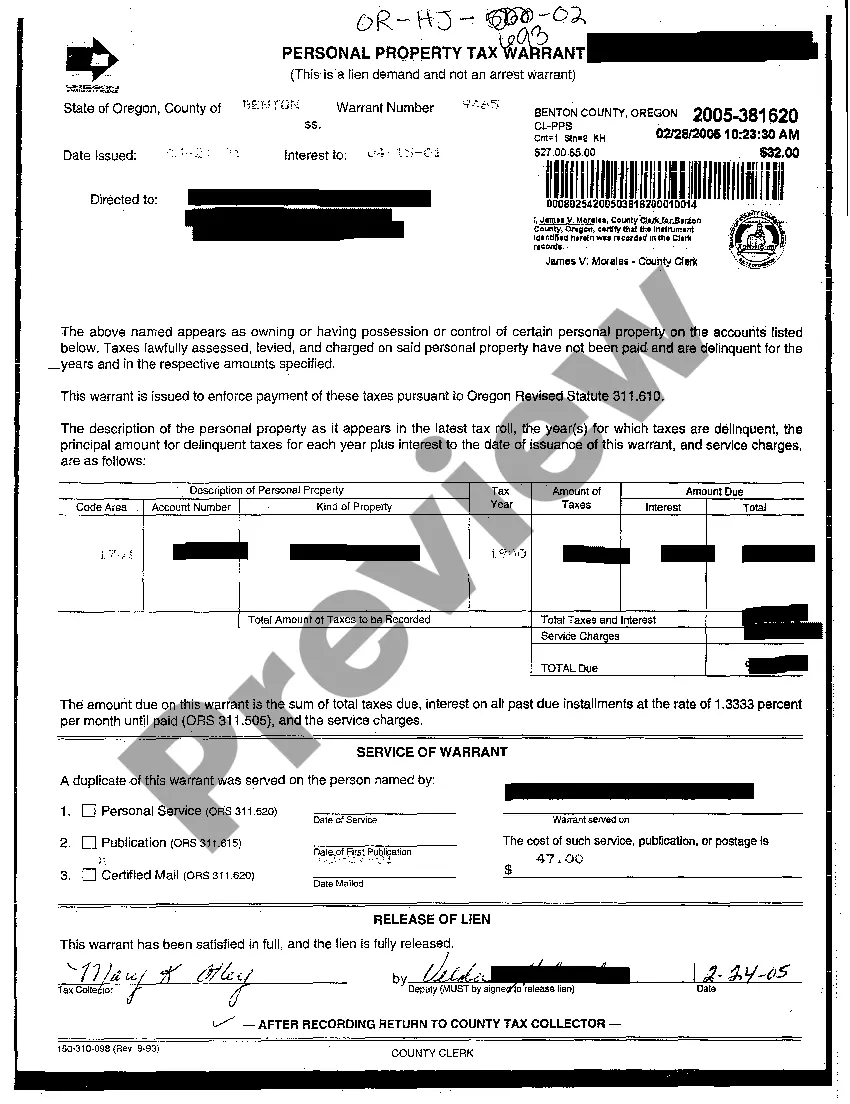

Gresham Oregon Personal Property Tax Warrant is a legal document issued by the city of Gresham to individuals or businesses who have failed to pay their personal property taxes on time. This warrant is an enforcement tool used to collect unpaid taxes and ensure compliance with local tax laws. The Gresham Oregon Personal Property Tax Warrant is typically issued when a taxpayer has ignored multiple notices and reminders regarding their delinquent tax payments. The warrant authorizes the city to seize and sell the taxpayer's personal property in order to recover the unpaid taxes. This could include belongings such as vehicles, furniture, electronics, and other assets. There are various types of Gresham Oregon Personal Property Tax Warrants, each serving a specific purpose: 1. Standard Warrant: This is the most common type of warrant issued for unpaid personal property taxes. It allows the city to take necessary actions to collect the outstanding amount, including property seizure and sale. 2. Renewal Warrant: In cases where the taxpayer's debt remains unpaid after a certain period of time, a renewal warrant may be issued. This extends the duration of the warrant and provides the city with continued authority to pursue collection efforts. 3. Contempt Warrant: If a taxpayer refuses to comply with the terms of a personal property tax warrant, a contempt warrant may be issued. This gives the city the power to take legal action against the individual or business, often resulting in fines or penalties in addition to the outstanding tax amount. 4. Partial Payment Warrant: In situations where a taxpayer has made a partial payment towards their personal property taxes but still has a remaining balance, a partial payment warrant may be issued. This warrant allows the city to collect the unpaid portion while acknowledging the taxpayer's efforts to settle the debt. It is important for taxpayers in Gresham, Oregon to promptly respond to tax notices and fulfill their personal property tax obligations to avoid the issuance of a warrant. Failure to address the warrant can result in serious consequences, including the loss of personal property and additional legal fees.

Gresham Oregon Personal Property Tax Warrant

Description

How to fill out Gresham Oregon Personal Property Tax Warrant?

Make use of the US Legal Forms and get instant access to any form sample you want. Our helpful website with a large number of document templates makes it simple to find and get almost any document sample you require. It is possible to save, fill, and sign the Gresham Oregon Personal Property Tax Warrant in a couple of minutes instead of browsing the web for many hours searching for an appropriate template.

Using our collection is a wonderful strategy to improve the safety of your document filing. Our experienced lawyers regularly review all the documents to ensure that the templates are relevant for a particular state and compliant with new acts and regulations.

How can you obtain the Gresham Oregon Personal Property Tax Warrant? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. In addition, you can find all the previously saved files in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Open the page with the template you require. Ensure that it is the template you were seeking: examine its name and description, and use the Preview function when it is available. Otherwise, use the Search field to find the needed one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the file. Indicate the format to obtain the Gresham Oregon Personal Property Tax Warrant and modify and fill, or sign it for your needs.

US Legal Forms is probably the most significant and reliable form libraries on the web. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Gresham Oregon Personal Property Tax Warrant.

Feel free to take full advantage of our form catalog and make your document experience as convenient as possible!