Allegheny Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as Land Contract, is a crucial document that outlines the specific terms and conditions related to the financing of a residential property. This disclosure is typically provided by the seller to the buyer and plays a significant role in ensuring transparency and clarity in the transaction. Keywords: Allegheny Pennsylvania, Seller's Disclosure, Financing Terms, Residential Property, Contract for Deed, Agreement for Deed, Land Contract. Types of Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed: 1. Traditional Land Contract: In a traditional land contract, the seller acts as the lender and finances the purchase of the property directly with the buyer. The disclosure would detail the specific financing terms such as the down payment amount, interest rate, duration of the contract, and any other relevant terms or conditions. 2. Installment Sales Contract: An installment sales contract, also known as a contract for deed, is an alternative financing arrangement where the buyer agrees to make regular installment payments to the seller. The disclosure would outline the payment schedule, interest rate, duration, and any other important financing terms to be considered. 3. Balloon Payment Land Contract: This type of land contract involves regular installment payments similar to the installment sales contract but with a large final payment, often referred to as a "balloon payment." The seller's disclosure would explicitly mention the presence of a balloon payment, its amount, and the circumstances under which it becomes due. 4. Graduated Payment Land Contract: A graduated payment land contract is designed to accommodate borrowers with lower initial income. In this arrangement, the buyer's payment increases gradually over a specified period. The disclosure would outline the specific graduated payment schedule, terms, and any adjustments in the future. 5. Adjustable Rate Land Contract: In an adjustable-rate land contract, the interest rate fluctuates periodically, typically based on a predetermined index such as the LIBOR or Treasury rates. The disclosure would elaborate on the interest rate adjustment formula, frequency of adjustments, and any caps or limits in place to protect the buyer. 6. Assumption Land Contract: An assumption land contract enables a buyer to assume the existing financing terms agreed upon by the seller, usually for the remaining term of the contract. The disclosure would describe the terms of the existing loan, any transfer fees, and the buyer's responsibilities in assuming the contract. It is essential for both sellers and buyers to carefully review and understand the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed in Allegheny Pennsylvania. Seeking professional advice or legal assistance is recommended to ensure compliance with the law and to make informed decisions throughout the transaction process.

Allegheny Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Allegheny Pennsylvania Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Allegheny Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Allegheny Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

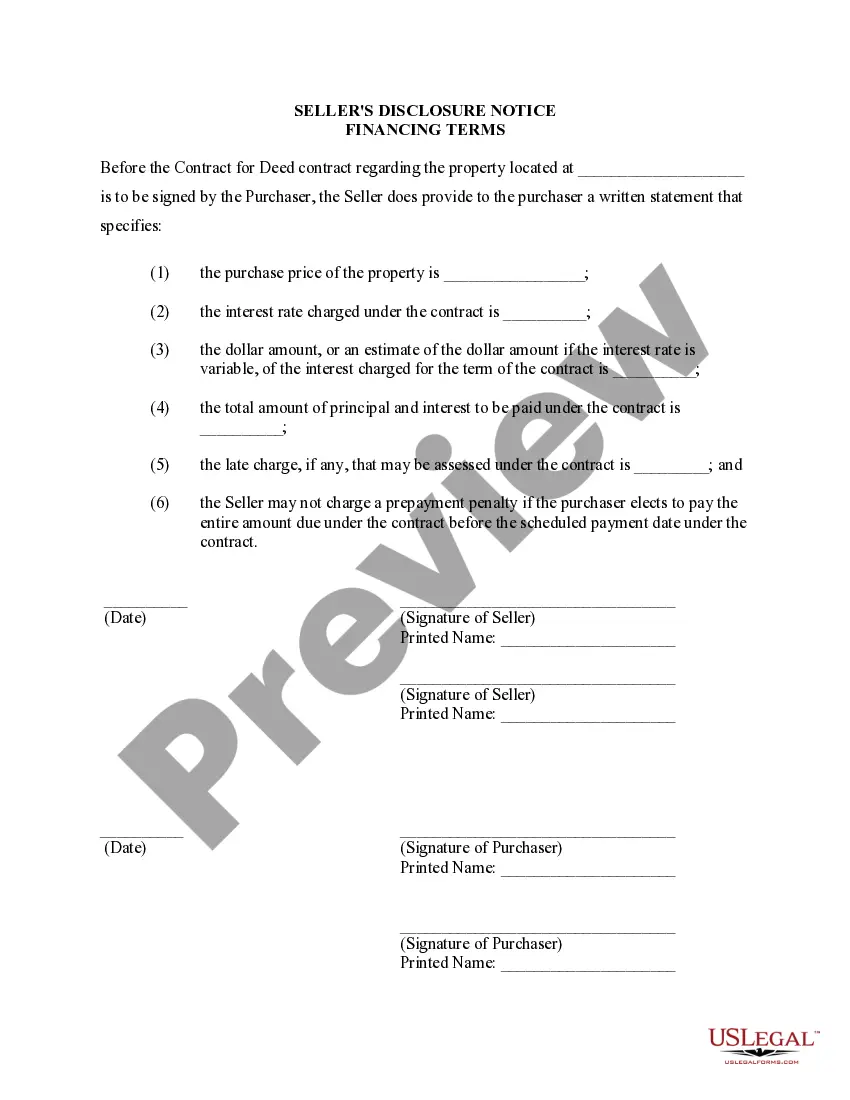

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Allegheny Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!