Philadelphia Pennsylvania Mortgage — Short refers to a specific type of mortgage option available to residents in Philadelphia, Pennsylvania, which features abbreviated repayment terms and a faster loan processing timeline. This type of mortgage is ideal for borrowers who wish to pay off their home loan in a shorter duration, allowing them to build equity and save on interest payments. Short-term mortgages in Philadelphia, Pennsylvania generally offer repayment periods ranging from 5 to 15 years, as opposed to the standard 30-year mortgages. These shorter terms enable borrowers to save thousands of dollars in interest costs over the life of their loan, and they may also benefit from lower interest rates compared to longer-term loans. The Philadelphia Pennsylvania Mortgage — Short options may vary depending on the lender, but common types include: 1. 5-year Fixed-Rate Mortgage: This mortgage offers a fixed interest rate over a 5-year term, allowing borrowers to pay off their loan more quickly while enjoying a stable monthly payment. 2. 10-year Adjustable-Rate Mortgage (ARM): With this mortgage, borrowers pay a fixed interest rate for the initial 10 years, after which the rate adjusts annually based on market conditions. It provides a lower rate in the initial years and is suitable for those planning to sell or refinance within a decade. 3. 15-year Conventional Mortgage: This mortgage carries a fixed interest rate throughout the 15-year repayment period, allowing homeowners to build equity faster and pay off their loan in a shorter time frame. 4. Federal Housing Administration (FHA) Short-Term Mortgage: This type of mortgage is insured by the FHA, designed for first-time homebuyers or those with lower credit scores. It offers competitive interest rates and typically requires a lower down payment. Borrowers considering a short-term mortgage in Philadelphia, Pennsylvania should engage with reputable lenders, compare rates, and evaluate their financial capabilities before committing to a specific mortgage option. It is essential to consider factors such as monthly payments, closing costs, and qualification requirements to choose the most suitable short-term mortgage that aligns with their financial goals and ability to repay.

Philadelphia Short Form

State:

Pennsylvania

County:

Philadelphia

Control #:

PA-0011

Format:

Word;

Rich Text

Instant download

Description

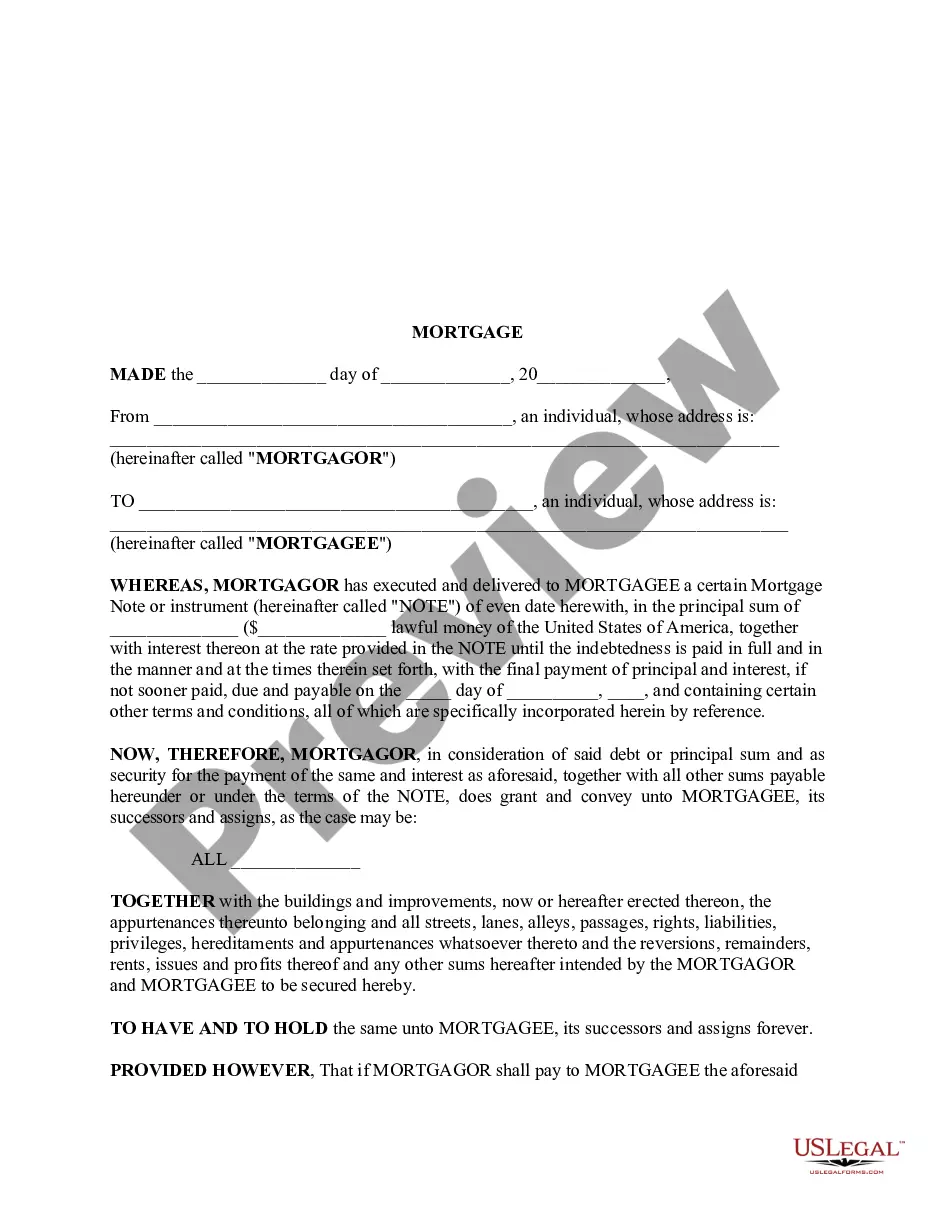

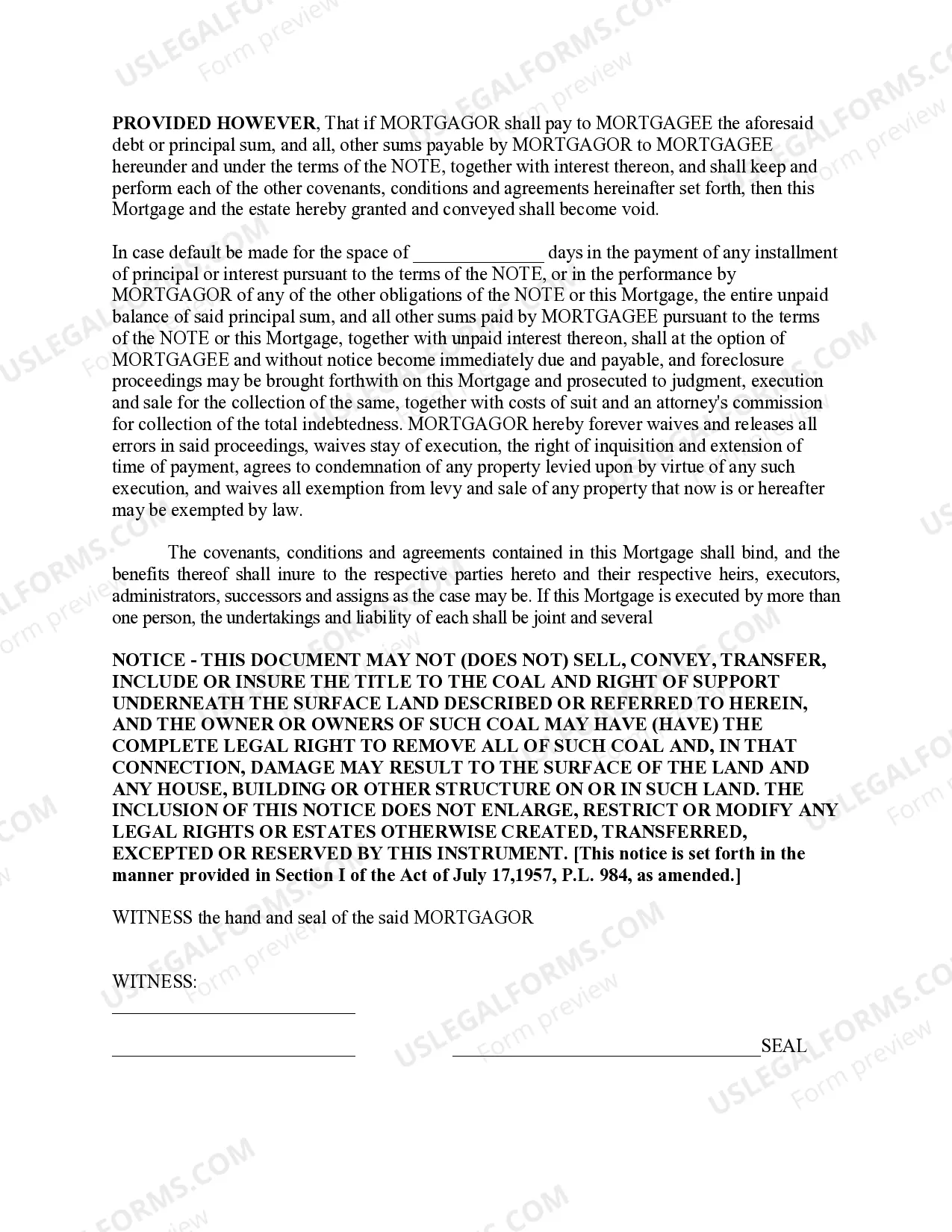

A deed of trust of mortgage is an instrument whereby a person grants to another a security interest in real estate to secure the payment of a promissory note.

Philadelphia Pennsylvania Mortgage — Short refers to a specific type of mortgage option available to residents in Philadelphia, Pennsylvania, which features abbreviated repayment terms and a faster loan processing timeline. This type of mortgage is ideal for borrowers who wish to pay off their home loan in a shorter duration, allowing them to build equity and save on interest payments. Short-term mortgages in Philadelphia, Pennsylvania generally offer repayment periods ranging from 5 to 15 years, as opposed to the standard 30-year mortgages. These shorter terms enable borrowers to save thousands of dollars in interest costs over the life of their loan, and they may also benefit from lower interest rates compared to longer-term loans. The Philadelphia Pennsylvania Mortgage — Short options may vary depending on the lender, but common types include: 1. 5-year Fixed-Rate Mortgage: This mortgage offers a fixed interest rate over a 5-year term, allowing borrowers to pay off their loan more quickly while enjoying a stable monthly payment. 2. 10-year Adjustable-Rate Mortgage (ARM): With this mortgage, borrowers pay a fixed interest rate for the initial 10 years, after which the rate adjusts annually based on market conditions. It provides a lower rate in the initial years and is suitable for those planning to sell or refinance within a decade. 3. 15-year Conventional Mortgage: This mortgage carries a fixed interest rate throughout the 15-year repayment period, allowing homeowners to build equity faster and pay off their loan in a shorter time frame. 4. Federal Housing Administration (FHA) Short-Term Mortgage: This type of mortgage is insured by the FHA, designed for first-time homebuyers or those with lower credit scores. It offers competitive interest rates and typically requires a lower down payment. Borrowers considering a short-term mortgage in Philadelphia, Pennsylvania should engage with reputable lenders, compare rates, and evaluate their financial capabilities before committing to a specific mortgage option. It is essential to consider factors such as monthly payments, closing costs, and qualification requirements to choose the most suitable short-term mortgage that aligns with their financial goals and ability to repay.

Free preview

How to fill out Philadelphia Pennsylvania Mortgage - Short?

If you’ve already used our service before, log in to your account and save the Philadelphia Pennsylvania Mortgage - Short on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Philadelphia Pennsylvania Mortgage - Short. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!