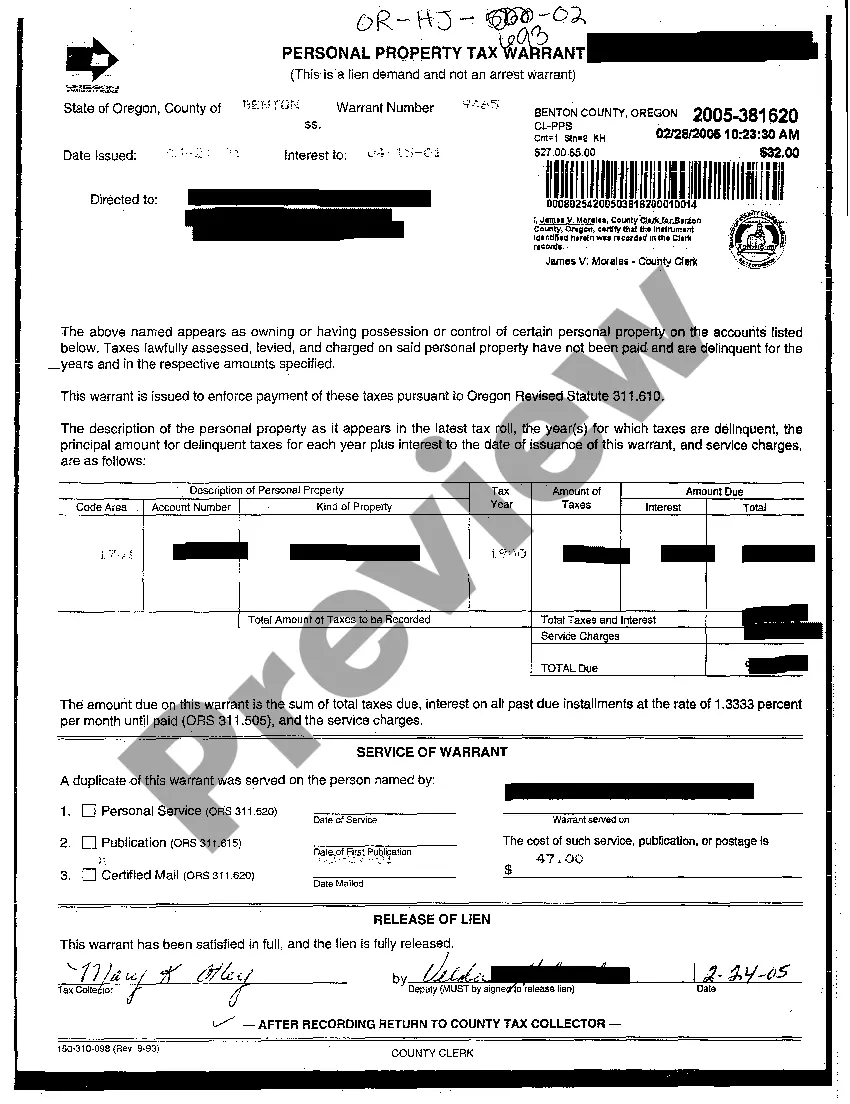

Portland Oregon Personal Property Tax Warrant is a legal document issued by the local government to collect unpaid personal property taxes from individuals or businesses in Portland, Oregon. This warrant is typically issued when the taxpayer fails to pay their assessed personal property taxes on time or neglects to address the outstanding tax liabilities. Personal property taxes include taxes on tangible assets such as cars, boats, machinery, equipment, furniture, and other assets not classified as real estate. These taxes are assessed annually based on the value of the personal property and are used to fund various local government services and initiatives. When a taxpayer fails to pay their personal property taxes, the Portland Oregon Department of Revenue may issue a personal property tax warrant. This warrant acts as a legal claim against the taxpayer's personal property, giving the government the authority to seize and sell the assets in order to recover the unpaid taxes. There are several types of Portland Oregon Personal Property Tax Warrants, including: 1. Standard Personal Property Tax Warrant: This is the most common type of warrant issued for unpaid personal property taxes. It is issued when the taxpayer fails to pay their assessed taxes within the specified timeframe. 2. Delinquent Personal Property Tax Warrant: This type of warrant is issued when the taxpayer has multiple outstanding personal property tax liabilities spanning over several years. It may involve significant amounts of unpaid taxes and can result in more severe consequences for the taxpayer. 3. Escalated Personal Property Tax Warrant: In certain cases, when a taxpayer repeatedly fails to pay their personal property taxes despite previous warrants being issued, the local government may escalate the situation by issuing an escalated personal property tax warrant. This type of warrant may involve additional penalties or legal actions against the taxpayer. It is essential for taxpayers in Portland, Oregon, to promptly pay their assessed personal property taxes to avoid the issuance of a personal property tax warrant. Failure to address the warrant can result in asset seizures, auctions, additional penalties, and potential legal consequences. Therefore, it is advisable to stay updated on personal property tax obligations and promptly address any outstanding tax liabilities to avoid complications.

Portland Oregon Personal Property Tax Warrant

Description

How to fill out Portland Oregon Personal Property Tax Warrant?

Make use of the US Legal Forms and have immediate access to any form sample you require. Our useful website with thousands of document templates makes it simple to find and obtain virtually any document sample you need. You can save, fill, and sign the Portland Oregon Personal Property Tax Warrant in just a couple of minutes instead of surfing the Net for hours looking for a proper template.

Using our collection is a wonderful way to improve the safety of your form filing. Our professional lawyers regularly check all the records to make certain that the templates are appropriate for a particular region and compliant with new laws and regulations.

How do you get the Portland Oregon Personal Property Tax Warrant? If you already have a profile, just log in to the account. The Download option will be enabled on all the samples you view. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you don’t have an account yet, stick to the instruction listed below:

- Open the page with the form you require. Make sure that it is the form you were looking for: check its headline and description, and take take advantage of the Preview feature if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the file. Pick the format to obtain the Portland Oregon Personal Property Tax Warrant and edit and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy form libraries on the internet. Our company is always happy to assist you in virtually any legal process, even if it is just downloading the Portland Oregon Personal Property Tax Warrant.

Feel free to take full advantage of our form catalog and make your document experience as convenient as possible!