Gresham Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Oregon Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

No matter one's social or professional standing, finalizing legal paperwork is an unfortunate requirement in the current landscape. More often than not, it’s nearly impossible for individuals without a legal education to generate such documents from scratch, primarily because of the intricate language and legal subtleties involved. This is where US Legal Forms comes to the rescue. Our platform provides an extensive collection of over 85,000 readily available state-specific documents suitable for nearly any legal situation. US Legal Forms also serves as a valuable tool for associates or legal advisors aiming to save time with our DIY forms.

Regardless of whether you require the Gresham Oregon Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other fiduciaries or any other document that applies to your state or locality, US Legal Forms has everything you need at your disposal. Here’s a quick guide to acquiring the Gresham Oregon Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other fiduciaries promptly using our dependable service. If you are an existing client, simply Log In to your account to obtain the necessary form.

However, if you’re new to our service, make sure to follow these instructions before downloading the Gresham Oregon Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other fiduciaries.

You’re all set! Now you can either print the form or fill it out online. If you encounter any issues retrieving your purchased documents, they can be easily accessed in the My documents section.

Regardless of the matter you're trying to resolve, US Legal Forms is here to assist you. Give it a try and witness the effectiveness for yourself.

- Verify that the form you’ve identified is applicable to your region because the regulations of one state may not apply in another.

- Review the form and read a brief overview (if provided) regarding the scenarios for which the document is applicable.

- If the form you selected does not satisfy your requirements, you can restart and search for the appropriate document.

- Click Buy now and select the subscription plan that suits you best.

- Log in with your credentials or create a new account.

- Choose the payment method and proceed to download the Gresham Oregon Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other fiduciaries as soon as the payment is finalized.

Form popularity

FAQ

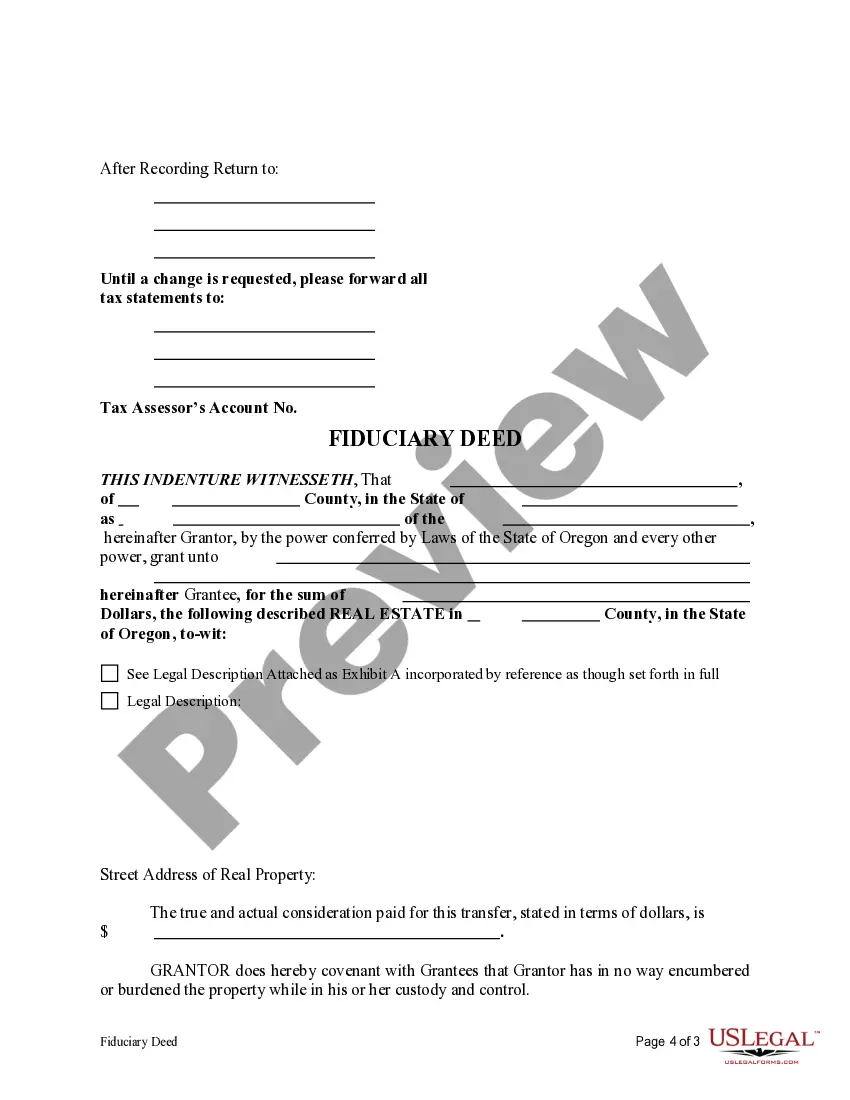

A fiduciary deed is a type of deed used by individuals in fiduciary roles, like Executors or Trustees, to transfer property. It emphasizes the trust and responsibility placed upon the fiduciary, ensuring that the property transfer is executed in the best interest of the beneficiaries. In Gresham, Oregon, utilizing a Fiduciary Deed can streamline the process for Executors, Trustees, Trustors, Administrators, and other Fiduciaries, helping them manage assets efficiently and transparently.

A warranty deed and an executor's deed are not the same. A warranty deed provides a guarantee from the seller regarding the property's title, while an executor's deed transfers property from an estate to heirs or beneficiaries following a person's death. In the context of Gresham, Oregon, a Fiduciary Deed allows Executors, Trustees, Trustors, Administrators, and other Fiduciaries to execute property transfers thoughtfully and legally.

A trust deed is a legal document that outlines the terms of a trust, which can include property or assets placed in that trust. It serves as a formal way for Executors, Trustees, Trustors, Administrators, and other Fiduciaries to manage and transfer property. In Gresham, Oregon, a Fiduciary Deed is essential for ensuring that fiduciaries fulfill their duties correctly, paving the way for clear and organized asset management.

The primary beneficiaries of a trust deed are the lenders who secure their loans against the property. Additionally, borrowers benefit by having a structured way to finance real estate transactions with clear terms. If you are a part of the fiduciary process in Gresham, utilizing a Gresham Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can enhance the security and clarity of your investment.

In Oregon, a trustee on a deed of trust can be an individual or an entity authorized to act in a fiduciary capacity. This includes licensed professionals or financial institutions proficient in managing trust arrangements. Choosing a qualified trustee is crucial when utilizing a Gresham Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

One of the main disadvantages of a trust deed is that it can lead to a quick foreclosure process if the borrower defaults. This means an investor or lender could potentially lose their investment faster than in traditional mortgage financing. Understanding this aspect is vital for anyone employing a Gresham Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

The Oregon Trust Deed Act establishes the legal framework for creating and enforcing fiduciary deeds in Oregon. This act specifies the roles and responsibilities of Executors, Trustees, Trustors, Administrators, and other Fiduciaries involved in property transactions. Understanding this act is essential for anyone utilizing a Gresham Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

A trustee typically uses a fiduciary deed when transferring property as part of trust management. This deed allows the trustee to act on behalf of beneficiaries, ensuring that the property is handled according to the trust’s stipulations. The Gresham Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is specifically designed for such situations, providing a clear legal process.

The safest type of deed is often considered to be a warranty deed, as it provides strong assurances regarding the property's title. However, the Gresham Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries also offers a level of protection when managed properly. Understanding your options and which deed suits your needs can mitigate potential risks.

The primary purpose of a fiduciary deed is to facilitate the transfer of real estate by a fiduciary acting in accordance with a legal agreement, such as a will or trust. This deed ensures that the fiduciary is following the deceased's wishes, making it an essential tool for Executors and Trustees. When you utilize the Gresham Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, you uphold the integrity of the estate’s management.