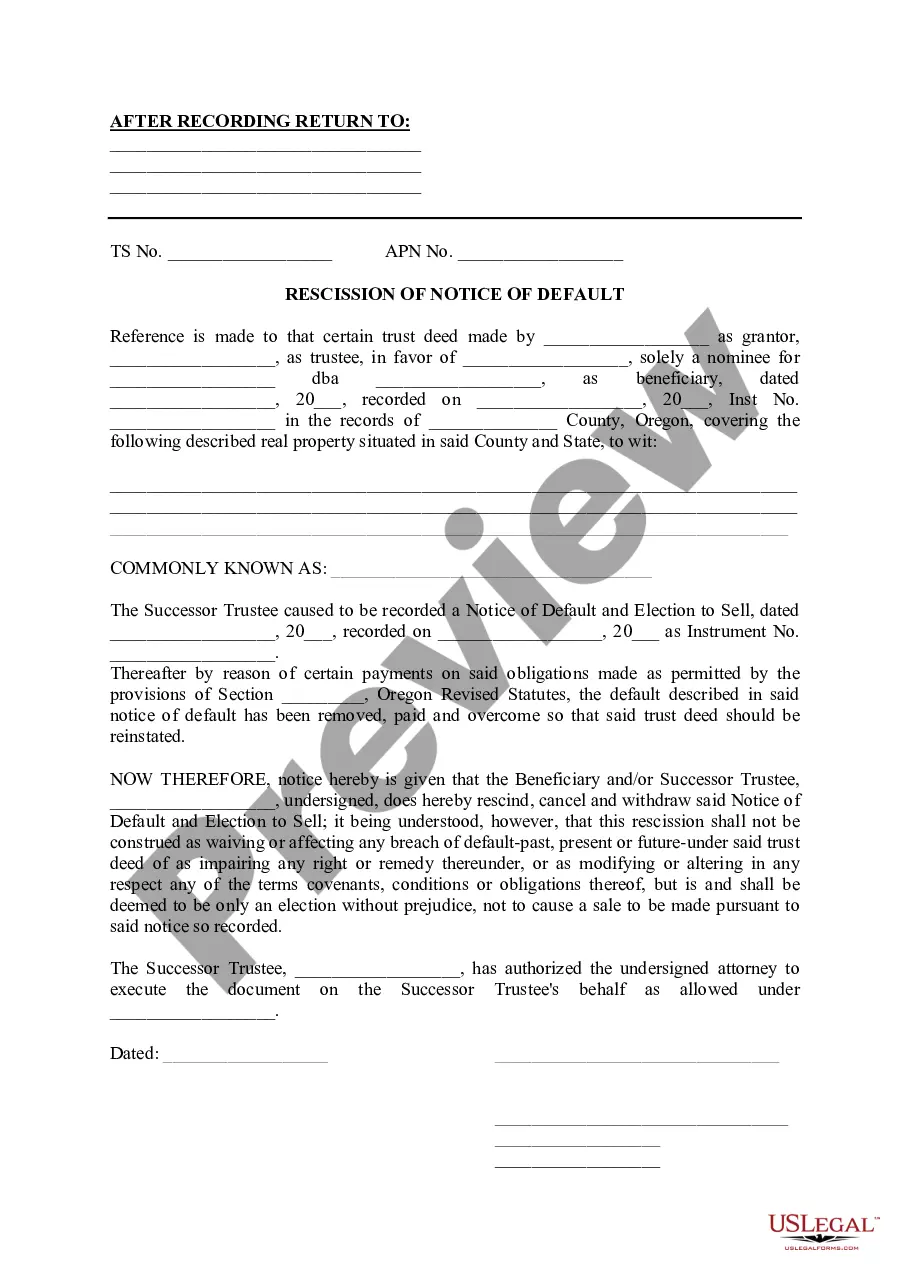

Bend Oregon Rescission of Notice of Default is a legal process that allows homeowners in Bend, Oregon, to cancel or revoke a Notice of Default (NOD) that has been previously filed by their lender due to mortgage loan default. This procedure provides an opportunity for borrowers to reinstate their loan and prevent their property from moving closer to foreclosure. When a borrower falls behind on their mortgage payments, their lender has the right to file a Notice of Default, which initiates the foreclosure process. However, if the homeowner can rectify the delinquency by paying the outstanding amount, along with any associated fees and costs, they may be able to request a Bend Oregon Rescission of Notice of Default. Keywords: Bend Oregon, Rescission of Notice of Default, homeowners, lender, mortgage loan default, foreclosure, reinstatement, borrower, delinquency, outstanding amount, fees, costs. There are two common types of Bend Oregon Rescission of Notice of Default: 1. Formal Rescission of Notice of Default: This type involves a formal legal process that requires the borrower to respond to the Notice of Default within a specific timeframe. The homeowner must provide evidence of their ability to fulfill the delinquent payment and any outstanding fees, and they may need to work with their lender or a housing counselor to negotiate new repayment terms. Once the requirements are met, the lender can issue a formal rescission, effectively canceling the previously filed Notice of Default. 2. Informal Rescission of Notice of Default: In some cases, lenders may be willing to work directly with borrowers to negotiate an informal rescission of the Notice of Default. This typically occurs when the borrower contacts their lender promptly after receiving the Notice of Default, expressing the intention to resolve the delinquency. This informal process can involve discussions regarding repayment plans, loan modifications, or other foreclosure prevention options. If both parties reach an agreement, the lender may agree to rescind the Notice of Default. Ultimately, the Bend Oregon Rescission of Notice of Default provides homeowners with an opportunity to rectify their mortgage loan default and prevent foreclosure. It is crucial for borrowers to act promptly once they receive a Notice of Default, seeking professional advice if necessary, to understand their options and initiate the rescission process accordingly. By making timely payments and fulfilling the lender's requirements, borrowers can regain control over their property and secure a path towards financial stability. Keywords: Bend Oregon, Rescission of Notice of Default, formal, informal, legal process, housing counselor, negotiations, repayment terms, foreclosure prevention, property ownership, financial stability.

Bend Oregon Rescission of Notice of Default

Description

How to fill out Bend Oregon Rescission Of Notice Of Default?

Benefit from the US Legal Forms and obtain immediate access to any form you want. Our useful platform with a huge number of templates simplifies the way to find and get virtually any document sample you will need. It is possible to save, complete, and sign the Bend Oregon Rescission of Notice of Default in a couple of minutes instead of surfing the Net for many hours attempting to find a proper template.

Utilizing our collection is a wonderful strategy to raise the safety of your record submissions. Our experienced legal professionals regularly review all the documents to make certain that the forms are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the Bend Oregon Rescission of Notice of Default? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you view. Moreover, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Open the page with the template you require. Make certain that it is the template you were hoping to find: examine its headline and description, and utilize the Preview feature if it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving process. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the document. Indicate the format to obtain the Bend Oregon Rescission of Notice of Default and change and complete, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy template libraries on the internet. Our company is always ready to help you in any legal process, even if it is just downloading the Bend Oregon Rescission of Notice of Default.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!