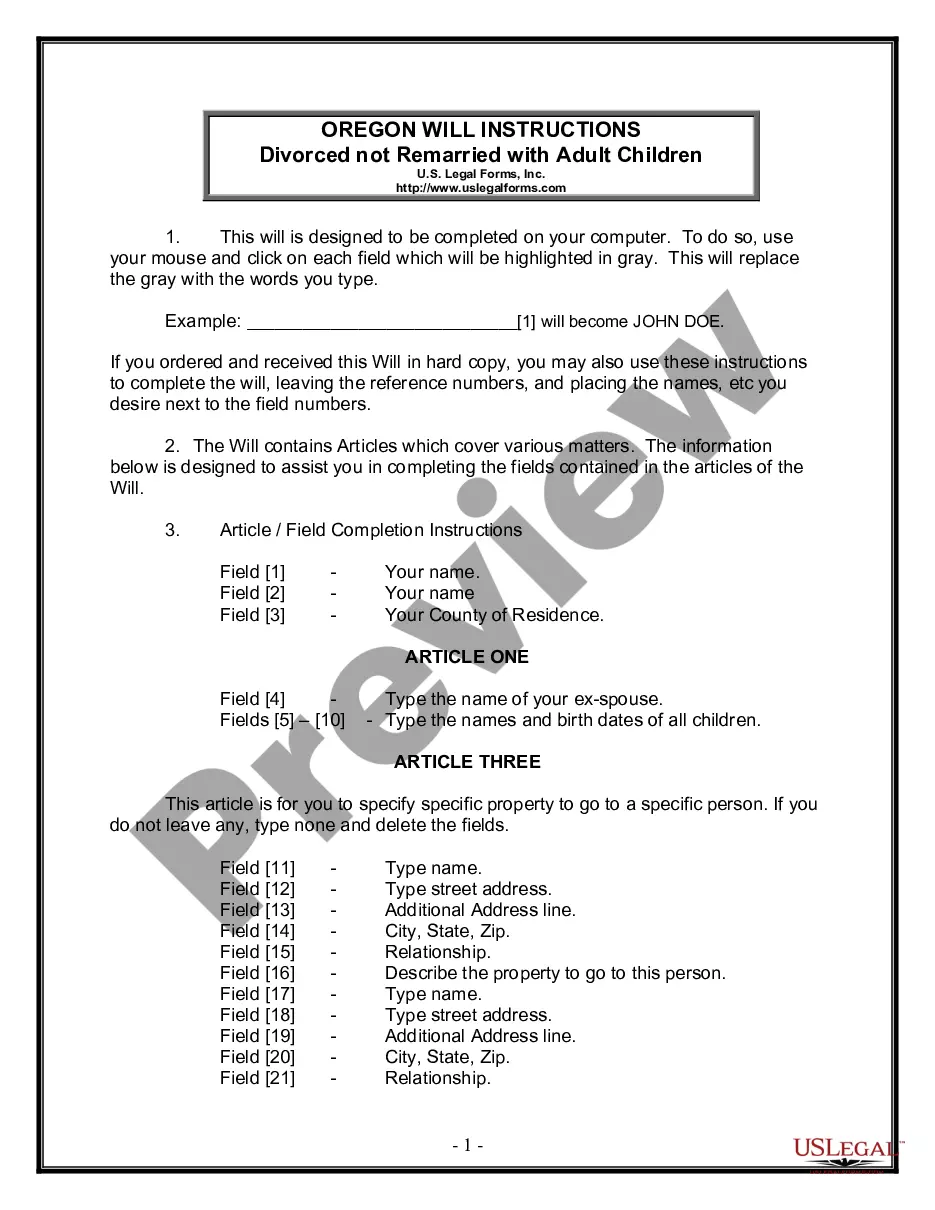

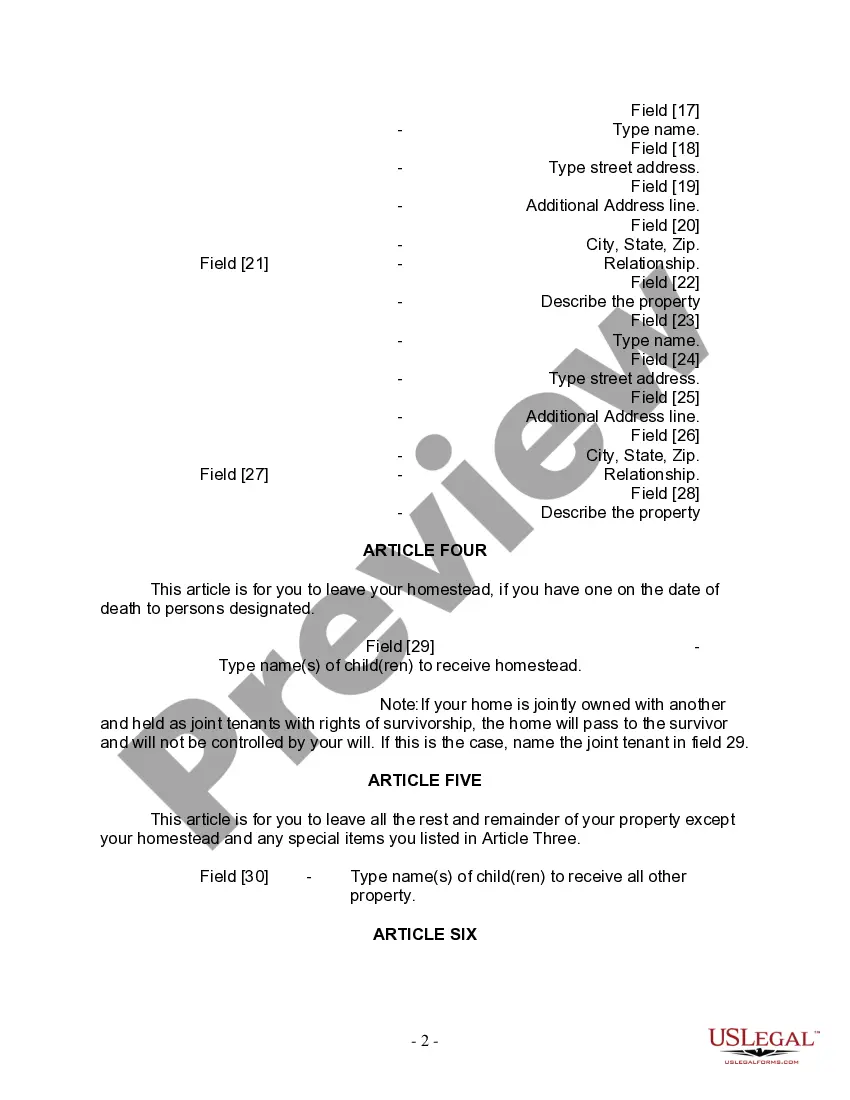

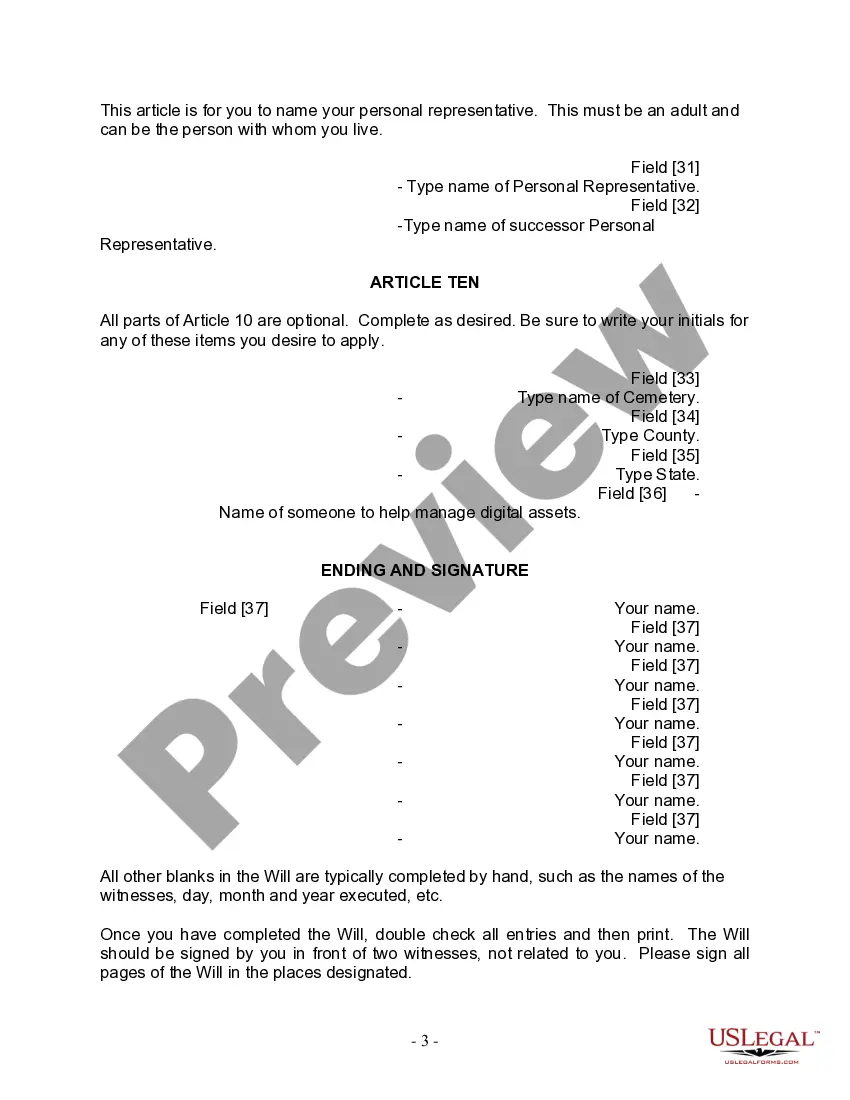

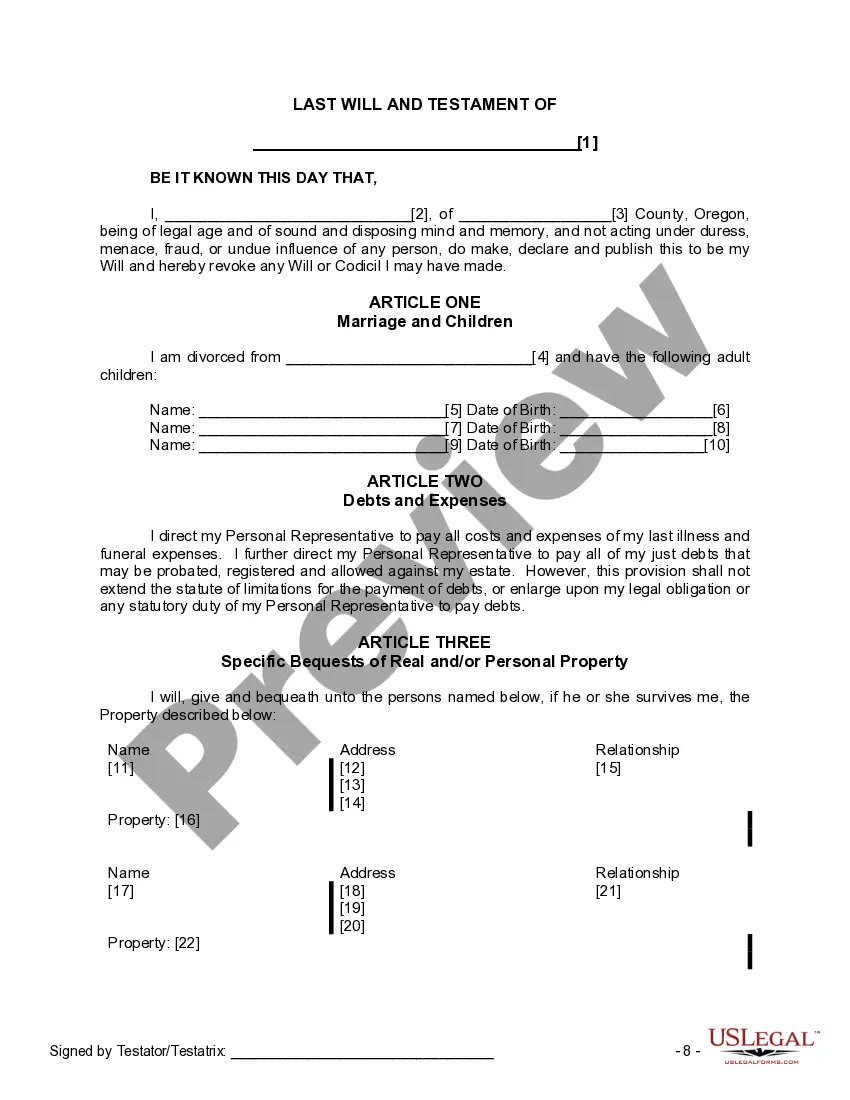

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Eugene Oregon Legal Last Will and Testament Form for a Divorced person not Remarried with Adult Children is a legally binding document that outlines the specific desires and distribution of assets for individuals who have gone through a divorce and have adult children. This form ensures that the estate of the individual is managed according to their wishes after their passing. Key Considerations and Provisions: 1. Asset Distribution: This Will form allows the individual to specify how their assets should be distributed among their adult children. They can allocate specific properties, investments, cash, or other valuable assets to each child, ensuring a fair distribution according to their wishes. 2. Guardian for Minor Children: In the case where the divorced person has any minor children, the form enables them to designate a guardian for the children. This provision ensures that responsible and trusted individuals will be responsible for the upbringing and care of the children in the event of their parent's passing. 3. Executor Appointment: The Will form allows the individual to appoint an executor, someone responsible for managing the estate and ensuring the wishes outlined in the Will are carried out accordingly. This can be a trusted family member, friend, or a professional executor. 4. Alternate Beneficiaries: The form provides an option to name alternate beneficiaries in case any of the designated adult children or primary beneficiaries are unable to inherit or choose not to inherit the assets. This ensures that the assets are still distributed as per the individual's intentions. Variations of the Eugene Oregon Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children: 1. Simple Will: This basic version of the form covers the essential elements, such as asset distribution and executor appointment, suitable for individuals with a relatively straightforward estate and uncomplicated familial relationships. 2. Complex Will: This version of the form caters to individuals with more complex estates, multiple properties, substantial investments, business ownership, or other intricate financial arrangements. It provides additional sections and provisions to address specific circumstances unique to the individual. 3. Living Will: Besides addressing asset distribution, a Living Will allows individuals to express their healthcare preferences in case they become incapacitated. It covers medical treatment, life support decisions, and organ donation choices. 4. Pour-Over Will: This type of Will often is used in conjunction with a Trust. It ensures that any assets inadvertently left out of the Trust are 'poured over' into the Trust after the individual's passing, minimizing the risk of unintended distribution. Remember, it is essential to consult an attorney or legal professional when preparing a last Will and Testament to ensure compliance with the specific laws and regulations of the state of Oregon and to address any individual circumstances appropriately.

The Eugene Oregon Legal Last Will and Testament Form for a Divorced person not Remarried with Adult Children is a legally binding document that outlines the specific desires and distribution of assets for individuals who have gone through a divorce and have adult children. This form ensures that the estate of the individual is managed according to their wishes after their passing. Key Considerations and Provisions: 1. Asset Distribution: This Will form allows the individual to specify how their assets should be distributed among their adult children. They can allocate specific properties, investments, cash, or other valuable assets to each child, ensuring a fair distribution according to their wishes. 2. Guardian for Minor Children: In the case where the divorced person has any minor children, the form enables them to designate a guardian for the children. This provision ensures that responsible and trusted individuals will be responsible for the upbringing and care of the children in the event of their parent's passing. 3. Executor Appointment: The Will form allows the individual to appoint an executor, someone responsible for managing the estate and ensuring the wishes outlined in the Will are carried out accordingly. This can be a trusted family member, friend, or a professional executor. 4. Alternate Beneficiaries: The form provides an option to name alternate beneficiaries in case any of the designated adult children or primary beneficiaries are unable to inherit or choose not to inherit the assets. This ensures that the assets are still distributed as per the individual's intentions. Variations of the Eugene Oregon Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children: 1. Simple Will: This basic version of the form covers the essential elements, such as asset distribution and executor appointment, suitable for individuals with a relatively straightforward estate and uncomplicated familial relationships. 2. Complex Will: This version of the form caters to individuals with more complex estates, multiple properties, substantial investments, business ownership, or other intricate financial arrangements. It provides additional sections and provisions to address specific circumstances unique to the individual. 3. Living Will: Besides addressing asset distribution, a Living Will allows individuals to express their healthcare preferences in case they become incapacitated. It covers medical treatment, life support decisions, and organ donation choices. 4. Pour-Over Will: This type of Will often is used in conjunction with a Trust. It ensures that any assets inadvertently left out of the Trust are 'poured over' into the Trust after the individual's passing, minimizing the risk of unintended distribution. Remember, it is essential to consult an attorney or legal professional when preparing a last Will and Testament to ensure compliance with the specific laws and regulations of the state of Oregon and to address any individual circumstances appropriately.