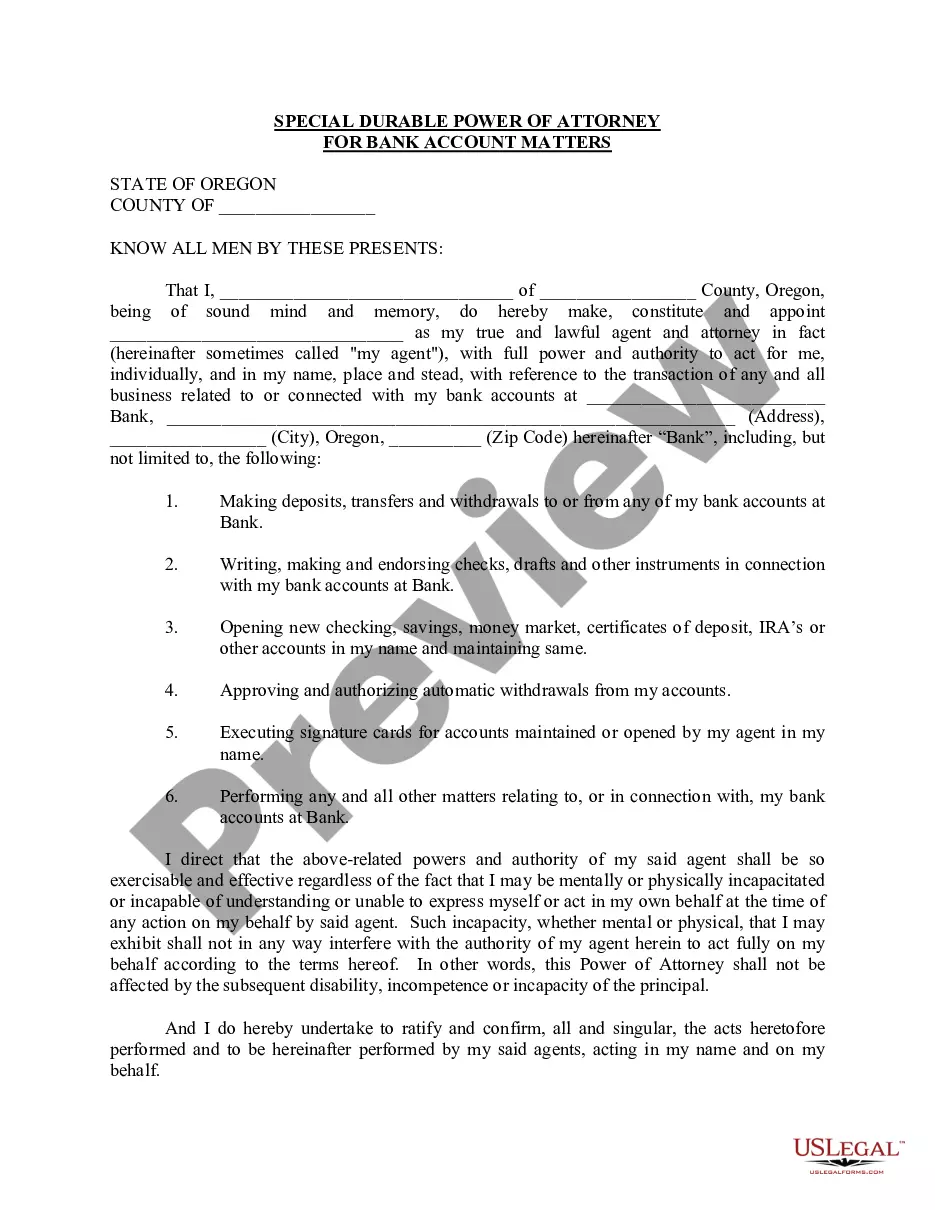

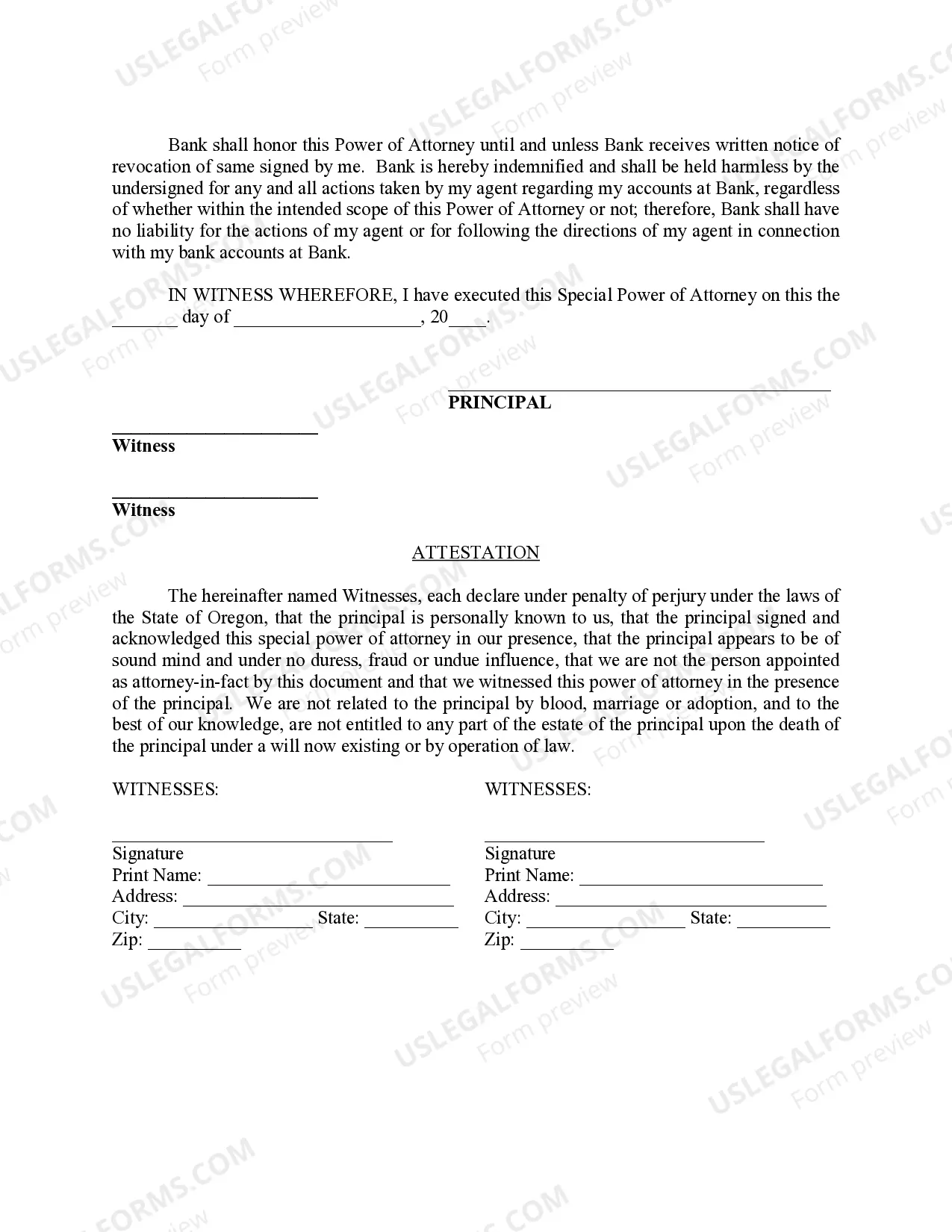

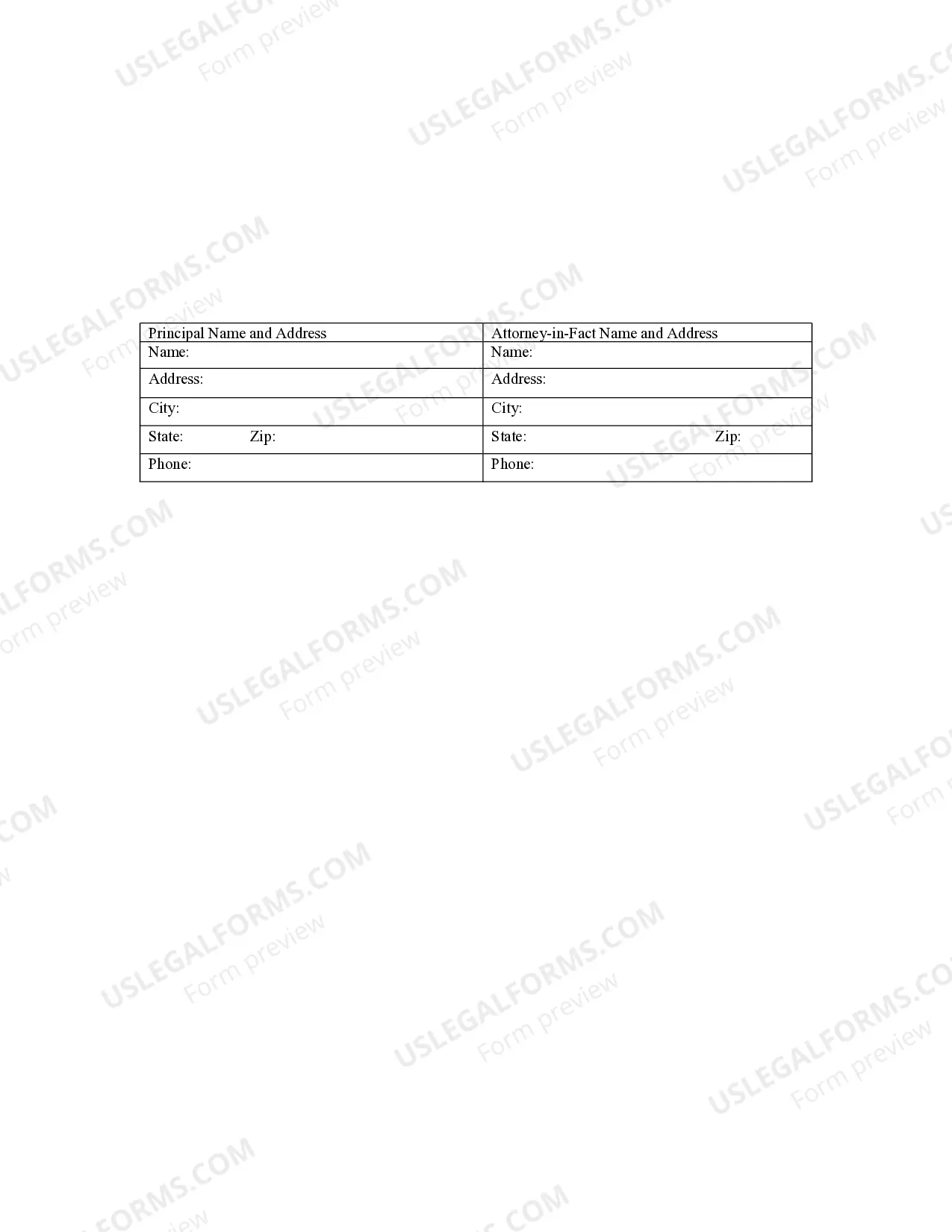

Eugene Oregon Special Durable Power of Attorney for Bank Account Matters allows an individual, referred to as the principal, to grant another person, known as the agent, the authority to manage their bank accounts and make financial decisions on their behalf. This legal document is designed to provide a trusted individual with the power to handle various aspects of the principal's bank account matters, ensuring they are efficiently managed even if the principal becomes incapacitated or is unable to handle their finances. The Eugene Oregon Special Durable Power of Attorney for Bank Account Matters grants specific powers to the agent, which may include accessing the principal's bank accounts, depositing and withdrawing funds, paying bills, managing investments, and handling any other financial transactions related to the accounts specified in the document. It is crucial to understand that the agent's authority is limited to bank account matters only and does not extend to other financial or personal affairs of the principal unless explicitly mentioned. Different types of Eugene Oregon Special Durable Power of Attorney for Bank Account Matters may include specific clauses or provisions to meet individual needs and preferences. These may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority over specific bank accounts or a specific financial institution only. It restricts the agent's powers to a defined scope specified in the document. 2. Full Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney provides the agent with broad authority over all the principal's bank accounts, allowing them to make decisions and manage all financial matters related to these accounts. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only upon the principal's incapacitation or the occurrence of a specified triggering event. Until then, the agent has no authority to act on behalf of the principal. Having a Special Durable Power of Attorney for Bank Account Matters in place can provide peace of mind, knowing that someone trustworthy can step in and handle financial matters as necessary. It is essential to consult with an attorney experienced in estate planning and power of attorney laws to draft a comprehensive and legally binding document that meets the principal's specific requirements.

Eugene Oregon Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Eugene Oregon Special Durable Power Of Attorney For Bank Account Matters?

If you are looking for a valid form, it’s impossible to find a better service than the US Legal Forms website – probably the most extensive libraries on the internet. With this library, you can get a large number of document samples for organization and individual purposes by categories and regions, or keywords. With our high-quality search feature, finding the most up-to-date Eugene Oregon Special Durable Power of Attorney for Bank Account Matters is as elementary as 1-2-3. Moreover, the relevance of each record is verified by a group of expert lawyers that on a regular basis review the templates on our website and update them in accordance with the newest state and county laws.

If you already know about our system and have an account, all you need to receive the Eugene Oregon Special Durable Power of Attorney for Bank Account Matters is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have discovered the sample you want. Look at its explanation and utilize the Preview option (if available) to see its content. If it doesn’t suit your needs, use the Search field at the top of the screen to discover the appropriate file.

- Affirm your choice. Choose the Buy now button. After that, select the preferred pricing plan and provide credentials to register an account.

- Process the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the form. Pick the file format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the received Eugene Oregon Special Durable Power of Attorney for Bank Account Matters.

Every single form you save in your user profile has no expiry date and is yours forever. It is possible to access them using the My Forms menu, so if you want to get an additional version for modifying or creating a hard copy, you may come back and save it once more at any time.

Make use of the US Legal Forms extensive collection to gain access to the Eugene Oregon Special Durable Power of Attorney for Bank Account Matters you were looking for and a large number of other professional and state-specific samples in a single place!