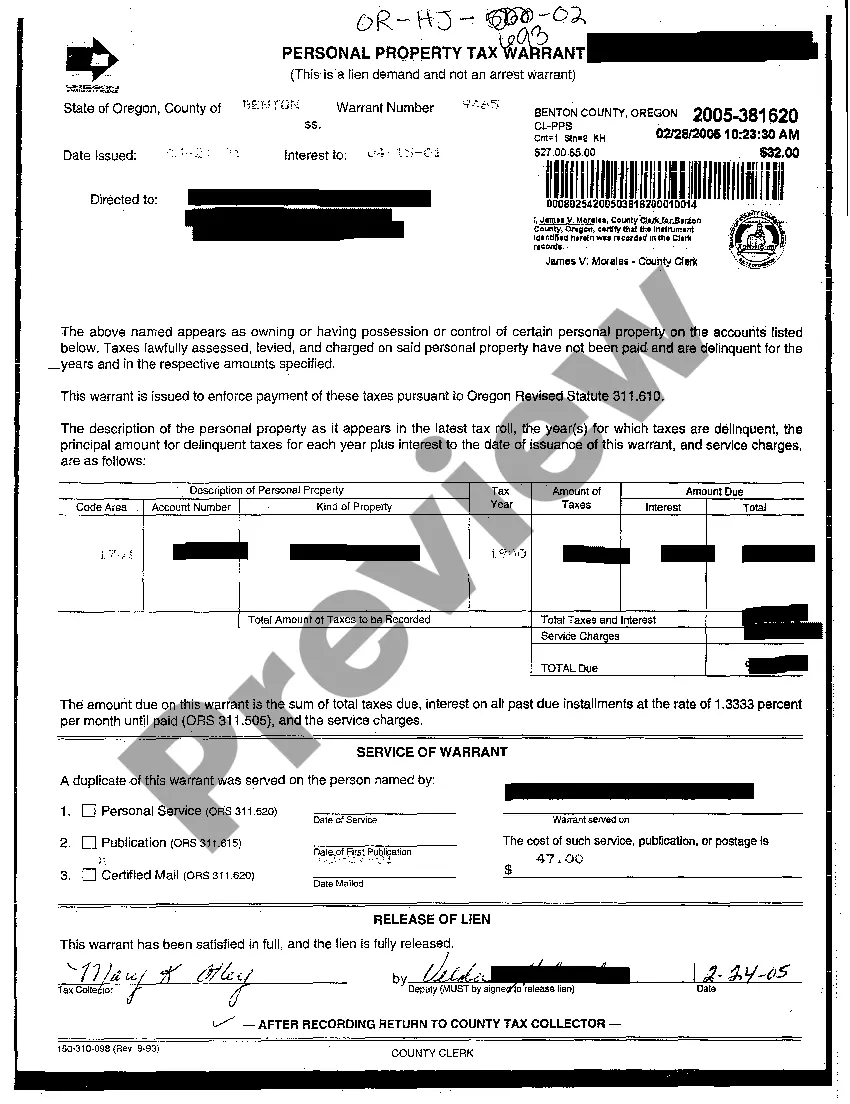

A Hillsboro Oregon Personal Property Tax Warrant is a legal document issued by the Washington County Department of Assessment and Taxation to enforce the collection of delinquent personal property taxes owed by individuals or businesses residing in Hillsboro, Oregon. It is essential to understand this process to ensure compliance with local tax laws and avoid any potential legal consequences. Personal property tax warrants are typically issued when a taxpayer fails to pay their personal property taxes within the designated timeframe established by the county. As with many jurisdictions, Hillsboro requires residents and businesses to pay taxes on personal property such as vehicles, boats, equipment, and other tangible assets. The personal property tax rate is determined annually, and failure to pay these taxes can result in the issuance of a tax warrant. A tax warrant serves as a legal notice to the delinquent taxpayer that they are in violation of tax laws and must pay the outstanding amount owed, including any penalties and interest. The warrant authorizes the County Sheriff's Office or other authorized agencies to take appropriate actions to collect the delinquent taxes. There are different types of Hillsboro Oregon Personal Property Tax Warrants, depending on the nature of the tax delinquency and the specific circumstances. These may include: 1. Standard Personal Property Tax Warrant: This is the most common type, issued when a taxpayer fails to pay personal property taxes within the specified timeframe. The warrant serves as a notice of delinquency and initiates the collection process. 2. Seizure and Sale Warrant: In cases where a taxpayer has repeatedly failed to pay their personal property taxes, the county may obtain a seizure and sale warrant. This authorizes the Sheriff's Office or other agencies to seize and sell the taxpayer's tangible assets to satisfy the outstanding taxes. 3. Garnishment Warrant: In situations where a taxpayer has failed to pay, the county may seek a garnishment warrant. This allows the county to withhold a portion of the taxpayer's wages or other sources of income until the tax debt is fully satisfied. 4. Bank Levy Warrant: If a taxpayer has substantial personal property tax debts and other collection efforts have been unsuccessful, the county may seek a bank levy warrant. This grants the county the authority to freeze the taxpayer's bank account(s) and seize funds to settle the outstanding tax liability. Understanding and promptly addressing a Hillsboro Oregon Personal Property Tax Warrant is crucial to avoid escalating consequences. Taxpayers who receive such a warrant should consult with the County Department of Assessment and Taxation or seek legal advice to explore potential payment options or negotiate a resolution. Responding promptly and addressing tax obligations is essential to protect personal property and maintain compliance with local tax laws.

Hillsboro Oregon Personal Property Tax Warrant

Description

How to fill out Hillsboro Oregon Personal Property Tax Warrant?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Hillsboro Oregon Personal Property Tax Warrant or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Hillsboro Oregon Personal Property Tax Warrant adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Hillsboro Oregon Personal Property Tax Warrant is proper for you, you can choose the subscription option and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!