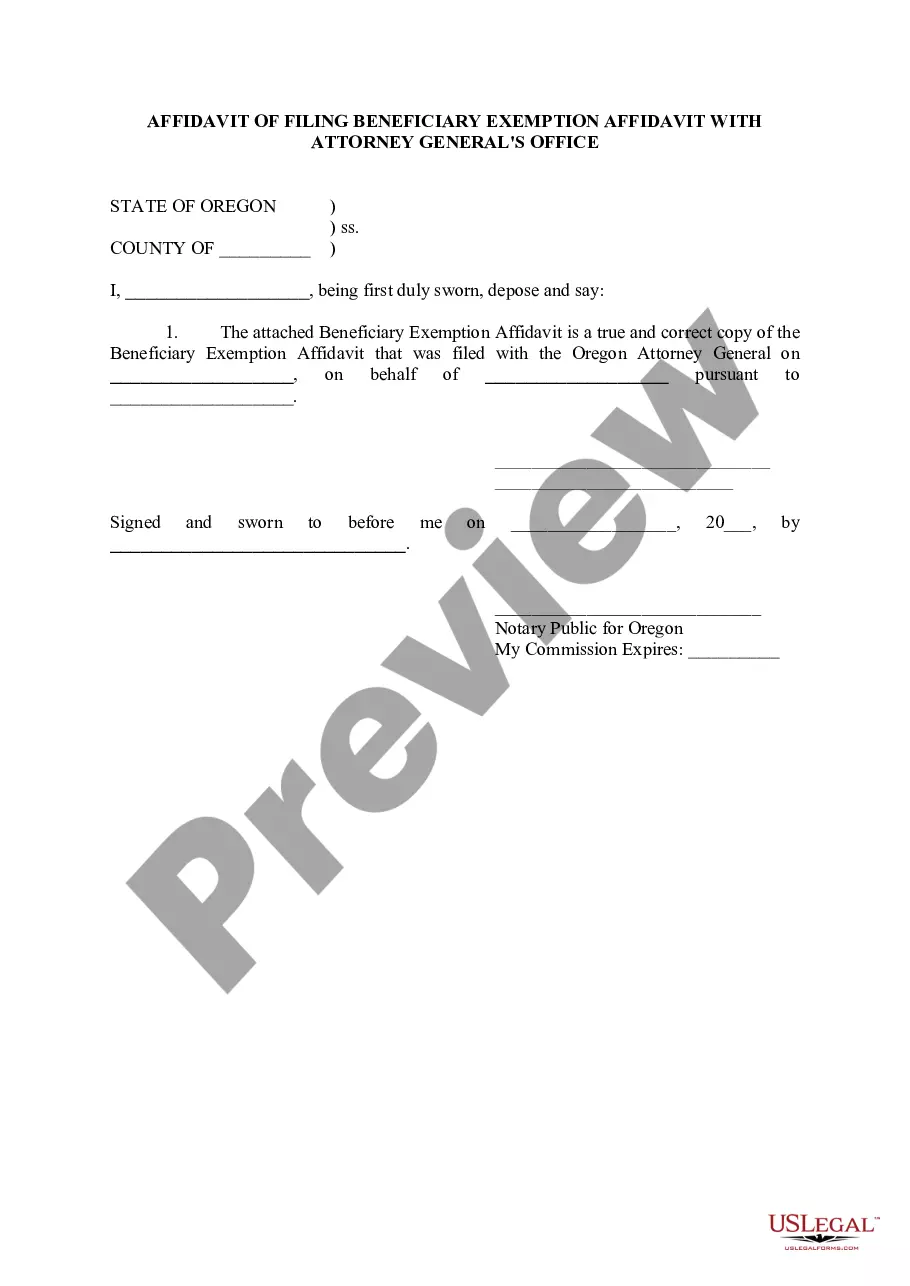

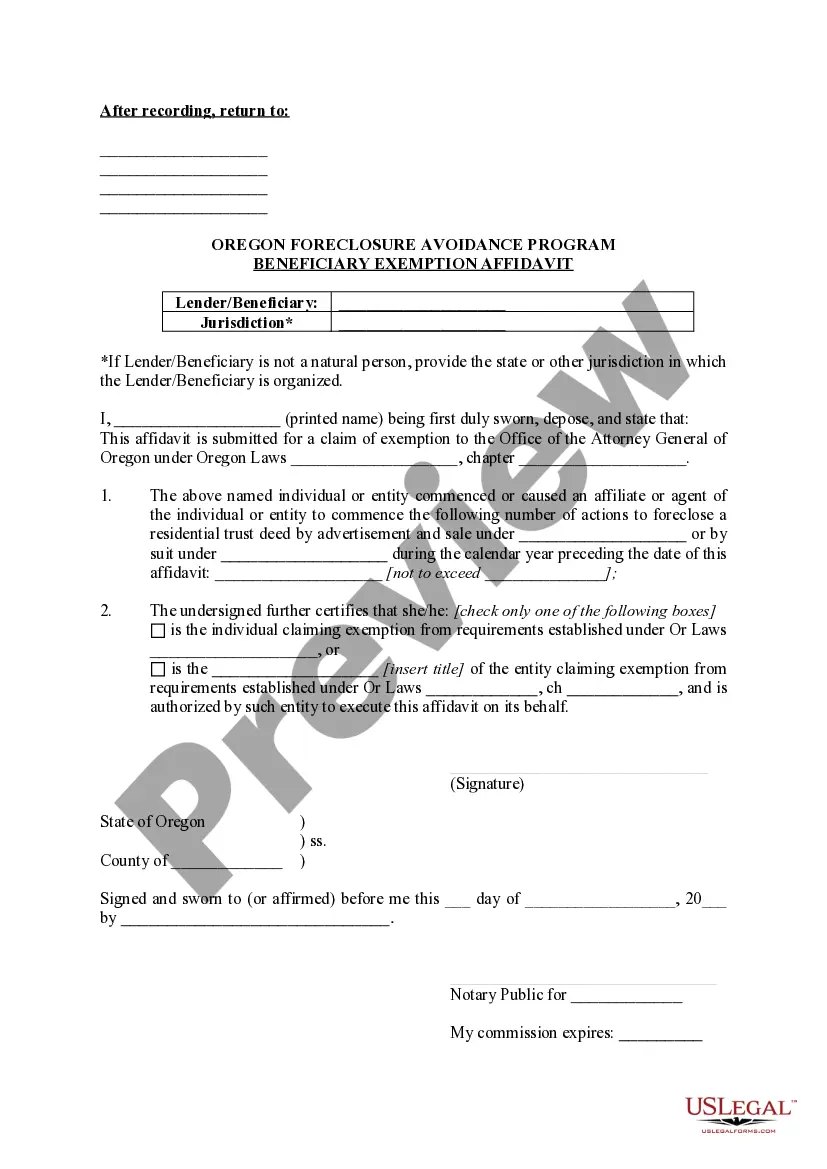

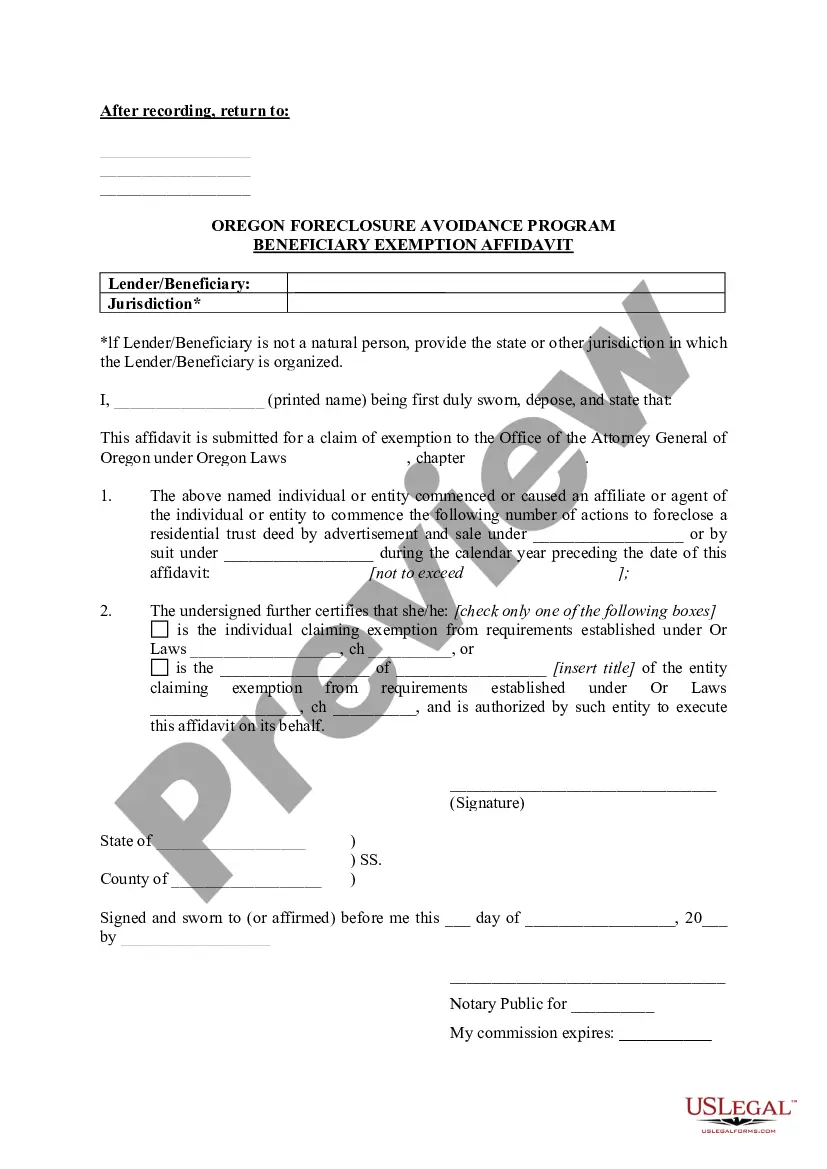

Eugene Oregon Affidavit of Filing Beneficiary Exemption Affidavit with Attorney General's Office

Category:

State:

Oregon

City:

Eugene

Control #:

OR-LR055T

Format:

Word;

Rich Text

Instant download

Description

An affidavit is statement of facts which is sworn to before an officer who has authority to administer an oath. The person making the

signed statement (the affiant) takes an oath that the contents

are, to the best of their knowledge, true.

signed statement (the affiant) takes an oath that the contents

are, to the best of their knowledge, true.

Free preview

How to fill out Oregon Affidavit Of Filing Beneficiary Exemption Affidavit With Attorney General's Office?

Finding validated templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms collection.

This is an online repository of over 85,000 legal documents for both personal and professional purposes, covering real-world scenarios.

All the forms are systematically organized by area of use and jurisdictional categories, making it as simple as 1-2-3 to look for the Eugene Oregon Affidavit of Filing Beneficiary Exemption Affidavit with the Attorney General's Office.

Maintaining documentation tidy and compliant with legal requirements is critically important. Leverage the US Legal Forms collection to have crucial document templates for any needs readily available at your fingertips!

- For those already knowledgeable about our catalog and who have accessed it previously, acquiring the Eugene Oregon Affidavit of Filing Beneficiary Exemption Affidavit with the Attorney General's Office requires only a few clicks.

- Simply Log In to your account, choose the document, and hit Download to store it on your device.

- The process will necessitate a couple more steps for new users.

- Adhere to the instructions below to begin with the most comprehensive online form database.

- Review the Preview mode and form details. Ensure that you have chosen the correct one that fulfills your needs and aligns with your local jurisdiction standards.