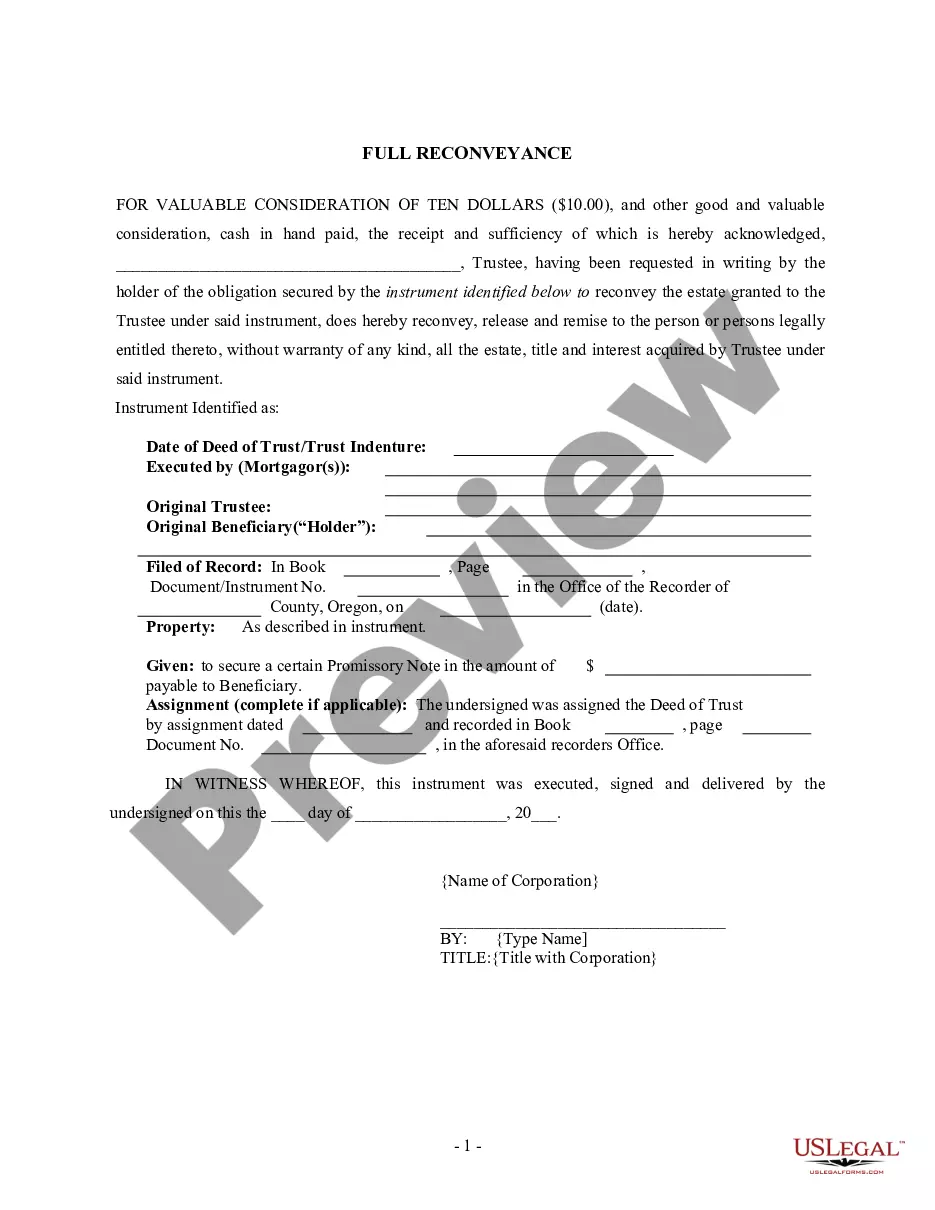

Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee

Description

How to fill out Oregon Full Reconveyance Of Deed Of Trust - By Corporate Trustee?

Are you in search of a trustworthy and budget-friendly legal documents provider to obtain the Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee? US Legal Forms is your ideal choice.

Whether you need a simple contract to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce in court, we have you covered. Our service provides over 85,000 current legal document templates for personal and business needs. All templates we offer are not one-size-fits-all; they are tailored to meet the stipulations of different states and regions.

To retrieve the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please bear in mind that you can download your previously acquired document templates at any time from the My documents section.

Are you a newcomer to our platform? No problem. You can create an account in just minutes, but before you do that, ensure the following.

Now you are ready to set up your account. Then pick a subscription option and proceed with the payment. Once the payment is successful, download the Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee in any available format. You can return to the website at any moment and redownload the document without any additional charges.

Locating current legal documents has never been simpler. Try US Legal Forms today and eliminate the hassle of spending hours researching legal documents online once and for all.

- Verify if the Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee complies with your state's and local area's regulations.

- Review the details of the form (if available) to determine who and what the document is suitable for.

- Reinitiate the search if the form does not apply to your legal circumstances.

Form popularity

FAQ

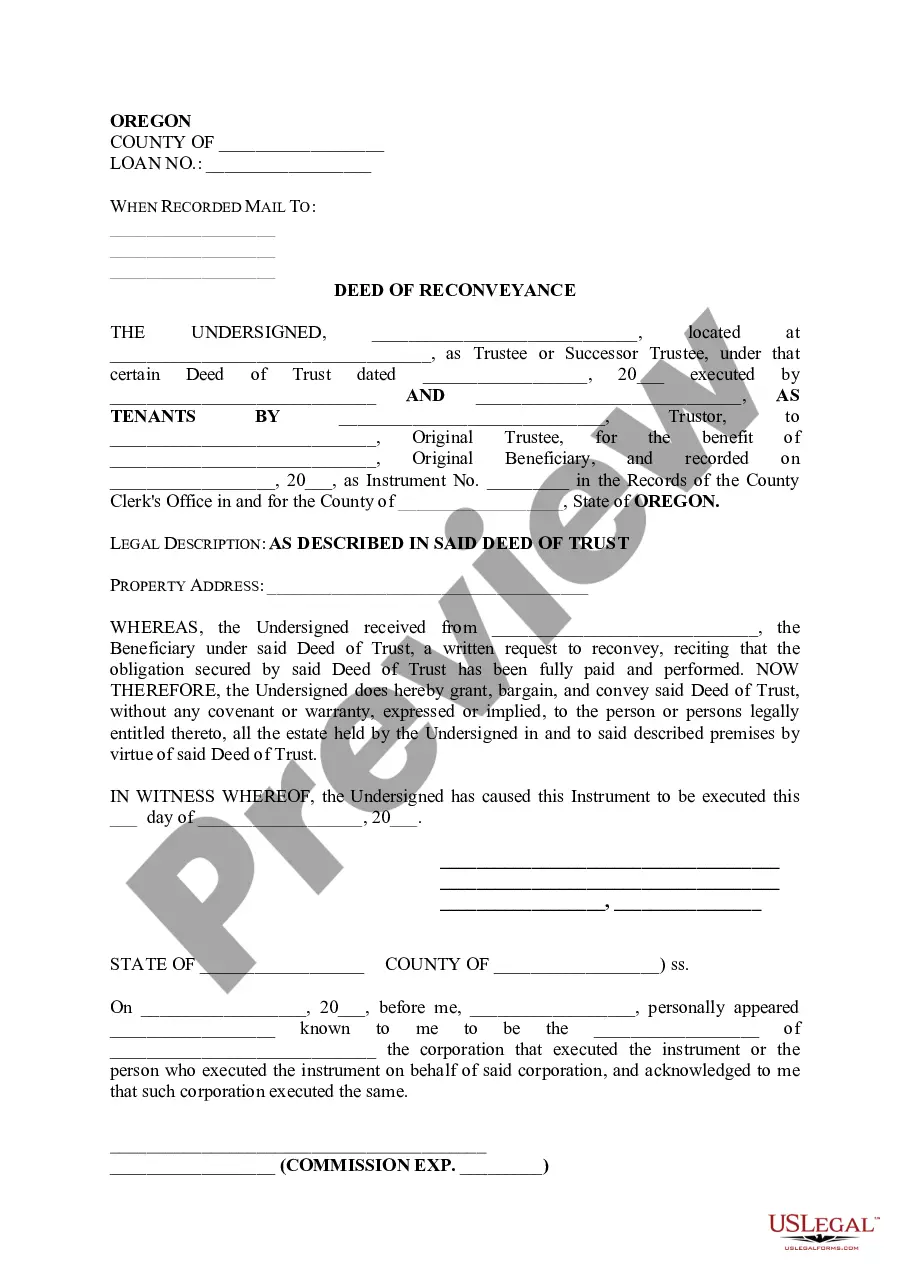

A deed of reconveyance is typically signed by the trustee who originally held the title on behalf of the lender. This signing indicates that the lender has fulfilled their obligations and releases their claim on the property. For homeowners in Eugene, Oregon, understanding the signer’s role can demystify the Full Reconveyance of Deed of Trust - by Corporate Trustee process. Always verify that the document is properly executed before relying on it.

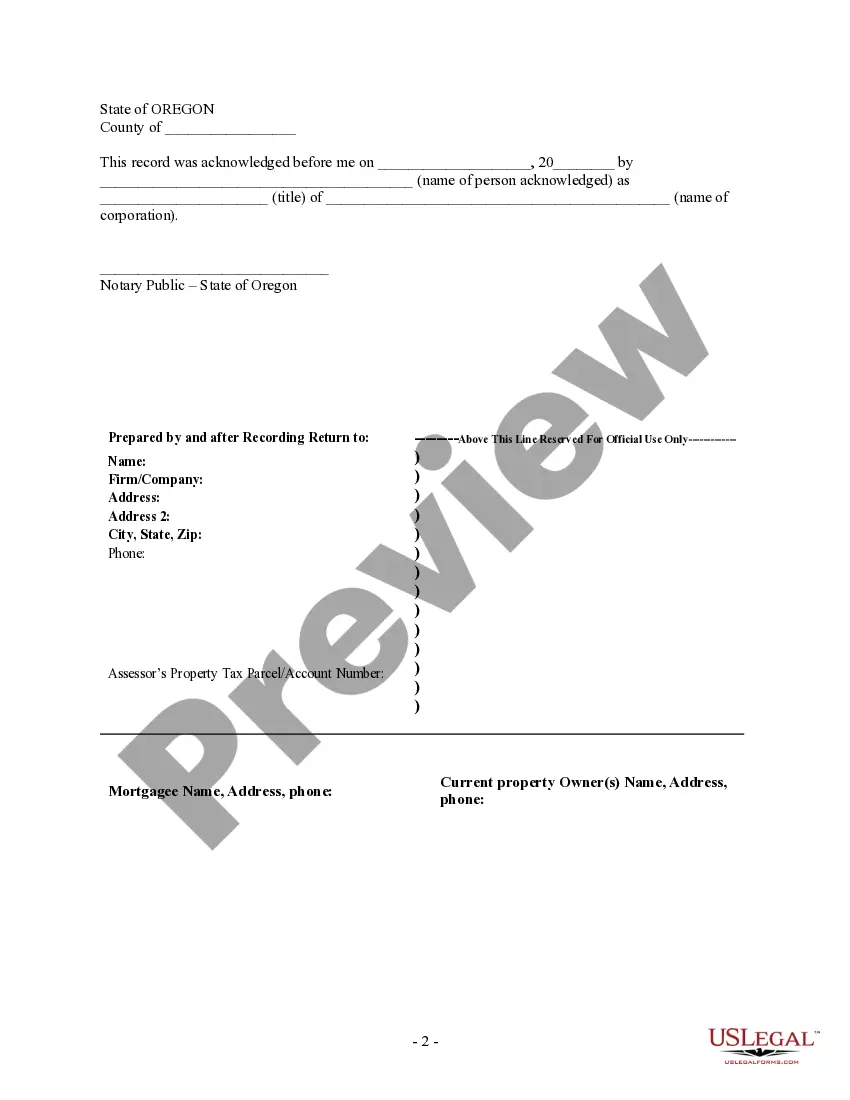

To record a reconveyance, first, obtain a duly executed deed of reconveyance signed by the trustee or lender involved in the original deed of trust. Next, take this document to the county recorder's office where the property is located, and submit it for recording along with any required fees. Once recorded, the reconveyance serves as public proof that the debt has been settled. For seamless execution of your Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee, consider utilizing UsLegalForms for efficient processing.

A deed of reconveyance is a legal document that signifies the release of a mortgage or lien on a property. It typically includes the grantor's name, the grantee's name, a description of the property, and the original deed of trust details. The document is often recorded with the county clerk to provide public notice that the debt has been satisfied. If you need assistance with obtaining a Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee, consider using the services of UsLegalForms.

Individuals often use a deed of trust to secure financing for real estate purchases. This arrangement involves a neutral third party, a trustee, which adds protection for lenders. Additionally, utilizing a Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee allows borrowers to establish a clear agreement on terms, ensuring both parties feel secure and informed throughout the transaction process.

Finding a suitable trustee for a deed of trust is crucial. You can start by seeking recommendations from real estate professionals or legal advisors in your area. Additionally, exploring services like uslegalforms can help streamline the process of locating a reliable Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee. They provide comprehensive resources to guide you in choosing a qualified trustee.

Yes, a deed of reconveyance serves as proof of ownership in property matters. It indicates that the borrower has fulfilled their obligations and the trust has been terminated. When you receive a Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee, you gain an essential document confirming your ownership status. This proof can be critical for future transactions or legal matters.

To create a deed of reconveyance, you first need to obtain the correct form, which you can find on platforms like U.S. Legal Forms. Fill in the necessary details, including the name of the borrower, the lender, and the property description. Afterward, have the document signed and notarized, ensuring that the corporate trustee executes it properly. Finally, file the reconveyance with the relevant county recorder to officially complete the Eugene Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee.