Title: Allentown, Pennsylvania Promissory Note: Understanding its Types and Importance Introduction: In the realm of financial transactions, a promissory note holds significant importance as a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This article delves into the concept of Allentown, Pennsylvania Promissory Notes, shedding light on their types and key features. Types of Allentown Pennsylvania Promissory Notes: 1. Secured Promissory Note: A secured promissory note requires the borrower to provide collateral, such as property or assets, as a form of security for the loan. In case of default, the lender gains the right to seize the collateral to recover their funds. 2. Unsecured Promissory Note: Unlike secured notes, an unsecured promissory note does not require collateral. The borrower's creditworthiness and reputation play a crucial role in determining the loan's approval. In case of default, the lender's recovery options are relatively limited. 3. Revolving Promissory Note: A revolving promissory note allows borrowers to make multiple withdrawals up to a specified credit limit, similar to a line of credit. The borrower can repay and borrow repeatedly within the predefined terms, enhancing flexibility. 4. Demand Promissory Note: A demand promissory note allows the lender to request immediate repayment for the outstanding loan amount at any given time. This type offers more flexibility to the lender if they require immediate access to funds. Importance of the Promissory Note: 1. Clarity on Loan Terms: An Allentown Pennsylvania Promissory Note provides a detailed description of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It establishes clarity and prevents misunderstandings between the parties involved. 2. Legal Protection: By signing a promissory note, both the lender and the borrower obtain legal protection against potential disputes or defaults. In case of default, the lender can pursue legal remedies based on the terms outlined in the note. 3. Confidence-Building Tool: Promissory notes instill confidence in the lender, demonstrating the borrower's commitment and seriousness towards repaying the loan. This can lead to more favorable loan terms, such as lower interest rates, longer repayment periods, or higher loan amounts. 4. Proof of Debt: A promissory note stands as concrete evidence of the debt owed by the borrower to the lender. It can be produced and used to support legal claims, track repayment history, or for tax purposes. Conclusion: Allentown, Pennsylvania Promissory Notes encompass various types designed to suit different borrowing needs and circumstances. Understanding the different types and their significance is crucial when entering into a loan agreement. By clearly delineating the terms and conditions, promissory notes ensure a transparent and legally binding relationship between lenders and borrowers.

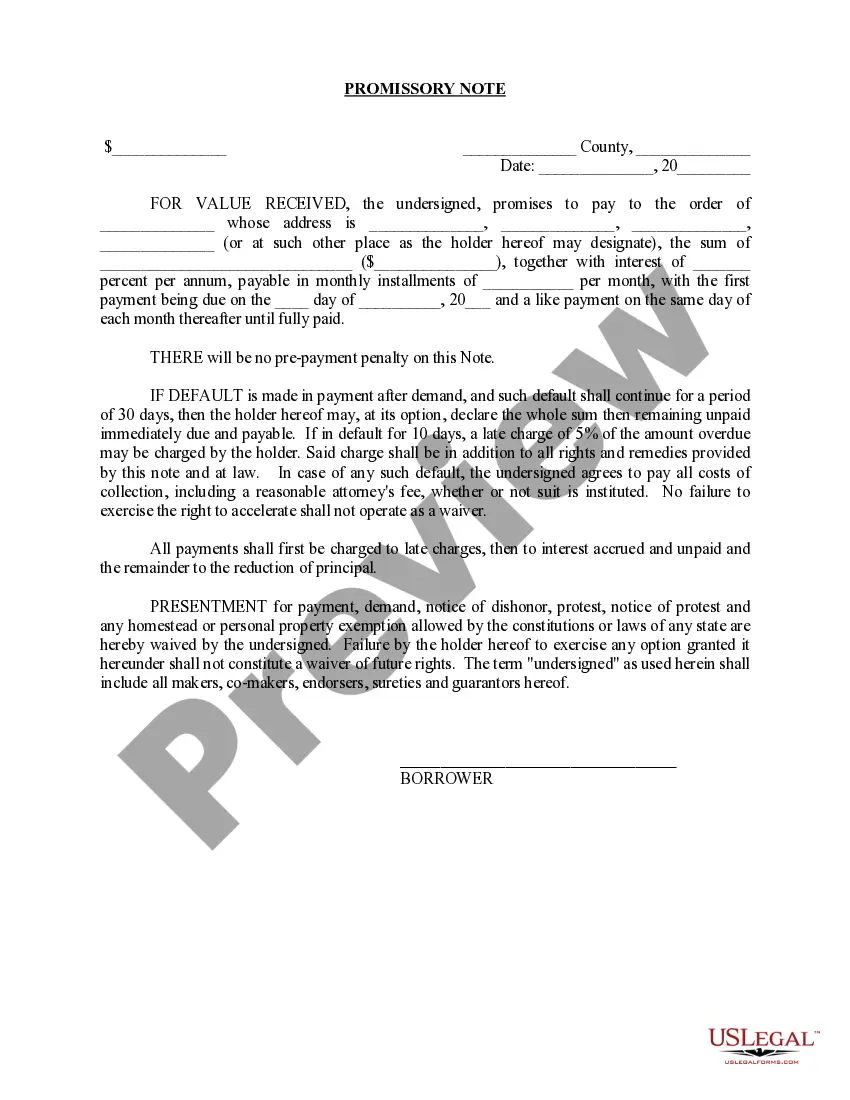

Allentown Pennsylvania Promissory Note

Description

How to fill out Allentown Pennsylvania Promissory Note?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no legal background to create this sort of paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Allentown Pennsylvania Promissory Note or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Allentown Pennsylvania Promissory Note in minutes employing our trustworthy platform. If you are already an existing customer, you can proceed to log in to your account to download the appropriate form.

Nevertheless, if you are new to our platform, ensure that you follow these steps prior to obtaining the Allentown Pennsylvania Promissory Note:

- Be sure the form you have chosen is suitable for your area because the regulations of one state or county do not work for another state or county.

- Preview the form and read a short description (if provided) of cases the paper can be used for.

- In case the form you selected doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the Allentown Pennsylvania Promissory Note once the payment is done.

You’re good to go! Now you can proceed to print out the form or complete it online. If you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.