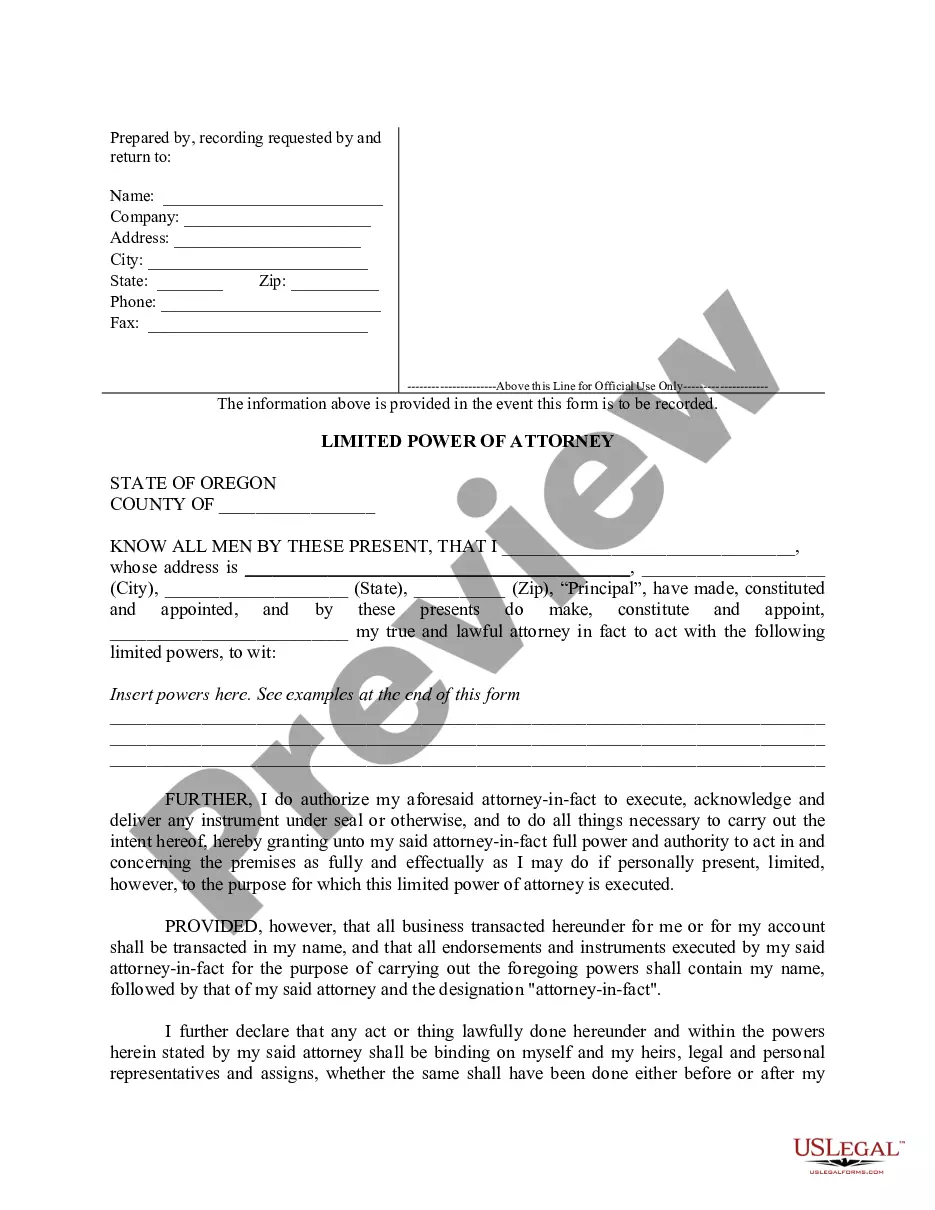

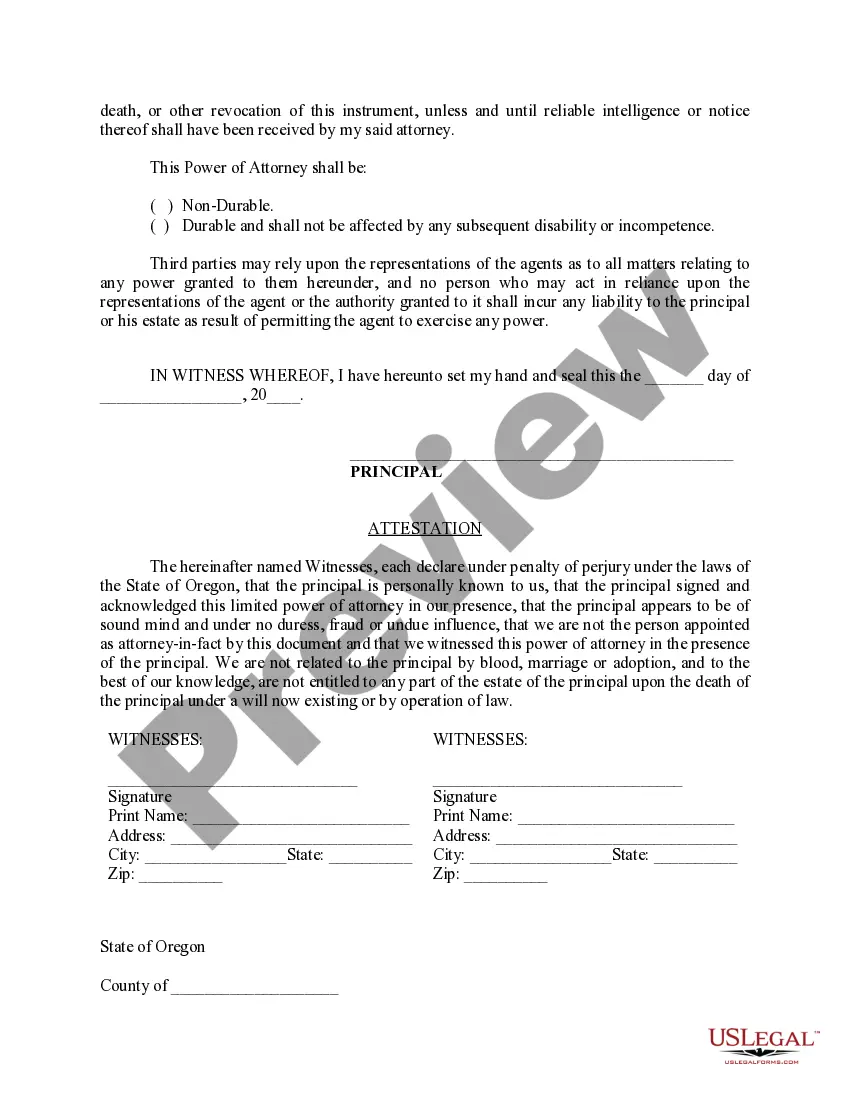

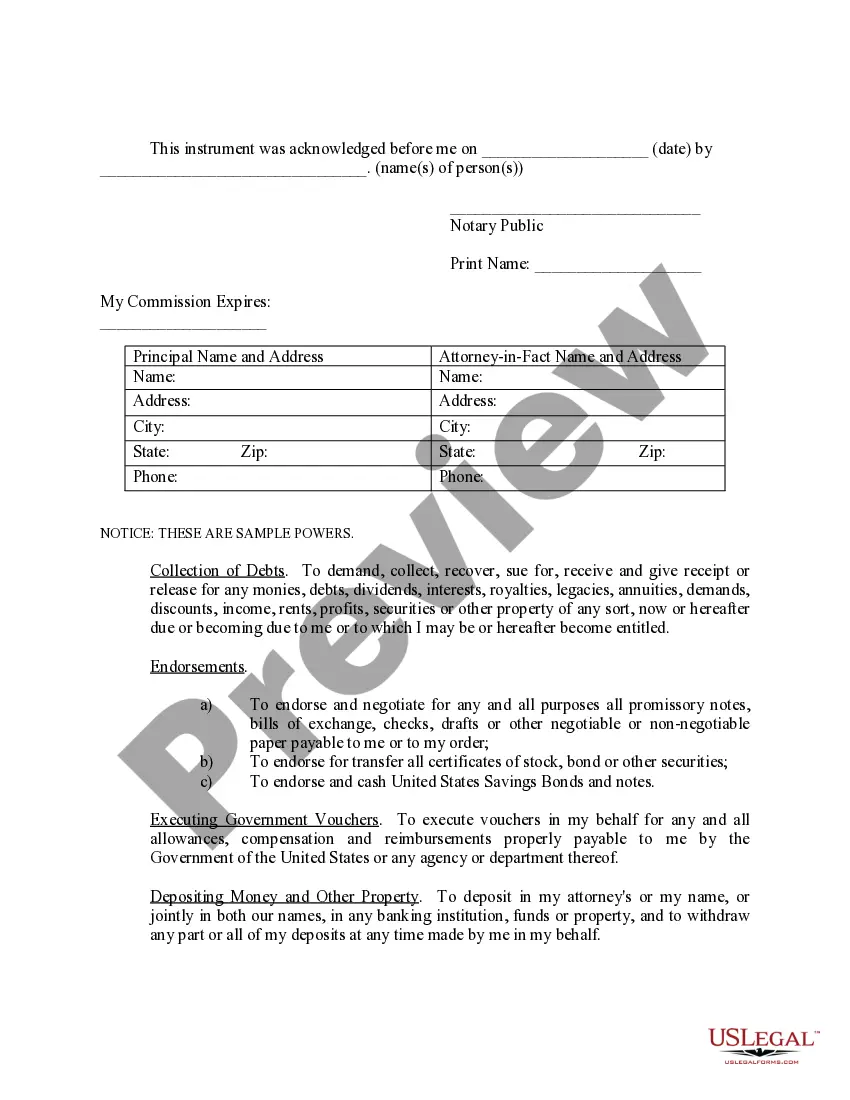

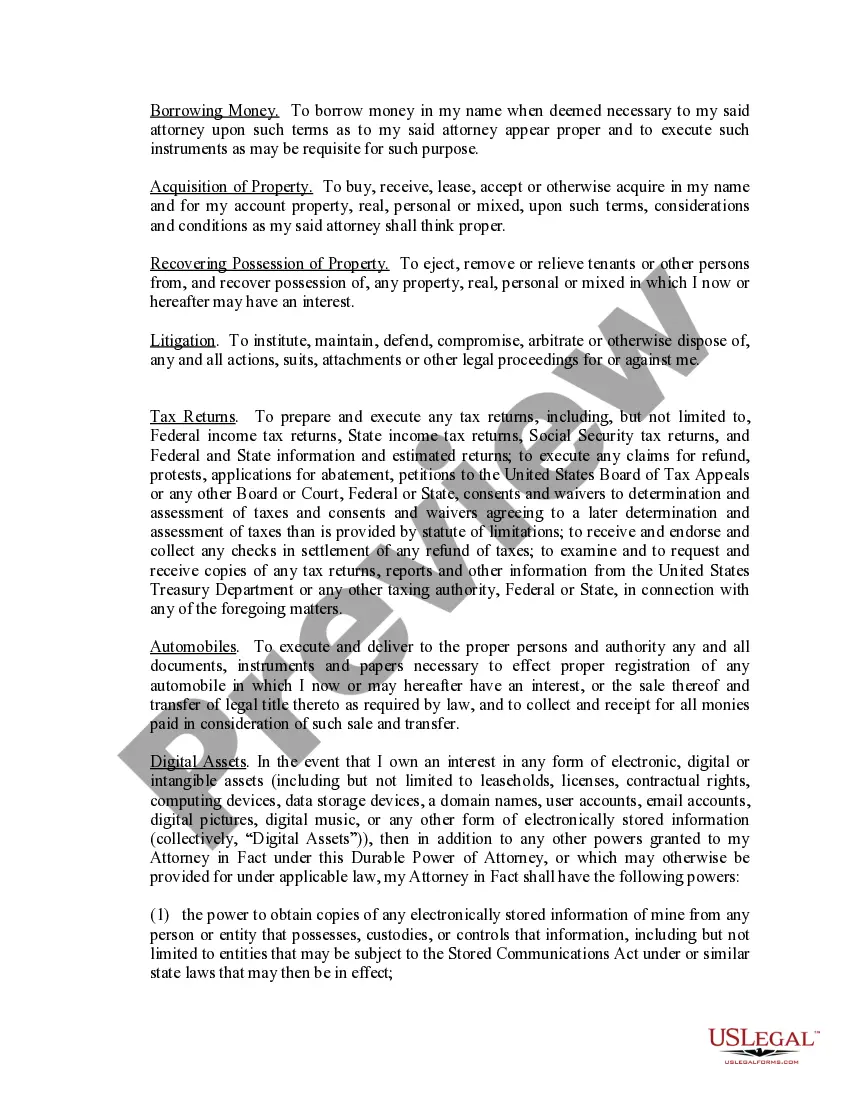

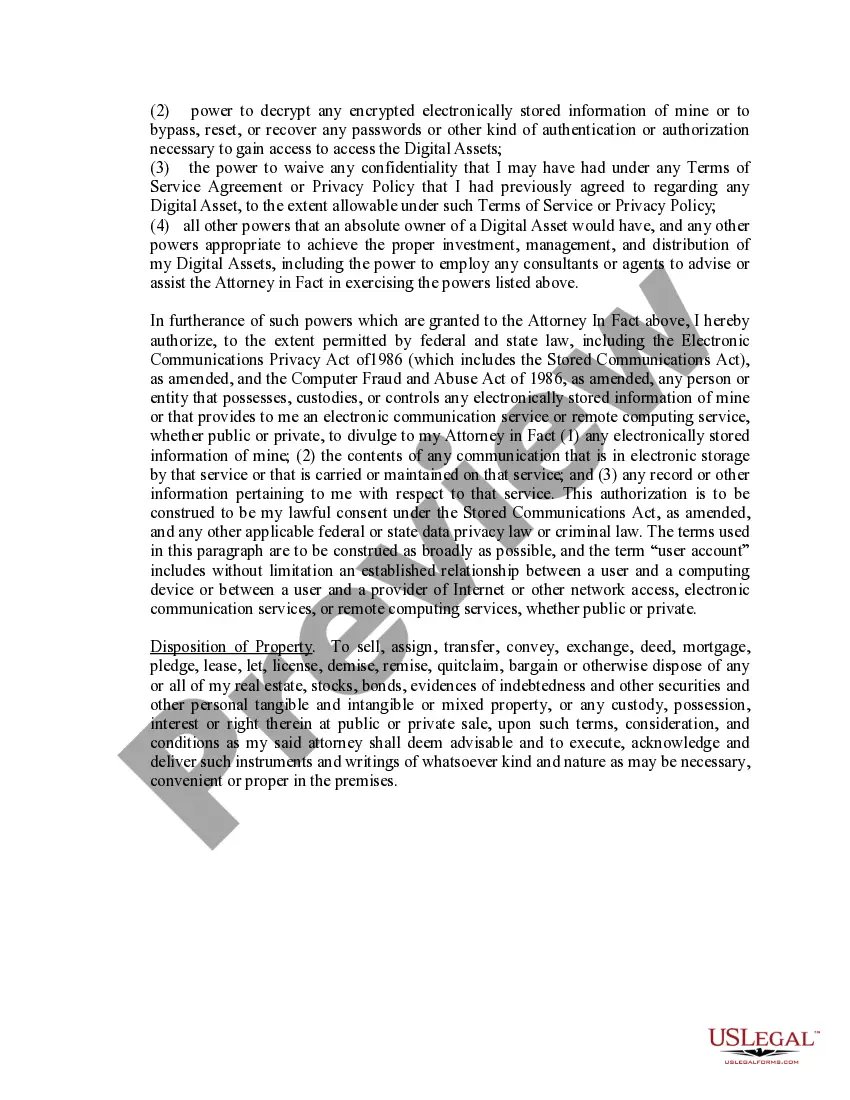

Eugene Oregon Limited Power of Attorney allows a person, known as the principal, to grant specific powers to another person, called the agent or attorney-in-fact, to act on their behalf in legal, financial, or personal matters. This legal document provides a clear and defined scope of authority for the agent, ensuring that they can only make decisions and take actions as specified by the principal. In Eugene, Oregon, there are different types of Limited Power of Attorney documents available, each with varying powers and purposes. Some common types of Limited Power of Attorney include: 1. Financial Limited Power of Attorney: This document grants the agent the authority to handle the principal's financial affairs. It may include powers such as managing bank accounts, paying bills, filing tax returns, buying or selling property, and conducting investment transactions. 2. Healthcare Limited Power of Attorney: With this document, the agent is empowered to make medical decisions on behalf of the principal if they become incapacitated or unable to make decisions themselves. The powers may involve selecting healthcare providers, making treatment choices, and accessing medical records. 3. Real Estate Limited Power of Attorney: This type of document allows the agent to handle real estate-related matters on behalf of the principal. It may include powers like buying or selling property, signing lease agreements, managing rental properties, or conducting property maintenance and repairs. 4. Vehicle Limited Power of Attorney: Granting an agent the powers to handle vehicle-related matters, this document enables them to register, transfer, or sell the principal's vehicle, obtain or renew licenses and registrations, or deal with insurance issues related to the vehicle. When drafting a Limited Power of Attorney document, it is essential to clearly specify the powers and limitations granted to the agent. Some sample powers that can be included in the document are: — Managing and accessing bank accounts, including withdrawing funds, making deposits, and handling financial transactions. — Buying, selling, trading, or leasing real estate or other property on behalf of the principal. — Making investment decisions, including buying or selling stocks, bonds, or other securities. — Filing tax returns, representing the principal before tax authorities, and accessing tax-related documents. — Making healthcare decisions, including consenting to or refusing medical treatments, choosing healthcare providers, and accessing medical records. — Handling insurance matters, such as filing insurance claims, renewing policies, or adjusting coverage. — Managing business affairs, including signing contracts, settling disputes, and making decisions related to business operations. — Representing the principal in legal proceedings or signing legal documents on their behalf. It is crucial to consult with an attorney experienced in estate planning or power of attorney matters to ensure the document accurately reflects the principal's intentions and complies with Oregon state laws.

Eugene Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Eugene Oregon Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone with no law education to draft this sort of papers from scratch, mostly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service provides a massive library with over 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you need the Eugene Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Eugene Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included quickly employing our reliable service. In case you are already a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps prior to obtaining the Eugene Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included:

- Be sure the form you have found is suitable for your location since the regulations of one state or county do not work for another state or county.

- Review the form and go through a short description (if provided) of scenarios the paper can be used for.

- If the form you chosen doesn’t meet your needs, you can start again and look for the needed document.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Eugene Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included as soon as the payment is through.

You’re good to go! Now you can proceed to print out the form or complete it online. In case you have any problems locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.