In Allentown, Pennsylvania, a promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions agreed upon between the buyer and seller of the vehicle. This note serves as a written record of the transaction and ensures that both parties are aware of their responsibilities and obligations. The Allentown Pennsylvania Promissory Note in Connection with Sale of Vehicle or Automobile typically includes the following key details: 1. Parties involved: The note begins by identifying the buyer (referred to as the "borrower") and the seller (referred to as the "lender") of the vehicle. It includes their names, addresses, and contact information. 2. Vehicle description: A comprehensive description of the automobile being sold is detailed, including the make, model, year, Vehicle Identification Number (VIN), color, mileage, and any other relevant details. 3. Purchase price: The agreed-upon purchase price for the vehicle is clearly stated in the note. This amount can be paid in full at the time of the transaction or in installments over a specified period. 4. Payment terms: The note outlines the payment terms, including the frequency of payments (monthly, bi-monthly, etc.), the due date of each payment, and the total number of payments required to settle the debt. 5. Interest rate: If interest is applicable, the note specifies the interest rate to be charged on the outstanding balance. Allentown, Pennsylvania does not have specific regulations on interest rates for vehicle promissory notes, but it is typically agreed upon by both parties. 6. Late payment penalties: The note may include provisions for penalties in case the borrower fails to make payments on time. These penalties may include late fees or additional interest charges. 7. Default conditions: The note addresses the consequences of default, outlining the actions that the lender can take in case of non-payment. It may include repossession of the vehicle or legal recourse to collect the outstanding debt. 8. Release of ownership: Once the borrower fulfills all the payment obligations, the note specifies the conditions under which the seller will release the ownership of the vehicle to the buyer, usually by signing over the title and providing any necessary documentation for registration. Different types of Allentown Pennsylvania Promissory Note in Connection with Sale of Vehicle or Automobile may exist, tailored to specific circumstances or preferences of the parties involved. These might include: 1. Secured Promissory Note: This note includes additional provisions to secure the lender's interest in the vehicle, such as a lien or security interest, making the vehicle collateral for the loan. 2. Co-Signer Promissory Note: When a borrower has insufficient credit or income, a co-signer can be added to the note. This type of note ensures that the co-signer shares responsibility for the loan if the borrower defaults. 3. Balloon Promissory Note: This note structure allows the borrower to make smaller payments over a specific term while leaving a larger payment, known as the balloon payment, to be paid at the end of the term. It is essential for both the buyer and the seller to thoroughly understand the terms and conditions laid out in an Allentown Pennsylvania Promissory Note in Connection with Sale of Vehicle or Automobile. Seeking legal advice before drafting or signing such a note is advisable to ensure compliance with local laws and to protect both parties' interests.

Allentown Pennsylvania Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Allentown Pennsylvania Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Allentown Pennsylvania Promissory Note in Connection with Sale of Vehicle or Automobile becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Allentown Pennsylvania Promissory Note in Connection with Sale of Vehicle or Automobile takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

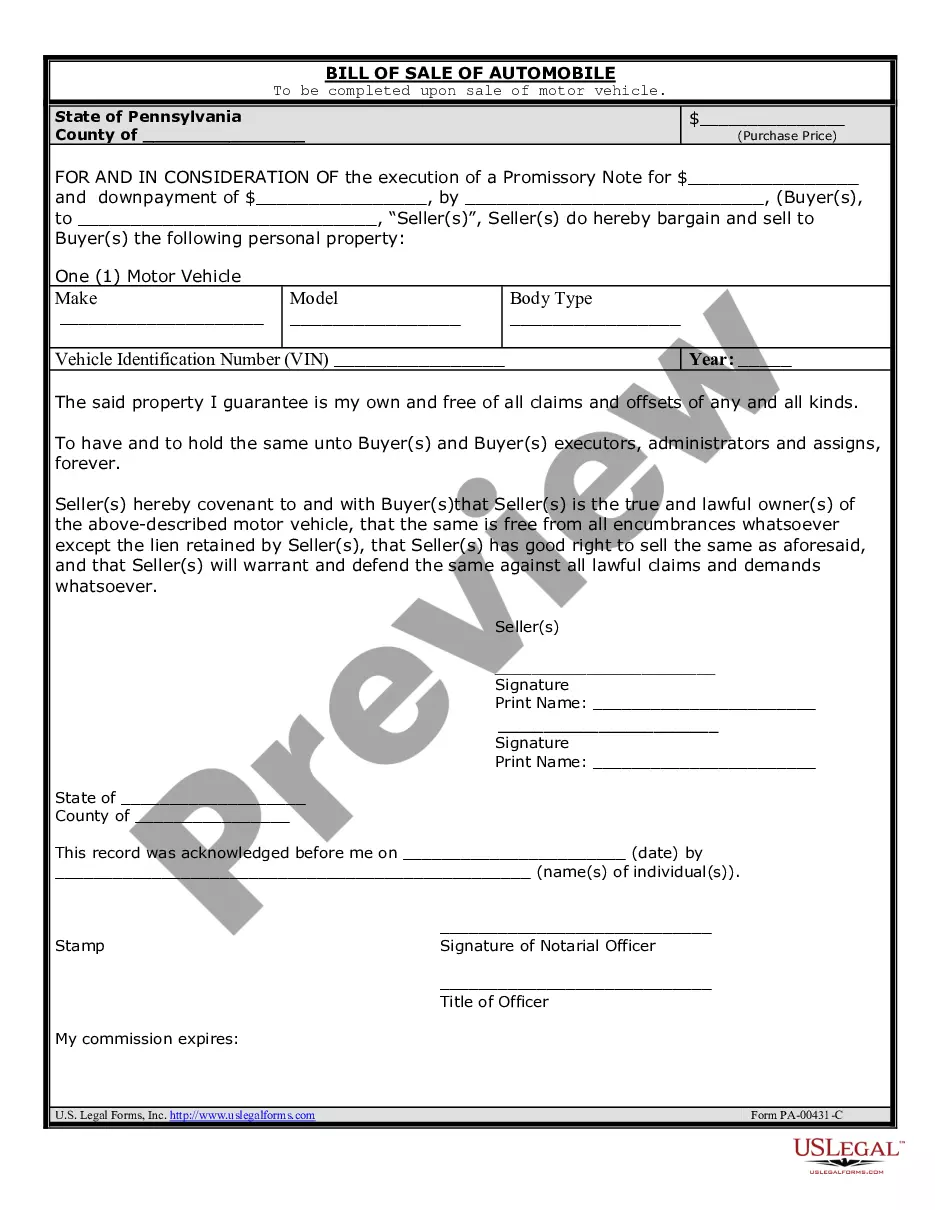

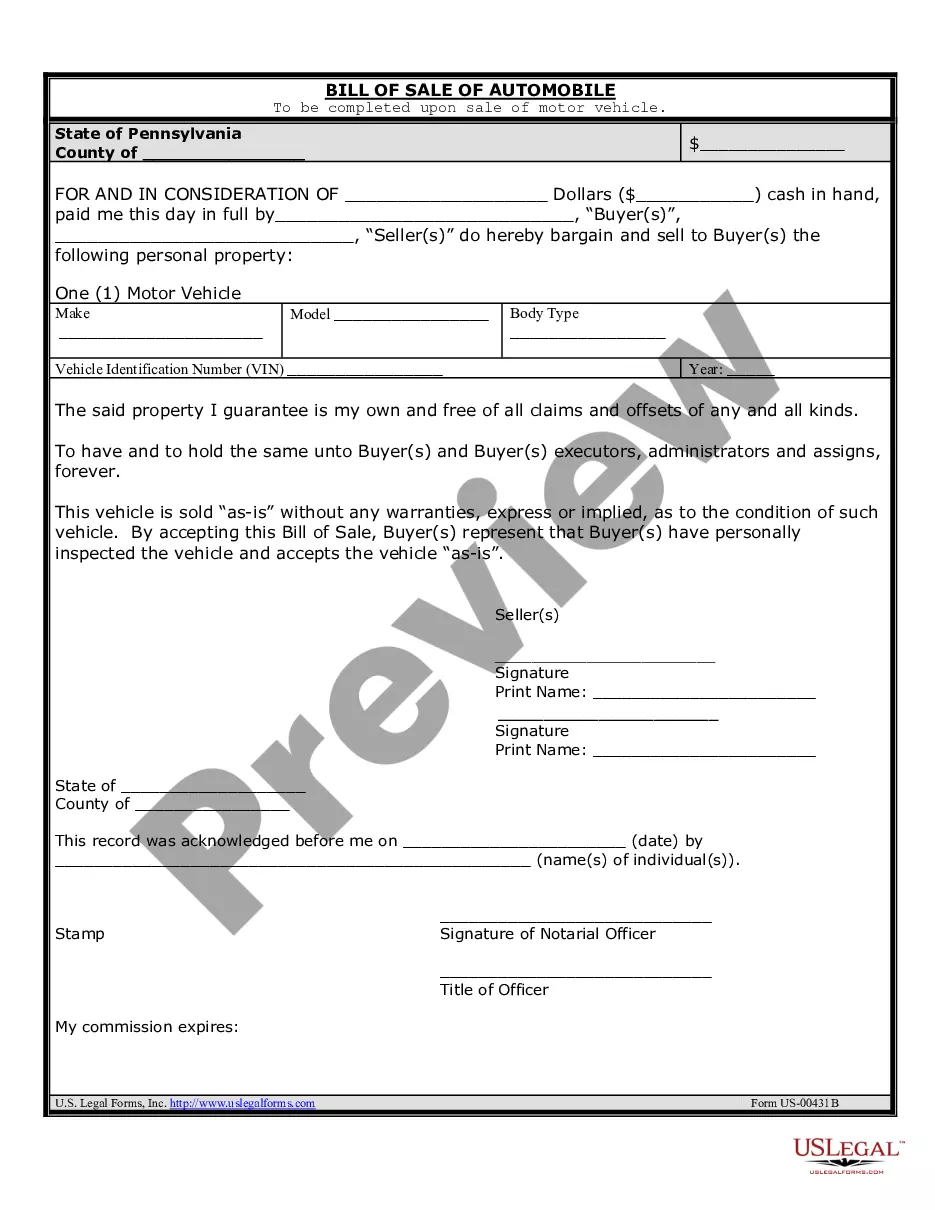

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Allentown Pennsylvania Promissory Note in Connection with Sale of Vehicle or Automobile. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!