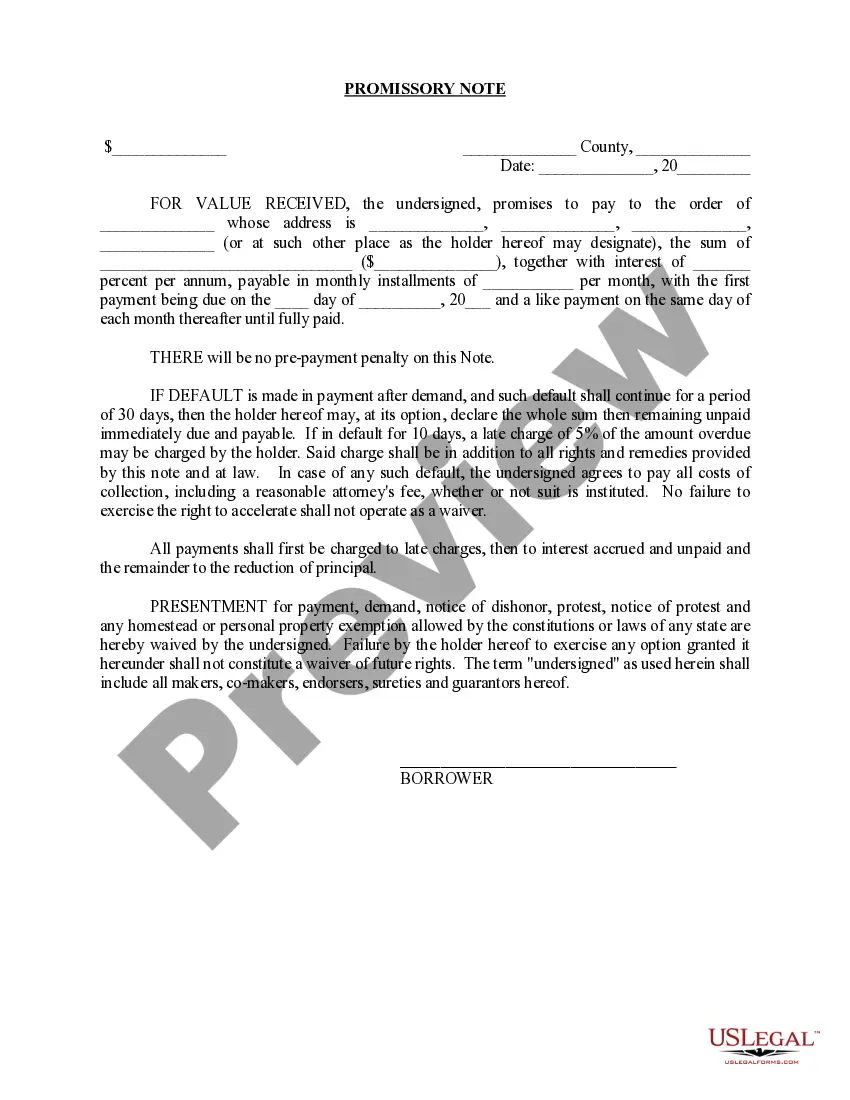

A promissory note is a legal document that outlines the terms and conditions of a loan agreement. In Allegheny County, Pennsylvania, a promissory note is commonly used when individuals or businesses lend money to one another. It serves as evidence of the debt and outlines the repayment terms. Since Allegheny County is home to many financial institutions and a thriving business community, understanding the types and key elements of promissory notes is crucial. 1. Allegheny Pennsylvania Promissory Note Overview: An Allegheny Pennsylvania Promissory Note is a legally binding contract that details the borrower's promise to repay a specific sum of money to the lender. This document serves as a written record of the loan agreement and establishes the terms, including interest rate, repayment schedule, and any applicable penalties or late fees. 2. Types of Allegheny Pennsylvania Promissory Notes: a) Traditional Promissory Note: This is the most common form of a promissory note used in Allegheny County, Pennsylvania. It outlines the loan amount, interest rate, repayment terms, and any collateral provided by the borrower. b) Secured Promissory Note: This particular promissory note includes the specific collateral pledged by the borrower as security for the loan. It provides an added layer of protection for the lender in case of default. c) Unsecured Promissory Note: In contrast to a secured note, this type of promissory note does not require any collateral from the borrower, making it a riskier option for lenders. However, borrowers often prefer it as they don't have to provide collateral. d) Demand Promissory Note: This note allows the lender to request repayment in full at any time. It doesn't have a fixed repayment schedule and provides flexibility to both parties. e) Installment Promissory Note: This note establishes regular installment payments for repaying the loan amount, including principal and interest. The terms can be fixed or variable, accommodating the convenience of both parties. 3. Key components of an Allegheny Pennsylvania Promissory Note: a) Loan Amount: Clearly specifies the exact amount borrowed by the borrower. b) Interest Rate: States the annual interest rate applied to the loan, ensuring both parties are aware of the cost of borrowing. c) Repayment Terms: Outlines the repayment schedule (monthly, quarterly, annually), including the number of installments and due dates. d) Late Payment Penalty: Specifies the penalty or additional charges if the borrower fails to make timely payments. e) Governing Law: Identifies Allegheny County, Pennsylvania, as the jurisdiction governing the promissory note. f) Parties Involved: Names and contact details (addresses, phone numbers, etc.) of the lender and borrower. g) Signatures: Both parties' signatures, along with the date, solidify the agreement's legality and consent. It is crucial to consult a legal professional or utilize reputable promissory note templates that comply with Allegheny County, Pennsylvania's specific laws and regulations. A well-written and comprehensive promissory note ensures both parties' rights are protected and provides clarity on the loan agreement's terms and conditions.

Allegheny Pennsylvania Promissory Note

Description

How to fill out Allegheny Pennsylvania Promissory Note?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Allegheny Pennsylvania Promissory Note becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Allegheny Pennsylvania Promissory Note takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Allegheny Pennsylvania Promissory Note. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!