Bend Sample Corporate Records for an Oregon Professional Corporation include various documents that are crucial for managing and maintaining the corporate entity. These records serve as an official repository of important information, transactions, and decisions made by the corporation. Here are some types of Bend Sample Corporate Records commonly seen for an Oregon Professional Corporation: 1. Articles of Incorporation: This document marks the creation of the corporation and includes essential information such as the corporation's name, purpose, address, registered agent details, and the names of incorporates. 2. Bylaws: Bend Sample Corporate Records may include the corporation's bylaws, which outline the internal rules and regulations governing the corporation's operations, including procedures for holding meetings, electing directors, and handling corporate affairs. 3. Minutes of Meetings: These records document the proceedings and decisions made during meetings of the corporation's directors and shareholders. Minutes often cover discussions on important matters such as major financial transactions, appointments of officers, and amendments to governing documents. 4. Stock Ledger: The stock ledger maintains a record of all issued and outstanding shares of the corporation. It includes information such as the shareholder's name, the number of shares held, purchase dates, and any transfers or cancellations. 5. Annual Reports: Oregon law requires corporations to file annual reports detailing essential information about the corporation's structure, directors, officers, and authorized shares. Bend Sample Corporate Records may include these reports to ensure compliance with the state's regulations. 6. Shareholder Agreements: If the corporation has specific agreements among its shareholders regarding issues like voting rights, equity distribution, or transfer restrictions, these agreements would be included as important corporate records. 7. Financial Statements: Financial statements provide a comprehensive overview of the corporation's financial health, including income statements, balance sheets, and cash flow statements. These records are vital for evaluating the corporation's performance, making informed decisions, and meeting legal and regulatory requirements. 8. Tax Filings: Bend Sample Corporate Records should include copies of federal and state tax filings, ensuring that the corporation complies with its tax obligations. Each of these Bend Sample Corporate Records plays a vital role in maintaining the legal and operational integrity of an Oregon Professional Corporation. They provide an accurate and transparent representation of the corporation's activities and help establish good corporate governance practices while fulfilling legal requirements.

Bend Sample Corporate Records for an Oregon Professional Corporation

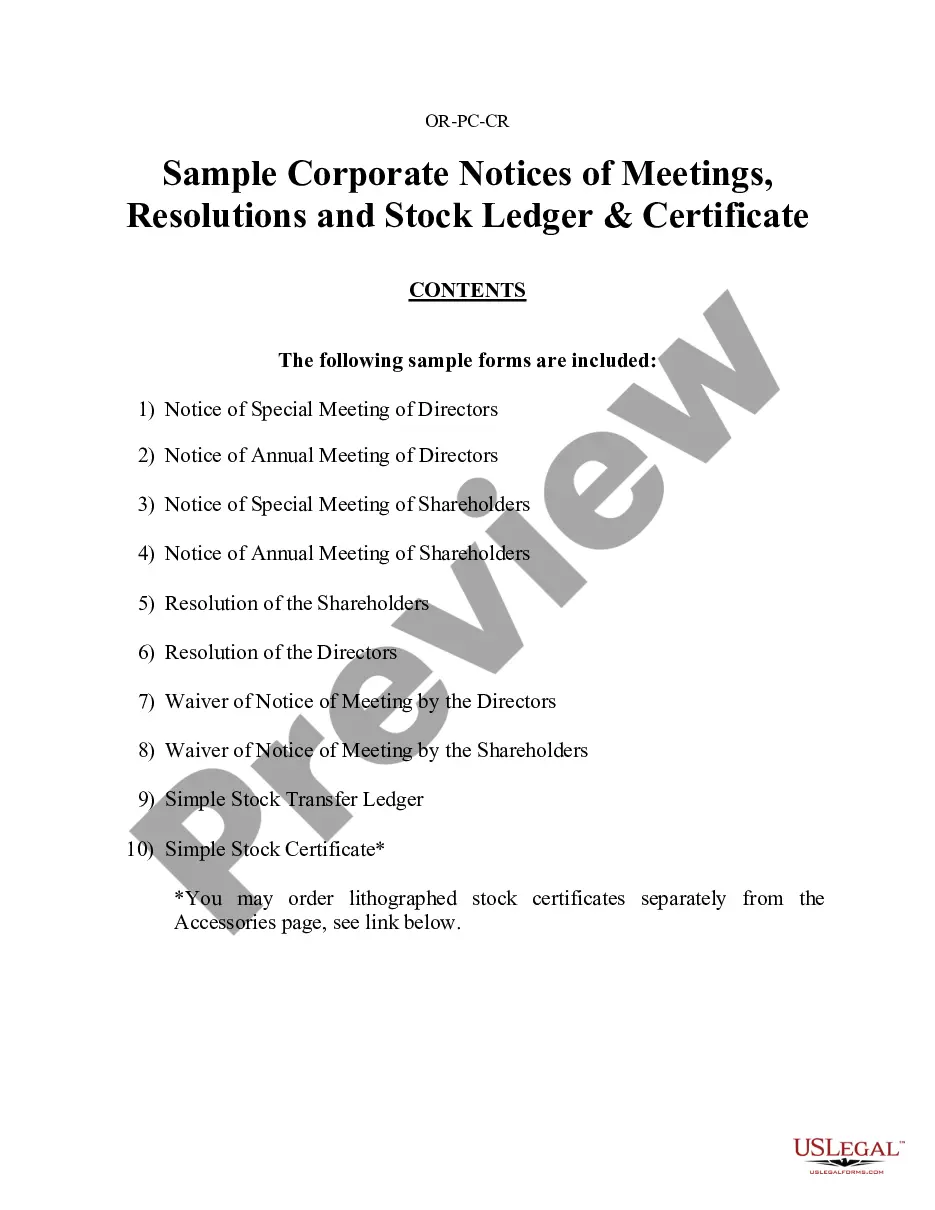

Description

How to fill out Bend Sample Corporate Records For An Oregon Professional Corporation?

Take advantage of the US Legal Forms and obtain immediate access to any form template you want. Our beneficial platform with a large number of templates allows you to find and obtain virtually any document sample you require. You are able to save, complete, and certify the Bend Sample Corporate Records for an Oregon Professional Corporation in just a couple of minutes instead of browsing the web for many hours looking for an appropriate template.

Using our library is an excellent strategy to increase the safety of your record submissions. Our experienced legal professionals on a regular basis check all the records to make certain that the forms are appropriate for a particular state and compliant with new acts and regulations.

How can you get the Bend Sample Corporate Records for an Oregon Professional Corporation? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you view. Additionally, you can get all the previously saved files in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Find the template you need. Ensure that it is the form you were hoping to find: verify its headline and description, and utilize the Preview function if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Pick the format to obtain the Bend Sample Corporate Records for an Oregon Professional Corporation and edit and complete, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy document libraries on the web. We are always happy to assist you in virtually any legal process, even if it is just downloading the Bend Sample Corporate Records for an Oregon Professional Corporation.

Feel free to make the most of our service and make your document experience as convenient as possible!