A Hillsboro Oregon Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Hillsboro, Oregon. This promissory note governs the repayment of a specific sum of money borrowed by the borrower, with interest, through a series of predetermined installment payments. The note specifies that it is unsecured, meaning that no collateral has been pledged by the borrower to secure the loan. Instead, the repayment is solely based on the borrower's promise to make the agreed-upon monthly installments on time. This type of promissory note is particularly suitable when lending relatively smaller amounts of money. The fixed rate mentioned in the note signifies that the interest rate remains constant throughout the loan term, providing the borrower with predictability in repayment obligations. The content of a Hillsboro Oregon Unsecured Installment Payment Promissory Note for Fixed Rate typically includes the following details: 1. Parties Involved: Names, addresses, and contact information of both the lender and borrower. 2. Loan Amount: The principal sum owed by the borrower to the lender. 3. Interest Rate: The fixed percentage at which interest accrues on the loan. 4. Installment Terms: The number and frequency of installment payments required. 5. Payment Amount: The specific amount to be paid in each installment. 6. Late Payment Penalty: The consequences or additional charges in case of missed or late payments. 7. Prepayment: Whether the borrower can make early payments without incurring penalties. 8. Default and Remedies: The actions the lender can take in case of loan default, such as accelerating the repayment or pursuing legal action. 9. Governing Law: The jurisdiction responsible for interpreting and enforcing the promissory note. While there might not be different named versions of Hillsboro Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, variations or amendments can be made to cater to specific circumstances or requirements. For instance, if the lender wants to add clauses related to late fees or modifications to the repayment structure, they can be specifically incorporated into the agreement. It is important for both parties to carefully review and understand the terms mentioned in the promissory note before signing it, ensuring that they are in compliance with relevant laws and regulations in Hillsboro, Oregon. Seeking legal advice or utilizing a template designed for this specific purpose is recommended to ensure accuracy and protection of both parties' interests.

Hillsboro Oregon Unsecured Installment Payment Promissory Note for Fixed Rate

Description

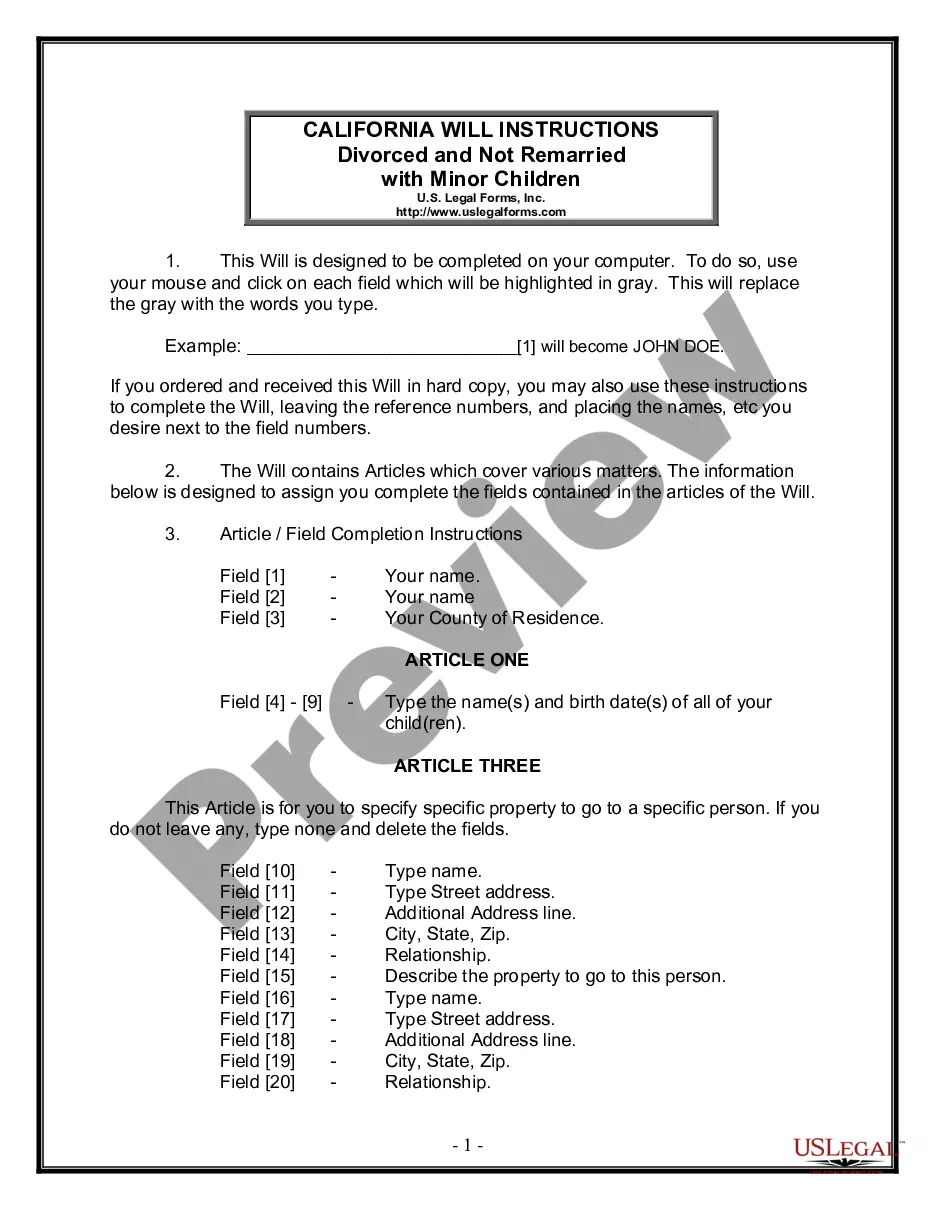

How to fill out Hillsboro Oregon Unsecured Installment Payment Promissory Note For Fixed Rate?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no legal education to create such paperwork from scratch, mostly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms can save the day. Our platform provides a massive library with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you require the Hillsboro Oregon Unsecured Installment Payment Promissory Note for Fixed Rate or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Hillsboro Oregon Unsecured Installment Payment Promissory Note for Fixed Rate in minutes using our trustworthy platform. In case you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are new to our library, ensure that you follow these steps before obtaining the Hillsboro Oregon Unsecured Installment Payment Promissory Note for Fixed Rate:

- Ensure the form you have chosen is good for your location since the rules of one state or county do not work for another state or county.

- Review the form and read a brief description (if available) of scenarios the document can be used for.

- If the one you selected doesn’t meet your needs, you can start again and look for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Hillsboro Oregon Unsecured Installment Payment Promissory Note for Fixed Rate once the payment is completed.

You’re all set! Now you can go ahead and print out the form or complete it online. In case you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.