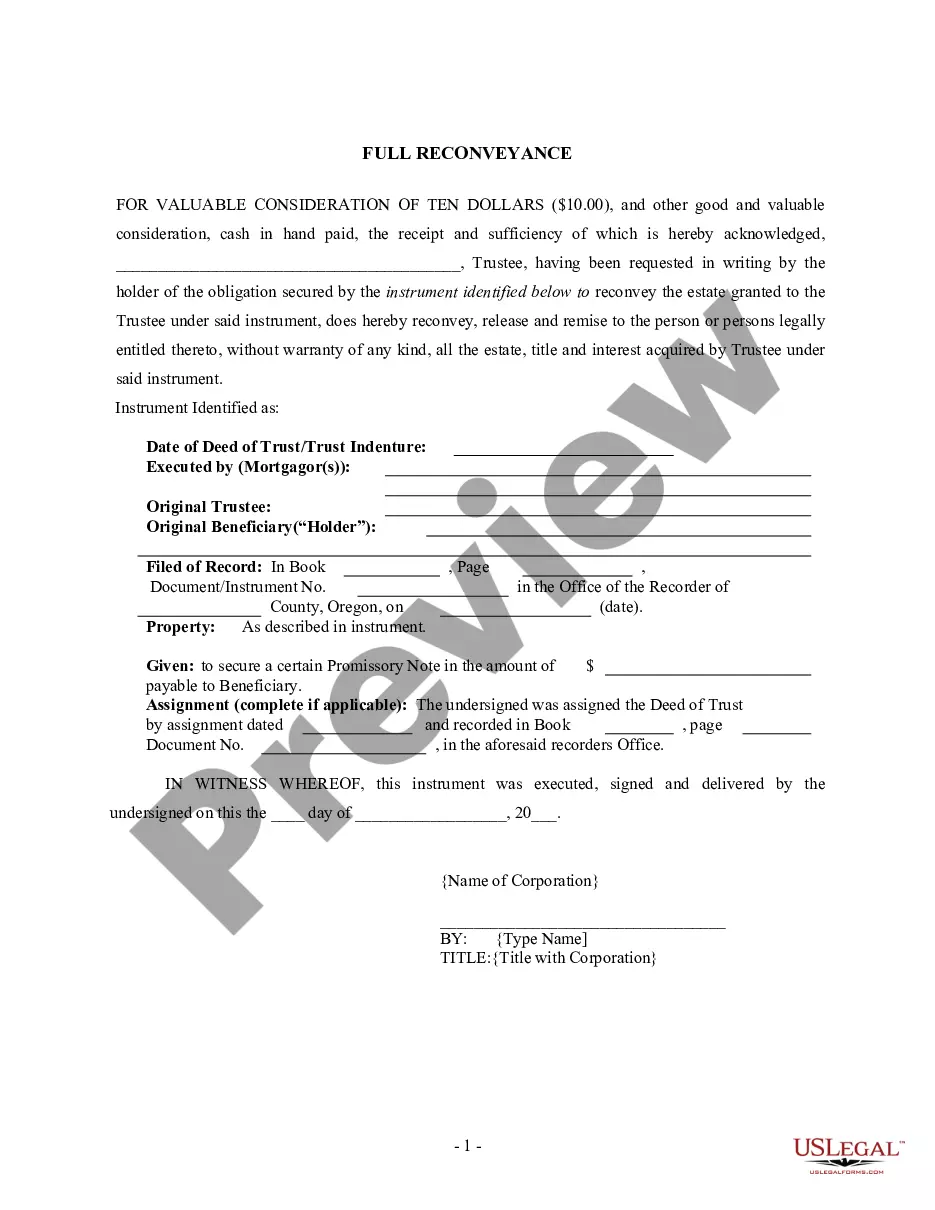

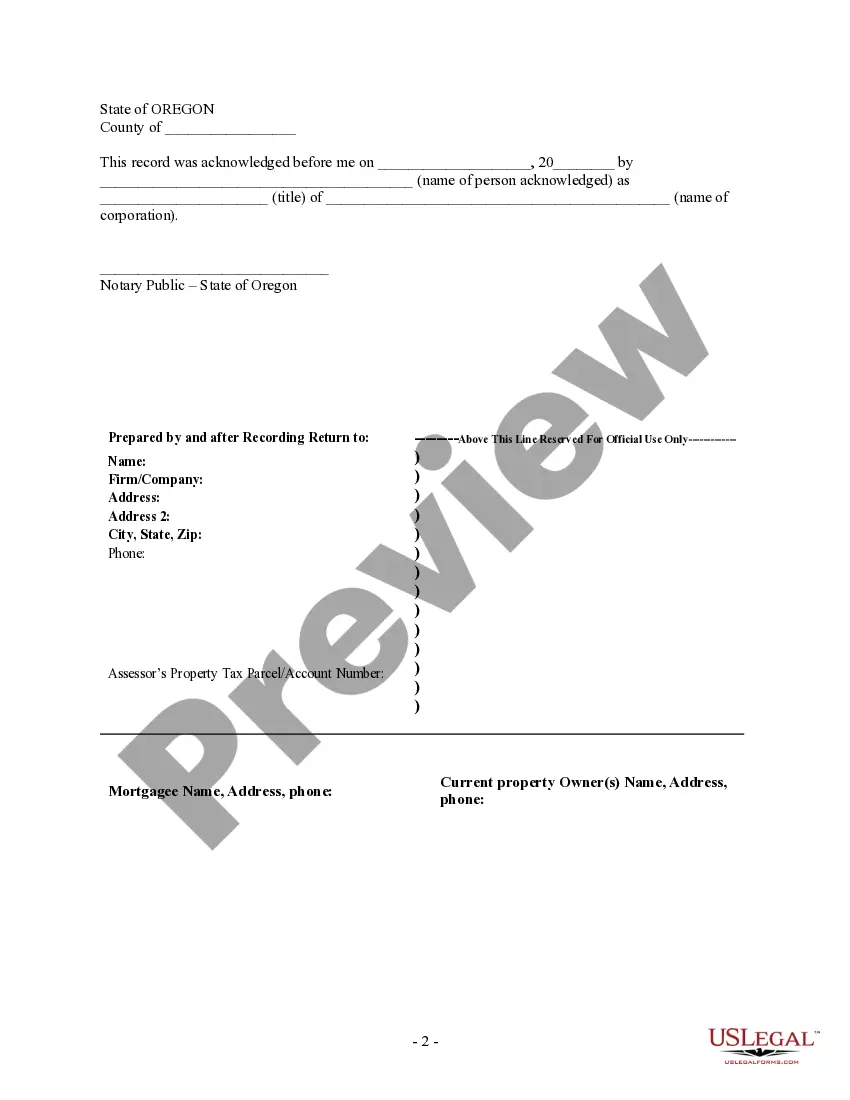

Title: Understanding the Bend Oregon Full Re conveyance of Deed of Trust — by Corporate Trustee Introduction: In Bend, Oregon, a full reconveyance of a deed of trust by a corporate trustee is an essential legal process that signifies the release of a property owner from the terms and obligations set forth in a loan agreement secured by a deed of trust. This comprehensive description aims to outline the key aspects and importance of Bend Oregon Full Re conveyance of Deed of Trust — by Corporate Trustee. Keywords: Bend Oregon, Full Re conveyance, Deed of Trust, Corporate Trustee, Loan Agreement 1. What is a Deed of Trust? A deed of trust is a legal document that establishes a lien against a property to secure the repayment of a loan. The deed of trust outlines the obligations and rights of the lender (the beneficiary) and the borrower (the trust or), ensuring that the loan is repaid according to the agreed-upon terms. 2. Understanding Full Re conveyance: Full reconveyance is the process through which a lender releases the ownership claim or "lien" on a property, stating that the borrower has fulfilled their loan obligations adequately according to the deed of trust. It is often the final step when a loan is fully repaid or upon the borrower's satisfaction of the agreed-upon terms. 3. Corporate Trustee's Role: A corporate trustee serves as the authorized representative of the lender and plays a crucial role in facilitating the full reconveyance of a deed of trust. This trustee is usually a reputable financial institution designated to administer and protect the interests of the lender throughout the loan term. 4. Importance of Full Re conveyance: a. Clear Property Title: Full reconveyance removes the lien on the property, ensuring that the borrower's title is free and clear from any encumbrances related to the loan, allowing for seamless property transfers and refinancing. b. Evidence of Loan Completion: The reconveyance document serves as legal evidence that the loan has been fully repaid or satisfied, preventing any future disputes regarding the borrower's responsibility for the debt. 5. Types of Bend Oregon Full Re conveyance of Deed of Trust — by Corporate Trustee: a. Voluntary Re conveyance: Occurs when the borrower pays off the loan completely, and the lender willingly releases the lien through a reconveyance document, allowing the borrower to gain clear title to the property. b. Re conveyance Upon Foreclosure: In cases where the borrower defaults on the loan, the lender may initiate foreclosure proceedings. If the property is subsequently sold at auction and the proceeds are sufficient to cover the debt, a reconveyance is issued, extinguishing the lien once again. Conclusion: The Bend Oregon Full Re conveyance of Deed of Trust — by Corporate Trustee is an important legal process that signifies the release of a borrower from the obligations associated with a loan secured by a deed of trust. Understanding this process is crucial for property owners to ensure a clear title and a satisfactory resolution to their loan agreement. By engaging a reliable corporate trustee, borrowers can navigate the reconveyance process smoothly and attain permanent resolution.

Bend Full Form

Description

How to fill out Bend Oregon Full Reconveyance Of Deed Of Trust - By Corporate Trustee?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Bend Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Bend Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Bend Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!