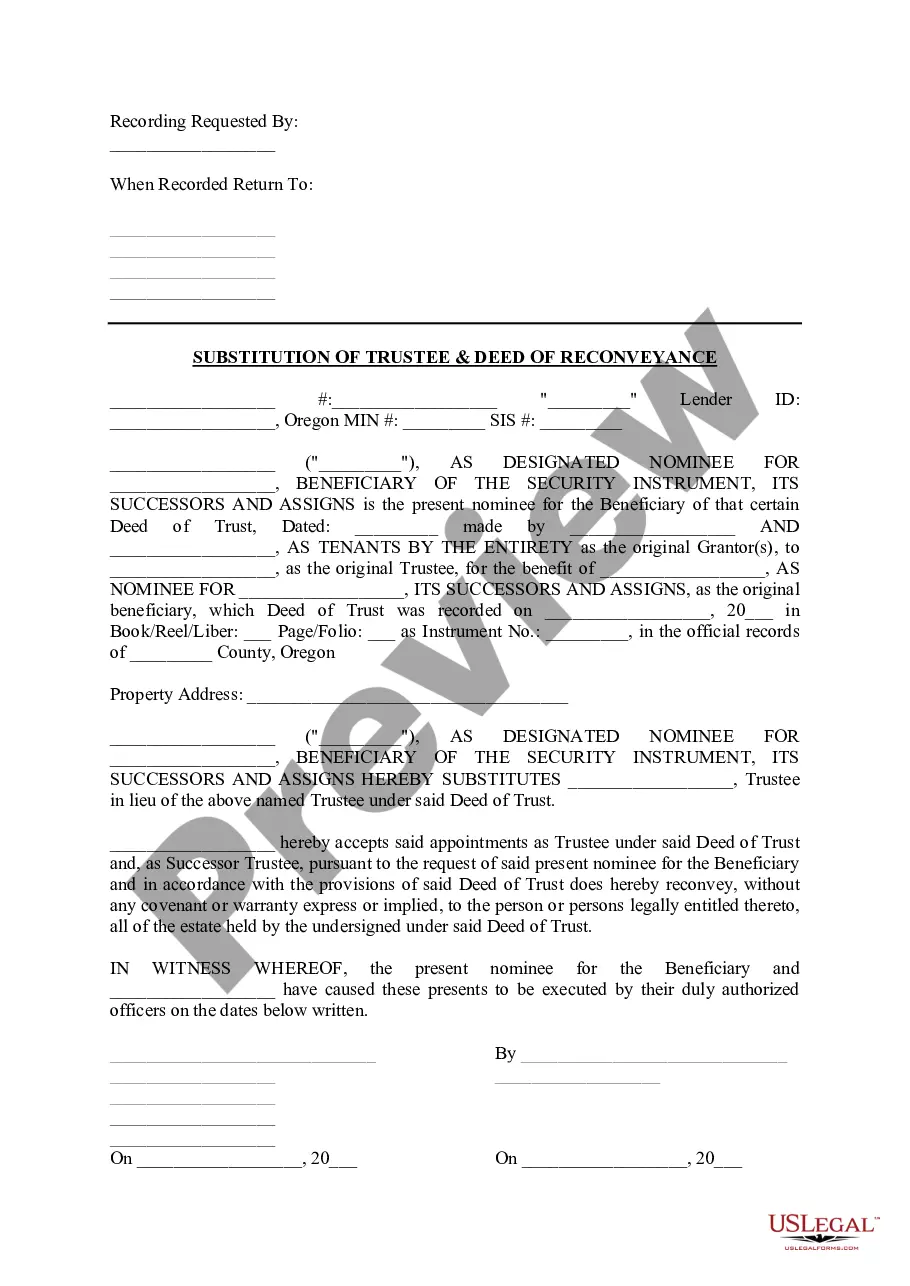

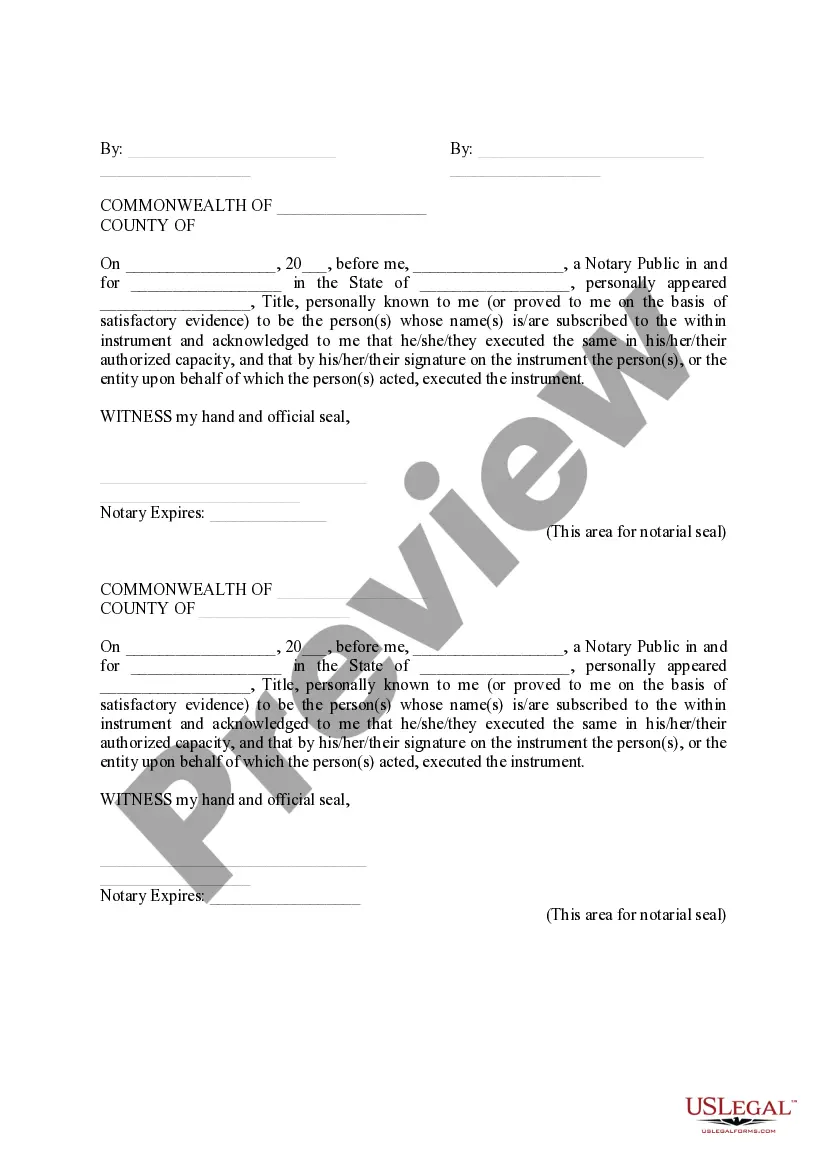

When it comes to real estate transactions in Eugene, Oregon, it is essential to understand the process and terminology involved. One such aspect is the Substitution of Trustee & Deed of Re conveyance. This article will provide a detailed description of what this means and the different types of Substitution of Trustee & Deed of Re conveyance you may encounter in Eugene, Oregon. The Substitution of Trustee refers to a legal document that allows the beneficiary of a trust deed (typically a lender) to replace the trustee named in the original trust deed with a new trustee. The trustee is responsible for holding the legal title to the property until the loan is fully repaid. This process often occurs when there is a change in the lender, either due to loan transfer or assignment, or when the original trustee is unable or unwilling to continue their role. The Substitution of Trustee is an important step in the mortgage or trust deed process as it ensures proper documentation and legal transfer of the responsibilities associated with the trust deed. In Eugene, Oregon, this procedure must comply with the laws and regulations set forth by the state. Similarly, the Deed of Re conveyance is another legal document related to the trust deed process. Once the borrower pays off the mortgage or loan in full, the lender is required to provide a Deed of Re conveyance. This document officially declares that the loan has been satisfied and releases the property from the mortgage lien. The borrower then becomes the sole owner of the property without any encumbrances from the loan. In Eugene, Oregon, there may be different types of Substitution of Trustee & Deed of Re conveyance depending on the specific circumstances of the transaction. These could include: 1. Standard Substitution of Trustee & Deed of Re conveyance: This is the most common type and occurs when the borrower completes the loan payments, and the lender issues a Deed of Re conveyance to release the property from the mortgage lien. 2. Trustee Replacement Substitution of Trustee & Deed of Re conveyance: In some cases, the beneficiary of the trust deed may wish to replace the original trustee due to various reasons, such as improved services, more favorable terms, or consolidation with the lender's other loans. In such instances, the lender files a Substitution of Trustee along with the Deed of Re conveyance to complete the transition. 3. Assignment Substitution of Trustee & Deed of Re conveyance: When there is a transfer of the loan from one lender to another, the new lender may appoint their own trustee through a Substitution of Trustee. This process helps facilitate the seamless transfer of responsibilities and ensures compliance with the trust deed laws in Eugene, Oregon. Understanding the Substitution of Trustee & Deed of Re conveyance is crucial for both borrowers and lenders involved in real estate transactions in Eugene, Oregon. It ensures that the trust deed process is legally and properly executed, providing clarity and protection for all parties involved.

Eugene Oregon Substitution of Trustee & Deed of Reconveyance

Category:

State:

Oregon

City:

Eugene

Control #:

OR-LR044T

Format:

Word;

Rich Text

Instant download

This form is available by subscription

Description

This form is for the reconveyance, satisfaction or release of a deed of trust for the state of Oregon by an Individual.

When it comes to real estate transactions in Eugene, Oregon, it is essential to understand the process and terminology involved. One such aspect is the Substitution of Trustee & Deed of Re conveyance. This article will provide a detailed description of what this means and the different types of Substitution of Trustee & Deed of Re conveyance you may encounter in Eugene, Oregon. The Substitution of Trustee refers to a legal document that allows the beneficiary of a trust deed (typically a lender) to replace the trustee named in the original trust deed with a new trustee. The trustee is responsible for holding the legal title to the property until the loan is fully repaid. This process often occurs when there is a change in the lender, either due to loan transfer or assignment, or when the original trustee is unable or unwilling to continue their role. The Substitution of Trustee is an important step in the mortgage or trust deed process as it ensures proper documentation and legal transfer of the responsibilities associated with the trust deed. In Eugene, Oregon, this procedure must comply with the laws and regulations set forth by the state. Similarly, the Deed of Re conveyance is another legal document related to the trust deed process. Once the borrower pays off the mortgage or loan in full, the lender is required to provide a Deed of Re conveyance. This document officially declares that the loan has been satisfied and releases the property from the mortgage lien. The borrower then becomes the sole owner of the property without any encumbrances from the loan. In Eugene, Oregon, there may be different types of Substitution of Trustee & Deed of Re conveyance depending on the specific circumstances of the transaction. These could include: 1. Standard Substitution of Trustee & Deed of Re conveyance: This is the most common type and occurs when the borrower completes the loan payments, and the lender issues a Deed of Re conveyance to release the property from the mortgage lien. 2. Trustee Replacement Substitution of Trustee & Deed of Re conveyance: In some cases, the beneficiary of the trust deed may wish to replace the original trustee due to various reasons, such as improved services, more favorable terms, or consolidation with the lender's other loans. In such instances, the lender files a Substitution of Trustee along with the Deed of Re conveyance to complete the transition. 3. Assignment Substitution of Trustee & Deed of Re conveyance: When there is a transfer of the loan from one lender to another, the new lender may appoint their own trustee through a Substitution of Trustee. This process helps facilitate the seamless transfer of responsibilities and ensures compliance with the trust deed laws in Eugene, Oregon. Understanding the Substitution of Trustee & Deed of Re conveyance is crucial for both borrowers and lenders involved in real estate transactions in Eugene, Oregon. It ensures that the trust deed process is legally and properly executed, providing clarity and protection for all parties involved.

Free preview

How to fill out Eugene Oregon Substitution Of Trustee & Deed Of Reconveyance?

If you’ve already utilized our service before, log in to your account and download the Eugene Oregon Substitution of Trustee & Deed of Reconveyance on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Eugene Oregon Substitution of Trustee & Deed of Reconveyance. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!