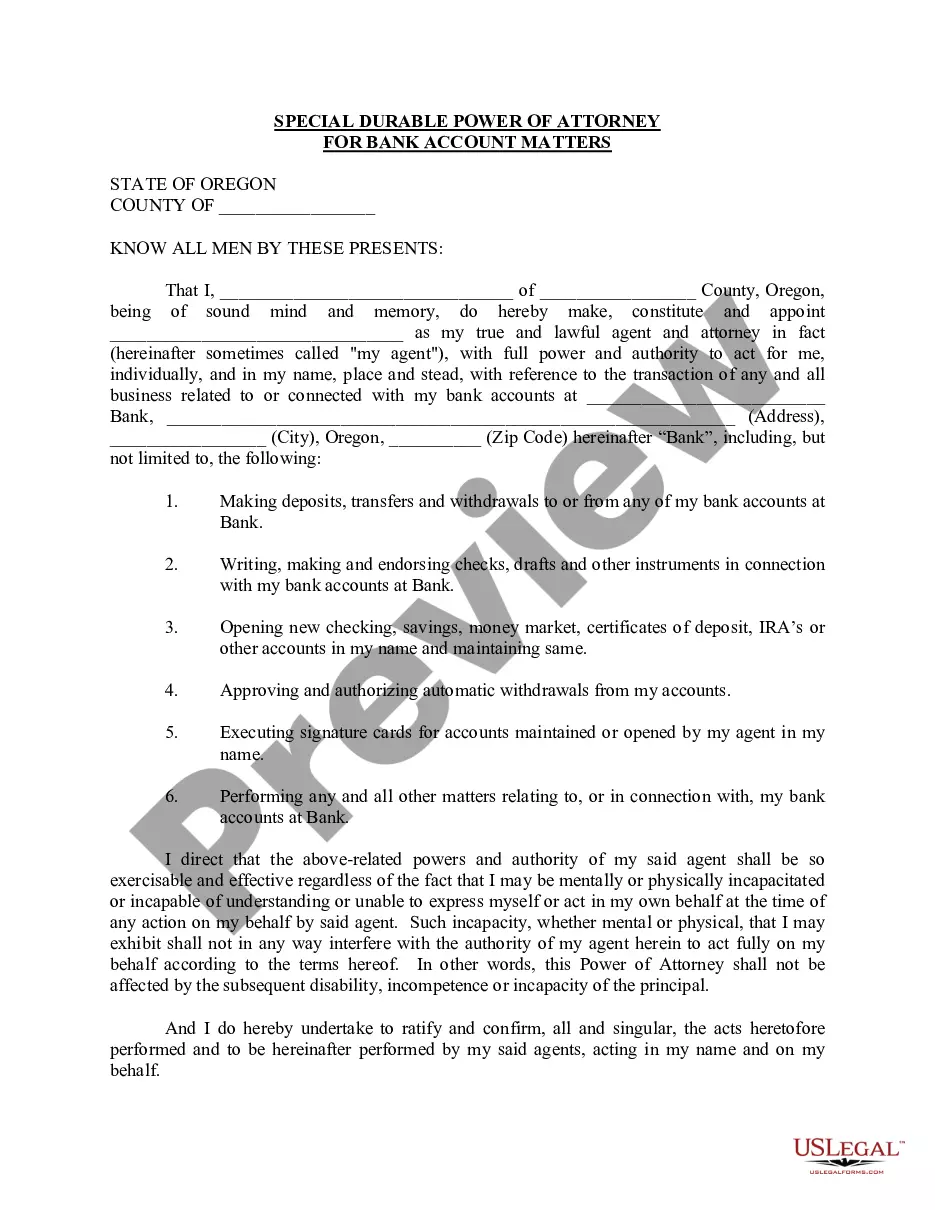

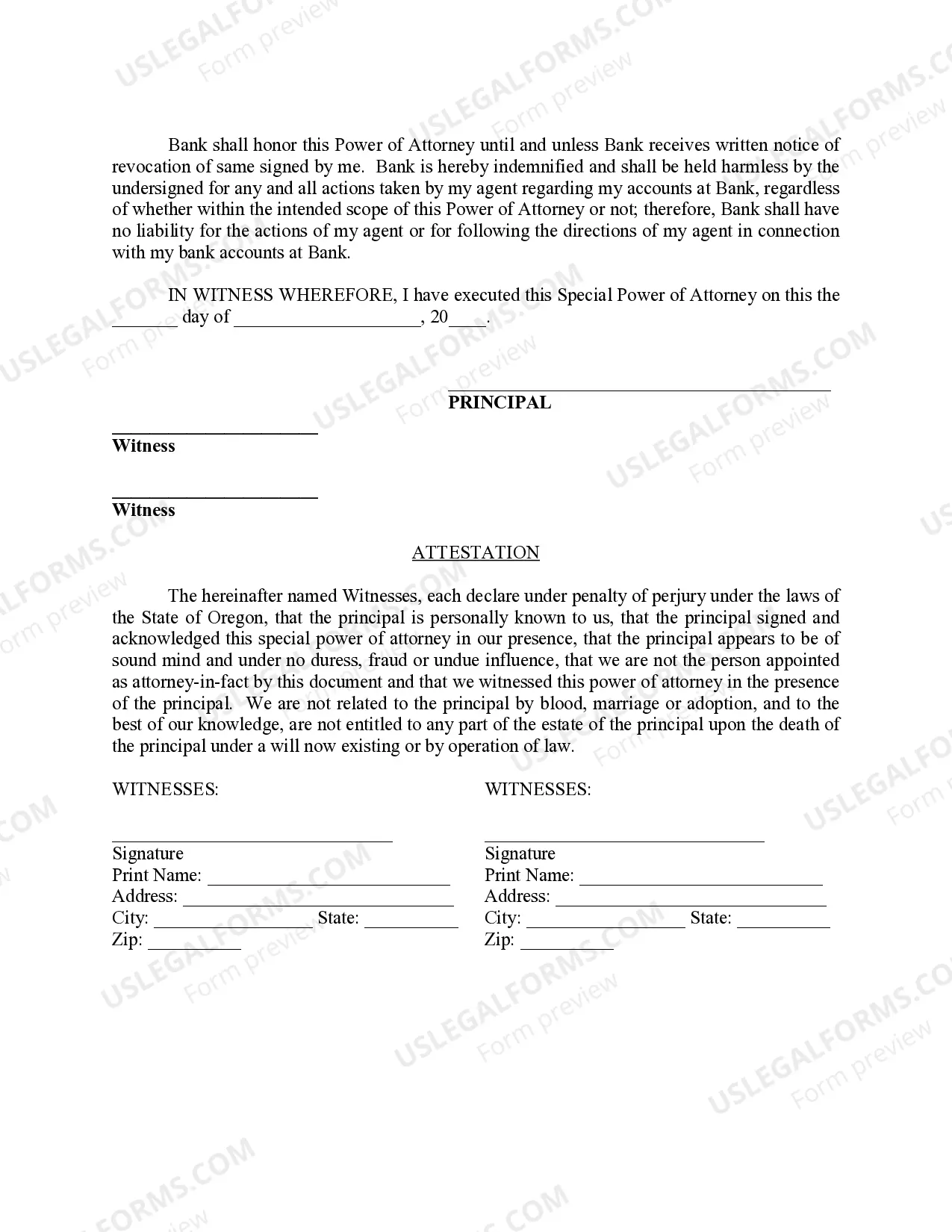

Gresham Oregon Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a person (referred to as the "agent" or "attorney-in-fact") the authority to manage specific bank account matters on behalf of another individual (referred to as the "principal"). This legal arrangement is commonly used when the principal is unable to handle their financial affairs due to physical or mental incapacity, or when they require assistance due to absence or distance. The Gresham Oregon Special Durable Power of Attorney for Bank Account Matters provides the agent with the power to perform various actions related to the principal's bank accounts, including but not limited to: 1. Depositing and withdrawing funds: The agent can make deposits or withdraw money from the principal's bank accounts, ensuring necessary transactions are conducted smoothly. 2. Paying bills and expenses: The agent can address bills, financial obligations, and expenses by using the principal's bank accounts, ensuring timely payments and avoiding any negative consequences. 3. Managing investments: If permitted by the principal, the agent can handle investment-related activities, such as buying or selling stocks, bonds, or other securities using the principal's bank funds. 4. Opening and closing accounts: The agent has the authority to open new accounts, close existing ones, or make any necessary changes to the principal's bank accounts. 5. Accessing online banking and electronic transactions: With the principal's permission, the agent can manage the principal's online banking activities, such as paying bills electronically or transferring funds between accounts. It is crucial to note that there may be different types or variations of the Gresham Oregon Special Durable Power of Attorney for Bank Account Matters, depending on the specific needs of the principal. It is recommended to consult with an attorney experienced in estate planning and power of attorney matters to determine the most appropriate type for your unique situation. Key variations of the Gresham Oregon Special Durable Power of Attorney for Bank Account Matters may include: 1. Limited Power of Attorney for Bank Account Matters: This type grants the agent authority solely for specific purposes or a limited time, allowing them to manage only certain financial aspects of the principal's bank accounts. 2. Springing Power of Attorney for Bank Account Matters: This type becomes effective only upon the occurrence of a predetermined event, such as the principal's incapacity or disability. Until then, the agent has no authority to act on the principal's behalf. 3. General Durable Power of Attorney for Bank Account Matters: Unlike the special durable power of attorney, this type gives the agent the authority to manage a wide range of financial matters on behalf of the principal, including bank accounts, investments, real estate, and more. In conclusion, the Gresham Oregon Special Durable Power of Attorney for Bank Account Matters is a critical legal tool that allows a trusted individual to manage specific bank account matters on behalf of another person. With the appropriate legal guidance, individuals can ensure their financial affairs are professionally handled during times of incapacity or absence.

Gresham Oregon Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Gresham Oregon Special Durable Power Of Attorney For Bank Account Matters?

Make use of the US Legal Forms and have instant access to any form sample you need. Our useful platform with a large number of documents makes it simple to find and obtain virtually any document sample you will need. It is possible to export, fill, and certify the Gresham Oregon Special Durable Power of Attorney for Bank Account Matters in just a couple of minutes instead of browsing the web for many hours trying to find a proper template.

Utilizing our library is a superb strategy to increase the safety of your record filing. Our professional attorneys regularly review all the records to make certain that the templates are relevant for a particular region and compliant with new laws and polices.

How do you get the Gresham Oregon Special Durable Power of Attorney for Bank Account Matters? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you view. Moreover, you can find all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, follow the tips below:

- Open the page with the template you need. Make certain that it is the template you were seeking: check its name and description, and use the Preview feature when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Choose the format to get the Gresham Oregon Special Durable Power of Attorney for Bank Account Matters and change and fill, or sign it according to your requirements.

US Legal Forms is probably the most considerable and reliable document libraries on the internet. Our company is always happy to help you in virtually any legal procedure, even if it is just downloading the Gresham Oregon Special Durable Power of Attorney for Bank Account Matters.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!