Eugene Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder

Description

How to fill out Oregon Full Reconveyance Of Deed Of Trust - Individual Lender Or Holder?

Are you searching for a reliable and budget-friendly legal forms supplier to obtain the Eugene Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish rules for living together with your partner or a collection of forms to facilitate your separation or divorce through the court, we have you covered. Our site offers over 85,000 current legal document templates for personal and business purposes. All templates we provide access to are tailored and specific to the laws of different states and regions.

To fetch the document, you must Log In to your account, find the required template, and click the Download button next to it. Please remember that you can download previously acquired form templates anytime from the My documents section.

Are you a newcomer to our platform? No problem. You can establish an account easily, but first, ensure to do the following.

Now you can set up your account. After that, select the subscription plan and continue to payment. Once the payment is completed, download the Eugene Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder in any available format. You can revisit the site at any moment and re-download the document without incurring any additional charges.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time trying to understand legal documentation online for good.

- Verify that the Eugene Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder complies with the laws of your state and locality.

- Review the form’s particulars (if available) to ascertain who and what the document is applicable for.

- Restart the search if the template does not fit your legal needs.

Form popularity

FAQ

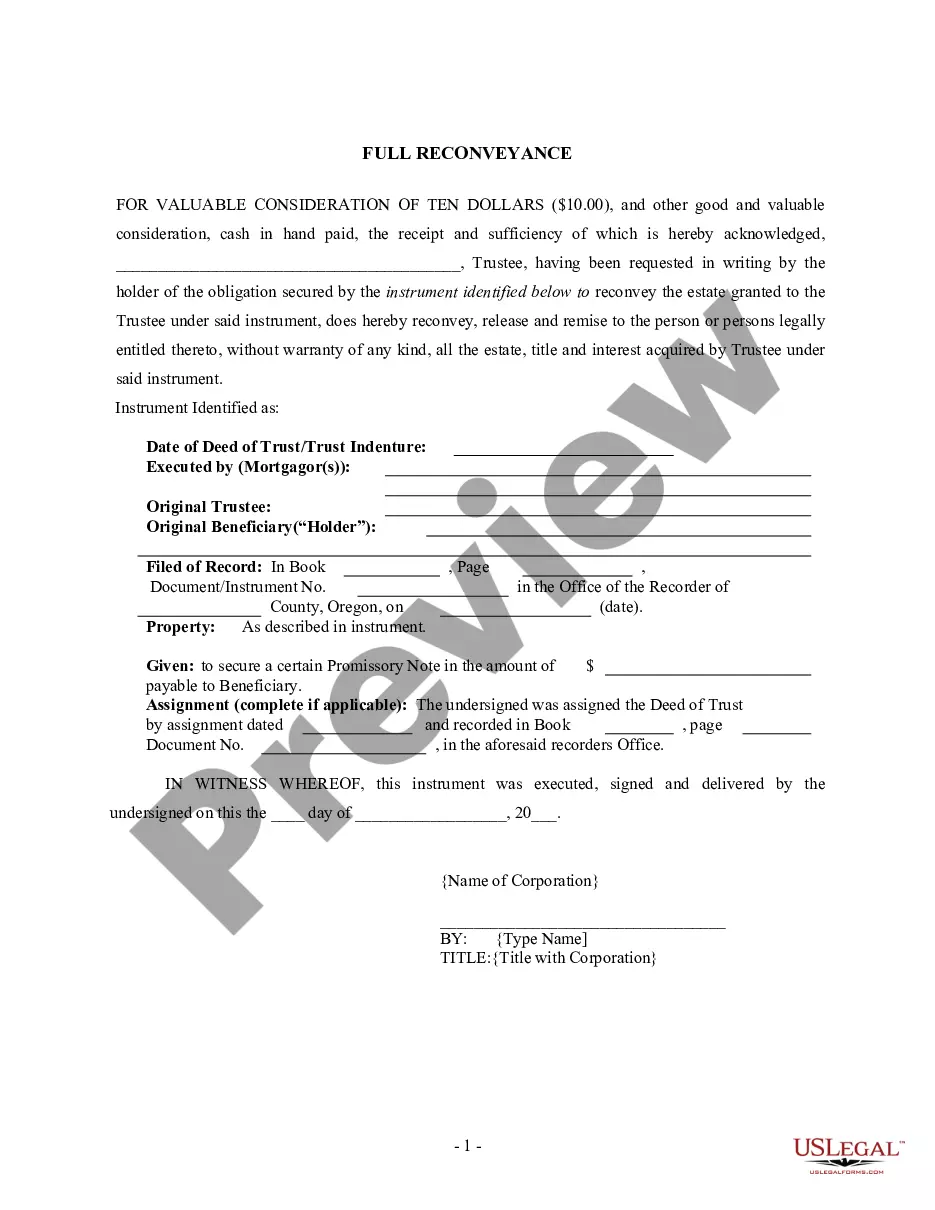

When you successfully complete a trust deed, the lender must issue a reconveyance of the deed of trust, formally releasing the lien on the property. This document signifies that all debts related to the mortgage are settled, allowing you to fully own your property without encumbrances. In the context of the Eugene Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder, it's essential to file this document with the county for public record. Services like USLegalForms can assist in ensuring that your reconveyance is processed properly and efficiently.

Yes, deeds must be recorded in California to provide public notice of property ownership and any encumbrances, like a deed of trust. Recording a deed ensures that anyone searching public records can determine the current owner and the status of any claims against the property. For clarity and to protect your interests, it's important to ensure that all deeds, including reconveyances, are accurately recorded. Consider using US Legal Forms for efficient and straightforward tracking of your documents.

The holder in a transaction refers to the entity or individual that possesses the deed of trust, representing the lender's rights. In the context of Eugene Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder, the holder has the authority to initiate the reconveyance process once all obligations are met. Clarifying the role of the holder can help you understand different responsibilities and rights involved in your transaction. It ensures clear communication during the reconveyance process, making everything transparent and straightforward.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

The relevant statute is the Oregon Trust Deed Act, ORS 86.705-86.795. A trust deed is similar to a mortgage but usually gives the security holder a ?right of sale.? This ?right of sale? allows the security holder to foreclose on the property without having to file a lawsuit in court.

Start Deed of Trust StateMortgage allowedDeed of trust allowedOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

Once the loan amount has been paid in full, California requires lenders to execute a deed of reconveyance within seventy-five days after the debt has been paid.

State laws generally require a mortgage lender to submit the deed of reconveyance documentation to the county recorder or borrower within a certain time frame after payoff ? typically 30 or 60 days, Hernandez says.

The Reconveyance Process Once you've repaid your loan in full, your lender contacts the title company to issue a deed of reconveyance. Depending on local laws, this must happen within 3 ? 4 weeks of your final payment.