Bend Oregon Assignments of Rents act as legal agreements between a lender and borrower, specifying the transfer of rental income from a property to the lender in the event of default or foreclosure. These assignments provide a valuable source of security for lenders, safeguarding their investment in the property. When granting a loan, lenders often require borrowers to sign an Assignment of Rents to ensure a consistent flow of funds in case of unforeseen circumstances. There are two main types of Bend Oregon Assignments of Rents. The first type is the Absolute Assignment, which grants the lender complete control over the rental income as soon as the loan agreement is executed. Under this arrangement, the borrower permanently surrenders their right to collect and allocate rental funds and instead, the lender gains the authority to collect all future rents directly. The second type is the Conditional Assignment, which takes effect only upon the occurrence of specified conditions, such as the borrower's default on the loan. In contrast to the Absolute Assignment, the Conditional Assignment allows the borrower to retain control over the rental income until such triggering events happen. Bend Oregon Assignments of Rents are particularly beneficial for lenders who want to minimize their risk exposure when providing financing for real estate investments. By securing a guaranteed payment stream through rental income, lenders have greater assurance of recouping their investment in case the borrower fails to meet their loan obligations. These assignments serve as legal tools to protect lenders' interests when borrowers encounter financial difficulties or face foreclosure, ensuring a steady cash flow that can be used to cover mortgage payments, property maintenance costs, or other outstanding expenses. Additionally, Assignments of Rents alleviate concerns of lenders who may be hesitant to provide loans due to the borrower's weak credit history. In summary, Bend Oregon Assignments of Rents are essential legal agreements that establish the transfer of rental income from borrowers to lenders, serving as a form of security to mitigate risks associated with real estate financing. The two main types, Absolute and Conditional Assignments, differ in terms of when the lender gains authority over rental income. These agreements allow lenders to protect their investment and ensure a consistent flow of funds, enabling them to recover their outstanding debts even in challenging circumstances.

Bend Oregon Assignments of Rents

Category:

State:

Oregon

City:

Bend

Control #:

OR-LR043T

Format:

Word;

Rich Text

Instant download

Description

Mortgage is a pledge of real property to a creditor as security for the repayment of a debt involving the property.

Bend Oregon Assignments of Rents act as legal agreements between a lender and borrower, specifying the transfer of rental income from a property to the lender in the event of default or foreclosure. These assignments provide a valuable source of security for lenders, safeguarding their investment in the property. When granting a loan, lenders often require borrowers to sign an Assignment of Rents to ensure a consistent flow of funds in case of unforeseen circumstances. There are two main types of Bend Oregon Assignments of Rents. The first type is the Absolute Assignment, which grants the lender complete control over the rental income as soon as the loan agreement is executed. Under this arrangement, the borrower permanently surrenders their right to collect and allocate rental funds and instead, the lender gains the authority to collect all future rents directly. The second type is the Conditional Assignment, which takes effect only upon the occurrence of specified conditions, such as the borrower's default on the loan. In contrast to the Absolute Assignment, the Conditional Assignment allows the borrower to retain control over the rental income until such triggering events happen. Bend Oregon Assignments of Rents are particularly beneficial for lenders who want to minimize their risk exposure when providing financing for real estate investments. By securing a guaranteed payment stream through rental income, lenders have greater assurance of recouping their investment in case the borrower fails to meet their loan obligations. These assignments serve as legal tools to protect lenders' interests when borrowers encounter financial difficulties or face foreclosure, ensuring a steady cash flow that can be used to cover mortgage payments, property maintenance costs, or other outstanding expenses. Additionally, Assignments of Rents alleviate concerns of lenders who may be hesitant to provide loans due to the borrower's weak credit history. In summary, Bend Oregon Assignments of Rents are essential legal agreements that establish the transfer of rental income from borrowers to lenders, serving as a form of security to mitigate risks associated with real estate financing. The two main types, Absolute and Conditional Assignments, differ in terms of when the lender gains authority over rental income. These agreements allow lenders to protect their investment and ensure a consistent flow of funds, enabling them to recover their outstanding debts even in challenging circumstances.

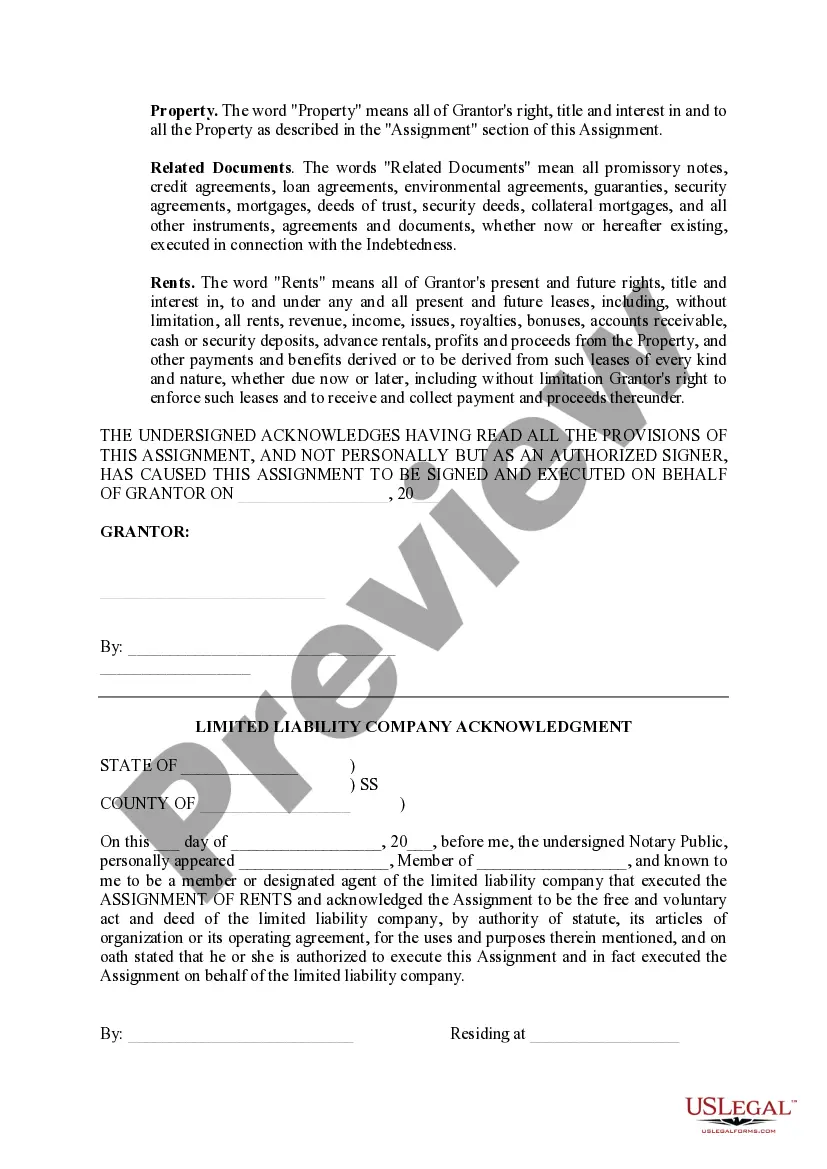

Free preview

How to fill out Bend Oregon Assignments Of Rents?

If you’ve already utilized our service before, log in to your account and download the Bend Oregon Assignments of Rents on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Bend Oregon Assignments of Rents. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!