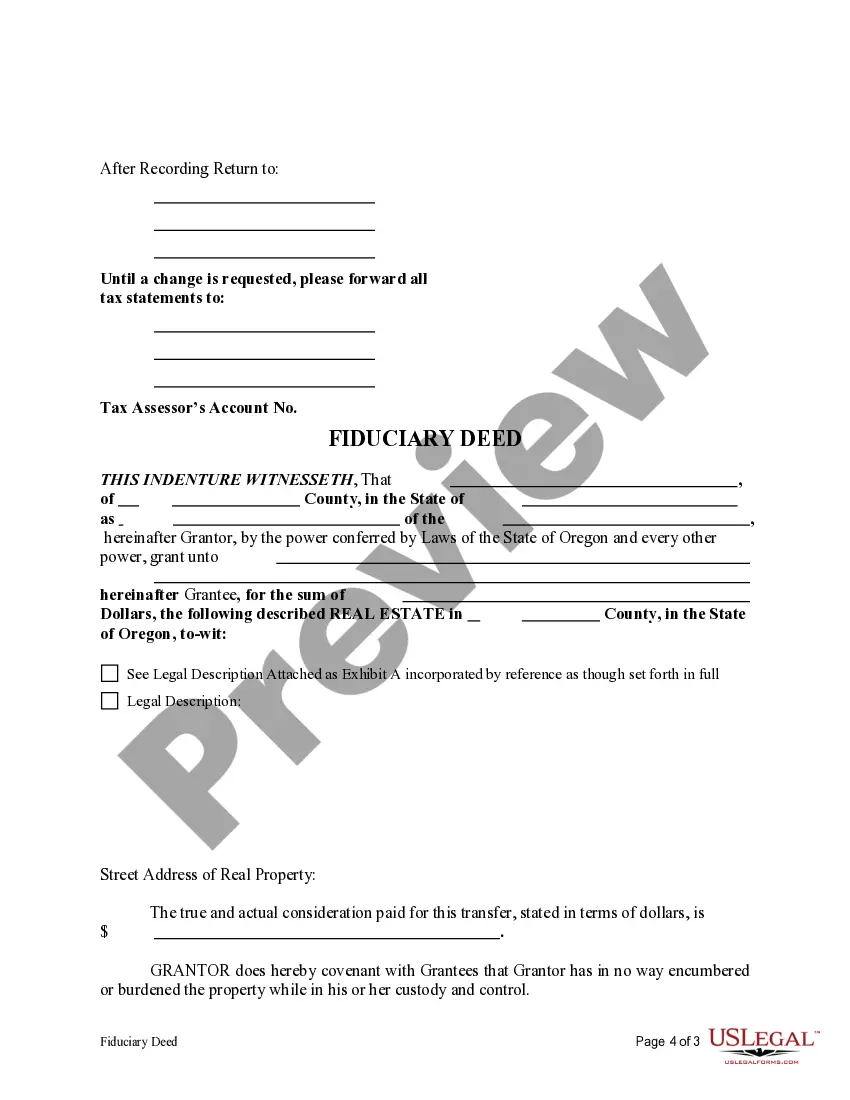

Eugene Oregon Fiduciary Deed: A Comprehensive Guide for Executors, Trustees, Trustees, Administrators, and Other Fiduciaries Introduction: In Eugene, Oregon, fiduciaries play a crucial role in managing and distributing assets on behalf of estates, trusts, and other legal entities. One essential tool at their disposal is the Eugene Oregon Fiduciary Deed. This detailed guide aims to provide comprehensive information about this important legal document, its purpose, and the different types available to various fiduciaries. Definition and Purpose: A Eugene Oregon Fiduciary Deed is a legal instrument executed by a fiduciary, authorized by law, who acts on behalf of another party or holds assets in a fiduciary capacity. The primary purpose of this deed is to transfer title to real property from an estate, trust, or other fiduciary entity to a designated beneficiary. Types of Eugene Oregon Fiduciary Deeds: 1. Executor's Deed: An Executor's Deed is commonly used when an executor is fulfilling their duties to transfer real estate from a deceased individual's estate to the identified heirs or beneficiaries. Executors must adhere to the decedent's will or intestate succession laws if no will exists. 2. Trustee's Deed: A Trustee's Deed is employed when a trustee is responsible for transferring real property held in a trust to the beneficiaries as outlined in the trust document. Trustees must act in accordance with the trust's terms and the best interests of the beneficiaries. 3. Trust or's Deed: A Trust or's Deed is utilized when a trust or (the creator of a trust) transfers property into the trust's ownership during their lifetime. This document allows the trust or to transfer title to real estate while maintaining control and often acts as an integral part of estate planning. 4. Administrator's Deed: Administrators appointed by the court in probate cases may use an Administrator's Deed to transfer real property to rightful heirs if the deceased did not leave behind a valid will. This deed ensures the proper distribution of assets in accordance with Oregon's intestate succession laws. Key Elements in a Eugene Oregon Fiduciary Deed: 1. Names and Roles: The deed should clearly state the full legal names and roles of the fiduciaries involved, such as executor, trustee, trust or, administrator, and other relevant parties. 2. Property Description: A detailed description of the property being transferred, including its legal description, address, and tax parcel information, must be included. 3. Granting Clause: The granting clause explicitly conveys the fiduciary's intent to transfer the property to the designated beneficiary, ensuring a legally valid transfer of ownership. 4. Consideration: The consideration section specifies the value, usually nominal, exchanged for the transfer of the property. However, fiduciary deeds often reference the consideration as "love and affection." 5. Signatures and Notarization: All fiduciary deeds must bear the signatures of the fiduciaries involved, and the signatures must be notarized to attest to their authenticity. Conclusion: Eugene Oregon Fiduciary Deeds are indispensable instruments used by executors, trustees, trustees, administrators, and other fiduciaries to facilitate the seamless transfer and distribution of real estate assets. Understanding the different types of fiduciary deeds available and their specific purposes is crucial for ensuring proper compliance with Oregon's legal requirements. By following the guidelines outlined in this comprehensive guide, fiduciaries can confidently navigate the intricate process of transferring real property while upholding their fiduciary responsibilities.

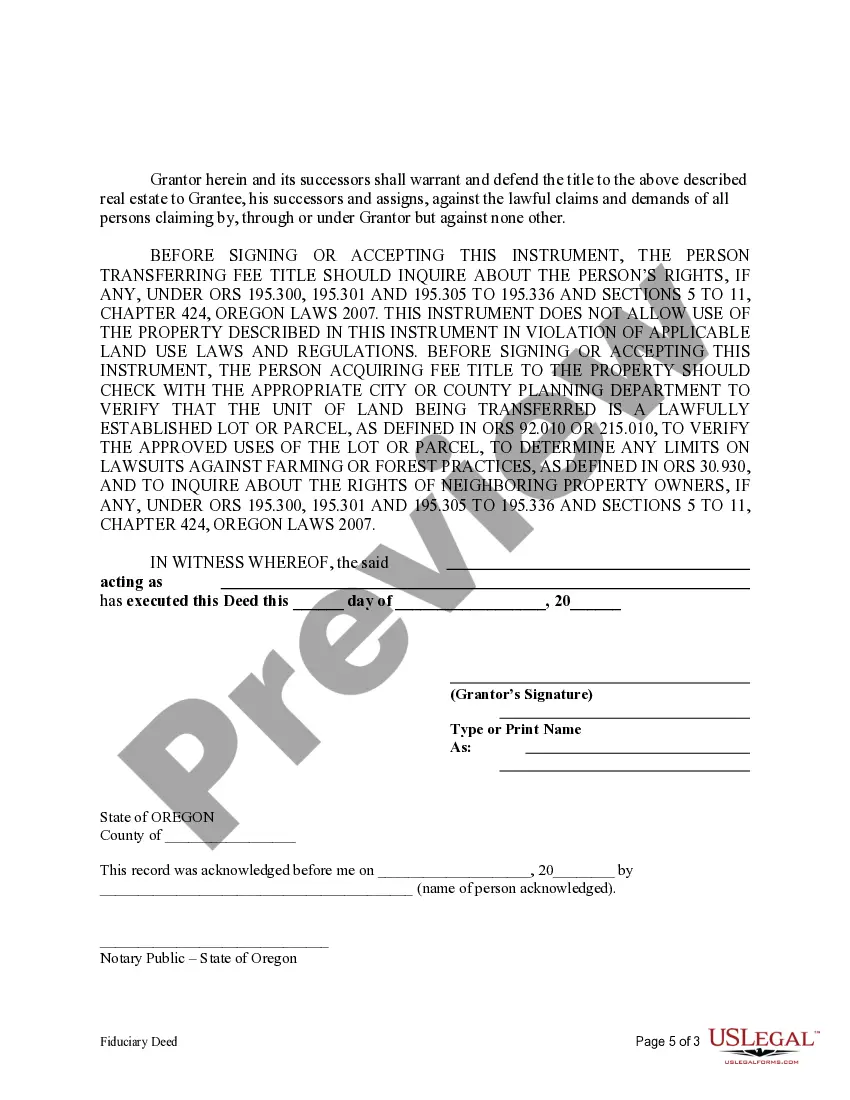

Eugene Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Eugene Oregon Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

If you are looking for a relevant form template, it’s impossible to find a more convenient service than the US Legal Forms site – one of the most comprehensive online libraries. Here you can find a huge number of document samples for company and personal purposes by types and states, or key phrases. Using our advanced search function, getting the latest Eugene Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is as easy as 1-2-3. In addition, the relevance of each file is confirmed by a team of professional attorneys that regularly review the templates on our platform and revise them in accordance with the latest state and county regulations.

If you already know about our platform and have a registered account, all you should do to get the Eugene Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the sample you need. Look at its explanation and utilize the Preview option to check its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to discover the proper record.

- Affirm your selection. Choose the Buy now option. After that, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Pick the file format and save it to your system.

- Make changes. Fill out, revise, print, and sign the obtained Eugene Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries.

Each form you save in your account does not have an expiration date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you want to have an additional copy for modifying or printing, feel free to return and download it again at any moment.

Take advantage of the US Legal Forms extensive collection to gain access to the Eugene Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries you were looking for and a huge number of other professional and state-specific samples on a single platform!