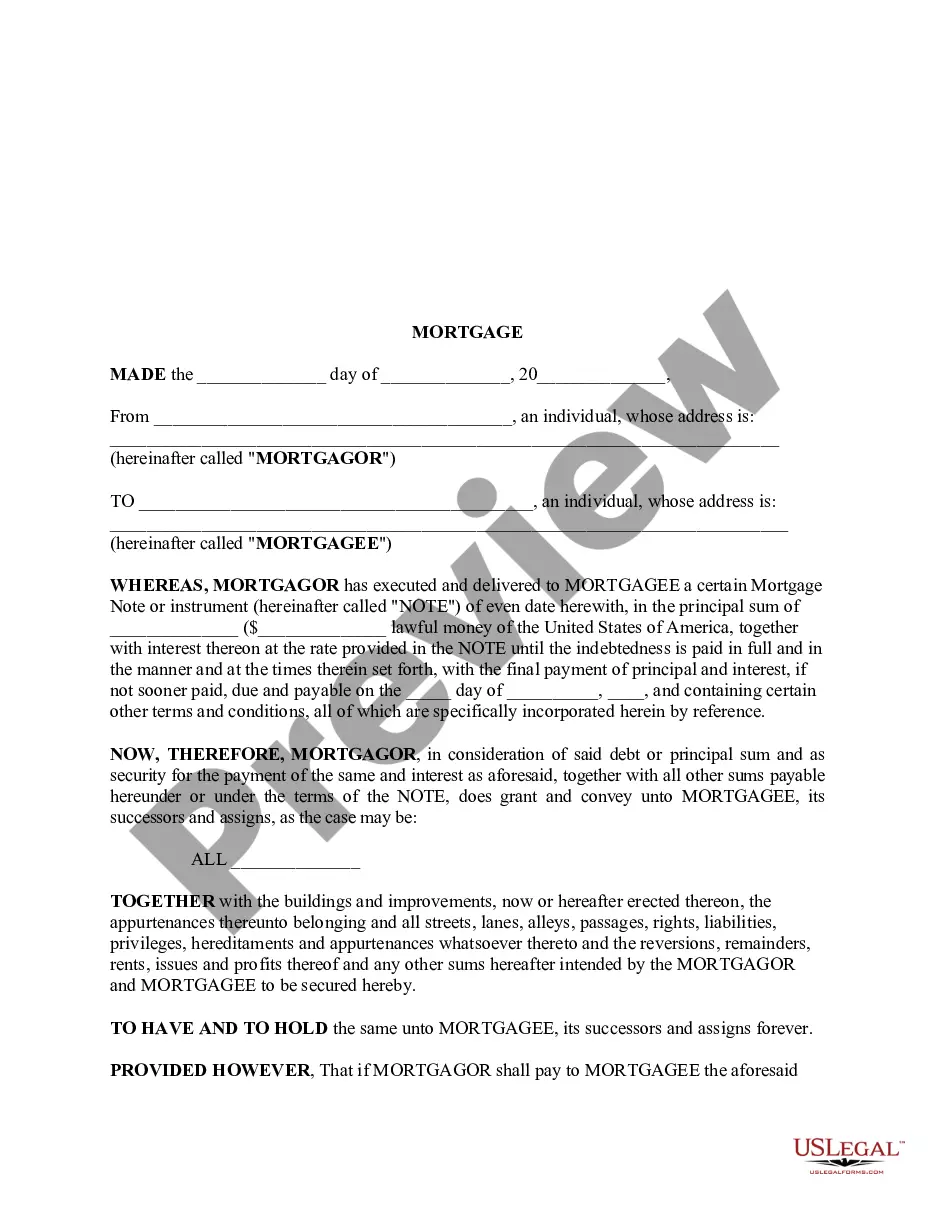

Allentown Pennsylvania Mortgage - Short

Description

How to fill out Pennsylvania Mortgage - Short?

Irrespective of social or occupational position, completing legal paperwork is a regrettable requirement in today's work landscape.

Frequently, it is nearly unfeasible for an individual without legal expertise to create this kind of documentation from the ground up, primarily because of the complex terminology and legal intricacies they entail.

This is where US Legal Forms proves beneficial.

Confirm that the template you have selected is suitable for your locality as the regulations of one region do not apply to another.

Examine the document and read a short description (if available) outlining the scenarios the document can be utilized for.

- Our service provides an extensive repository with over 85,000 ready-to-utilize state-specific forms suitable for almost any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors aiming to conserve time using our DIY templates.

- Whether you require the Allentown Pennsylvania Mortgage - Short or any other document valid in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how to acquire the Allentown Pennsylvania Mortgage - Short in a matter of minutes using our reliable service.

- If you are currently a subscriber, you can go ahead and Log In to your account to obtain the necessary form.

- However, if you are new to our platform, ensure you follow these steps before acquiring the Allentown Pennsylvania Mortgage - Short.

Form popularity

FAQ

In Allentown, Pennsylvania, the smallest mortgage amount varies by lender, but typically, you can find mortgages starting at around $50,000. This minimum can depend on various factors including your credit score and financial situation. It’s important to consult with your mortgage provider to explore your options and see what they can offer you in the Allentown Pennsylvania mortgage market.

Yes, mortgages are considered public record in Pennsylvania. This means that anyone can access the information about your Allentown Pennsylvania Mortgage - Short through the county recorder's office. This transparency helps maintain accurate property ownership records and allows for due diligence in real estate transactions. It's important to understand that this can impact privacy and should be considered before taking on a mortgage.

Yes, a mortgage is typically recorded in the county where the property is located. Recording your Allentown Pennsylvania Mortgage - Short ensures that the public has access to important information about the property. This process protects the lender's interest in the property and provides clarity in ownership. Proper recording can also assist in future transactions regarding your mortgage.

The average mortgage rate in Pennsylvania varies but generally falls within a competitive range. As of your inquiry, expect rates to fluctuate based on governmental economic policies and local market conditions. Keeping an eye on rate changes allows you to make informed decisions when searching for an Allentown Pennsylvania mortgage. Utilize platforms like USLegalForms to navigate your mortgage journey effectively.

Mortgage rates in Allentown, PA, typically align with state and national trends but may offer unique local opportunities. Rates can be influenced by the lender, your credit score, and the specific type of mortgage product you select. Always compare offers from multiple sources to find the best deal. Engaging with services like USLegalForms can streamline your search for an Allentown Pennsylvania mortgage.

The current interest rate on mortgages in Pennsylvania can vary based on economic conditions and individual lender offerings. Generally, rates fluctuate often, so it's advisable to check with local lenders regularly. For the most accurate and up-to-date information, visit reputable financial websites. Finding an Allentown Pennsylvania mortgage with competitive rates could save you significantly.

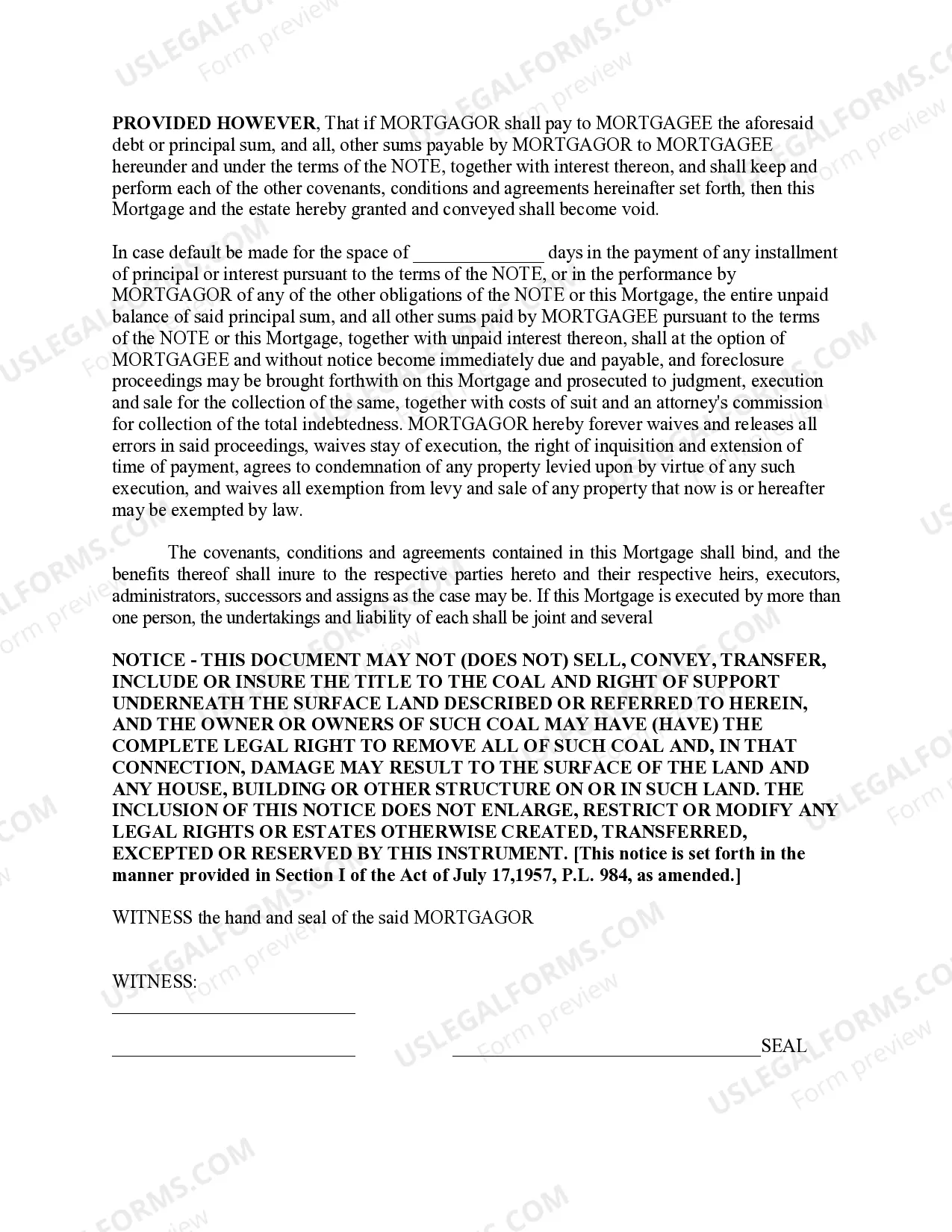

If you find yourself short on your mortgage payments in Allentown, Pennsylvania, you may face several consequences. Your lender might start the foreclosure process, which could lead to losing your home. It's important to communicate with your lender as soon as you realize you may be short; they might offer options to help you. Utilizing services like USLegalForms can assist you in exploring alternatives to foreclosure.

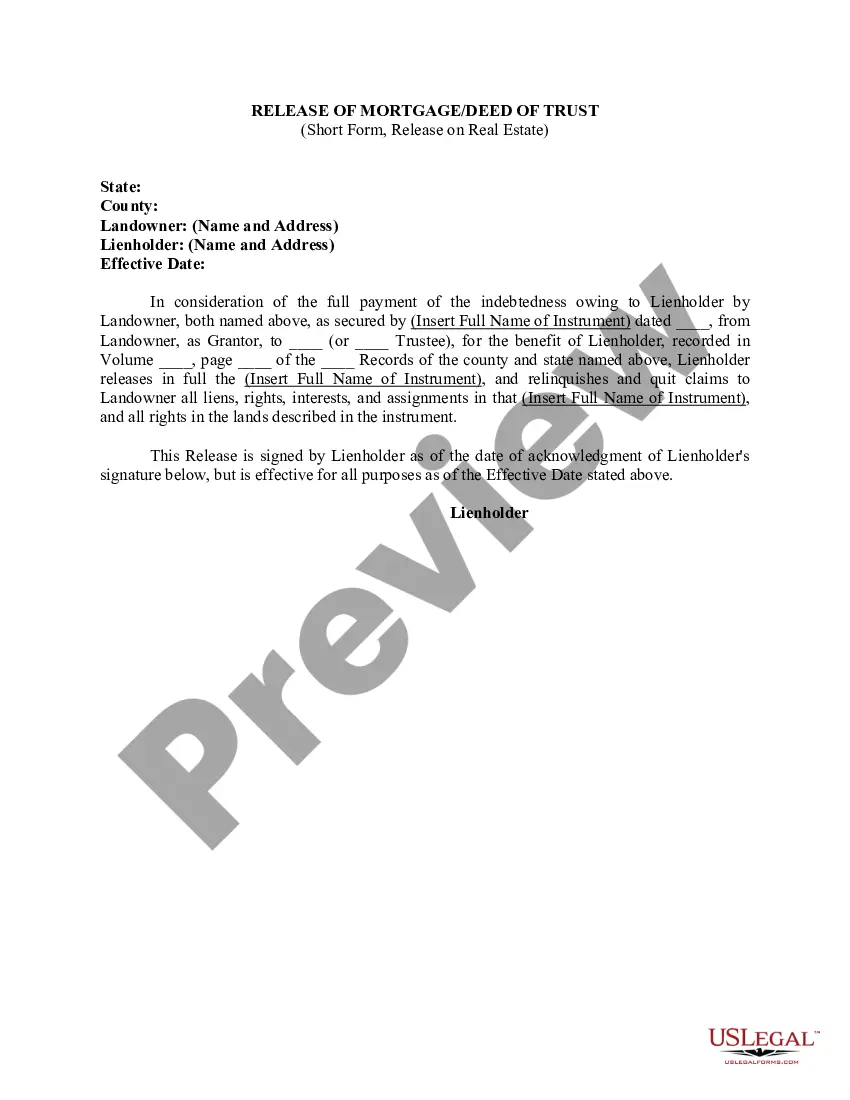

A short form mortgage is a simplified mortgage agreement that captures essential terms without extensive detail. This type of mortgage is often used for straightforward transactions, allowing for a quicker closing process. For those looking at an Allentown Pennsylvania Mortgage - Short, utilizing a short form can help streamline the borrowing experience.

'Short a mortgage' refers to a situation where a lender accepts a payoff amount that is less than the outstanding mortgage balance. This often occurs during a short sale, where the homeowner sells their property for less than what is owed on the mortgage. Understanding this term can be beneficial when dealing with an Allentown Pennsylvania Mortgage - Short.

If you face issues with your Allentown Pennsylvania Mortgage - Short, you can file a complaint against your mortgage lender. Start by contacting the Pennsylvania Department of Banking and Securities, which oversees mortgage lenders. You may also consider reaching out to the Consumer Financial Protection Bureau, as they assist with disputes concerning federal regulations.