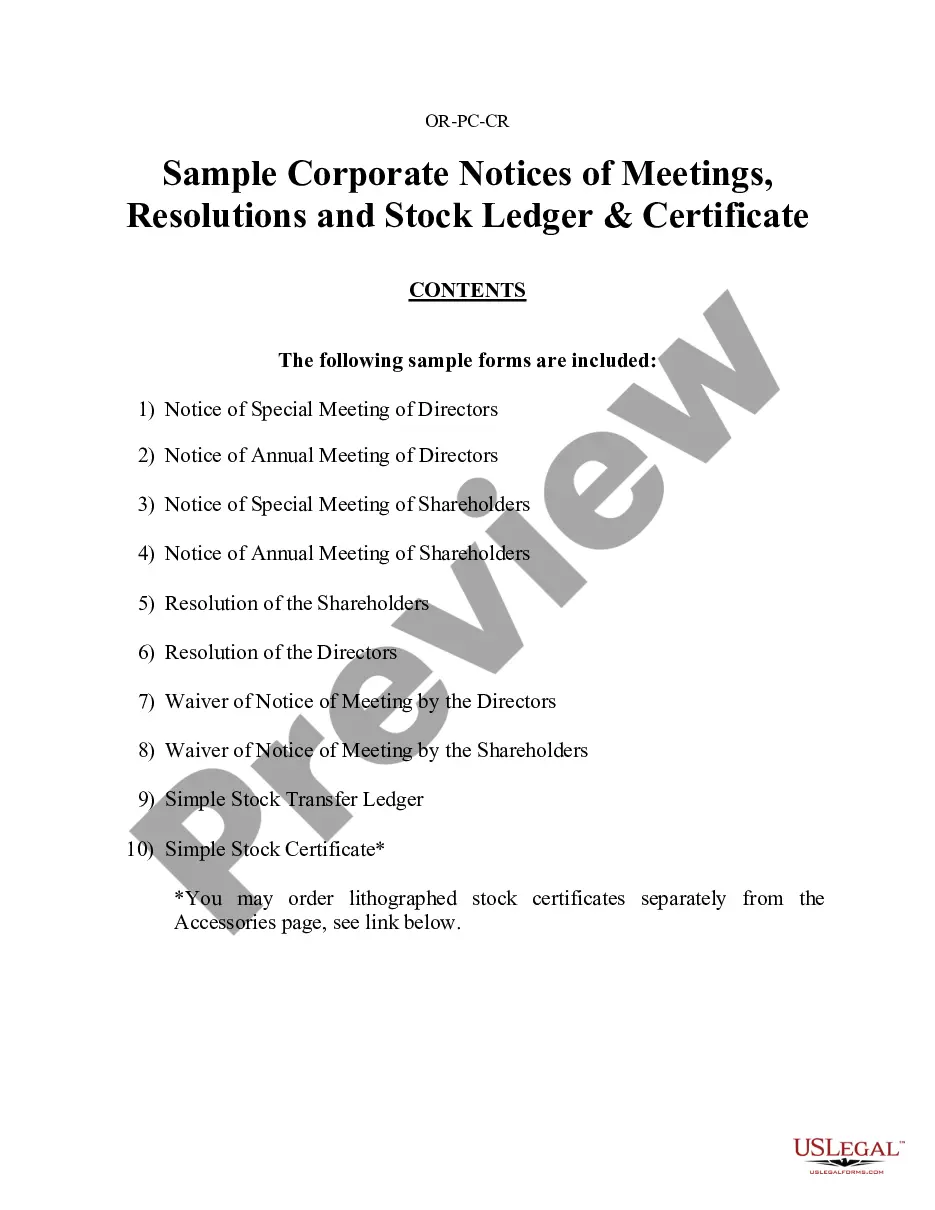

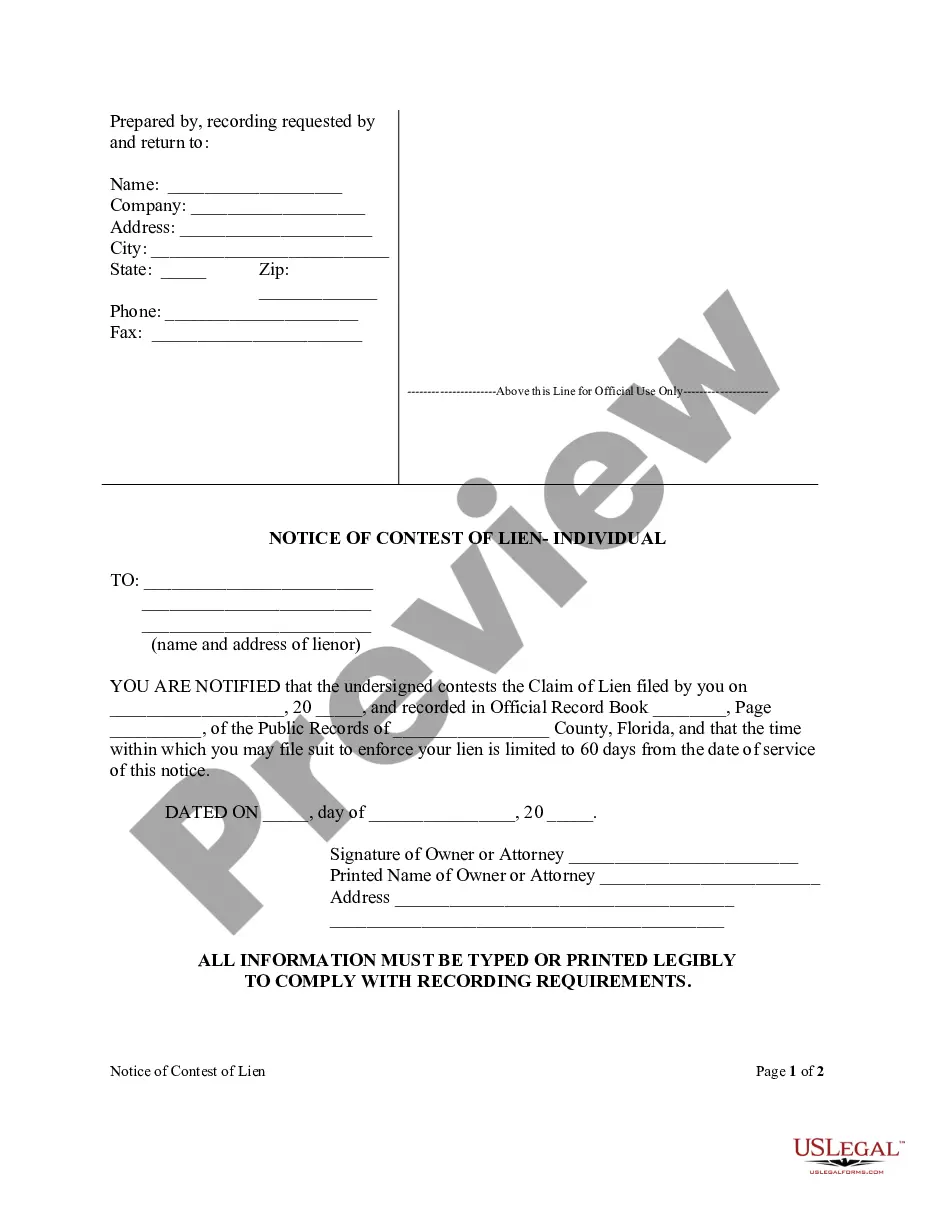

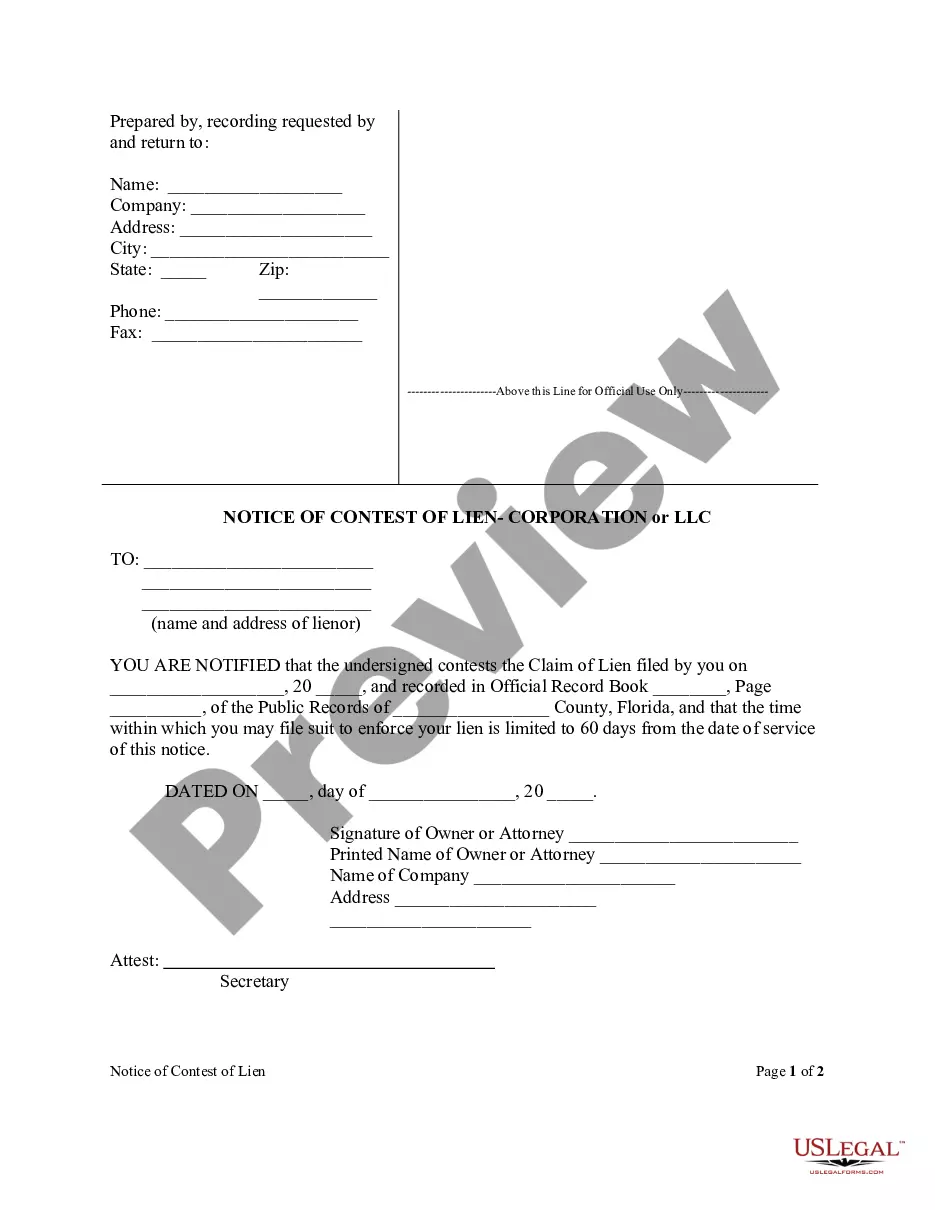

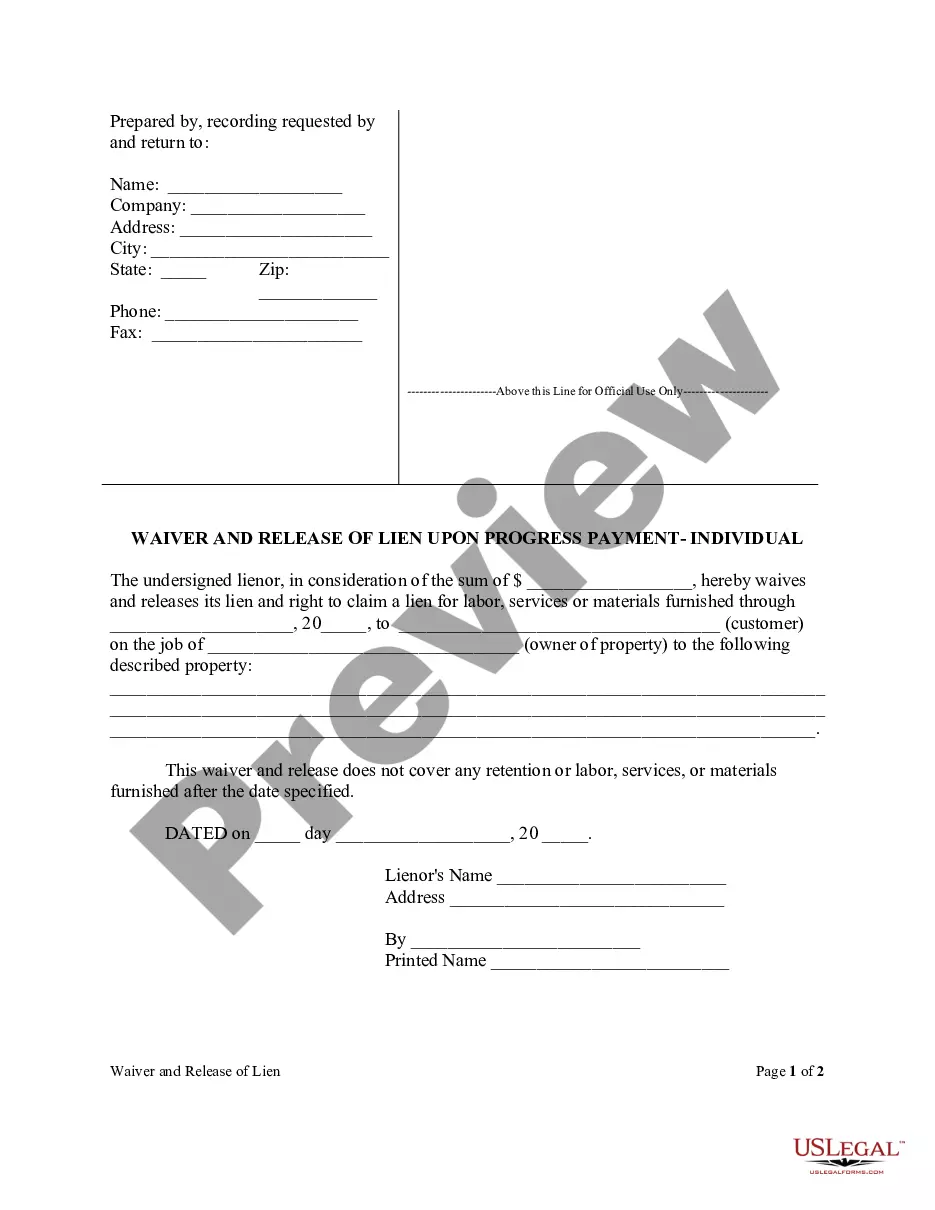

Portland Sample Corporate Records for an Oregon Professional Corporation are comprehensive documents that record various legal and financial activities of the corporation. These records are vital for maintaining corporate compliance and documentation, and can serve as a reference point for future transactions and audits. Below are some key areas and their associated records commonly found in Portland Sample Corporate Records for an Oregon Professional Corporation: 1. Articles of Incorporation: This record outlines the information regarding the corporation's establishment, including its name, business purpose, registered agent details, and the number and type of shares authorized for issuance. 2. Bylaws: These records define the rules and procedures for the internal management of the corporation, including the roles and responsibilities of directors, officers, and shareholders. Bylaws typically cover topics such as meetings, voting, quorum requirements, and terms of office. 3. Shareholder Agreements: These records outline the agreements and restrictions among the corporation's shareholders, which may include transfer restrictions, voting rights, preemptive rights, or buy-sell provisions. 4. Board of Directors Meeting Minutes: These records document the discussions, decisions, and actions taken during board meetings. Meeting minutes typically include attendance, topics discussed, voting outcomes, and approval of corporate resolutions. 5. Shareholder Meeting Minutes: Similar to board meeting minutes, these records capture important discussions and decisions made during shareholder meetings, such as electing directors, approving financial statements, or making significant corporate changes. 6. Stock Ledger: This record provides details of the corporation's stock ownership, including the names of shareholders, number of shares held, dates of issuance, and any transfers or cancellations of shares. 7. Financial Statements: Portland Sample Corporate Records often include financial statements, such as balance sheets, income statements, and cash flow statements. These records provide a snapshot of the corporation's financial health and performance. 8. Annual Reports: These reports summarize the corporation's activities and financial status for each fiscal year. They typically include business highlights, financial statements, and a statement from management. 9. Contracts and Agreements: Portland Sample Corporate Records may include copies of contracts and agreements entered into by the corporation, such as leases, employment contracts, or client agreements. 10. Licenses and Permits: These records document the corporation's compliance with applicable licenses, permits, and regulatory requirements necessary to operate legally. 11. Tax Records: Portland Sample Corporate Records can also include tax-related documents, such as federal and state tax returns, tax payment records, and correspondences with tax authorities. It's important to note that while these records are typical for most Oregon Professional Corporations based in Portland, the specific types and extent of records may vary depending on the nature of the business and any industry-specific regulations. Consulting with legal professionals can help ensure accurate and comprehensive record keeping for compliance and corporate governance purposes.

Portland Sample Corporate Records for an Oregon Professional Corporation

Description

How to fill out Portland Sample Corporate Records For An Oregon Professional Corporation?

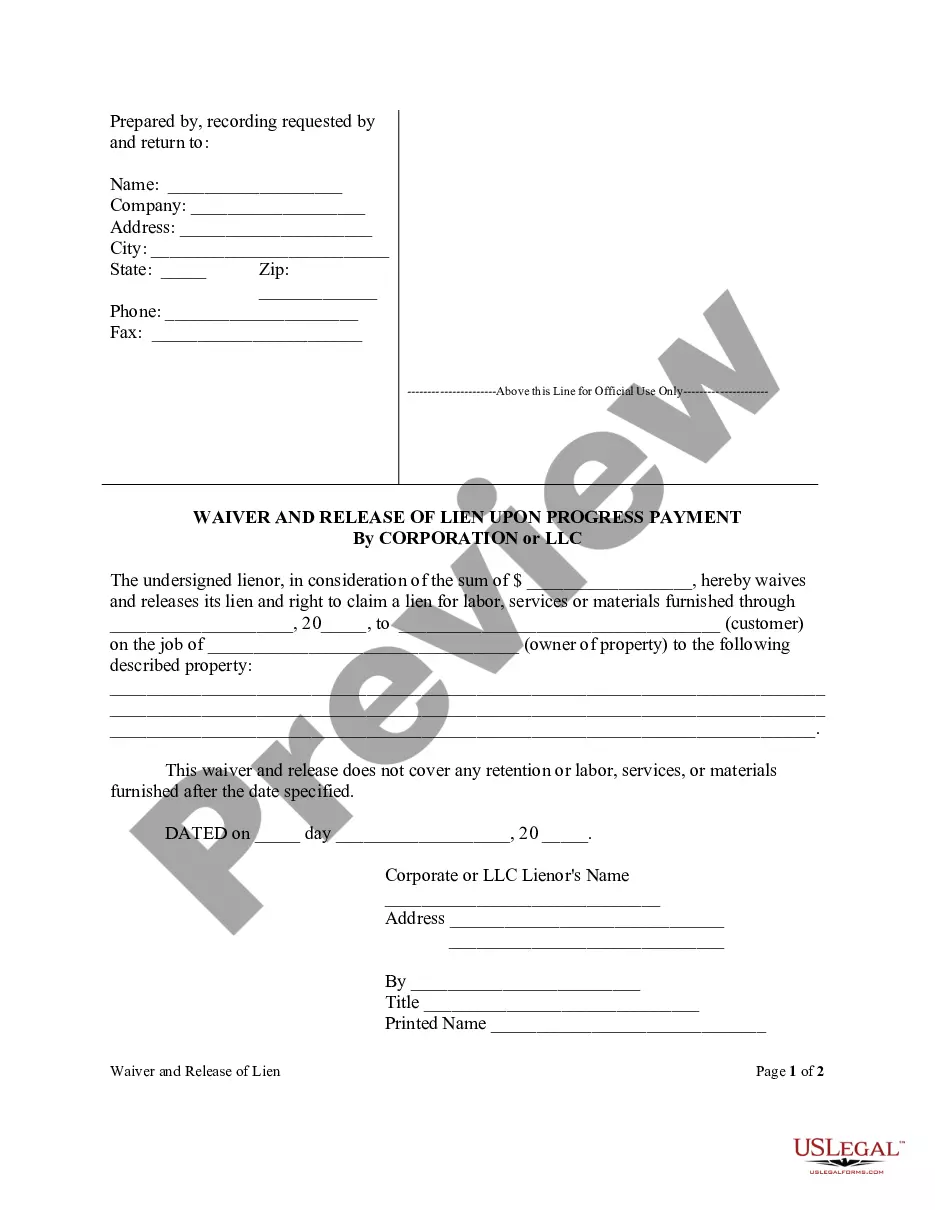

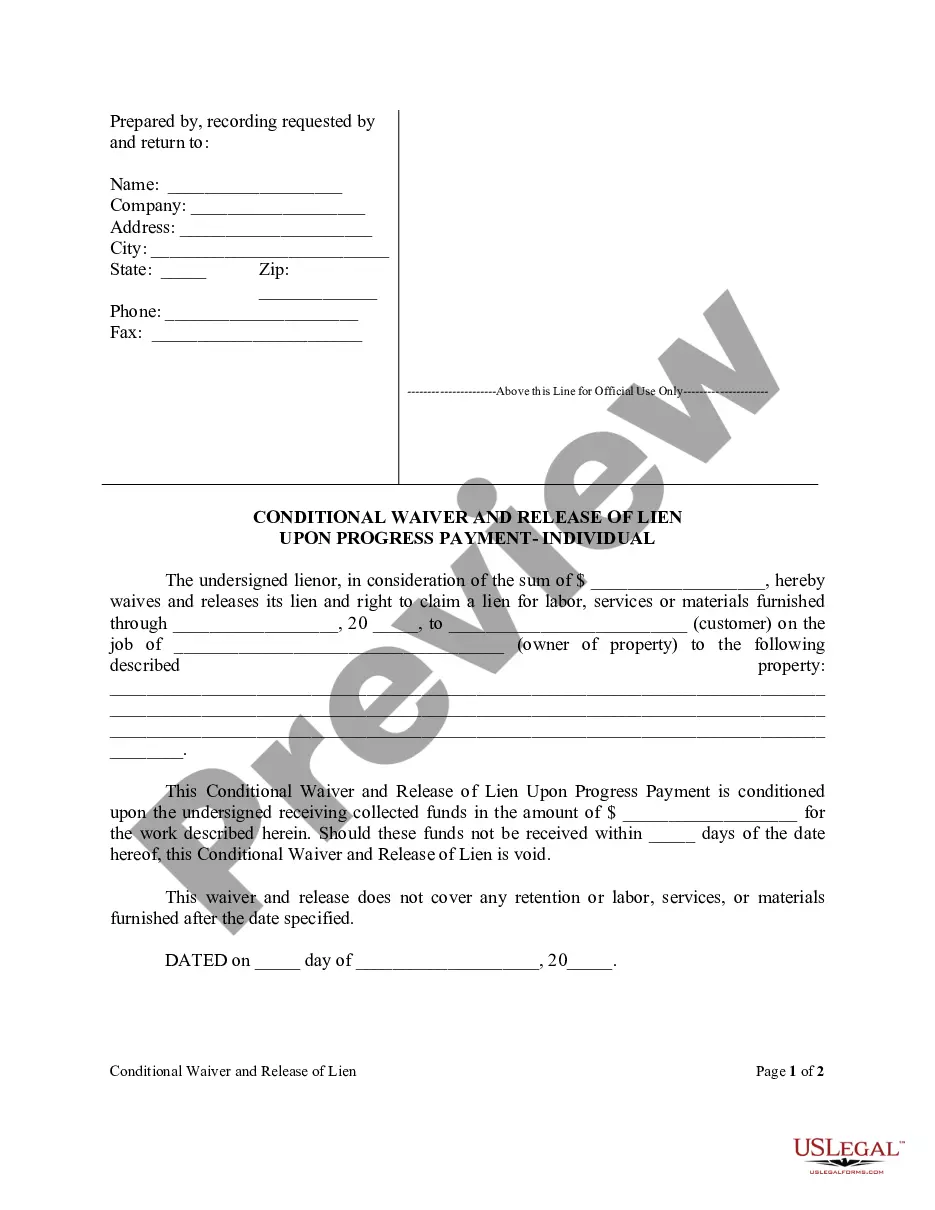

Are you looking for a reliable and affordable legal forms supplier to get the Portland Sample Corporate Records for an Oregon Professional Corporation? US Legal Forms is your go-to choice.

Whether you require a basic arrangement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and county.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Portland Sample Corporate Records for an Oregon Professional Corporation conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the form is good for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Portland Sample Corporate Records for an Oregon Professional Corporation in any available file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal papers online once and for all.