The Portland Oregon UCC1 Financing Statement Addendum is an essential document used in commercial transactions to provide additional information to supplement the UCC1 Financing Statement. This addendum is specifically tailored to comply with the laws and regulations of the state of Oregon, ensuring a seamless financial transaction process. It includes pertinent details that further describe the collateral involved in the transaction, adding clarity and protecting the interests of both parties involved. Keywords: Portland Oregon, UCC1 Financing Statement Addendum, commercial transactions, UCC1 Financing Statement, additional information, Oregon laws and regulations, financial transaction process, collateral, clarity, protect interests. There are two main types of UCC1 Financing Statement Addendum commonly used in Portland, Oregon: 1. General UCC1 Financing Statement Addendum: This type of addendum is used to provide general supplementary information about the collateral, such as a detailed description, serial numbers, or any other necessary details related to the assets involved in the transaction. 2. Specific UCC1 Financing Statement Addendum: This addendum is used when there is a need to provide specific additional information that goes beyond what can be included in a general addendum. It allows for the inclusion of complex details about the collateral, such as intellectual property rights, multiple parties' interests, or any unique aspects of the transaction. Both types of addendums serve the purpose of ensuring transparency, legal compliance, and the proper recording of the transaction. They contribute to the smooth flow of commercial activities in Portland, Oregon, and protect the rights of all parties involved. Keywords: General UCC1 Financing Statement Addendum, specific UCC1 Financing Statement Addendum, collateral description, serial numbers, supplementary information, assets, intellectual property rights, multiple parties' interests, legal compliance, transaction recording, commercial activities, rights protection.

Portland Oregon UCC1 Financing Statement Addendum

State:

Oregon

City:

Portland

Control #:

OR-UCC1-A

Format:

PDF

Instant download

Public form

Description

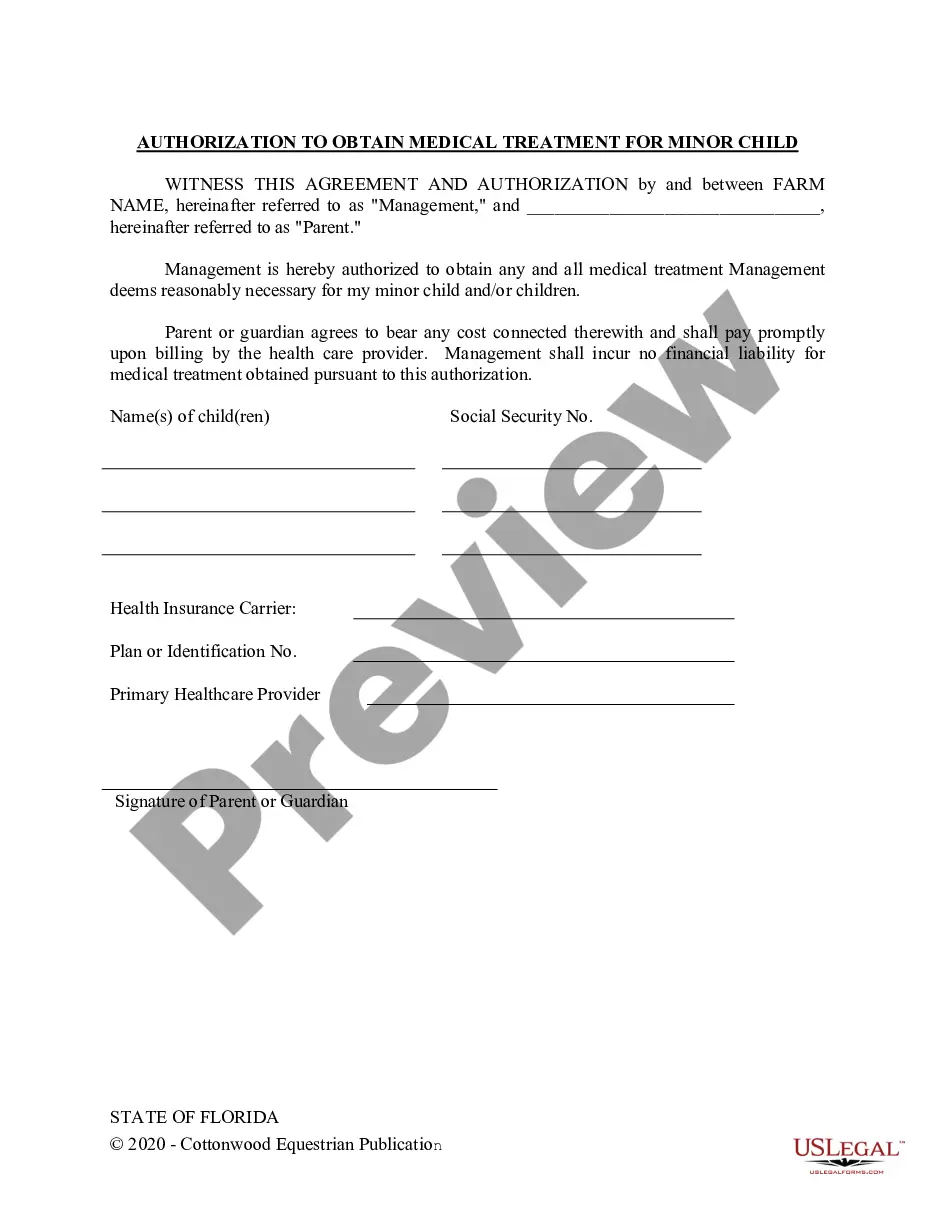

UCC1 - Financing Statement Addendum - Oregon - For use after July 1, 2001. This form permits you to add an additional debtor if necessary to cover collateral as specified in the statement.

The Portland Oregon UCC1 Financing Statement Addendum is an essential document used in commercial transactions to provide additional information to supplement the UCC1 Financing Statement. This addendum is specifically tailored to comply with the laws and regulations of the state of Oregon, ensuring a seamless financial transaction process. It includes pertinent details that further describe the collateral involved in the transaction, adding clarity and protecting the interests of both parties involved. Keywords: Portland Oregon, UCC1 Financing Statement Addendum, commercial transactions, UCC1 Financing Statement, additional information, Oregon laws and regulations, financial transaction process, collateral, clarity, protect interests. There are two main types of UCC1 Financing Statement Addendum commonly used in Portland, Oregon: 1. General UCC1 Financing Statement Addendum: This type of addendum is used to provide general supplementary information about the collateral, such as a detailed description, serial numbers, or any other necessary details related to the assets involved in the transaction. 2. Specific UCC1 Financing Statement Addendum: This addendum is used when there is a need to provide specific additional information that goes beyond what can be included in a general addendum. It allows for the inclusion of complex details about the collateral, such as intellectual property rights, multiple parties' interests, or any unique aspects of the transaction. Both types of addendums serve the purpose of ensuring transparency, legal compliance, and the proper recording of the transaction. They contribute to the smooth flow of commercial activities in Portland, Oregon, and protect the rights of all parties involved. Keywords: General UCC1 Financing Statement Addendum, specific UCC1 Financing Statement Addendum, collateral description, serial numbers, supplementary information, assets, intellectual property rights, multiple parties' interests, legal compliance, transaction recording, commercial activities, rights protection.

How to fill out Portland Oregon UCC1 Financing Statement Addendum?

If you’ve already used our service before, log in to your account and download the Portland Oregon UCC1 Financing Statement Addendum on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Portland Oregon UCC1 Financing Statement Addendum. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!