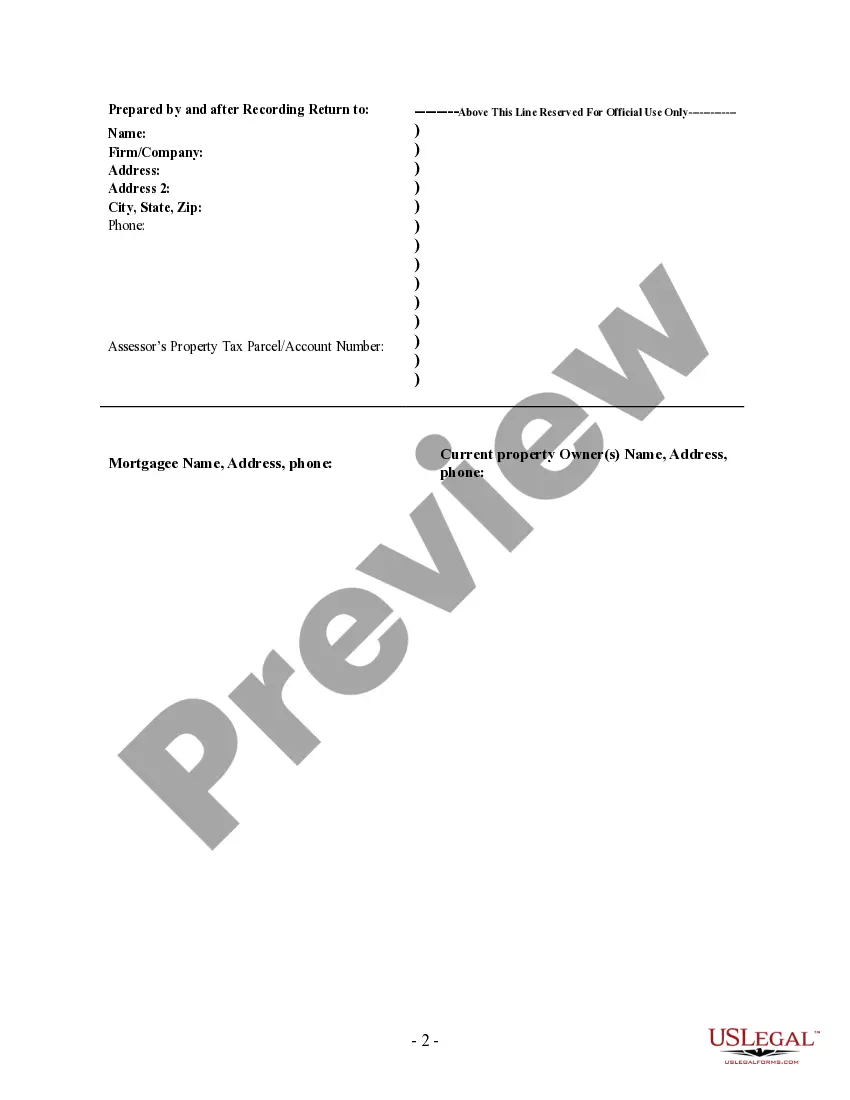

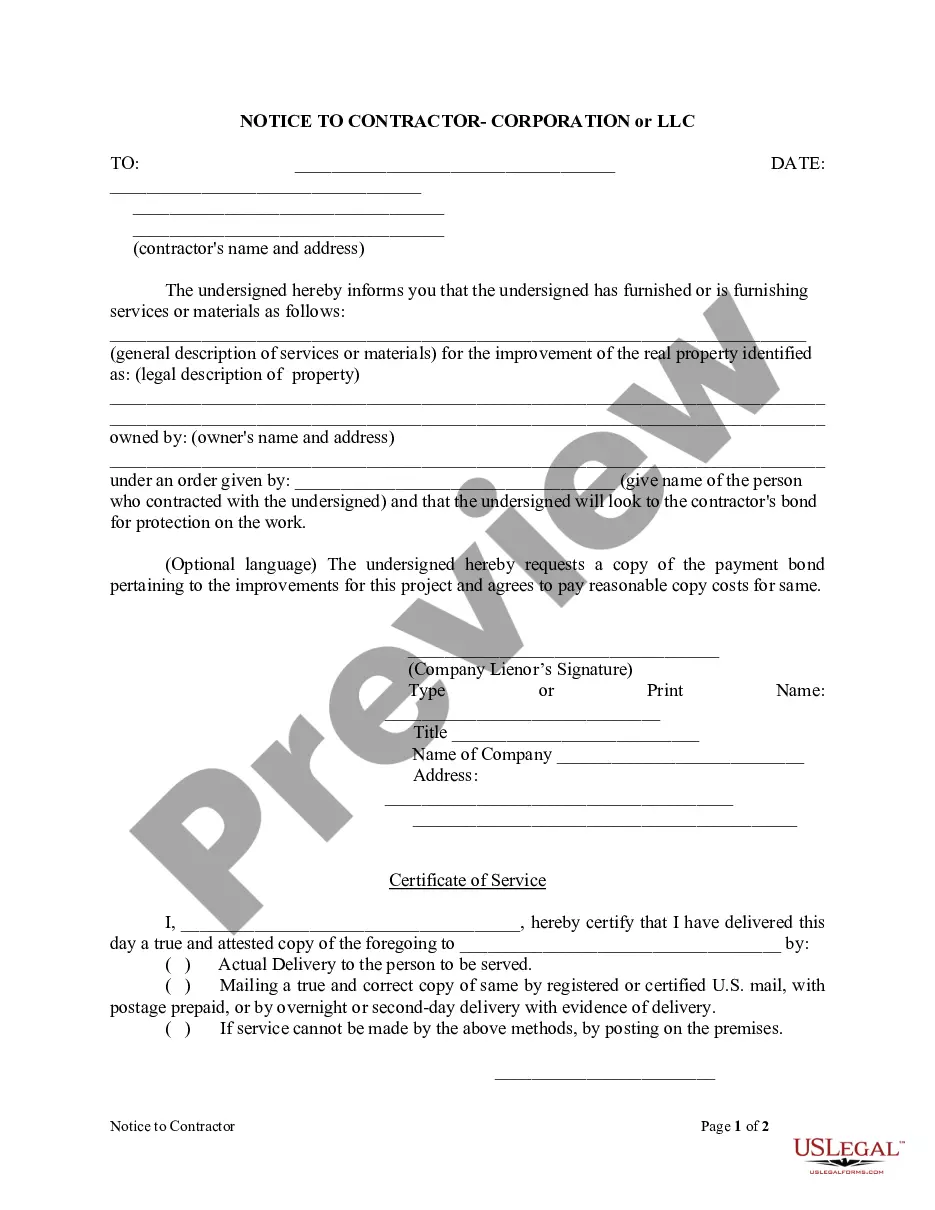

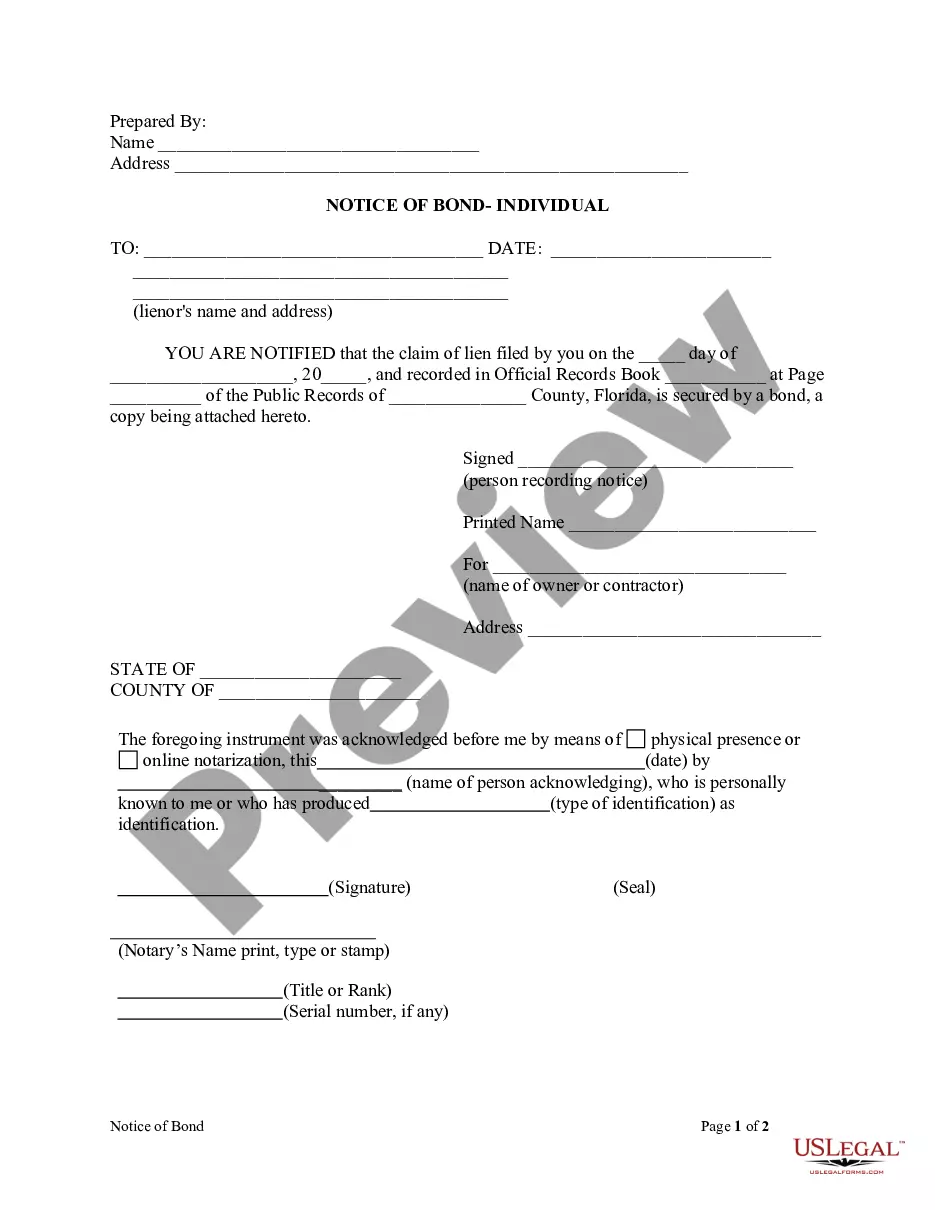

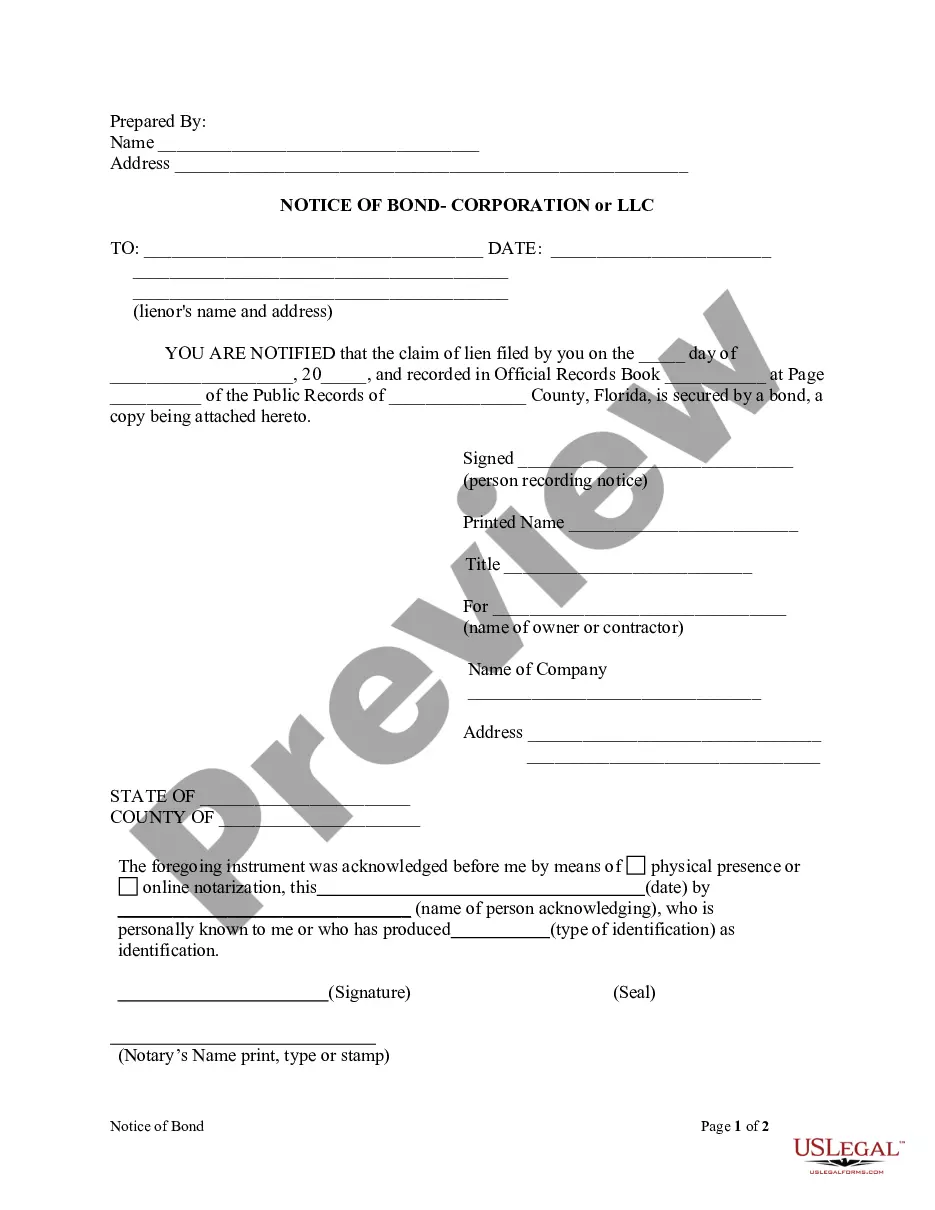

Portland, Oregon Full Re conveyance of Deed of Trust — Individual Lender or Holder A Full Re conveyance of Deed of Trust is a legal document commonly used in the state of Oregon, specifically in the vibrant city of Portland, to release a property owner, commonly referred to as the "borrower," from the obligations and liens associated with a Deed of Trust. This process occurs when the loan secured by the property has been fully paid off or satisfied. The term "Individual Lender or Holder" implies that the beneficiary of the Deed of Trust is an individual, rather than a financial institution or a company. This designation is significant since the process and requirements may differ in some aspects when an individual lender or holder is involved. In Portland, Oregon, there are two primary types of Full Re conveyance of Deed of Trust — Individual Lender or Holder: 1. Full Re conveyance of Deed of Trust — Individual Lender: This type of reconveyance occurs when the original lender is an individual, often referred to as a private lender, who extended a loan to the borrower. Once the borrower repays the loan, the individual lender will execute a Full Re conveyance of Deed of Trust, releasing their interest in the property and recognizing that the debt has been fulfilled. 2. Full Re conveyance of Deed of Trust — Individual Holder: In some cases, an individual may obtain the Deed of Trust from the original lender, making them the holder of the trust deed. This individual holder would then become the beneficiary of the loan. When the borrower completes their loan payment obligations, the individual holder issues a Full Re conveyance of Deed of Trust to relinquish their interest in the property. Both types of Full Re conveyance of Deed of Trust — Individual Lender or Holder involve similar processes and documents. Typically, the borrower or their representative, along with the individual lender or holder, must gather all relevant loan documents, including the original promissory note, Deed of Trust, and any subsequent modifications or agreements. To initiate the Full Re conveyance of Deed of Trust, the individual lender or holder must draft a Re conveyance Deed, which explicitly states the release of the borrower from any obligations and removes the lien on the property. This document must comply with Oregon's legal requirements and be notarized. Once the Re conveyance Deed is prepared, the borrower and the individual lender or holder must sign it in the presence of a notary public. Additionally, a clear and accurate legal description of the property should be included in the document. After the Re conveyance Deed is fully executed, it must be recorded at the appropriate county recorder's office in Portland, Oregon, to effectively remove the Deed of Trust from the property's title. This recording ensures that the public record accurately reflects the release of the lien, safeguarding the borrower's interest and title rights. In conclusion, a Portland, Oregon Full Re conveyance of Deed of Trust — Individual Lender or Holder is a legal procedure utilized to release a borrower from their loan obligations and remove the associated lien on a property. Depending on whether an individual lender or holder is involved, the specific process and parties may vary slightly. It is crucial for all parties involved to follow the appropriate legal steps to ensure a smooth and accurate Full Re conveyance of Deed of Trust.

Portland Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder

Description

How to fill out Portland Oregon Full Reconveyance Of Deed Of Trust - Individual Lender Or Holder?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person with no law background to create this sort of paperwork from scratch, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our service provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you need the Portland Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Portland Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder in minutes using our trustworthy service. In case you are already an existing customer, you can go on and log in to your account to download the appropriate form.

However, if you are a novice to our platform, make sure to follow these steps before downloading the Portland Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder:

- Be sure the template you have found is good for your location since the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your needs, you can start over and search for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment method and proceed to download the Portland Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder once the payment is done.

You’re good to go! Now you can go on and print the form or complete it online. In case you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.