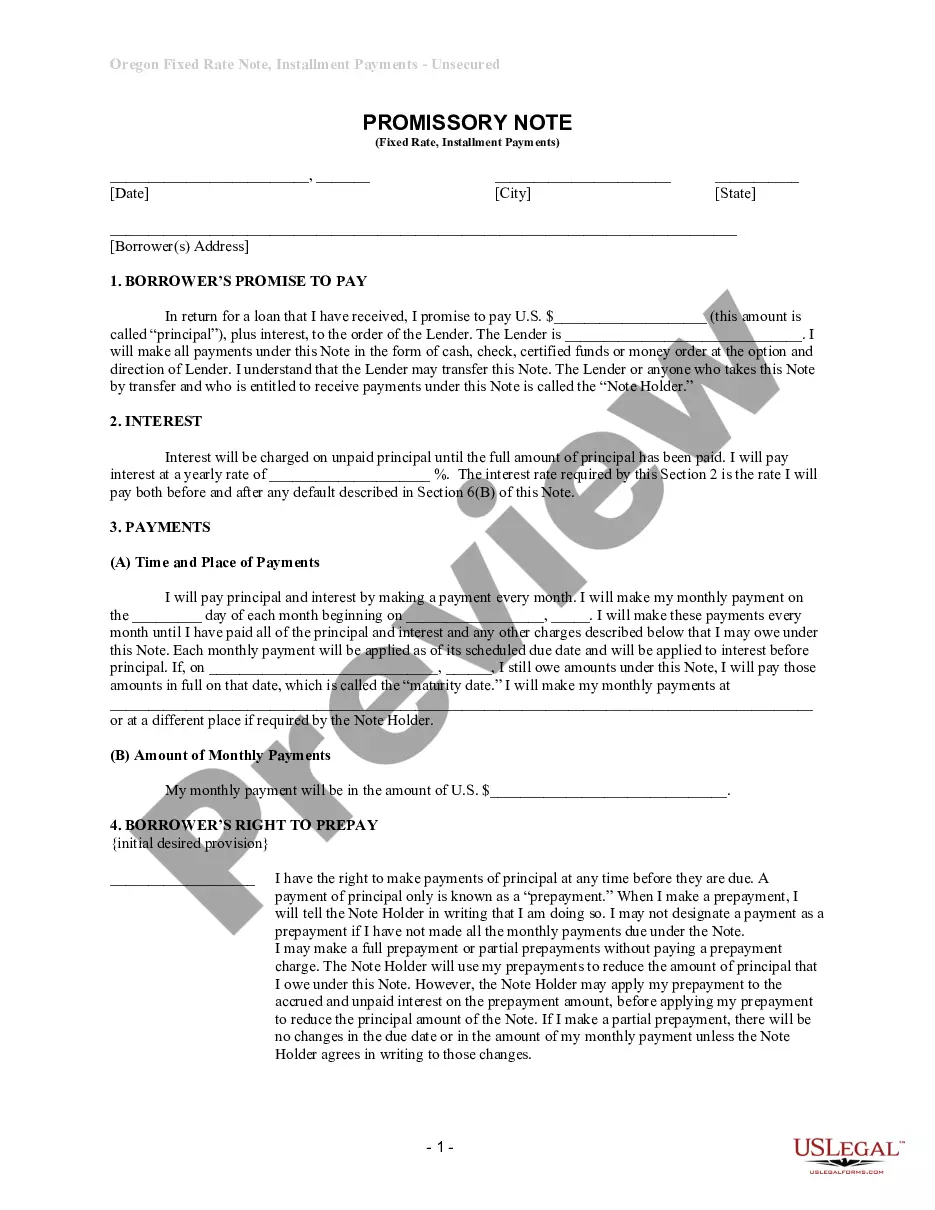

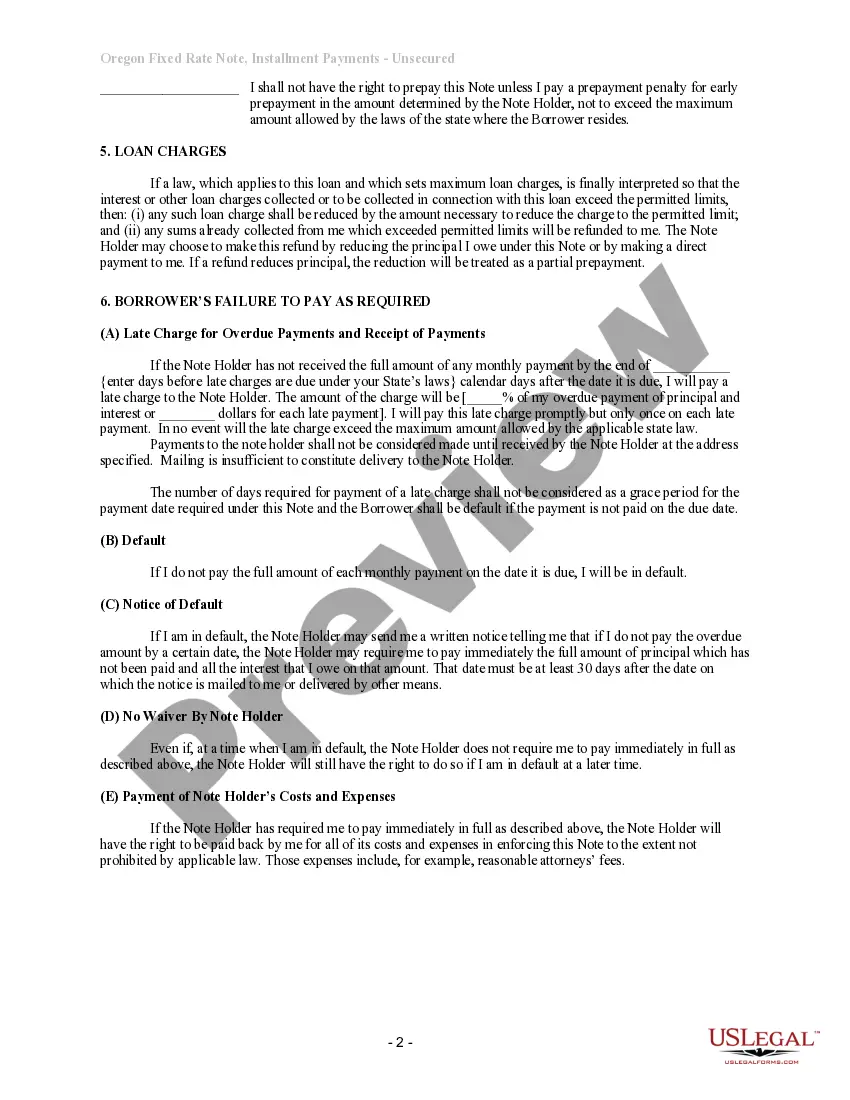

Title: Understanding Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate Introduction: The Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate is an important legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note provides a detailed framework for individuals seeking monetary assistance in Eugene, Oregon. In this article, we will delve into the key aspects of this note, its purpose, and different types available. Key Keywords: Eugene Oregon, Unsecured Installment Payment Promissory Note, Fixed Rate, loan agreement, lender, borrower 1. Purpose of Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate: The Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate serves as a legally binding agreement wherein the borrower promises to repay the lender a specific sum of money borrowed. This note provides a comprehensive framework that outlines the terms, conditions, and repayment schedule, ensuring clarity and transparency between the parties. 2. Features of Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate: — Unsecured: This type of promissory note is unsecured, meaning it does not require any collateral from the borrower. It is solely based on the borrower's promise to repay the loan. — Installment Payments: The loan is repaid through regular installment payments, which are predetermined and agreed upon by both parties. — Fixed Interest Rate: The interest rate on the borrowed amount remains fixed throughout the repayment period, ensuring predictability for both parties. 3. Different Types of Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate: a) Personal Loan Promissory Note: This note is commonly used for borrowing money for personal needs, such as education, medical expenses, or home renovations. It outlines the terms specific to personal loans. b) Business Loan Promissory Note: This note caters to individuals seeking financial assistance for business purposes, such as starting a new venture, expanding an existing business, or acquiring assets. It typically includes provisions tailored to business transactions. Conclusion: The Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial legal document that protects the interests of both lenders and borrowers. It ensures clarity and transparency in loan agreements, allowing borrowers to access financial assistance and lenders to secure their investments. Understanding the nuances of this promissory note will enable individuals to make informed decisions regarding their monetary needs in Eugene, Oregon.

Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Eugene Oregon Unsecured Installment Payment Promissory Note For Fixed Rate?

Are you looking for a reliable and inexpensive legal forms supplier to get the Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is good for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate in any provided format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal papers online once and for all.