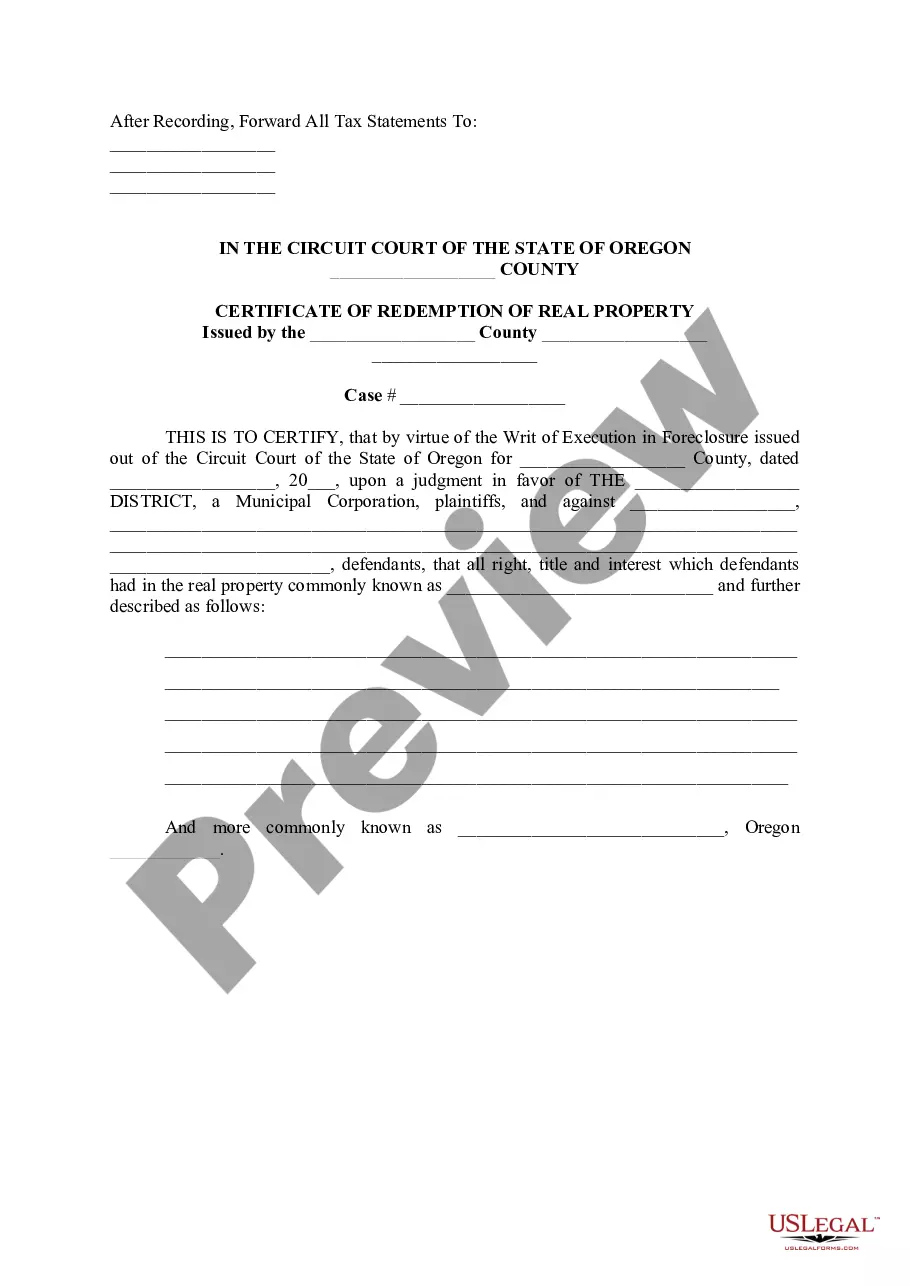

Eugene Oregon Certificate of Redemption of Real Property

Description

approved by the Commissioner of Commerce.

How to fill out Oregon Certificate Of Redemption Of Real Property?

Are you searching for a reliable and cost-effective provider of legal forms to obtain the Eugene Oregon Certificate of Redemption of Real Property? US Legal Forms is your primary option.

Whether you require a straightforward agreement to outline rules for cohabitating with your partner or a collection of forms to facilitate your divorce proceedings in court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business applications. All templates we provide are not generic and are tailored to meet the specifications of individual states and counties.

To retrieve the document, you need to Log In to your account, find the necessary template, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time in the My documents section.

Is this your first visit to our platform? No problem. Establishing an account is quick and easy, but before proceeding, ensure you do the following.

Now you can create your account. Then select the subscription plan and continue to payment. Once the payment is completed, download the Eugene Oregon Certificate of Redemption of Real Property in any available format. You can return to the website at any time and redownload the document at no additional cost.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal documents online once and for all.

- Verify that the Eugene Oregon Certificate of Redemption of Real Property adheres to the regulations of your state and locality.

- Review the form’s specifics (if available) to understand its purpose and the intended recipients.

- Restart your search if the template does not fit your particular situation.

Form popularity

FAQ

One downside of buying a foreclosure includes the potential hidden costs associated with repairs and maintenance. Many foreclosed homes sell as-is, meaning you might encounter unexpected issues that require significant investment. Additionally, you might face challenges associated with navigating the legal aspects, such as the Eugene Oregon Certificate of Redemption of Real Property, which can complicate the buying process. Therefore, conducting thorough inspections and being prepared can mitigate these risks.

Generally, a credit score of at least 620 is recommended to secure financing for a foreclosed home. However, some lenders may consider lower scores, depending on their specific criteria and your overall financial situation. Improving your credit score will enhance your chances of getting better rates and faster approvals. Additionally, understanding the implications of the Eugene Oregon Certificate of Redemption of Real Property can help you manage your finances better throughout this journey.

To buy a foreclosure in Oregon, start by researching listings online or consulting a real estate agent familiar with foreclosures. After identifying a property, be prepared to act quickly, as these homes often attract multiple offers. Review the property's condition and align your offer with the Eugene Oregon Certificate of Redemption of Real Property to secure your investment effectively. Utilizing platforms like uslegalforms can provide necessary documentation and clarity in the process.

The foreclosure process in Oregon often spans from a few months to over a year. The timeline largely depends on whether the foreclosure is judicial or non-judicial, and the circumstances surrounding the case. Having access to the Eugene Oregon Certificate of Redemption of Real Property can significantly assist in navigating the complexities and timelines of foreclosure.

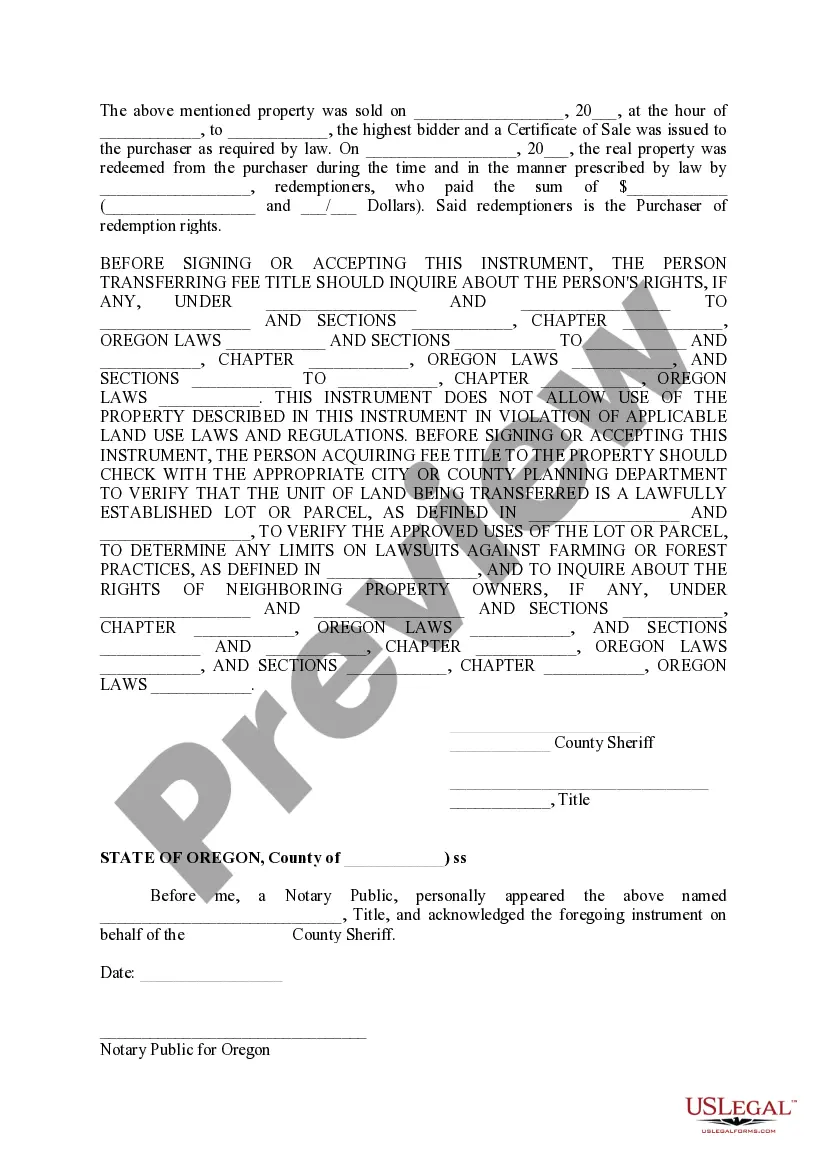

The redemption period in Oregon is typically 180 days for most homeowners after a foreclosure sale. During this time, you can reclaim your property by paying the necessary amounts owed, including fees and costs. Having an Eugene Oregon Certificate of Redemption of Real Property is essential, as it details your rights and outlines your options during the redemption process.

Yes, you can sell your property during the redemption period in Oregon. This period allows homeowners to reclaim their property after a foreclosure sale. If you possess an Eugene Oregon Certificate of Redemption of Real Property, you may be able to negotiate the terms of a sale more favorably during this crucial time.

Foreclosure in Oregon can take several months to over a year, depending on various factors like the lender's approach and the court's schedule. If the homeowner contests the foreclosure, the process may extend even longer. Utilizing the Eugene Oregon Certificate of Redemption of Real Property can provide options during this timeframe, ensuring homeowners understand their rights and potential actions.

The two primary types of redemption are statutory redemption and equitable redemption. Statutory redemption occurs after a foreclosure sale, allowing you to reclaim your property through payment of the debt. Equitable redemption happens before the sale, where you can settle your missed payments to avoid foreclosure altogether. When utilizing an Eugene Oregon Certificate of Redemption of Real Property, you can understand and access both types, finding the best option for your circumstances.

Redemption in foreclosure generally involves paying off the mortgage debt to regain ownership of your property. In Oregon, the process is legally structured, allowing you to reclaim your home during the redemption period. Engaging with resources and services such as the Eugene Oregon Certificate of Redemption of Real Property can provide you with the insights you need to navigate this process effectively.

In Oregon, the right of redemption allows homeowners to reclaim their property after foreclosure by paying the total amount owed. This right exists for a limited time, typically up to one year after the foreclosure sale. Knowing your rights can empower you to act decisively when facing foreclosure. Obtaining an Eugene Oregon Certificate of Redemption of Real Property can support and guide you through this important process.