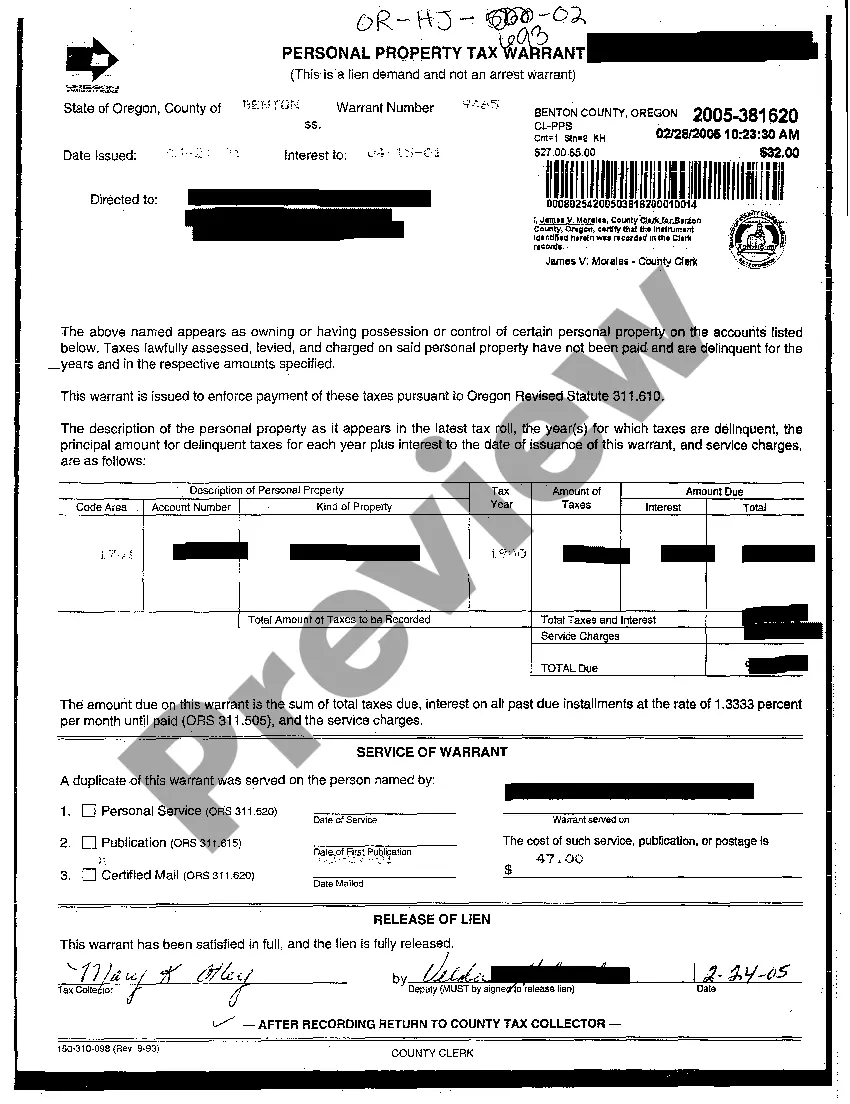

A Bend Oregon Personal Property Tax Warrant is a legal document issued by the local government authorities in Bend, Oregon, to enforce the collection of personal property taxes that have not been paid by a taxpayer. Personal property taxes are assessed on items such as furniture, equipment, and vehicles that are not part of real estate. When a taxpayer fails to pay their personal property taxes on time, the local tax authority may choose to issue a personal property tax warrant. This warrant acts as a formal notice to the taxpayer that their taxes are overdue and that legal action will be taken to collect the outstanding amount. There are different types of Bend Oregon Personal Property Tax Warrants based on the specific circumstances. A few common types are: 1. Standard Personal Property Tax Warrant: This is the regular warrant issued by the tax authority when personal property taxes are unpaid by the due date. It acts as a warning to the taxpayer and provides a deadline to settle the outstanding amount. 2. Late Payment Personal Property Tax Warrant: This type of warrant is issued when the taxpayer fails to pay their personal property taxes within a specified grace period after the due date. It includes additional penalties and interest charges for the late payment. 3. Repeat Offender Personal Property Tax Warrant: If a taxpayer has a history of repeatedly failing to pay their personal property taxes on time, the tax authority may issue this warrant. It may carry more severe penalties and consequences compared to the standard warrant. 4. Non-Compliance Personal Property Tax Warrant: In cases where a taxpayer consistently refuses or neglects to pay their personal property taxes despite multiple warnings and notices, a non-compliance warrant may be issued. This warrant can lead to more severe enforcement actions, such as asset seizure or legal proceedings. It is important for taxpayers in Bend, Oregon, to regularly review their personal property tax obligations and make timely payments to avoid the issuance of a personal property tax warrant. Failure to resolve the outstanding tax debt after the issuance of a warrant can result in further financial and legal consequences.

Bend Oregon Personal Property Tax Warrant

Description

How to fill out Bend Oregon Personal Property Tax Warrant?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone with no law background to draft this sort of paperwork from scratch, mainly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes in handy. Our platform offers a huge library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Bend Oregon Personal Property Tax Warrant or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Bend Oregon Personal Property Tax Warrant in minutes employing our reliable platform. In case you are already an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps before obtaining the Bend Oregon Personal Property Tax Warrant:

- Ensure the template you have found is suitable for your area because the rules of one state or county do not work for another state or county.

- Review the form and read a quick outline (if available) of cases the paper can be used for.

- In case the one you selected doesn’t suit your needs, you can start over and look for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Bend Oregon Personal Property Tax Warrant once the payment is done.

You’re good to go! Now you can go on and print the form or fill it out online. If you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.